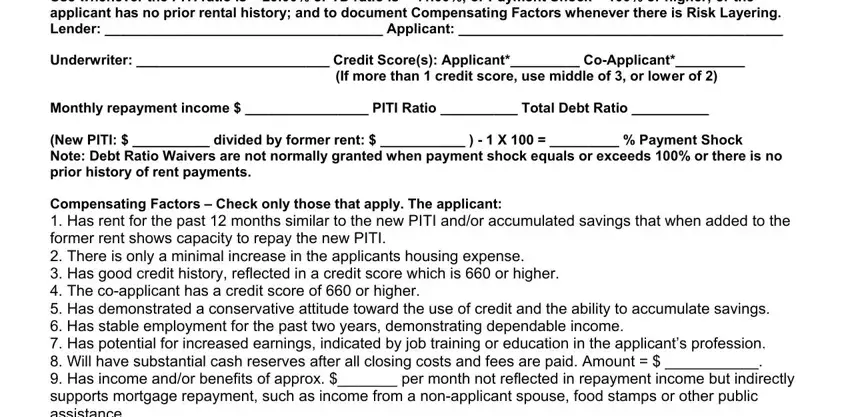

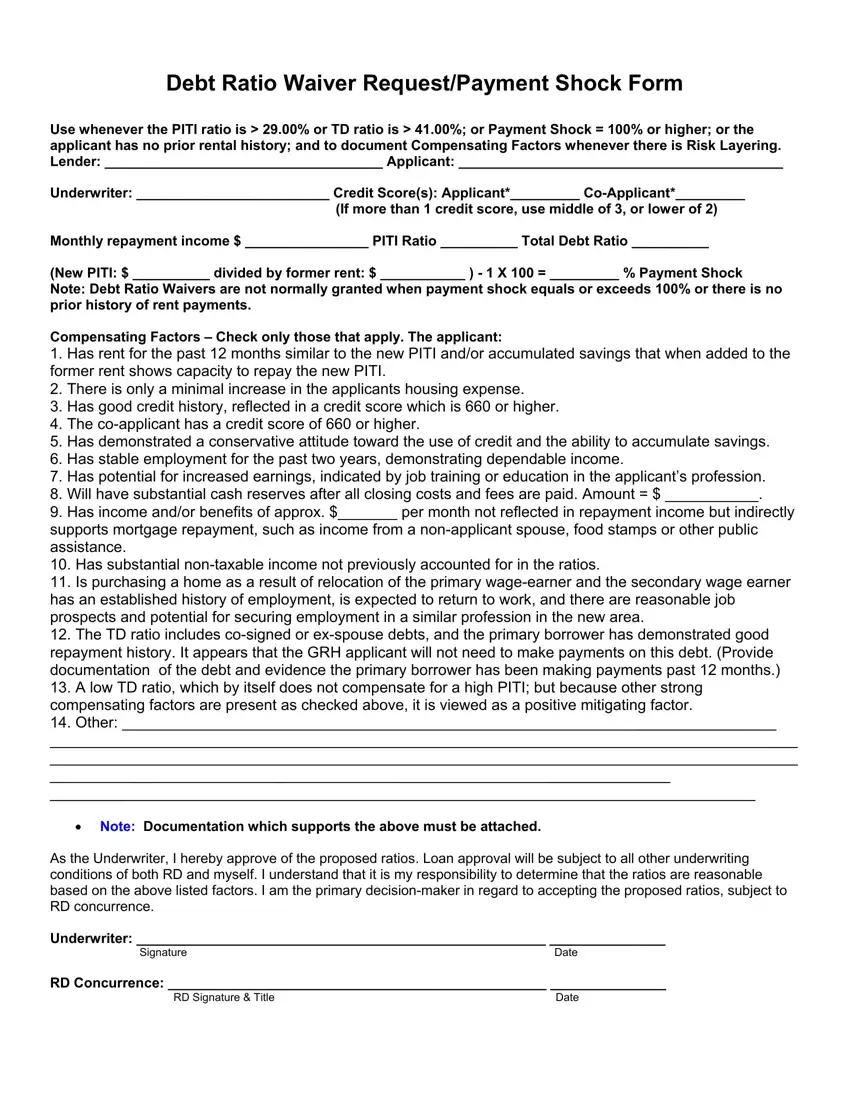

Debt Ratio Waiver Request/Payment Shock Form

Use whenever the PITI ratio is > 29.00% or TD ratio is > 41.00%; or Payment Shock = 100% or higher; or the applicant has no prior rental history; and to document Compensating Factors whenever there is Risk Layering. Lender: ____________________________________ Applicant: __________________________________________

