When working in the online PDF tool by FormsPal, you can easily fill out or modify utah form here and now. To have our tool on the forefront of efficiency, we strive to put into action user-oriented capabilities and improvements regularly. We are at all times happy to receive feedback - join us in remolding how we work with PDF files. To get started on your journey, go through these basic steps:

Step 1: Open the PDF form inside our tool by pressing the "Get Form Button" at the top of this webpage.

Step 2: When you start the PDF editor, you will find the form all set to be filled in. Other than filling out different fields, you might also perform other sorts of actions with the PDF, particularly putting on any text, editing the original text, inserting graphics, signing the form, and a lot more.

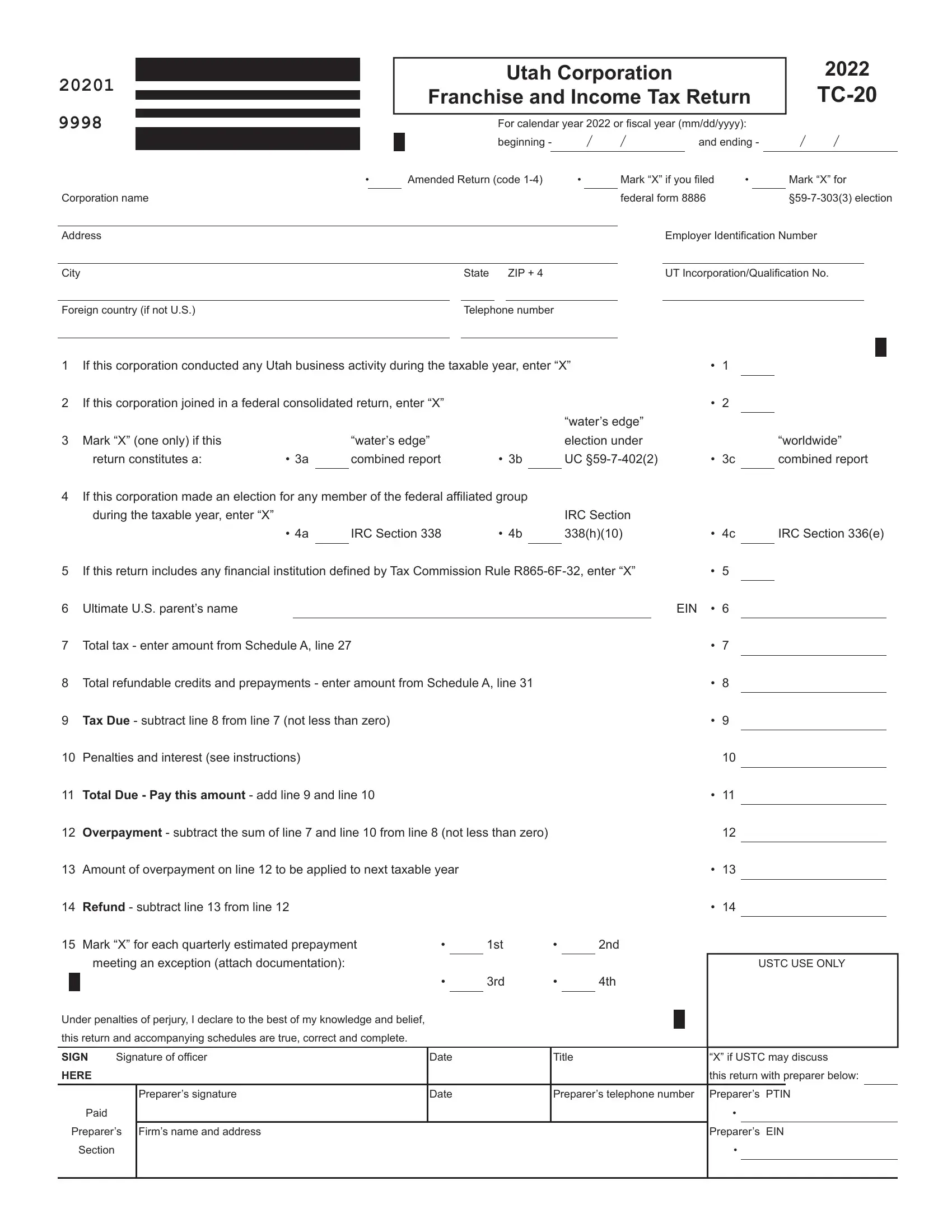

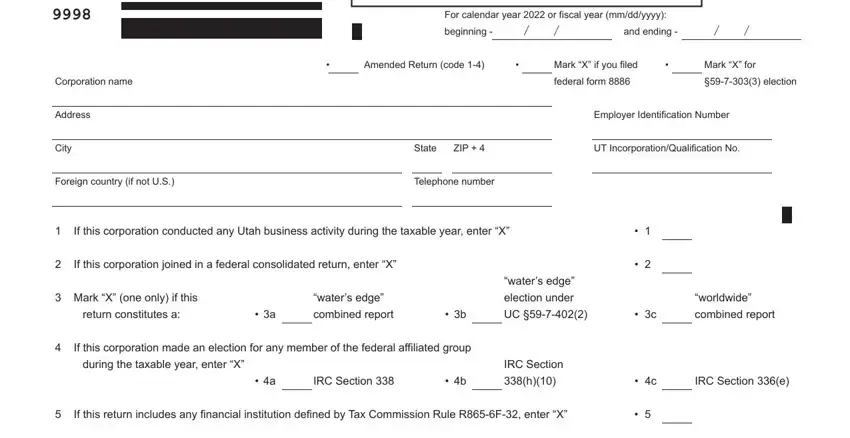

This document will require some specific information; to guarantee accuracy and reliability, don't hesitate to heed the suggestions hereunder:

