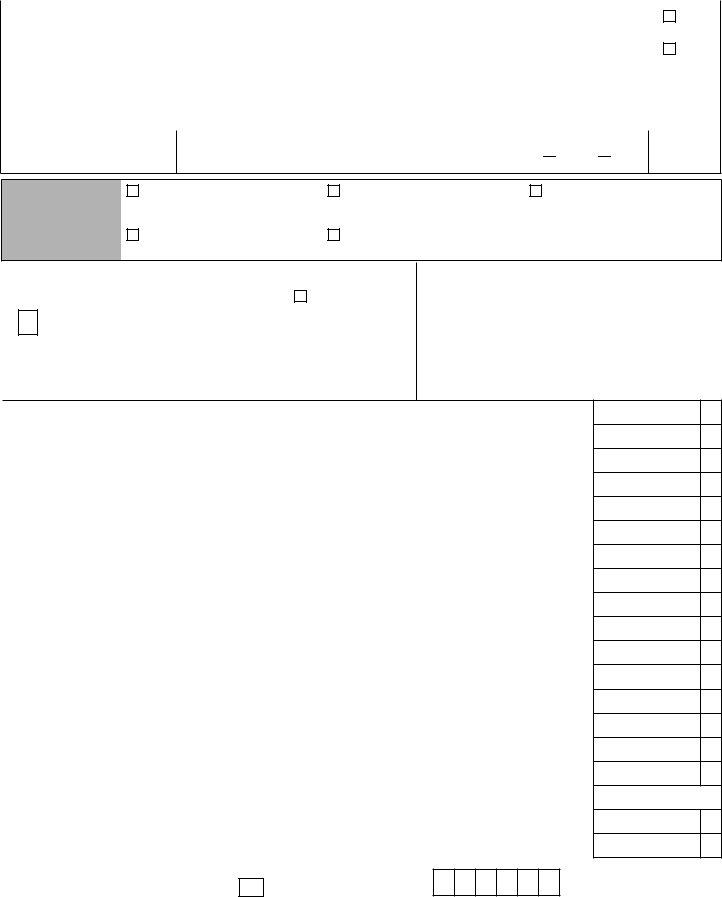

Filing taxes can often seem like navigating a maze, especially when dealing with specific forms such as the Virginia Nonresident Income Tax Return, known as Form VA 763. This form is specifically designed for individuals who earned income in Virginia but are not residents of the state, providing a structured way to report their Virginia-sourced income and calculate the corresponding tax liability for the tax year 2021, due by May 1, 2022. Integral to the filing process is the requirement to enclose a complete copy of the federal tax return along with any other necessary documents specified by the Virginia Department of Taxation. The form itself covers a wide array of information, from personal details like social security numbers and birth dates to income specifics and deductions. It even includes sections for specialized situations such as amended returns and various tax credits. The calculations encompass adjustments to the gross income, allocation of nonresident income, and deductions permitted under Virginia state law, ultimately arriving at the tax owed or refund due to the filer. What stands out is the detail required, such as the inclusion of one's principal place of business or employment location within Virginia, indicating the state's interest in accurately allocating tax liability based on actual economic engagement within its borders. Completing and submitting VA 763 is critical for nonresidents to comply with Virginia tax laws and avoid penalties, making understanding its components and requirements an essential part of the tax filing process.

| Question | Answer |

|---|---|

| Form Name | Va 763 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | 2021 Form 763, Virginia Nonresident Income Tax Return. 2021 Virginia Nonresident Income Tax Return |

|

Page 1 |

2021 Virginia Nonresident Income Tax Return |

*VA0763121888* |

||||||||||||

|

|

|

|

|

|

|

|

||||||||

763 |

|

Due May 1, 2022 |

|

|

|

|

|

|

|

|

|

|

|||

|

Enclose a complete copy of your federal tax return and all other required Virginia enclosures. |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

First Name |

|

|

MI |

Last Name |

|

Suffix |

Your Social Security Number |

|

|

Check if |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

deceased |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Spouse's First Name (Filing Status 2 Only) |

|

MI |

Last Name |

|

Suffix |

Spouse's Social Security Number |

|

|

Check if |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

deceased |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Present Home Address (Number and Street or Rural Route) |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Your Birth Date |

|

- |

- |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, Town or Post Office |

|

|

State |

ZIP Code |

|

|

|

|

|

|

||||

|

|

|

Spouse’s Birth Date |

|

- |

- |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State of Residence

Important - Name of Virginia City or County in which principal place of business, employment, or income source is located.

City OR County

Locality Code

Amended Return |

|

|

Name(s) or Address Different |

Overseas on Due Date |

|

|

|||

Reason Code |

|

|

than Shown on 2020 VA |

|

Check Applicable |

|

|

Return |

|

|

|

|||

Boxes |

Qualifying Farmer, Fisherman, or |

EIC Claimed on federal return |

||

Dependent on Another’s Return |

||||

Merchant Seaman |

$___________________ .00 |

|

Filing Status Enter Filing Status Code in box below.

