The PDF editor can make managing documents easy. It is extremely easy to enhance the [FORMNAME] form. Follow the following steps to be able to do this:

Step 1: Hit the button "Get form here" to access it.

Step 2: Now you are free to modify utah tc 40 tax. You have a lot of options thanks to our multifunctional toolbar - you can add, erase, or modify the text, highlight the specified sections, as well as perform several other commands.

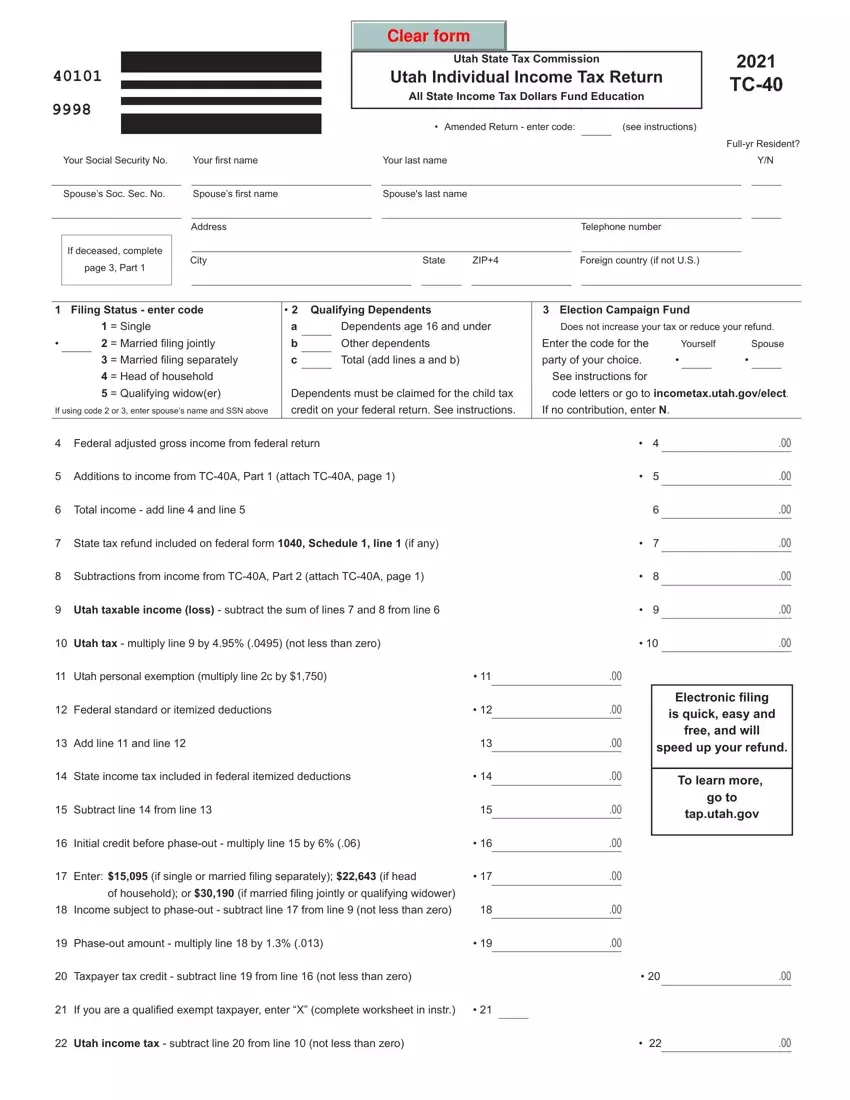

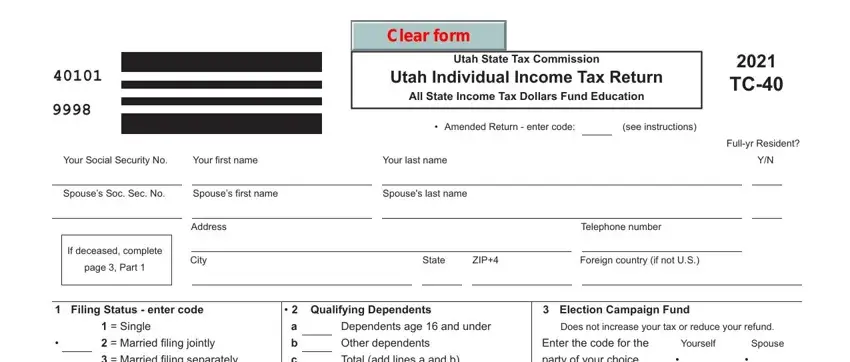

Create the utah tc 40 tax PDF by providing the content required for each section.

