Using PDF forms online is always super easy with this PDF editor. Anyone can fill in Utah Form Tc 941D here within minutes. FormsPal team is ceaselessly working to develop the editor and ensure it is even easier for users with its handy features. Make use of today's progressive opportunities, and find a heap of emerging experiences! If you are seeking to begin, here's what it takes:

Step 1: Hit the "Get Form" button above. It'll open our pdf editor so you can start filling in your form.

Step 2: The editor will let you work with most PDF forms in many different ways. Enhance it by writing customized text, correct what's originally in the file, and add a signature - all at your disposal!

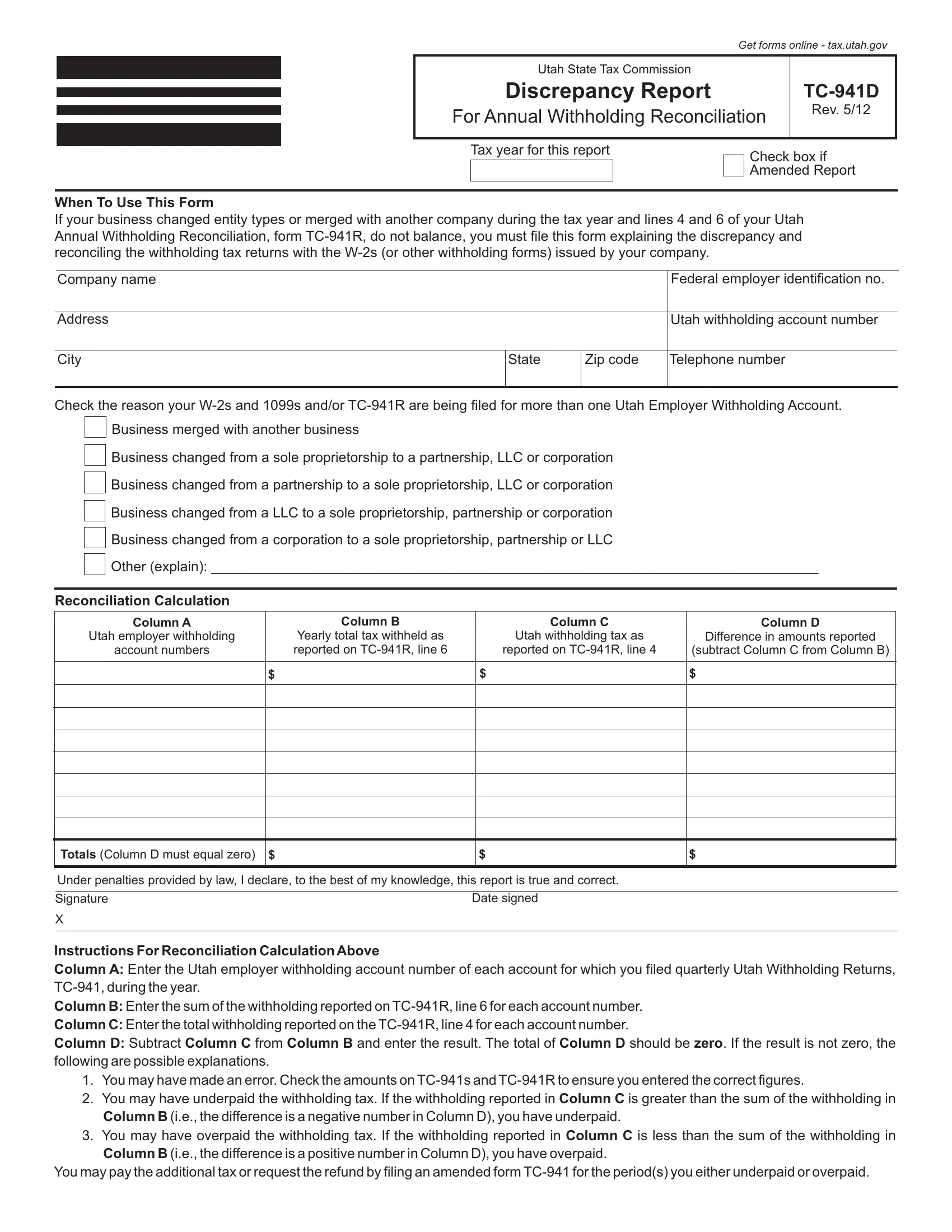

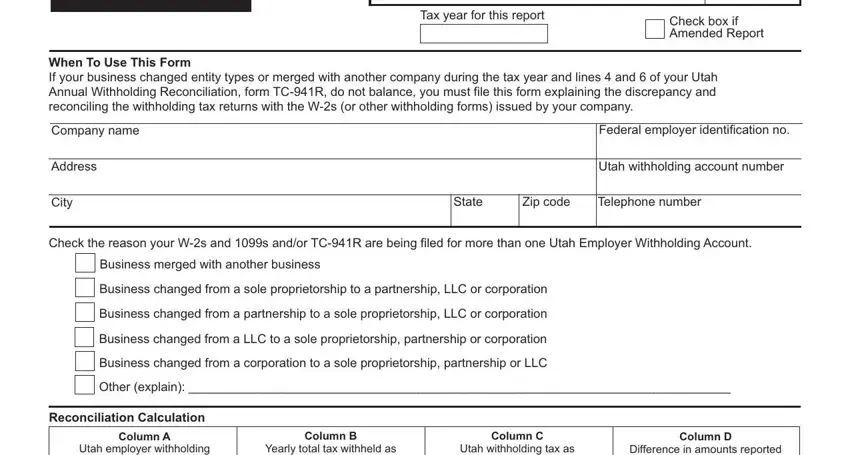

As a way to complete this PDF form, be sure to enter the required details in each and every blank field:

1. While submitting the Utah Form Tc 941D, make certain to complete all important blank fields in its associated form section. It will help facilitate the process, allowing your details to be processed quickly and properly.

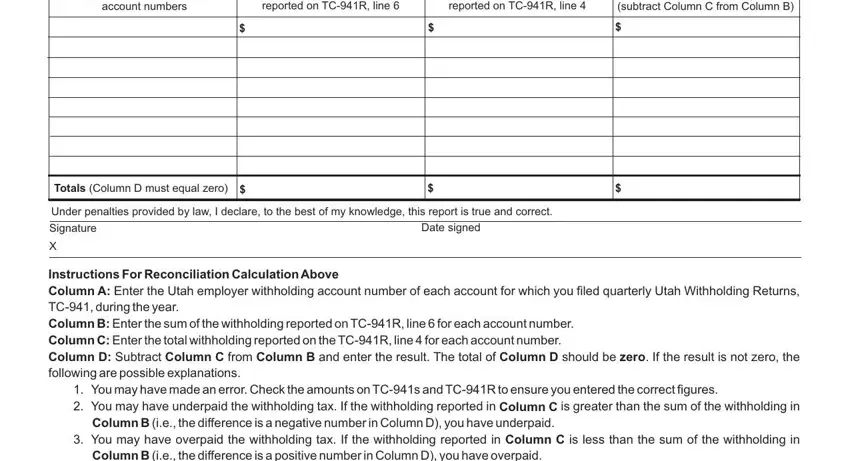

2. Once your current task is complete, take the next step – fill out all of these fields - Utah employer withholding, account numbers, Yearly total tax withheld as, Utah withholding tax as, reported on TCR line, Difference in amounts reported, subtract Column C from Column B, Totals Column D must equal zero, Under penalties provided by law I, Signature, Date signed, Enter the Utah employer, Instructions For Reconciliation, Column B, and from with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

In terms of Utah employer withholding and Date signed, be sure you do everything properly in this section. The two of these are the key ones in the document.

Step 3: Before moving forward, it's a good idea to ensure that all blank fields are filled out properly. Once you are satisfied with it, click on “Done." Download your Utah Form Tc 941D after you sign up for a free trial. Quickly get access to the pdf inside your personal account, with any edits and changes automatically saved! When using FormsPal, it is simple to complete documents without having to get worried about database incidents or entries getting shared. Our secure software helps to ensure that your private data is maintained safely.