1. When filling in the utah form, make sure to incorporate all of the necessary blank fields in its corresponding part. It will help speed up the work, making it possible for your details to be handled promptly and appropriately.

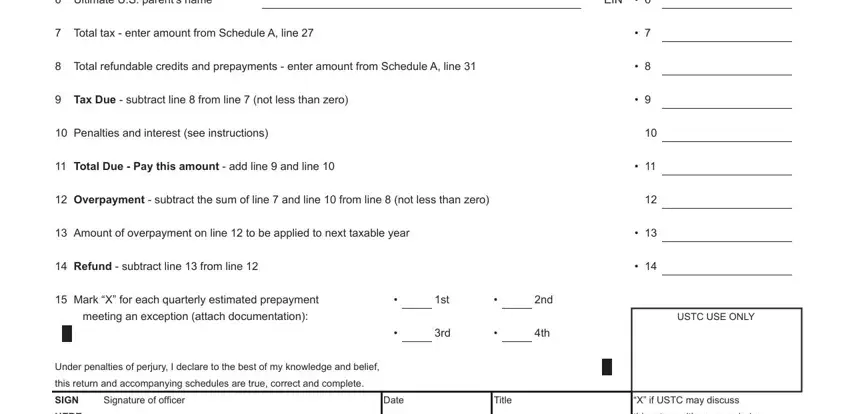

2. Once your current task is complete, take the next step – fill out all of these fields - Ultimate US parents name, Total tax enter amount from, Total refundable credits and, Tax Due subtract line from line, Penalties and interest see, Total Due Pay this amount add, Overpayment subtract the sum of, cid, cid, Amount of overpayment on line to, Refund subtract line from line, Mark X for each quarterly, meeting an exception attach, Under penalties of perjury I, and this return and accompanying with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

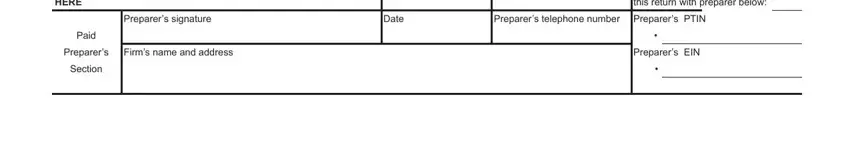

3. Throughout this part, have a look at Preparers signature, HERE, Paid, Preparers, Firms name and address, Section, Date, this return with preparer below, Preparers telephone number, cid, Preparers EIN, and cid. All these should be filled out with utmost accuracy.

