Form RD 3550-1 |

Form Approved |

(Rev. 06-06) |

0MB No. 0575-0172 |

United States Department of Agriculture

Rural Development

Rural Housing Service

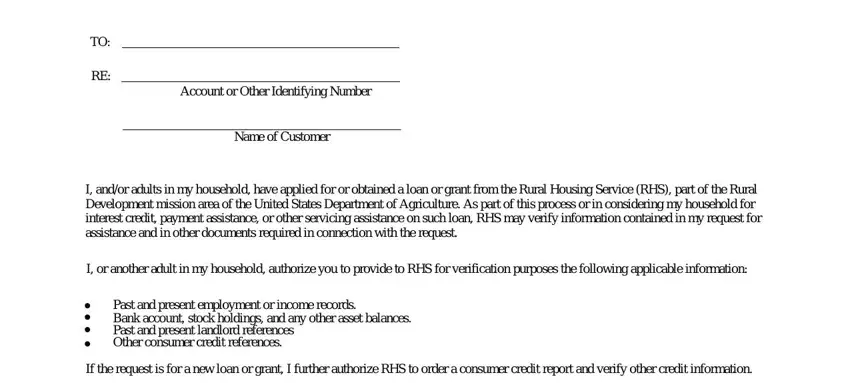

AUTHORIZATION TO RELEASE INFORMATION

TO:

RE:

Account or Other Identifying Number

Name of Customer

I, and/or adults in my household, have applied for or obtained a loan or grant from the Rural Housing Service (RHS), part of the Rural Development mission area of the United States Department of Agriculture. As part of this process or in considering my household for interest credit, payment assistance, or other servicing assistance on such loan, RHS may verify information contained in my request for assistance and in other documents required in connection with the request.

I, or another adult in my household, authorize you to provide to RHS for verification purposes the following applicable information:

Past and present employment or income records.

Bank account, stock holdings, and any other asset balances.

Past and present landlord references

Other consumer credit references.

If the request is for a new loan or grant, I further authorize RHS to order a consumer credit report and verify other credit information.

I understand that under the Right to Financial Privacy Act of 1978, 12 U.S.C. 3401, et seq., RHS is authorized to access my financial records held by financial institutions in connection with the consideration or administration of assistance to me. I also understand that financial records involving my loan and loan application will be available to RHS without further notice or authorization, but will not be disclosed or released by RHS to another Government agency or department or used for another purpose without my consent except as required or permitted by law.

This authorization is valid for the life of the loan.

The recipient of this form may rely on the Government's representation that the loan is still in existence.

The information RHS obtains is only to be used to process my request for a loan or grant, interest credit, payment assistance, or other servicing assistance. I acknowledge that I have received a copy of the Notice to Applicant Regarding Privacy Act Information. I understand that if I have requested interest credit or payment assistance, this authorization to release information will cover any future requests for such assistance and that I will not be renotified of the Privacy Act information unless the Privacy Act information has changed conceming use of such information.

A copy of this authorization may be accepted as an original.

Your prompt reply is appreciated.

Signature (Applicant or Adult Household Member) |

|

Date |

According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information unless as displays a valid OMB control number. The valid OMB control number for this information collection is 0575-0172. The time required to complete this information collection is estimated to average 5 minutes per response, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information.

RHS Is An Equal Opportunity Lender

SEE ATTACHED PRIVACY ACT NOTICE

Rural Development

State Office

359 East Park

Drive, Suite 4 Harrisburg, PA 17111- 2747

Voice 717.237.2299 Fax 855-813-2863

TTY/TDD & Voice 711 TDD only 717.237.2261

www.rurdev.usda.gov/pa

Dear Applicant:

