For individuals who manage properties or earn royalties, comprehending the intricacies of the US Tax Schedule E form is pivotal for accurate financial reporting and tax compliance. This detailed document serves as a critical tool for declaring income from rental properties, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. Through the Schedule E, taxpayers provide the IRS with a comprehensive overview of their rental and royalty income, encompassing descriptions, locations, types of properties, and the respective income and expenses associated with each. The form is meticulously designed to account not only for direct expenses related to property management, such as advertising, maintenance, and insurance, but also for indirect expenses, which include utilities and repairs for properties not fully occupied by tenants. Additionally, the form allows for the declaration of ownership percentages and tenant occupancy rates, which can influence the tax implications of the reported income. It's further complicated by distinctions between passive and nonpassive income activities, as well as specific reporting requirements for real estate professionals. In essence, properly navigating the Schedule E form requires a deep understanding of both its components and the taxpayer's individual circumstances, ensuring that all pertinent information from the previous year is accurately captured and reported to meet federal tax obligations.

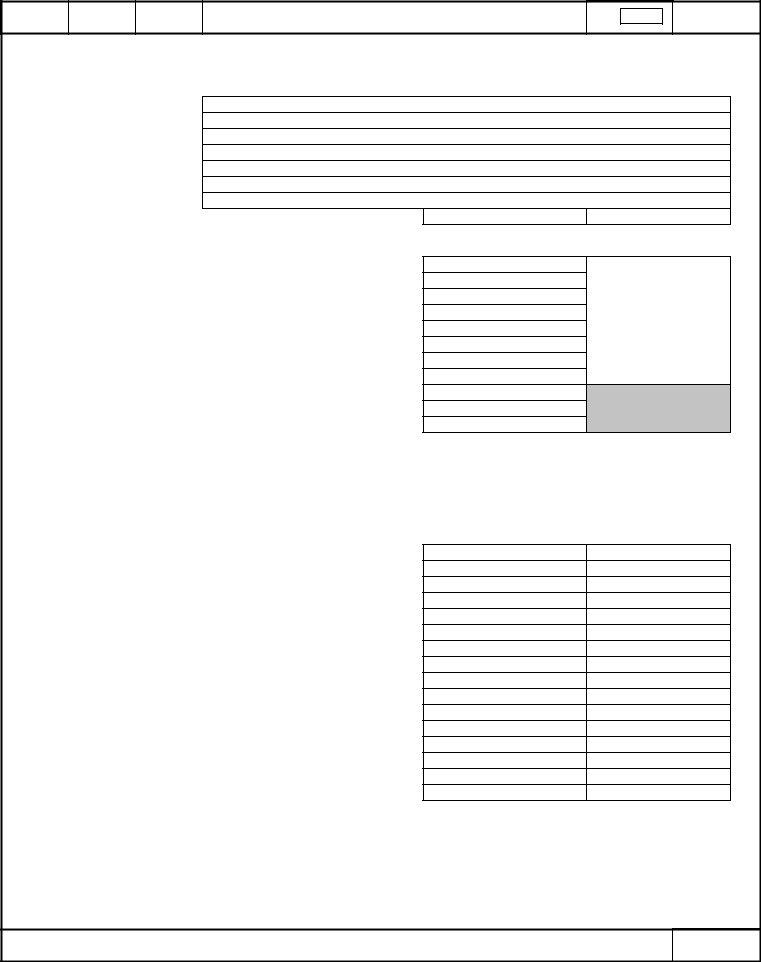

| Question | Answer |

|---|---|

| Form Name | Us Tax Form Schedule E |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | schedule e form 1040, irs schedule b, print schedule e, irs forms schedule e |

ORGANIZER |

Page 1 |

2012

1040

US

Rental & Royalty Income (Schedule E)

No.

18

Please enter all pertinent 2012 amounts. Last year's amounts are provided for your reference.

RENTAL & ROYALTY INCOME (Schedule E)

2012 Amount |

2011 Amount |

Description of property. . . . . . . . .

Street address . . . . . . . . . . . . . . . .

City. . . . . . . . . . . . . . . . . . . . . . . . . .

State. . . . . . . . . . . . . . . . . . . . . . . . .

ZIP code . . . . . . . . . . . . . . . . . . . . .

Type of property (see table) . . . .

Other type of property. . . . . . . . . .

Number of days rented. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

GENERAL INFORMATION

Percentage of ownership if not 100% (.xxxx). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Percentage of tenant occupancy if not 100% (.xxxx). . . . . . . . . . . . . . . . . . . . . . . .

1=spouse, 2=joint. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1=qualified joint venture. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If required to file Form(s) 1099, did you or will you file all required Form(s) 1099: 1=yes, 2=no. . .

1=nonpassive activity, 2=passive royalty . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1=did not actively participate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1=real estate professional. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1=rental other than real estate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1=investment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1=single member limited liability company. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

INCOME

Rents or royalties received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Type of Property

1 = Single Family Residence

2 =

3 =

4 = Commercial

5 = Land

6 = Royalties

7 =

2012 Amount |

2011 Amount |

|

|

DIRECT EXPENSES

NOTE:Direct expenses are related only to the rental activity. These include rental agency fees, advertising, and office supplies.

Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Association dues. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Auto and travel (not entered elsewhere) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Cleaning and maintenance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Commissions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Gardening. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Insurance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Legal and professional fees. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Licenses and permits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Management fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Miscellaneous. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Mortgage interest (paid to banks, etc.). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Qualified mortgage insurance premiums . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Excess mortgage interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Other interest (not entered elsewhere). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Painting and decorating. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

NOTE: If you purchased or disposed of any business assets, please complete Sheet 22.

