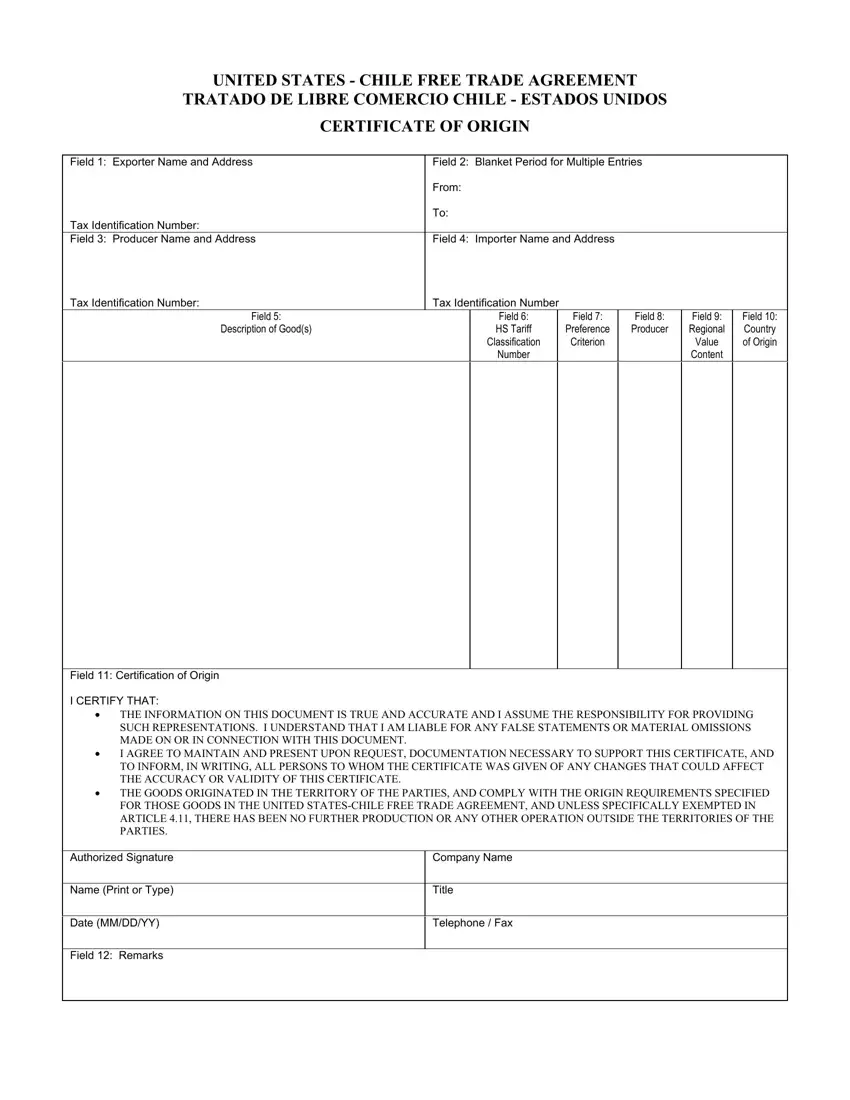

UNITED STATES - CHILE FREE TRADE AGREEMENT

TRATADO DE LIBRE COMERCIO CHILE - ESTADOS UNIDOS

CERTIFICATE OF ORIGIN

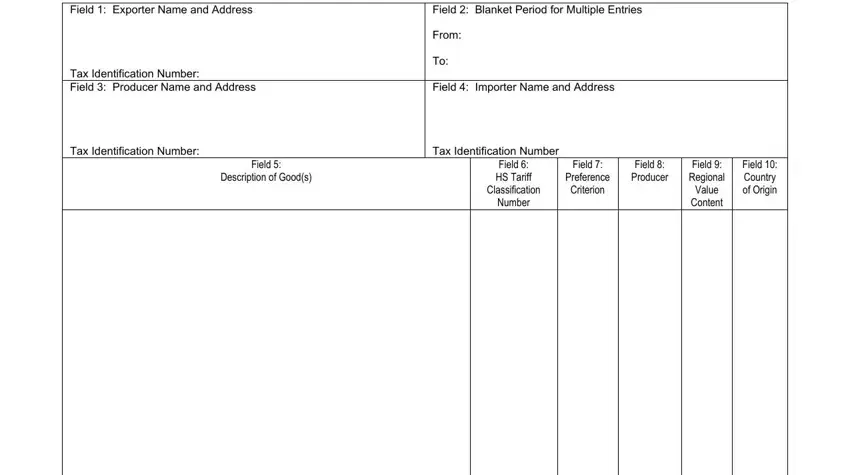

Field 1: Exporter Name and Address |

Field 2: Blanket Period for Multiple Entries |

|

|

|

From: |

|

|

|

|

Tax Identification Number: |

To: |

|

|

|

|

|

|

|

|

|

|

|

Field 3: Producer Name and Address |

Field 4: Importer Name and Address |

|

|

|

Tax Identification Number: |

Tax Identification Number |

|

|

|

|

Field 5: |

|

Field 6: |

|

Field 7: |

Field 8: |

Field 9: |

Field 10: |

Description of Good(s) |

|

HS Tariff |

|

Preference |

Producer |

Regional |

Country |

|

|

Classification |

|

Criterion |

|

Value |

of Origin |

|

|

Number |

|

|

|

Content |

|

|

|

|

|

|

|

|

|

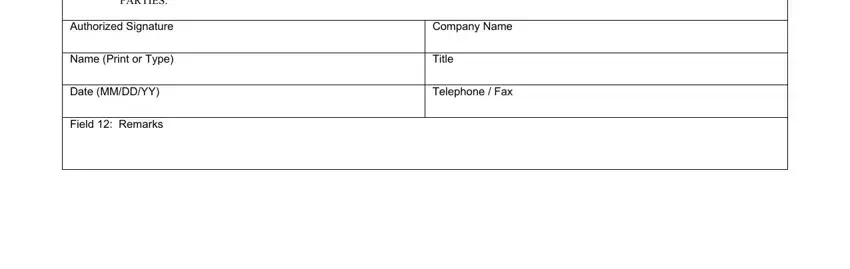

Field 11: Certification of Origin

I CERTIFY THAT:

• THE INFORMATION ON THIS DOCUMENT IS TRUE AND ACCURATE AND I ASSUME THE RESPONSIBILITY FOR PROVIDING SUCH REPRESENTATIONS. I UNDERSTAND THAT I AM LIABLE FOR ANY FALSE STATEMENTS OR MATERIAL OMISSIONS MADE ON OR IN CONNECTION WITH THIS DOCUMENT.

• I AGREE TO MAINTAIN AND PRESENT UPON REQUEST, DOCUMENTATION NECESSARY TO SUPPORT THIS CERTIFICATE, AND TO INFORM, IN WRITING, ALL PERSONS TO WHOM THE CERTIFICATE WAS GIVEN OF ANY CHANGES THAT COULD AFFECT THE ACCURACY OR VALIDITY OF THIS CERTIFICATE.

• THE GOODS ORIGINATED IN THE TERRITORY OF THE PARTIES, AND COMPLY WITH THE ORIGIN REQUIREMENTS SPECIFIED FOR THOSE GOODS IN THE UNITED STATES-CHILE FREE TRADE AGREEMENT, AND UNLESS SPECIFICALLY EXEMPTED IN ARTICLE 4.11, THERE HAS BEEN NO FURTHER PRODUCTION OR ANY OTHER OPERATION OUTSIDE THE TERRITORIES OF THE PARTIES.