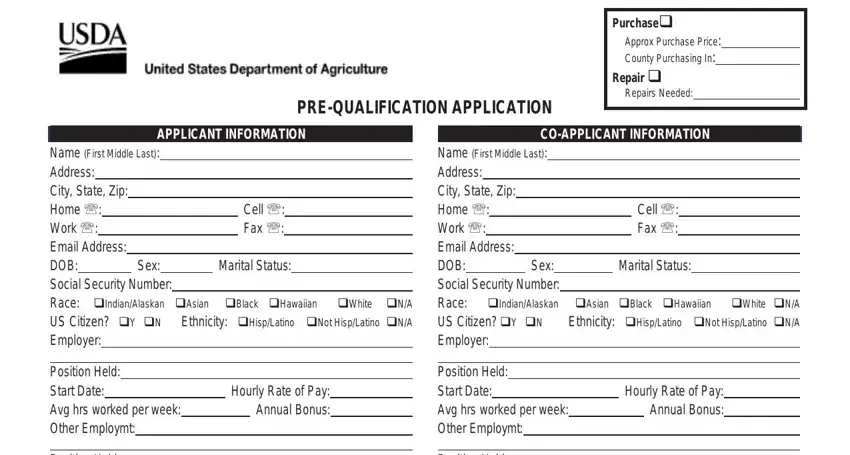

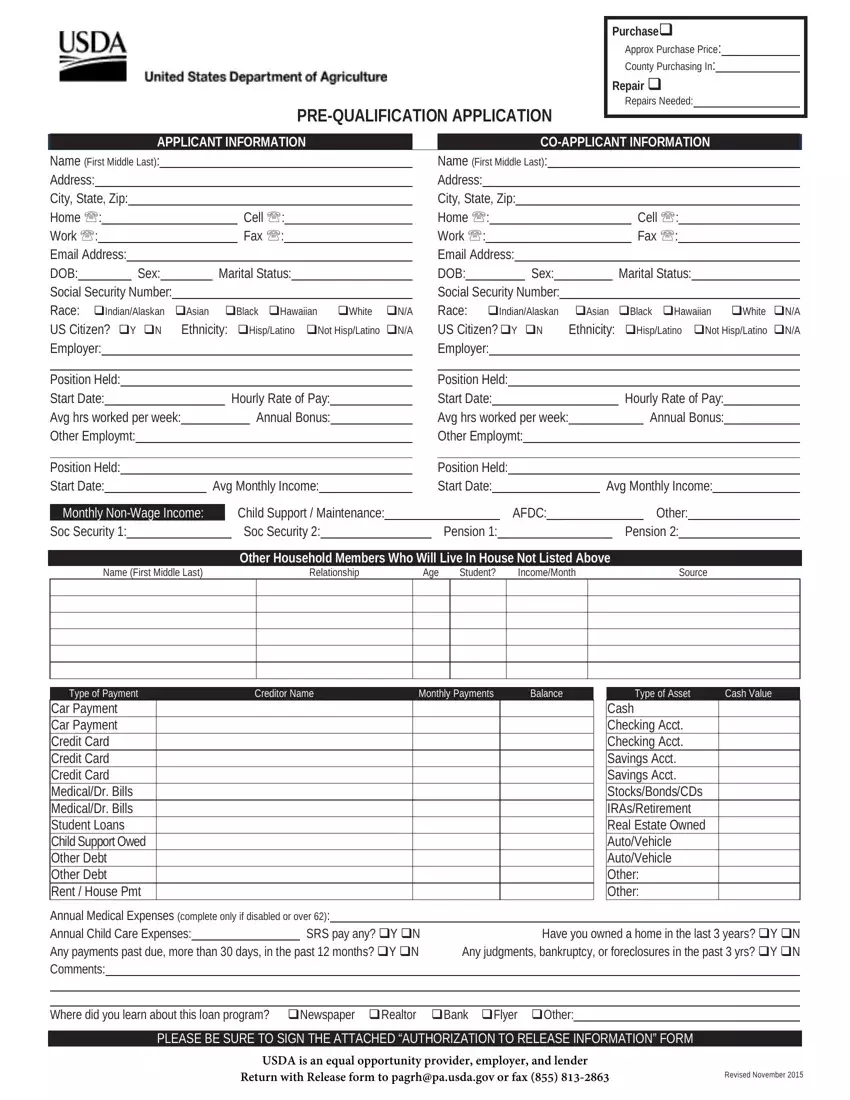

Thank you for your interest in USDA Rural Development’s Section 502 Direct Lending Program.

As requested, enclosed is a Pre-Qualification worksheet. This form is the first step in preparing for homeownership through the USDA Rural Development Loan Program.

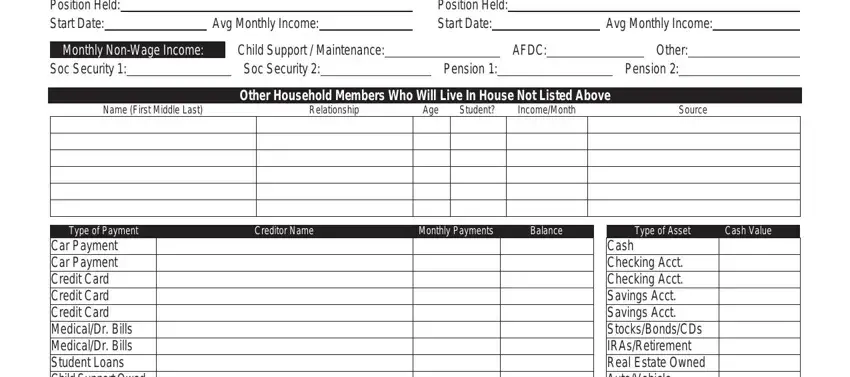

To help us determine if you are eligible for the Section 502 program, please complete all applicable sections. Upon receipt of your application and signed Form 3550-1, a Preliminary Credit Report will be obtained at no cost to you. We will evaluate the information provided to gain a general idea of your situation and assess of your financial eligibility.

