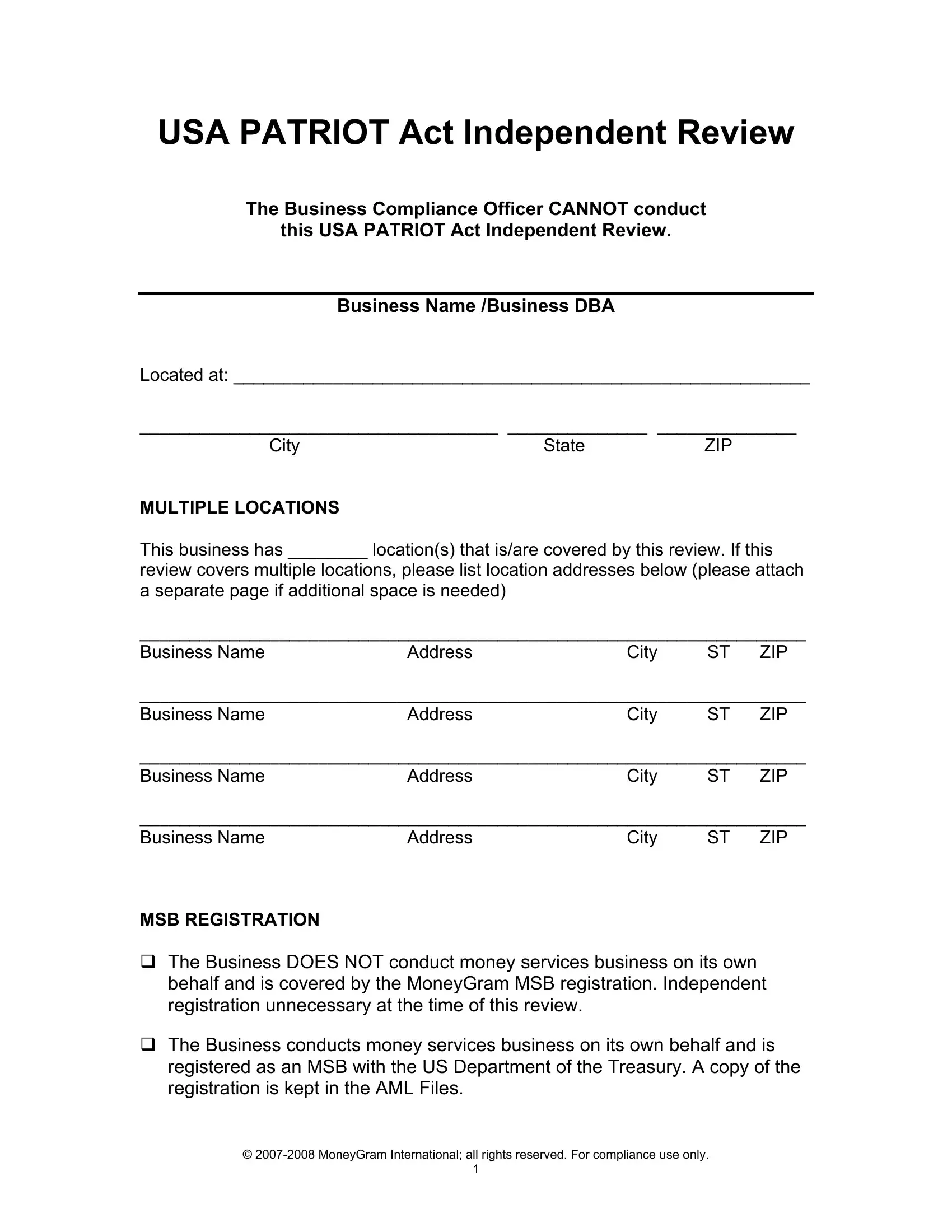

USA PATRIOT Act Independent Review

The Business Compliance Officer CANNOT conduct

this USA PATRIOT Act Independent Review.

Business Name /Business DBA

Located at: __________________________________________________________

____________________________________ ______________ ______________

CityState ZIP

MULTIPLE LOCATIONS

This business has ________ location(s) that is/are covered by this review. If this

review covers multiple locations, please list location addresses below (please attach a separate page if additional space is needed)

___________________________________________________________________

Business NameAddressCity ST ZIP

___________________________________________________________________

Business NameAddressCity ST ZIP

___________________________________________________________________

Business NameAddressCity ST ZIP

___________________________________________________________________

Business Name |

Address |

City |

ST ZIP |

MSB REGISTRATION

The Business DOES NOT conduct money services business on its own behalf and is covered by the MoneyGram MSB registration. Independent registration unnecessary at the time of this review.

