In case you desire to fill out Utah Tc 41 Form, it's not necessary to download and install any kind of applications - simply try using our PDF tool. To have our tool on the leading edge of practicality, we strive to integrate user-driven features and improvements regularly. We're always pleased to get feedback - play a pivotal role in revampimg PDF editing. With a few simple steps, you'll be able to start your PDF journey:

Step 1: Press the "Get Form" button above on this webpage to access our tool.

Step 2: When you open the PDF editor, you'll notice the document prepared to be filled in. Apart from filling out different blanks, you may also perform some other actions with the Document, namely writing your own words, editing the initial text, inserting illustrations or photos, signing the form, and a lot more.

Pay close attention while filling out this pdf. Make certain all necessary fields are filled in properly.

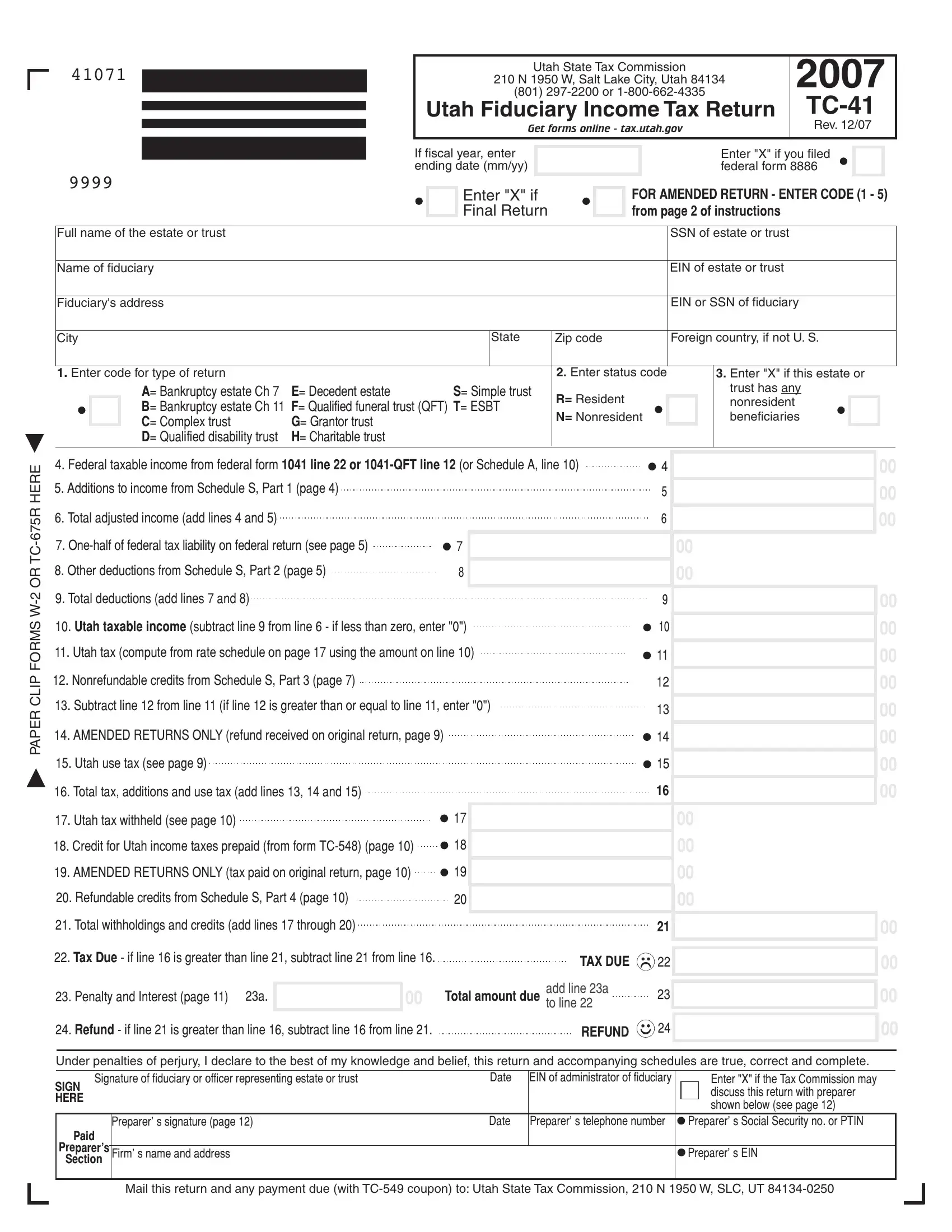

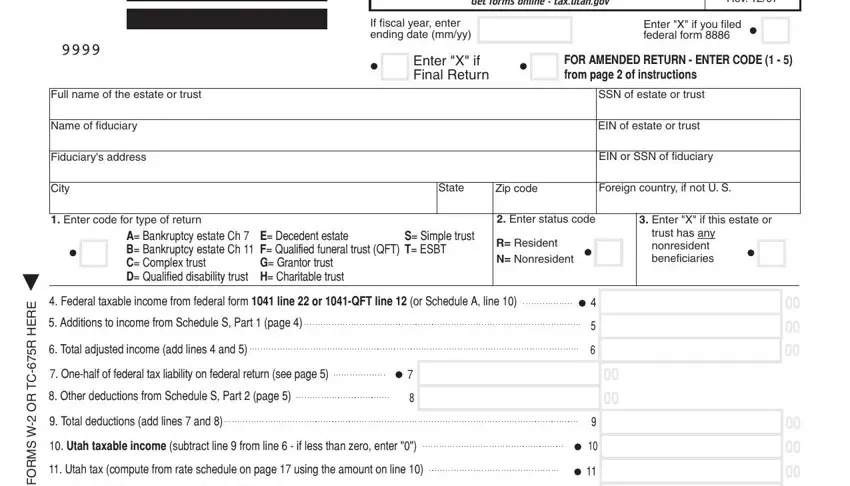

1. Begin filling out your Utah Tc 41 Form with a group of necessary blanks. Gather all of the information you need and make sure nothing is neglected!

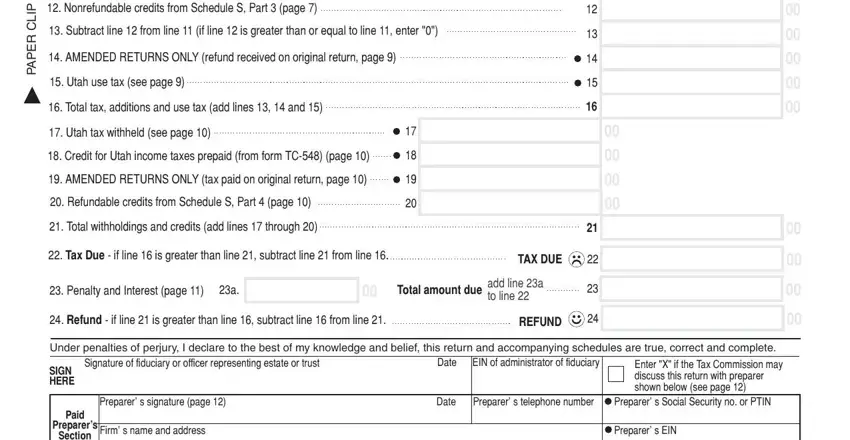

2. Right after performing the last section, go on to the subsequent part and fill in the necessary details in these blank fields - E R E H R C T R O W S M R O, Nonrefundable credits from, Subtract line from line if line, AMENDED RETURNS ONLY refund, Utah use tax see page, Total tax additions and use tax, Utah tax withheld see page, Credit for Utah income taxes, AMENDED RETURNS ONLY tax paid on, Refundable credits from Schedule, Total withholdings and credits, Tax Due, if line is greater than line, TAX DUE, and Penalty and Interest page.