Please ensure all adult household members 18 years or older SIGN and

DATE Form 3550-1 “Authorization to Release Information.”

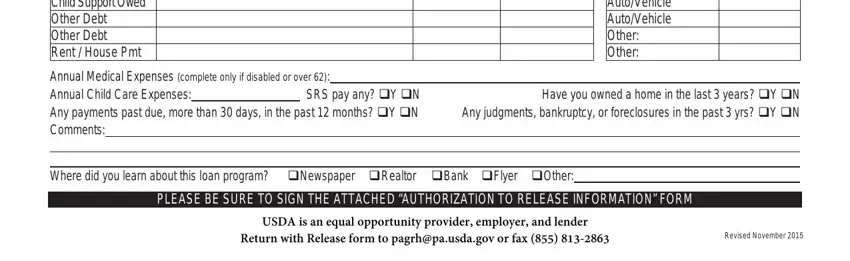

Please submit your completed application to include the Pre-Qualification Application and Form 3550-1 by mail, fax, or email to the contact information below. We will notify you within 14 days by email or mail once a preliminary review has been completed.

If you have any questions, please contact our state office at (717) 237-2186 or visit www.rd.usda.gov/PA_Contact_Us to locate our nearest field office.

We appreciate the opportunity to serve you.

USDA Rural Development Housing Programs

359 East Park Drive, Suite 4

Harrisburg, PA 17111-2747

Fax: 855-813-2863

Email: pagrh@pa.usda.gov

USDA is an equal opportunity provider and employer.

If you wish to file a Civil Rights program complaint of discrimination, complete the USDA Program Discrimination Complaint Form (PDF), found online at http://www.ascr.usda.gov/complaint_filing_cust.html, or at any USDA office, or call (866) 632-9992 to request the form. You may also write a letter containing all of the information requested in the form. Send your completed complaint form or letter to us by mail at U.S. Department of Agriculture, Director, Office of Adjudication, 1400 Independence Avenue, S.W., Washington, D.C.

20250-9410, by fax (202) 690-7442 or email at program.intake@usda.gov.

NOTICE TO APPLICANT REGARDING PRIVACY ACT INFORMATION

The information requested on this form is authorized to be collected by the Rural Housing Service (RHS), Rural Business-Cooperative Services (RBS), Rural Utilities Service (RUS) or the Farm Service Agency (FSA) (''the agency'') by title V of the Housing Act of 1949, as amended (42 U.S.C. 1471 et seq.) or by the Consolidated Farm and Rural Development Act (7 U.S.C. 1921 et seq.), or by other laws administered by RHS, RBS, RUS or FSA.

Disclosure of information requested is voluntary. However, failure to disclose certain items of information requested, including your Social Security Number or Federal Identification Number, may result in a delay in the processing of an application or its rejection. Information provided may be used outside of the agency for the following purposes:

1 . When a record on its face, or in conjunction with other records, indicates a violation or potential violation of law, whether civil, criminal or regulatory in nature, and whether arising by general statute or particular program statute, or by regulation, rule, or order issued pursuant thereto, disclosure may be made to the appropriate agency, whether Federal, foreign, State, local, or tribal, or other public authority responsible for enforcing, investigating or prosecuting such violation or charged with enforcing or implementing the statute, or rule, regulation, or order issued pursuant thereto, if the information disclosed is relevant to any enforcement, regulatory, investigative, or prosecutive responsibility of the receiving entity.

2. A record from this system of records may be disclosed to a Member of Congress or to a Congressional staff member in response to an inquiry of the Congressional office made at the written request of the constituent about whom the record is maintained.

3. Rural Development will provide information from this system to the U.S. Department of the Treasury and to other Federal agencies maintaining debt servicing centers, in connection with overdue debts, in order to participate in the Treasury Offset Program as required by the Debt Collection Improvement Act, Pub. L. 104-134, Section 31001.

4. Disclosure of the name, home address, and information concerning default on loan repayment when the default involves a security interest in tribal allotted or trust land. Pursuant to the Cranston-Gonzales National Affordable Housing Act of 1990 (42 U.S.C. 12701 et seq.), liquidation may be pursued only after offering to transfer the account to an eligible tribal member, the tribe, or the Indian Housing Authority serving the tribe(s).