The Business conducts money services business on its own behalf and is registered as an MSB with the US Department of the Treasury. A copy of the registration is kept in the AML Files.

©2007-2008 MoneyGram International; all rights reserved. For compliance use only. 1

RISK ASSESSMENT

All money services businesses (MSB) can be victimized by money launderers or other criminals. This risk increases based on the location of the Business, the number of financial services offered and / or with the number of providers.

Offering multiple products and / or services increases a money launderer or other criminal’s ability to structure transactions to avoid detection and recordkeeping requirements. If more than one (1) product or service is offered, the Independent Reviewer should more carefully review the compliance program.

Location Risk

Law enforcement agencies and government regulators have identified areas that are at higher risk for money laundering, related financial crimes, and drug trafficking. The appropriate websites are listed to help determine the correct response to the following questions.

The MSB is located in an area at high risk for money laundering or related financial crimes. (http://www.fincen.gov/hifcaregions.html)

The MSB is located in an area at high risk for drug trafficking. (http://www.whitehousedrugpolicy.gov/hidta/index.html)

The MSB transfers funds to high-risk areas. (http://www.treas.gov/offices/enforcement/ofac/)

Product Risk

The Business offers the following products:

|

Money transfers / wire transfers |

|

Money orders |

|

Check cashing |

|

Currency exchange |

Stored value cards

Service Risk

The Business acts as an agent for more than one MSB provider.

Please list all MSB providers: ______________________________________

______________________________________________________________

______________________________________________________________

______________________________________________________________

©2007-2008 MoneyGram International; all rights reserved. For compliance use only. 2

COMPLIANCE OFFICER

The Business has designated a Compliance Officer.

Name of the Business Compliance Officer: ___________________________

The Compliance Officer fully understands and performs the duties and responsibilities of this position.

Briefly describe the Compliance Officer’s duties: _______________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

COMPLIANCE PROGRAM

The Business has adopted a written Compliance Program.

The Compliance Program includes written policies, procedures and internal controls designed to comply with the Bank Secrecy Act, including:

Customer identification

Filing Suspicious Activity Reports (SAR-MSB)

Filing Currency Transaction Reports (CTR)

Recordkeeping and retention requirements

Response to law enforcement requests for information

The Compliance Program includes limits specific to the Business, such as a maximum send amount, a maximum receive amount or a maximum amount of money orders that may be purchased.

Briefly describe how these limits are enforced and monitored:

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

©2007-2008 MoneyGram International; all rights reserved. For compliance use only. 3

EMPLOYEE TRAINING

All employees that provide MSB services have received compliance training.

Employees are trained:

|

Daily |

|

Monthly |

|

Semi-Annually |

|

Annually |

|

Every 18 months |

|

Bi-Annually |

As necessary

Employee training includes reading the Compliance Program.

If NO, why not? _____________________________________________

Employees are trained to identify suspicious activity, including structuring.

Employees are tested to validate the employees’ understanding.

Training records and employee signatures are documented and maintained for a minimum of five (5) years.

Is training material thorough and current? Briefly describe the training content:

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

INDEPENDENT REVIEW

The Business conducts periodic Independent Reviews to monitor and maintain an adequate compliance Program.

An Independent Review is conducted:

Semi-Annually Annually Every 18 months |

Bi-Annually |

Other: ______________________________

©2007-2008 MoneyGram International; all rights reserved. For compliance use only. 4

MONEY TRANSFERS

The Compliance Officer (or their designee) reviews the Send / Receive forms or Form Free receipts for accuracy and completeness.

Send/Receive forms or Form Free receipts are properly completed and maintained for transfers of $3,000 or more.

The Send/Receive forms or Form Free receipts are reviewed to determine if CTRs and / or SAR-MSBs should have been filed. They are reviewed every:

Day Week Month Other ________________

Send/Receive forms or Form Free receipts for transfers of $3,000 and more are maintained for a minimum of five (5) years)

MONEY ORDERS

Money order Logs are maintained for money order sales of $3,000 or more.