18

Series: 53 |

Rental & Royalty Income (Schedule E) |

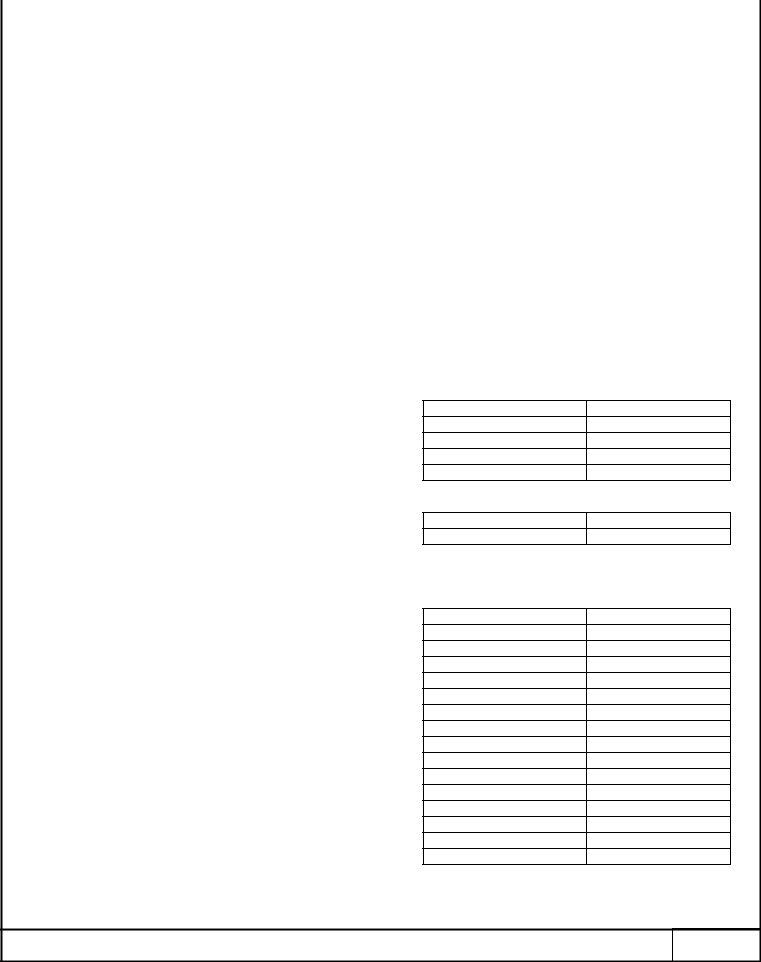

ORGANIZERPage 2

2012 |

1040 |

US |

Rental & Royalty Income (Sch. E) (cont.) |

No. |

|

|

18 p2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please enter all pertinent 2012 amounts. Last year's amounts are provided for your reference. The indirect

expense column should only be used for vacation homes or less than 100% tenant occupied rentals.

DIRECT EXPENSES (continued)

|

Direct expenses are related only to the rental activity. These include |

|

|

|

|

rental agency fees, advertising, and office supplies. |

2012 Amount |

2011 Amount |

|

|

|

|

||

Pest control |

|

|

||

Plumbing and electrical |

|

|

||

Repairs |

|

|

||

Supplies |

|

|

||

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Taxes - real estate |

|

|

||

Taxes - other (not entered elsewhere) |

|

|

||

|

|

|||

Telephone |

|

|

||

|

|

|||

Utilities |

|

|

||

|

|

|||

Wages and salaries |

|

|

||

|

|

|||

Other: |

|

|

||

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OIL AND GAS

Production type (preparer use only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Cost depletion. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Percentage depletion rate or amount. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

State cost depletion, if different

State % depletion rate or amount, if different

VACATION HOME

Number of days personal use. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Number of days owned (if optional method elected). . . . . . . . . . . . . . . . . . . . . . . .

INDIRECT EXPENSES

NOTE:Indirect expenses are related to operating or maintaining the dwelling unit.

These include repairs, insurance, and utilities.

. .Advertising |

. . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . . . . |

Association dues |

. . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . . . . |

Auto and travel (not entered elsewhere) . . |

. . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . . . . |

Cleaning and maintenance |

. . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

THIS |

Commissions |

|

|

|

. . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . . . . |

|

Gardening |

. . . . . . . . . . . . . . . . . |

....USE |

. . . . . |

Insurance |

. . . . . . . . . . . . . . . . . |

. . . . . |

|

Legal and professional fees |

. . . . . . . . . . . . . . . . . |

. . . . . |

|

Licenses and permits |

. . . . . . . . . NOT |

. . . . . |

|

Management fees |

|

|

|

. . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . . . . |

|

Miscellaneous |

.. .. .. .. O |

. . . . . . . . . . |

. . . . . |

Mortgage interest (paid to banks, etc.). . . . |

. . . . . . . . . . |

. . . . . |

|

Qualified mortgage insurance premiums . . |

.D |

. . . . . . . . . . |

. . . . . |

Excess mortgage interest |

. . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . . . . |

Other interest (not entered elsewhere). . . . |

. . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . . . . |

Painting and decorating |

. . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . . . . |

AREA

18 p2

Series: 53 |

Rental & Royalty Income (Sch. E) (cont.) |