Any time you want to fill out Utah Tc 559 Form, you don't need to install any applications - just try our online tool. Our tool is continually developing to give the best user experience possible, and that is due to our dedication to constant enhancement and listening closely to feedback from customers. Here's what you would need to do to start:

Step 1: Click the "Get Form" button above on this webpage to get into our PDF tool.

Step 2: The editor provides the opportunity to work with PDF documents in various ways. Improve it by writing any text, correct original content, and add a signature - all manageable within a few minutes!

This PDF doc will need some specific information; to ensure accuracy and reliability, make sure you pay attention to the tips further down:

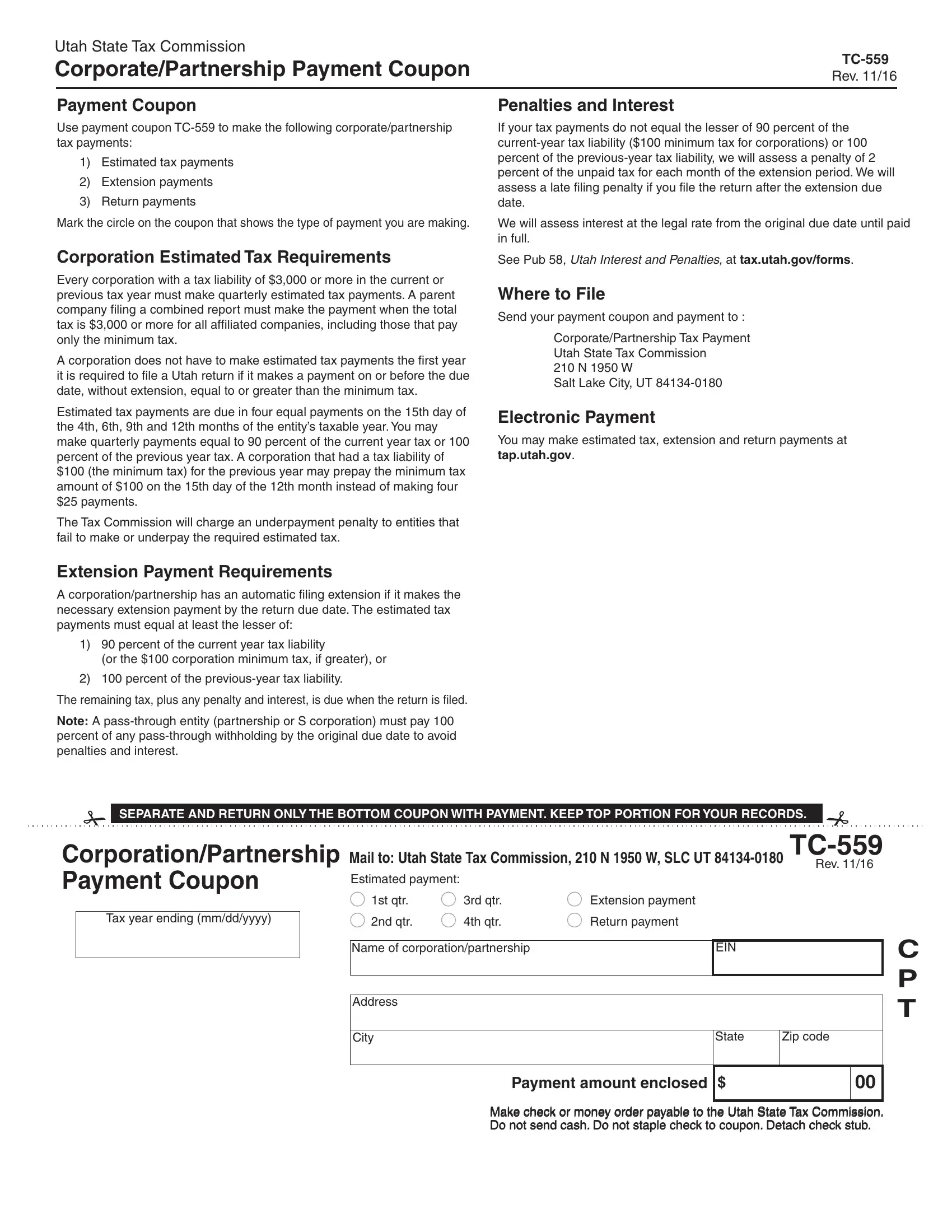

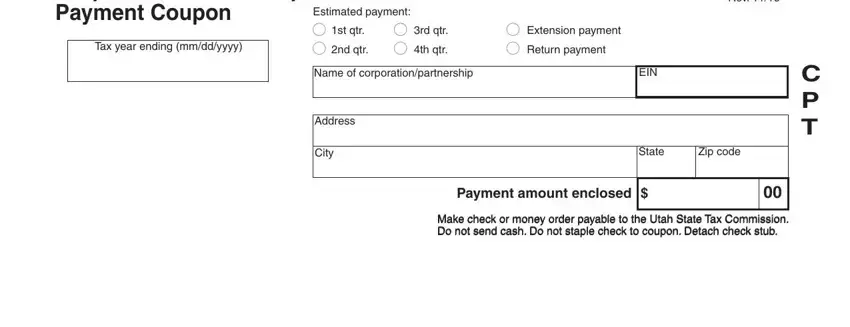

1. When completing the Utah Tc 559 Form, be sure to complete all of the essential fields in the associated area. It will help to facilitate the process, making it possible for your information to be processed quickly and properly.

Step 3: Prior to obtaining the next step, it's a good idea to ensure that blank fields have been filled out the proper way. As soon as you’re satisfied with it, press “Done." Join FormsPal now and immediately use Utah Tc 559 Form, available for download. All changes made by you are preserved , allowing you to edit the pdf at a later time if needed. FormsPal is committed to the privacy of all our users; we ensure that all personal information put into our editor is kept secure.