5. Referral of names, home addresses, social security numbers, and financial information to a collection or servicing contractor, financial institu- tion, or a local, State, or Federal agency, when Rural Development determines such referral is appropriate for servicing or collecting the borrower's account or as provided for in contracts with servicing or collection agencies.

6. It shall be a routine use of the records in this system of records to disclose them in a proceeding before a court or adjudicative body, when: (a) the agency or any component thereof; or (b) any employee of the agency in his or her official capacity; or (c) any employee of the agency in his or her individual capacity where the agency has agreed to represent the employee, or (d) the United States is a party to litigation or has an interest in such litigation, and by careful review, the agency determines that the records are both relevant and necessary to the litigation, provided; however, that in each case, the agency determines that disclosure of the records is a use of the information contained in the records that is compatible with the purpose for which the agency collected the records.

7. Referral of names, home addresses, and financial information for selected borrowers to financial consultants, advisors, lending institutions, packagers, agents and private or commercial credit sources, when Rural Development determines such referral is appropriate to encourage the borrower to refinance the Rural Development indebtedness as required by title V of the Housing Act of 1949, as amended (42 U.S.C. 1471), or to assist the borrower in the sale of the property .

8. Referral of legally enforceable debts to the Department of the Treasury, Internal Revenue Service (IRS), to be offset against any tax refund that may become due the debtor for the tax year in which the referral is made, in accordance with the IRS regulations at 26 C.F.R. 301.6402-6T, Offset of Past Due Legally Enforceable Debt Against Overpayment, and under the authority contained in 31 U.S.C. 3720A.

9. Referral of information regarding indebtedness to the Defense Manpower Data Center, Department of Defense, and the United States Postal Service for the purpose of conducting computer matching programs to identify and locate individuals receiving Federal salary or benefit payments and who are delinquent in their repayment of debts owed to the U.S. Government under certain programs administered by Rural Development in order to collect debts under the provisions of the Debt Collection Act of 1982 (5 U.S.C. 5514) by voluntary repayment, administrative or salary offset procedures, or by collection agencies.

10. Referral of names, home addresses, and financial information to lending institutions when Rural Development determines the individual may be financially capable of qualifying for credit with or without a guarantee.

11.Disclosure of names, home addresses, social security numbers, and financial information to lending institutions that have a lien against the same property as Rural Development for the purpose of the collection of the debt. These loans can be under the direct and guaranteed loan programs.

12.Referral to private attorneys under contract with either Rural Development or with the Department of Justice for the purpose of foreclosure and possession actions and collection of past due accounts in connection with Rural Development.

13.It shall be a routine use of the records in this system of records to disclose them to the Department of Justice when: (a) The agency or any component thereof; or (b) any employee of the agency in his or her official capacity where the Department of Justice has agreed to represent the employee; or (c) the United States Government, is a party to litigation or has an interest in such litigation, and by careful review, the agency deter- mines that the records are both relevant and necessary to the litigation and the use of such records by the Department of Justice is therefore deemed by the agency to be for a purpose that is compatible with the purpose for which the agency collected the records.

NOTICE TO APPLICANT REGARDING PRIVACY ACT INFORMATION- CONTINUED

14Referral of names, home addresses, social security numbers, and financial information to the Department of Housing and Urban Development (HUD) as a record of location utilized by Federal agencies for an automatic credit prescreening system.

15.Referral of names, home addresses, social security numbers, and financial information to the Department of Labor, State Wage Information Collection Agencies, and other Federal, State, and local agencies, as well as those responsible for verifying information furnished to qualify for Federal benefits, to conduct wage and benefit matching through manual and/or automated means, for the purpose of determining compliance with Federal regulations and appropriate servicing actions against those not entitled to program benefits, including possible recovery of improper benefits.

16.Referral of names, home addresses, and financial information to financial consultants, advisors, or underwriters, when Rural Development determines such referral is appropriate for developing packaging and marketing strategies involving the sale of Rural Development loan assets.

17.Rural Development, in accordance with 31 U.S.C. 3711(e)(5), will provide to consumer reporting agencies or commercial reporting agencies information from this system indicating that an individual is responsible for a claim that is current.

18.Referral of names, home addresses, home telephone numbers, social security numbers, and financial information to escrow agents (which also could include attorneys and title companies) selected by the applicant or borrower for the purpose of closing the loan.

19.Disclosures pursuant to 5 U.S.C. 552a(b)(12): Disclosures may be made from this system to consumer reporting agencies as defined in the

Fair Credit Reporting Act (15 U.S.C. 168a(f) or the Federal Claims Collection Act (31U.S.C. 3701(a)(3)).