{ |

1 |

= Single. Federal head of household? YES |

|

2 |

= Married, Filing Joint Return - both must have Virginia income |

||

|

|||

|

3 |

= Married, Spouse Has No Income From Any Source |

|

|

4 |

= Married, Filing Separate Returns |

If Filing Status 3 or 4, enter spouse's SSN in the Spouse's Social Security Number box at top of form and enter Spouse’s Name___________________________________

Exemptions Add Sections 1 and 2. Enter the sum on Line 12.

|

|

|

|

|

Spouse if |

|

|

|

|

|

|

|

|

|

|||

|

You |

|

Filing Status Dependents |

|

Total Section 1 |

||||||||||||

|

|

|

|

|

2 or 3 |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

1 |

|

+ |

|

|

|

|

|

+ |

|

|

= |

|

X $930 = |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

You 65 |

Spouse 65 |

You |

|

Spouse |

|

|

Total Section 2 |

||||||||||

or over |

|

or over |

Blind |

|

|

Blind |

|

|

|||||||||

|

|

|

|

|

|

||||||||||||

|

|

|

+ |

|

|

|

+ |

|

+ |

|

|

|

= |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X $800 = |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Adjusted Gross Income from federal return - Not federal taxable income |

1 |

|

2 |

Additions from Schedule 763 ADJ, Line 3 |

2 |

|

3 |

Add Lines 1 and 2 |

3 |

|

4 |

Age Deduction (See instructions and the Age Deduction Worksheet) |

You |

4a |

|

Enter Birth Dates above. Enter Your Age Deduction |

|

|

|

on Line 4a and Your Spouse's Age Deduction on Line 4b |

Spouse |

4b |

5 |

Social Security Act and equivalent Tier 1 Railroad Retirement Act benefits reported on your federal return |

5 |

|

6 |

State income tax refund or overpayment credit reported as income on your federal return |

6 |

|

7 |

Subtractions from Schedule 763 ADJ, Line 7 |

7 |

|

8 |

Add Lines 4a, 4b, 5, 6, and 7 |

8 |

|

9 |

Virginia Adjusted Gross Income (VAGI). Subtract Line 8 from Line 3 |

9 |

|

10 |

Itemized Deductions from Virginia Schedule A, if applicable. See instructions |

10 |

|

11 |

If you do not claim itemized deductions on Line 10, enter standard deduction. See instructions |

11 |

|

12 |

Exemption amount. Enter the total amount from the Exemption Sections 1 and 2 above |

12 |

|

13 |

Deductions from Schedule 763 ADJ, Line 9 |

13 |

|

14 |

Add Lines 10, 11, 12 and 13 |

14 |

|

15 |

Virginia Taxable Income computed as a resident. Subtract Line 14 from Line 9 |

15 |

|

16 |

Percentage from Nonresident Allocation Section on Page 2 (Enter to one decimal place only) |

16 |

|

17 |

Nonresident Taxable Income. (Multiply Line 15 by percentage on Line 16) |

17 |

|

18 |

Income Tax from Tax Table or Tax Rate Schedule |

18 |

|

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

%

00

00

Va. Dept. of Taxation |

For Local Use |

LTD |

2601044 Rev. 06/21 |

|

$_________

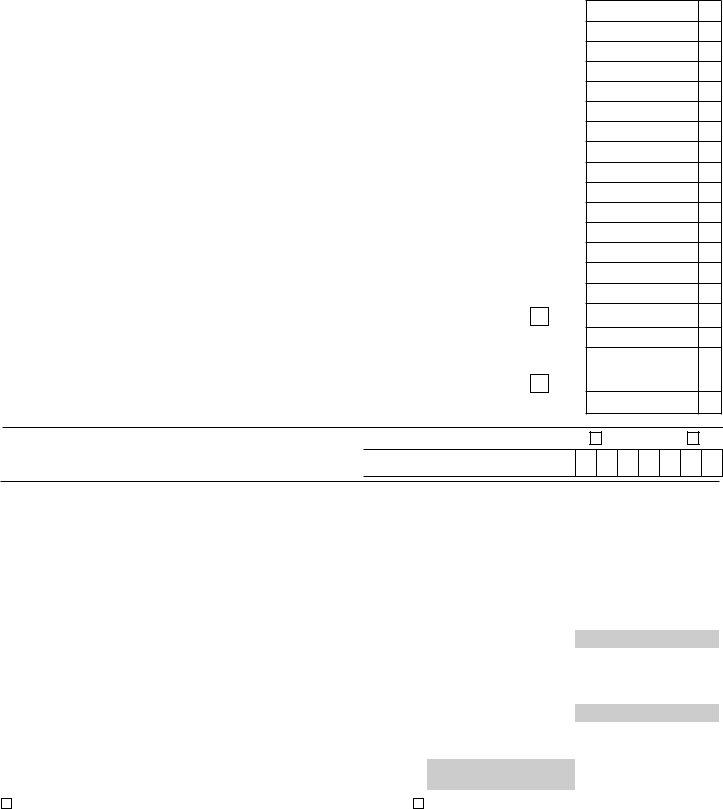

2021 FORM 763 Page 2

Your Name |

Your SSN |

|

|

*VA0763221888*

19a Your Virginia income tax withheld. Enclose Forms

19b Spouse's Virginia income tax withheld. Enclose Forms

202021 Estimated Tax Payments...........................................................................................................................

