Utah Form Tc 42 can be filled out online very easily. Just try FormsPal PDF editor to complete the task fast. Our team is aimed at providing you with the ideal experience with our editor by constantly introducing new capabilities and enhancements. With all of these improvements, using our tool becomes better than ever before! In case you are seeking to get started, this is what it will require:

Step 1: Open the PDF doc inside our editor by hitting the "Get Form Button" above on this webpage.

Step 2: When you access the PDF editor, you will notice the document made ready to be filled out. Besides filling in different fields, you may as well perform other actions with the Document, including writing your own words, editing the initial textual content, adding graphics, affixing your signature to the form, and much more.

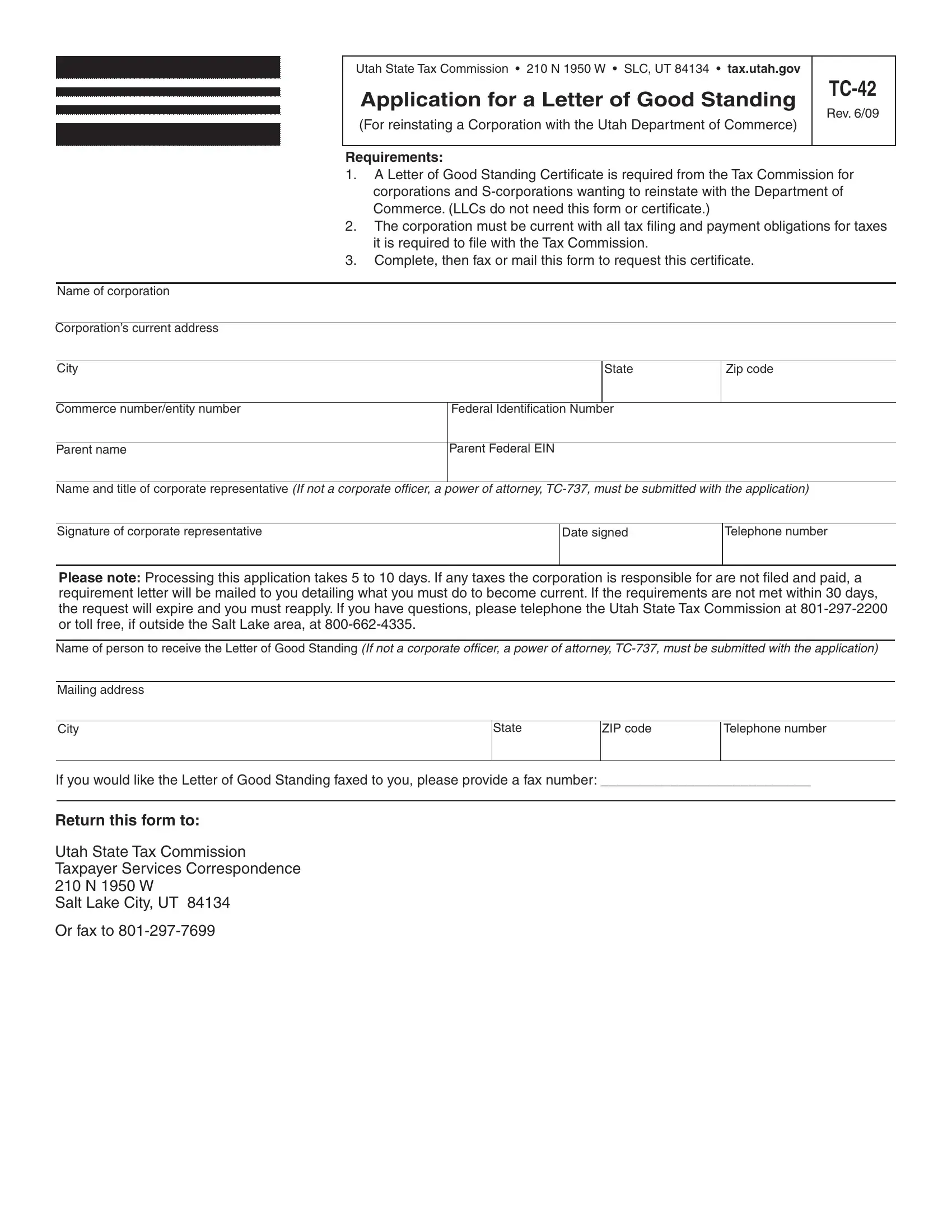

As for the blanks of this particular document, here is what you need to know:

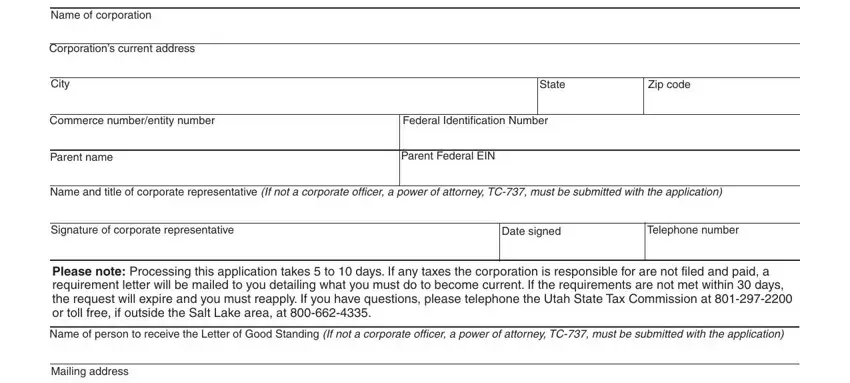

1. To start off, while completing the Utah Form Tc 42, start out with the form section that has the next fields:

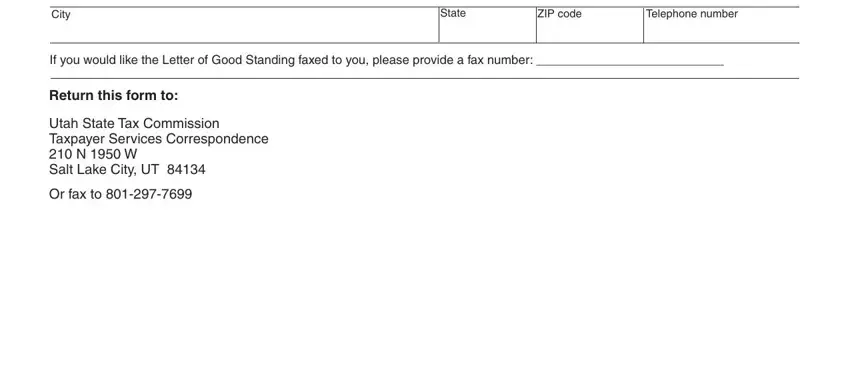

2. Once your current task is complete, take the next step – fill out all of these fields - City, State, ZIP code, Telephone number, If you would like the Letter of, Return this form to, Utah State Tax Commission Taxpayer, and Or fax to with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

It's easy to get it wrong while completing the State, hence make sure that you go through it again prior to deciding to send it in.

Step 3: After you've looked once again at the information in the file's blanks, press "Done" to conclude your document creation. Right after starting a7-day free trial account at FormsPal, you will be able to download Utah Form Tc 42 or email it right off. The document will also be easily accessible via your personal account with your changes. FormsPal is invested in the privacy of our users; we ensure that all information going through our editor continues to be secure.