Authorized Signature |

Company Name |

|

|

Name (Print or Type) |

Title |

|

|

Date (MM/DD/YY) |

Telephone / Fax |

|

|

Field 12: Remarks |

|

INSTRUCTIONS FOR COMPLETING A CERTIFICATE OF ORIGIN TO CLAIM PREFERENTIAL TARIFF TREATMENT UNDER THE

UNITED STATES-CHILE FREE TRADE AGREEMENT

As provided by the National Customs Service of Chile, in Oficio Circular No. 343, Anexo 1

In order to obtain the preferential tariff treatment established in the FTA, the certificate of origin should be completed legibly and in full by the importer, exporter or producer of the merchandise, according to the following process.

Pursuant to article 4.13(1) of the FTA, and to number 4 of the Oficio Circular No. 333 published on December 18, 2003, by Chilean Customs, the certificate of origin should comply with the following instructions:

1.The format of the certificate may follow the same format of the certificates of origin established for the Chile-Canada Free Trade Agreement or the North American Free Trade Agreement, excluding any reference to the aforementioned agreements, and expressly indicating that the certificate is to be used for the United States-Chile Free Trade Agreement.

2.If the format utilized is based on an official certificate used for either of the aforementioned agreements, the contents of the certificate should follow the instructions contained in this Annex and not the instructions created for the Chile-Canada Free Trade Agreement or the North American Free Trade Agreement.