212020 overpayment credited to 2021 estimated tax.............................................................................................

22Extension Payment - submitted using Form 760IP.............................................................................................

23Credit for

24Total credits from Schedule OSC. ......................................................................................................................

25Credits from Schedule CR, Section 5, Line 1A...................................................................................................

26Total payments and credits. Add Lines 19a through 25. .............................................................................

27If Line 18 is larger than Line 26, enter the difference. This is the INCOME TAX YOU OWE. ............................

28If Line 26 is larger than Line 18, enter the difference. This is the OVERPAYMENT AMOUNT. .........................

29Amount of overpayment on Line 28 to be CREDITED TO 2022 ESTIMATED INCOME TAX. ..............................

30Virginia529 and ABLE Contributions from Schedule VAC, Part I, Line 6............................................................

31Other Voluntary Contributions from Schedule VAC, Section II, Line 14 .............................................................

32Addition to Tax, Penalty, and Interest from enclosed Schedule 763 ADJ, Line 21. ..........................................

33Sales and Use Tax is due on Internet, mail order, and

See instructions |

Check here if no sales and use tax is due |

34Add Lines 29 through 33..................................................................................................................................

35If you owe tax on Line 27, add Lines 27 and 34 - OR - If you have an overpayment on Line 28 and

Line 34 is larger than Line 28, enter the difference. AMOUNT YOU OWE. Enclose payment or pay at

www.tax.virginia.gov. ........Check here if paying by credit or debit card - See instructions. ......................

36 If Line 28 is larger than Line 34, subtract Line 34 from Line 28. This is the amount to be REFUNDED TO YOU.

19a

19b

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

If the Direct Deposit section below is not completed, your refund will be issued by check.

DIRECT BANK DEPOSIT |

Your Bank Routing Transit Number |

Your Bank Account Number |

Checking |

|||||||||||||||||

Domestic Accounts Only |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No International Deposits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Savings

Nonresident Allocation Percentage |

|

|

1. |

Wages, salaries, tips, etc |

1 |

2. |

Interest income |

2 |

3. |

Dividends |

3 |

4. |

Alimony received |

4 |

5. |

Business income or loss |

5 |

6. |

Capital gain or loss/capital gain distributions |

6 |

7. |

Other gains or losses |

7 |

8. |

Taxable pensions, annuities and IRA distributions |

8 |

9. |

Rents, royalties, partnerships, estates, trusts, S corporations, etc |

9 |

10. |

Farm income or loss |

10 |

11. |

Other income |

11 |

12. |

Interest on obligations of other states from Schedule 763 ADJ, Line 1 |

12 |

13. |

13 |

|

14. |

TOTAL - Add Lines 1 through 13 and enter each column total here |

14 |

15.Nonresident allocation percentage - Divide Line 14 B, by Line 14 A. Compute

percentage to one decimal place (e.g., 5.4%). Enter on Page 1, Line 16 |

15 |

A - All Sources |

B - Virginia Sources |

||

|

|

|

|

|

00 |

|

00 |

|

|

|

|

|

00 |

|

00 |

|

|

|

|

|

00 |

|

00 |

|

|

|

|

|

00 |

|

00 |

|

|

|

|

|

00 |

|

00 |

|

|

|

|

|

00 |

|

00 |

|

|

|

|

|

00 |

|

00 |

|

|

|

|

|

00 |

|

|

|

|

|

|

|

00 |

|

00 |

|

|

|

|

|

00 |

|

00 |

|

|

|

|

|

00 |

|

00 |

|

|

|

|

|

00 |

|

|

|

|

|

|

|

00 |

|

00 |

|

|

|

|

|

00 |

|

00 |

|

|

|

|

|

|

% |

|

|

|

|

|

I (We) authorize the Dept. of Taxation to discuss this return with my (our) preparer.

I agree to obtain my Form

I (We), the undersigned, declare under penalty provided by law that I (we) have examined this return and to the best of my (our) knowledge, it is a true, correct, and complete return.

Your Signature |

|

Your Phone Number |

Date |

|

|

|

|

|

|

|

|

Spouse’s Signature (If a joint return, both must sign) |

|

Spouse’s Phone Number |

Preparer’s PTIN |

Vendor Code |

|

|

|

|

|

|

|

Preparer’s Name |

|

Firm’s Name (or Yours if |

Preparer’s Phone Number |

Filing Election Code |

ID Theft PIN |

|

|

|

|

|

|