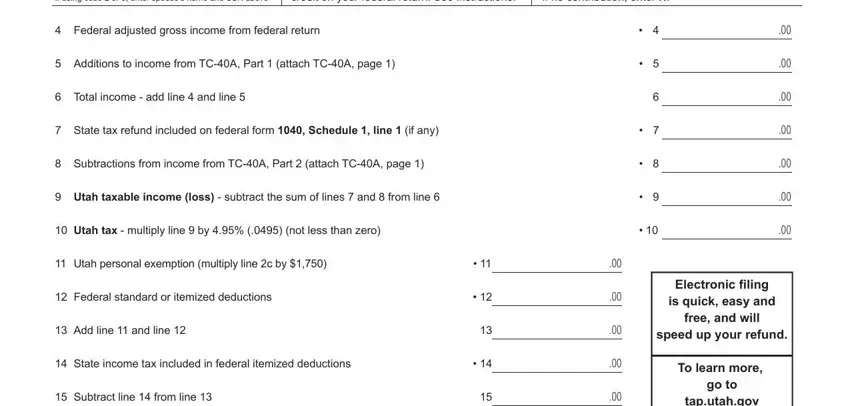

You should note the details within the section If using code or enter spouses, credit on your federal return See, If no contribution enter N, Federal adjusted gross income, Additions to income from TCA Part, Total income add line and line, State tax refund included on, Subtractions from income from TCA, Utah taxable income loss, Utah tax multiply line by not, Utah personal exemption multiply, Federal standard or itemized, Add line and line, State income tax included in, and Subtract line from line.

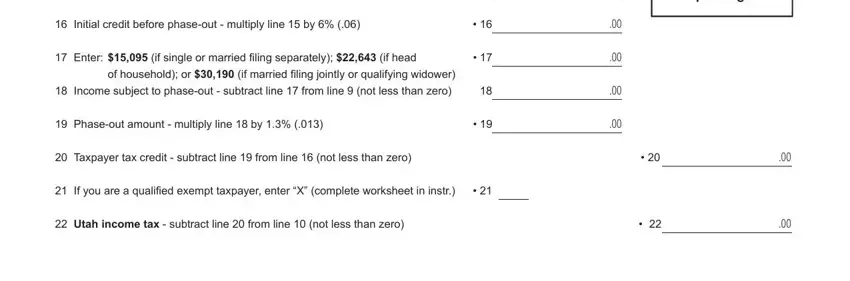

Mention the important details in Initial credit before phaseout, Enter if single or married, of household or if married filing, Income subject to phaseout, Phaseout amount multiply line, Taxpayer tax credit subtract, If you are a qualified exempt, Utah income tax subtract line, and To learn more go to taputahgov section.

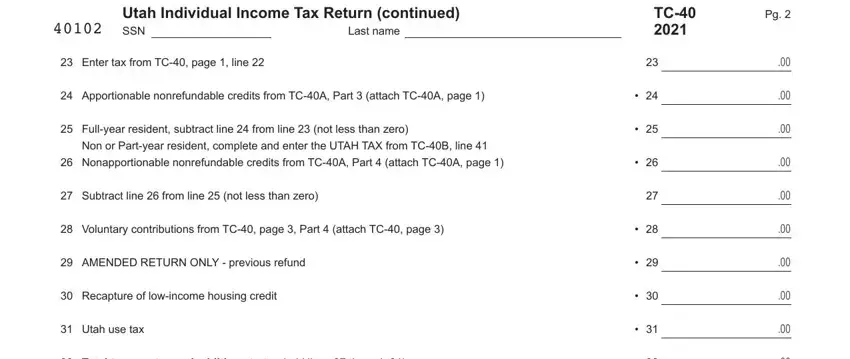

In part Utah Individual Income Tax Return, Last name, Enter tax from TC page line, Apportionable nonrefundable, Fullyear resident subtract line, Non or Partyear resident complete, Nonapportionable nonrefundable, Subtract line from line not, Voluntary contributions from TC, AMENDED RETURN ONLY previous, Recapture of lowincome housing, Utah use tax, and Total tax use tax and additions, define the rights and responsibilities.

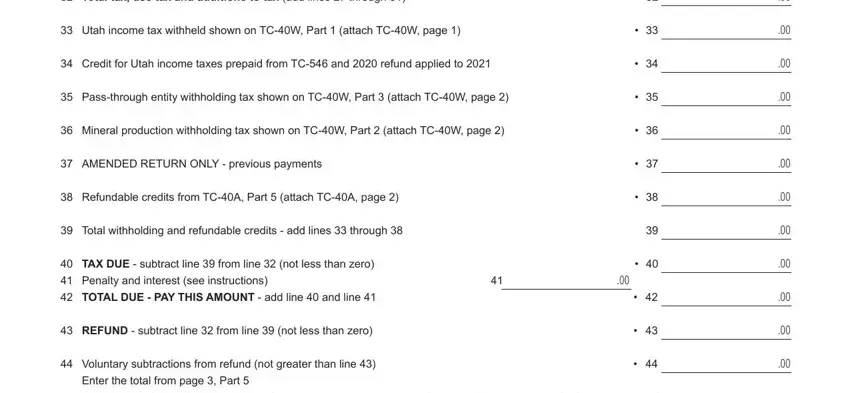

Fill in the document by analyzing all of these sections: Total tax use tax and additions, Utah income tax withheld shown on, Credit for Utah income taxes, Passthrough entity withholding, Mineral production withholding, AMENDED RETURN ONLY previous, Refundable credits from TCA Part, Total withholding and refundable, TAX DUE subtract line from line, Penalty and interest see, TOTAL DUE PAY THIS AMOUNT add, REFUND subtract line from line, Voluntary subtractions from, Enter the total from page Part, and DIRECT DEPOSIT YOUR REMAINING.

Step 3: After you have selected the Done button, your file should be accessible for upload to every gadget or email you indicate.

Step 4: Ensure you stay away from future misunderstandings by generating a minimum of two duplicates of the file.