The Compliance Officer (or their designee) reviews daily activity to identify multiple transactions that may require a Money Order log to be completed.

Money order Logs are reviewed to determine if CTRs/SAR-MSBs should have been filed. They are reviewed every:

Day Week Month Other ________________

Money order Logs are maintained for a minimum of five (5) years.

CUSTOMER IDENTIFICATION

The Compliance Officer (or their designee) periodically reviews the Money Order logs and / or the Send / Receive forms or Form Free receipts to ensure that the identification policy and procedures are being followed.

Valid, government issued, photo identification is recorded for money order sales of $3,000 or more.

Valid, government issued photo identification is recorded for MoneyGram money transfer transactions of $900 or more.

©2007-2008 MoneyGram International; all rights reserved. For compliance use only. 5

SAR-MSBs

The Compliance Officer (or their designee) reviews transaction activity to look for structuring and to ensure that SAR-MSBs are being filed when necessary.

Transaction activity is reviewed to determine if a SAR is needed, was filed or needs to be filed every:

Day Week Month Other ________________

SAR-MSBs are accurately completed and filed on a timely basis for all suspicious transaction(s) of $2,000 or more. If “NO”, why not?

________________________________________________________________

________________________________________________________________

Copies of SAR-MSB forms and supporting documentation are maintained for a minimum of five (5) years.

Blank SAR-MSB forms are available for immediate use.

CTRs

The Compliance Officer (or their designee) reviews all daily MSB activity to identify transactions that either individually or combined may require a CTR to be filed.

Transaction activity is reviewed to determine if a CTR is needed or was filed every:

Day Week Month Other ________________

CTRs are accurately completed and filed on a timely basis for all transactions greater than $10,000, including fees. If “NO”, why not?

________________________________________________________________

________________________________________________________________

Copies of CTRs are maintained for a minimum of five (5) years.

Blank CTR forms are available for immediate use.

©2007-2008 MoneyGram International; all rights reserved. For compliance use only. 6

DATA ANALYSIS

In order to verify that transactions have been properly identified for record keeping and reporting requirements, the Independent Reviewer may choose to conduct a random test of a sample of transactions.

1. Money transfers of $900 and above must include the customer’s:

Name

Current residential address

Phone number

Type of ID provided, the ID number and the ID issuer

2. Money transfers of $3,000 and above must include the customer’s:

Name

Current residential address Phone number

Type of ID provided, the ID number and the ID issuer

Social security number (SSN) or tax identification number (TIN), if the customer is a citizen or authorized resident in the US

–A SSN or TIN is unnecessary if the customer lives and works outside of the US and presents a passport or other applicable photo ID issued by a foreign government.

Date of birth (DOB)

Specific occupation

Signature

3.Single or multiple money orders sold to one person in a single business day must include the customer’s:

Name

Current residential address Phone number

Type of ID provided, the ID number and the ID issuer

Social security number (SSN) or tax identification number (TIN), if the customer is a citizen or authorized resident in the US

–A SSN or TIN is unnecessary if the customer lives and works outside of the US and presents a passport or other applicable photo ID issued by a foreign government.

Date of birth (DOB)

Specific occupation

Signature

4.Aggregated transaction activity should be reviewed to determine if SARs and / or CTRs are needed or were filed as required.

©2007-2008 MoneyGram International; all rights reserved. For compliance use only. 7

Data Analysis was conducted. If “NO”, why not?

________________________________________________________________

________________________________________________________________

Briefly describe the results of the review and analysis:

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

Additional Comments (all unacceptable areas must be addressed):

©2007-2008 MoneyGram International; all rights reserved. For compliance use only. 8

Certification of Independent Review

An independent review of the compliance program of

__________________________________________________________

Name of Business

has been completed.

Among other things, this review focused on the requirements of the USA PATRIOT Act and the Bank Secrecy Act. The results of this review show this entity’s anti-money laundering compliance program to be:

Acceptable:

______________________________________________________________

Acceptable, but recommend the following enhancements:

Unacceptable for the following reasons:

Reviewer’s Name:_________________________________________

Reviewer’s Title:__________________________________________

Reviewer’s Company:______________________________________

Date of Review: __________________________________________

Reviewer Signature: ________________________________

©2007-2008 MoneyGram International; all rights reserved. For compliance use only. 9