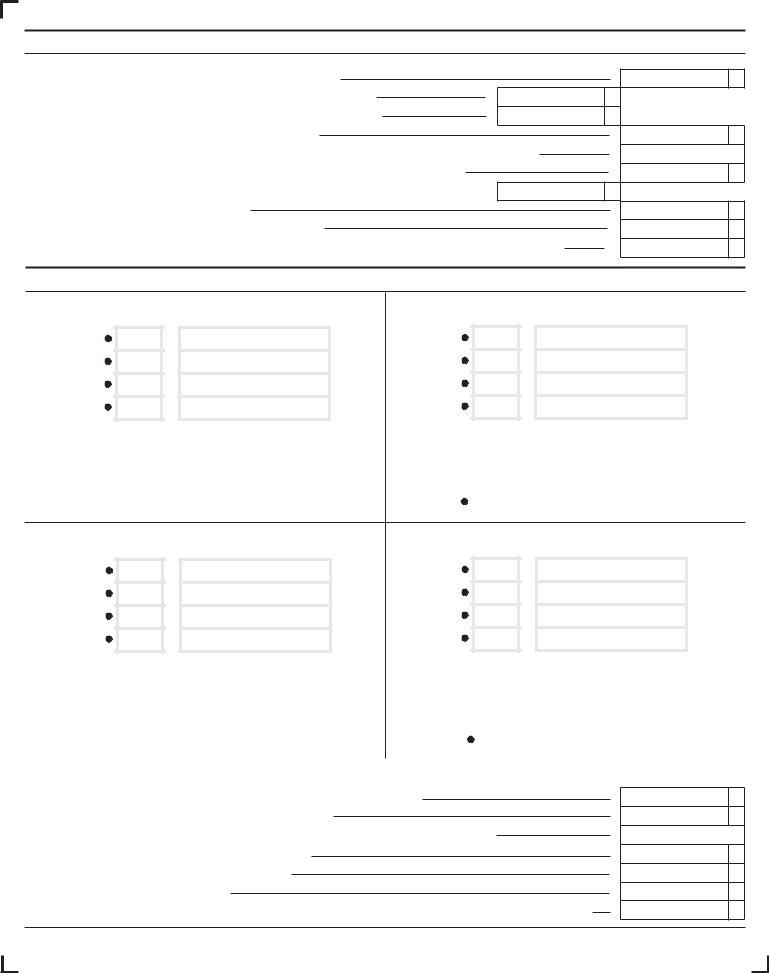

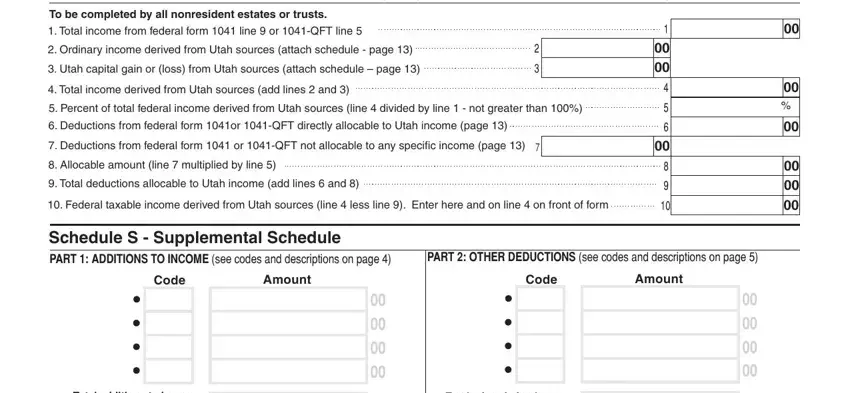

3. The next section should also be relatively easy, Schedule A Nonresident Estate or, To be completed by all nonresident, Total income from federal form, Ordinary income derived from Utah, Utah capital gain or loss from, Total income derived from Utah, Percent of total federal income, Deductions from federal form or, Deductions from federal form or, Allocable amount line multiplied, Total deductions allocable to, Federal taxable income derived, Schedule S Supplemental Schedule, PART OTHER DEDUCTIONS see codes, and Code - each one of these form fields will have to be filled out here.

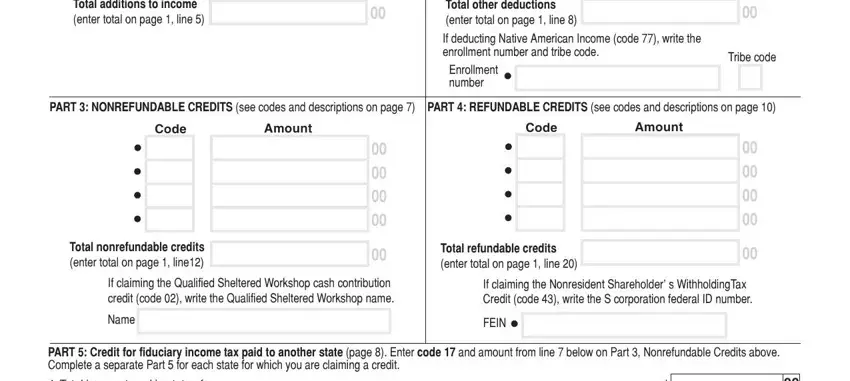

4. The subsequent section will require your details in the subsequent areas: Total additions to income enter, Total other deductions enter total, If deducting Native American, Tribe code, Enrollment number, PART NONREFUNDABLE CREDITS see, PART REFUNDABLE CREDITS see codes, Code, Amount, Code, Amount, Total nonrefundable credits enter, Total refundable credits enter, If claiming the Qualified, and If claiming the Nonresident. Make certain to fill in all of the requested information to go further.

People frequently make mistakes while filling out PART NONREFUNDABLE CREDITS see in this section. Don't forget to review what you type in right here.

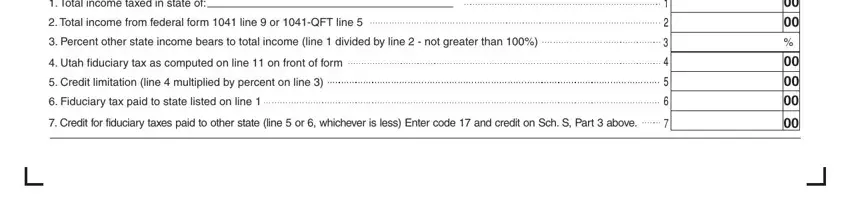

5. To conclude your document, the final part includes a couple of additional blanks. Completing Total income taxed in state of, Total income from federal form, Percent other state income bears, Utah fiduciary tax as computed on, Credit limitation line, Fiduciary tax paid to state, and Credit for fiduciary taxes paid will certainly finalize the process and you'll surely be done in an instant!

Step 3: Immediately after proofreading the entries, click "Done" and you are good to go! Right after creating a7-day free trial account at FormsPal, it will be possible to download Utah Tc 41 Form or send it through email right away. The file will also be easily accessible from your personal account with your adjustments. FormsPal guarantees secure document editing with no data record-keeping or any type of sharing. Rest assured that your information is secure here!