3.The certificate of origin should include the following data fields and information:

Field 1: Indicate complete name, address (including country), and tax identification number of the exporter.

Field 2: Complete field if the certificate covers multiple shipments of identical goods, as described in Field #5, that are imported into Chile or the United States for a specified period (the blanket period). “FROM” is the date upon which the certificate becomes applicable to the good covered by the blanket certificate. “TO” is the date upon which the blanket period expires. The importation of a good for which preferential treatment is claimed based on this certificate must occur between these dates. It is suggested that the length of the blanket period covered by the certificate should not exceed one year.

Field 3: Indicate complete name, address (including country), and tax identification number of the producer. If the producer and exporter are the same person, state “SAME” in this field. If the producer is not known, state “UNKNOWN.”

Field 4: Indicate complete name, address (including country), and tax identification number of the importer.

Field 5: Provide a full description of each good. The description should be sufficiently detailed such that it can be related to the invoice description and to the Harmonized System (H.S.) description of the good. If the certificate covers only one shipment of goods, indicate the number of the commercial invoice. If the invoice number is not known, use another unique reference number, such as the waybill number, purchase order number, or any other number that can be used to identify the goods.

Field 6: For each good described in Field 5, identify the H.S. classification number to 6 digits. (Note: If the good is subject to a specific rule of origin requiring eight or ten digits, identify the good to the relevant

number of digits using the H.S. tariff classification of the country into whose territory the good is imported.)

Field 7: For each good described in Field 5, state which preference criterion has been used to confer origin (A, B, or C). As stated in Article 4.1.1 of the U.S.-Chile Free Trade Agreement, the criterion are as follows:

(A)the good is wholly obtained or produced entirely in the territory of one or both of the Parties;

(B)the good is produced entirely in the territory of one or both of the Parties and

(i)each of the non-originating materials used in the production of the good undergoes an applicable change in tariff classification specified in Annex 4.1, or

(ii)the good otherwise satisfies any applicable regional value

content or other requirements specified in Annex 4.1,

and the good satisfies all other applicable requirements of this Chapter; or

(C)the good is produced entirely in the territory of one or both of the Parties exclusively from originating materials.

Field 8: If you are the producer of the good, state “YES” in this field. If you are not the producer of the good, state “NO” followed by a reference to Article 4.13 (2a) if the certificate is based upon a completed and signed certificate of origin provided by the producer, or Article 4.13 (2b) if the certificate of origin is based upon your knowledge of whether the good qualifies as an originating good.

Field 9: For each good described in Field 5, if the good is not subject to a Regional Value Content (RVC) requirement, state “NO.” Otherwise, indicate which method was used to calculate the RVC by stating either “BUILDUP” or “BUILDDOWN.”

Field 10: Identify the name of the country: State “US” for all goods originating in the United States and exported to Chile or state “CL” for all goods originating in Chile for export to the United States.

Field 11: This field should be completed, signed and dated by the party declaring origin (importer, exporter, or producer) indicating the name, title, and company. The signer must also certify to the following suggested text:

I CERTIFY THAT:

•THE INFORMATION ON THIS DOCUMENT IS TRUE AND ACCURATE AND I ASSUME THE RESPONSIBILITY FOR PROVING SUCH REPRESENTATIONS. I UNDERSTAND THAT I AM LIABLE FOR ANY FALSE STATEMENTS OR MATERIAL OMISSIONS MADE ON OR IN CONNECTION WITH THIS DOCUMENT;

•I AGREE TO MAINTAIN, AND PRESENT UPON REQUEST, DOCUMENTATION NECESSARY TO SUPPORT THIS CERTIFICATE, AND TO INFORM, IN WRITING, ALL PERSONS TO WHOM THE CERTIFICATE WAS GIVEN OF ANY CHANGES THAT COULD AFFECT THE ACCURACY

OR VALIDITY OF THIS CERTIFICATE;

•THE GOODS ORIGINATED IN THE TERRITORY OF ONE OR MORE OF THE PARTIES, AND COMPLY WITH THE ORIGIN REQUIREMENTS SPECIFIED FOR THOSE GOODS IN THE UNITED STATES - CHILE FREE TRADE AGREEMENT, AND UNLESS SPECIFICALLY EXEMPTED IN ARTICLE 4.11, THERE HAS BEEN NO FURTHER PRODUCTION OR ANY OTHER OPERATION OUTSIDE THE TERRITORIES OF THE PARTIES.

Field 12: Provide any additional or necessary remarks.