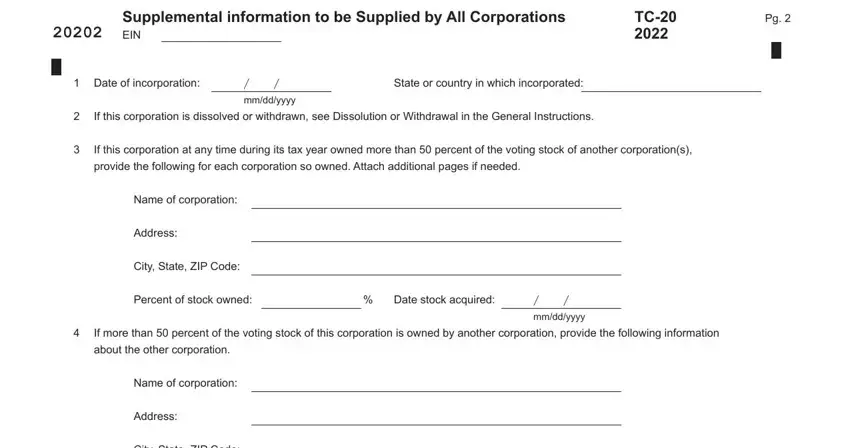

4. This next section requires some additional information. Ensure you complete all the necessary fields - Supplemental information to be, Date of incorporation, mmddyyyy, State or country in which, If this corporation is dissolved, If this corporation at any time, provide the following for each, Name of corporation, Address, City State ZIP Code, Percent of stock owned, Date stock acquired, mmddyyyy, If more than percent of the, and about the other corporation - to proceed further in your process!

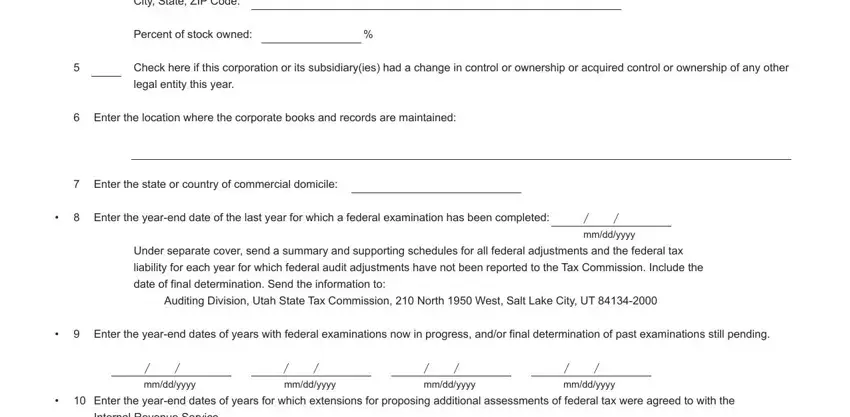

5. Last of all, the following final part is what you'll have to complete before using the form. The blanks at issue include the following: City State ZIP Code, Percent of stock owned, Check here if this corporation or, legal entity this year, Enter the location where the, Enter the state or country of, cid Enter the yearend date of the, mmddyyyy, Under separate cover send a, liability for each year for which, date of final determination Send, Auditing Division Utah State Tax, cid Enter the yearend dates of, mmddyyyy, and mmddyyyy.

Be really mindful when filling in mmddyyyy and legal entity this year, as this is the section in which many people make a few mistakes.

Step 3: Spell-check everything you have inserted in the blank fields and press the "Done" button. Try a 7-day free trial option with us and gain direct access to utah form - with all transformations preserved and available from your personal account. FormsPal is committed to the personal privacy of all our users; we ensure that all personal information used in our tool stays secure.