usda 1980 19 can be completed online without any problem. Just use FormsPal PDF editor to accomplish the job promptly. The editor is continually improved by our staff, receiving additional functions and growing to be better. To get the ball rolling, go through these simple steps:

Step 1: Hit the "Get Form" button above. It'll open up our pdf tool so you could start filling in your form.

Step 2: With this advanced PDF editing tool, you'll be able to do more than merely fill out blanks. Express yourself and make your docs seem sublime with customized text incorporated, or modify the original content to excellence - all comes along with the capability to add your own photos and sign the document off.

This document will require specific info to be entered, therefore you should take the time to provide precisely what is expected:

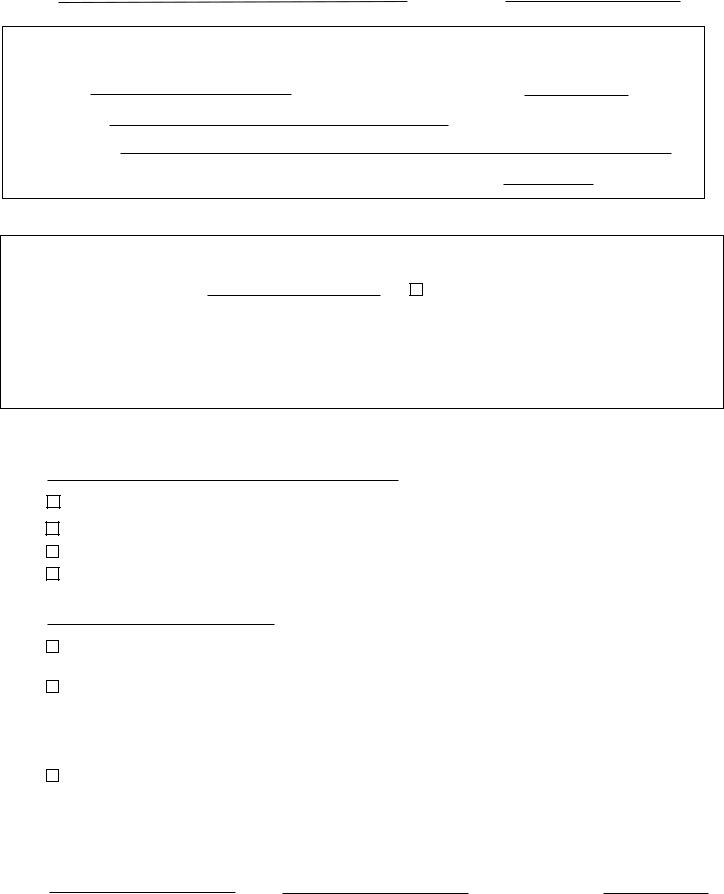

1. Whenever submitting the usda 1980 19, make sure to incorporate all important fields within the associated part. This will help to expedite the work, allowing your details to be processed without delay and appropriately.

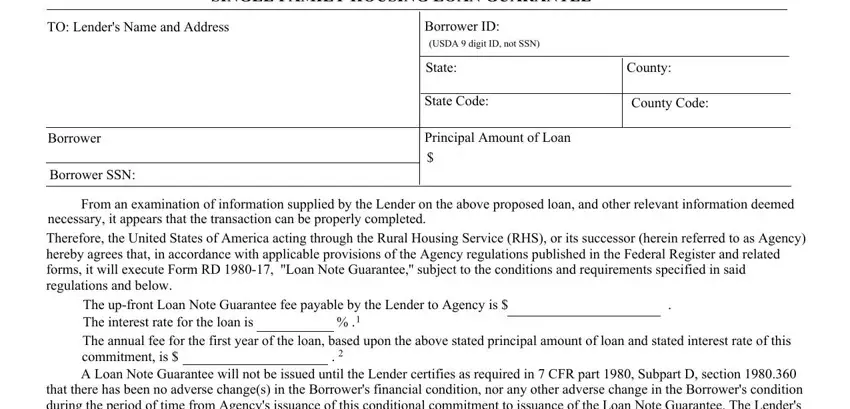

2. The next part is usually to submit all of the following blanks: A Loan Note Guarantee will not be, This conditional commitment, with CFR part Subpart D section, Additional Conditions and, See Attachment to this form for, No additional conditions, This conditional commitment will, unless the time is extended in, the Lenders earlier notification, UNITED STATES OF AMERICA, Date, and Title.