Underwriter: _________________________ Credit Score(s): Applicant*_________ Co-Applicant*_________

(If more than 1 credit score, use middle of 3, or lower of 2) Monthly repayment income $ ________________ PITI Ratio __________ Total Debt Ratio __________

(New PITI: $ __________ divided by former rent: $ ___________ ) - 1 X 100 = _________ % Payment Shock

Note: Debt Ratio Waivers are not normally granted when payment shock equals or exceeds 100% or there is no prior history of rent payments.

Compensating Factors – Check only those that apply. The applicant:

1.Has rent for the past 12 months similar to the new PITI and/or accumulated savings that when added to the former rent shows capacity to repay the new PITI.

2.There is only a minimal increase in the applicants housing expense.

3.Has good credit history, reflected in a credit score which is 660 or higher.

4.The co-applicant has a credit score of 660 or higher.

5.Has demonstrated a conservative attitude toward the use of credit and the ability to accumulate savings.

6.Has stable employment for the past two years, demonstrating dependable income.

7.Has potential for increased earnings, indicated by job training or education in the applicant’s profession.

8.Will have substantial cash reserves after all closing costs and fees are paid. Amount = $ ___________.

9.Has income and/or benefits of approx. $_______ per month not reflected in repayment income but indirectly supports mortgage repayment, such as income from a non-applicant spouse, food stamps or other public assistance.

10.Has substantial non-taxable income not previously accounted for in the ratios.

11.Is purchasing a home as a result of relocation of the primary wage-earner and the secondary wage earner has an established history of employment, is expected to return to work, and there are reasonable job prospects and potential for securing employment in a similar profession in the new area.

12.The TD ratio includes co-signed or ex-spouse debts, and the primary borrower has demonstrated good repayment history. It appears that the GRH applicant will not need to make payments on this debt. (Provide documentation of the debt and evidence the primary borrower has been making payments past 12 months.)

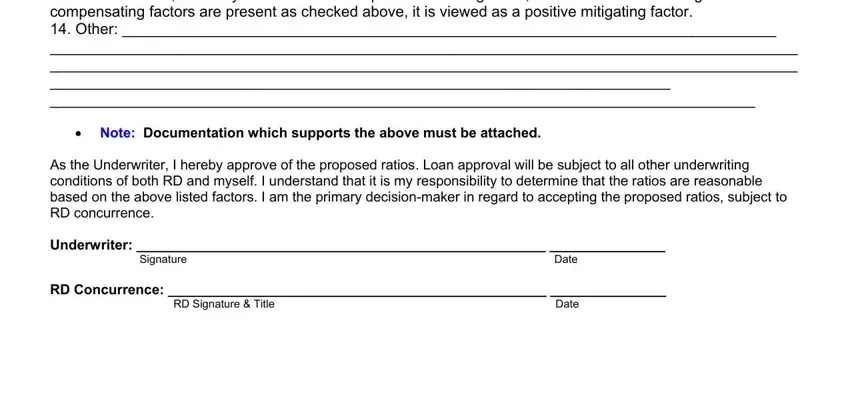

13.A low TD ratio, which by itself does not compensate for a high PITI; but because other strong compensating factors are present as checked above, it is viewed as a positive mitigating factor.

14.Other: _____________________________________________________________________________

________________________________________________________________________________________

________________________________________________________________________________________

_________________________________________________________________________

___________________________________________________________________________________

•Note: Documentation which supports the above must be attached.

As the Underwriter, I hereby approve of the proposed ratios. Loan approval will be subject to all other underwriting conditions of both RD and myself. I understand that it is my responsibility to determine that the ratios are reasonable based on the above listed factors. I am the primary decision-maker in regard to accepting the proposed ratios, subject to RD concurrence.

Underwriter: _____________________________________________________ _______________

SignatureDate

RD Concurrence: _________________________________________________ _______________

RD Signature & Title |

Date |