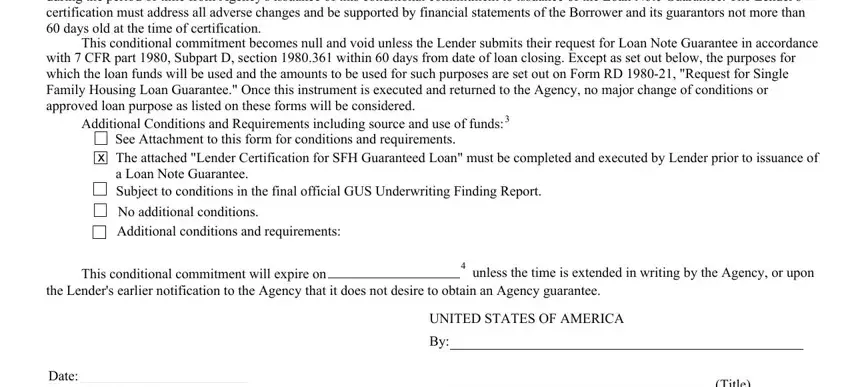

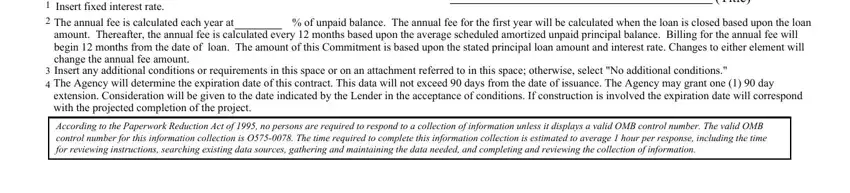

3. Completing Date, Insert fixed interest rate, Title, The annual fee is calculated each, The Agency will determine the, and According to the Paperwork is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

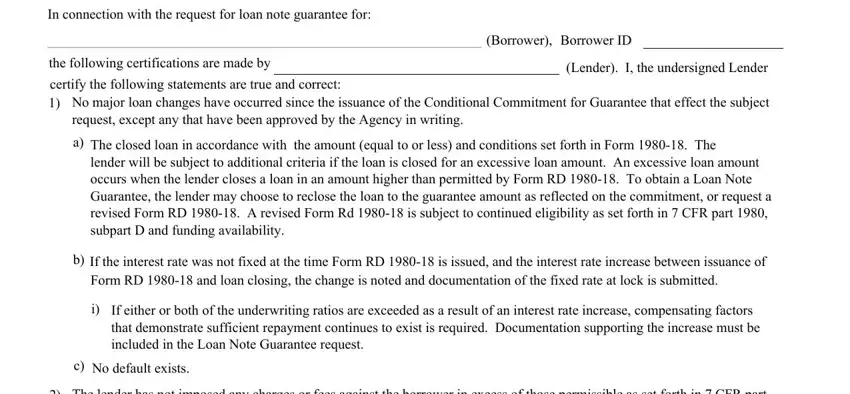

4. This part comes with the next few blanks to fill out: In connection with the request for, the following certifications are, Borrower, Borrower ID, Lender I the undersigned Lender, certify the following statements, No major loan changes have, a The closed loan in accordance, lender will be subject to, If the interest rate was not fixed, If either or both of the, No default exists, and The lender has not imposed any.

You can easily make an error when filling out the Borrower, so make sure to go through it again prior to when you finalize the form.

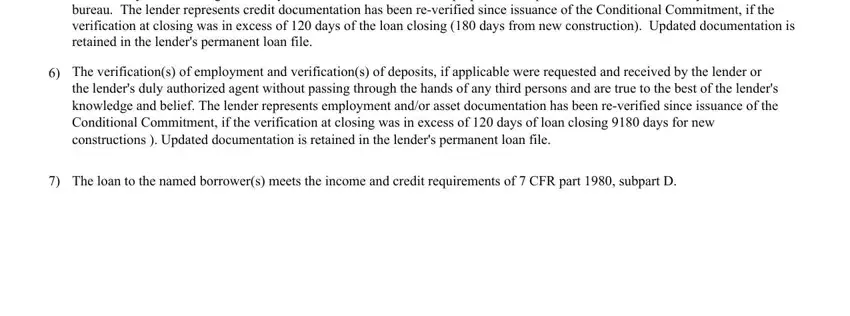

5. Lastly, the following final section is precisely what you'll want to finish before submitting the form. The blank fields under consideration include the following: The credit report submitted on the, The verifications of employment, and The loan to the named borrowers.

Step 3: Before moving forward, double-check that form fields are filled in the right way. The moment you think it is all good, click “Done." After starting a7-day free trial account here, you will be able to download usda 1980 19 or send it through email right off. The PDF file will also be available through your personal cabinet with your adjustments. We don't share any information you enter whenever working with forms at our site.