The VA-8879 form is a critical document for Virginia residents who opt to file their individual income tax returns electronically, serving as an e-file signature authorization for the tax year 2011. This form plays a pivotal role by allowing taxpayers and their Electronic Return Originators (EROs) to confirm that the tax return submitted is accurate and complete to the best of their knowledge. The form requests essential information, including federal and Virginia adjusted gross income, taxable income, and the amount owed or to be refunded, if any. Part II of the form specifically deals with taxpayer declarations and the authorization for EROs to transmit the return to the Virginia Department of Taxation using a personal identification number (PIN) as an electronic signature, ensuring a secure and efficient submission process. Additionally, it delineates responsibilities for both the taxpayer and the ERO, emphasizing the importance of accuracy, timely communication, and adherence to new federal banking regulations regarding electronic transactions. It's important to note that this form, while crucial for the electronic filing process, should not be sent to the Virginia Department of Taxation or the IRS but instead be retained in the filer's records, highlighting the importance of documentation and confidentiality in the electronic tax filing process.

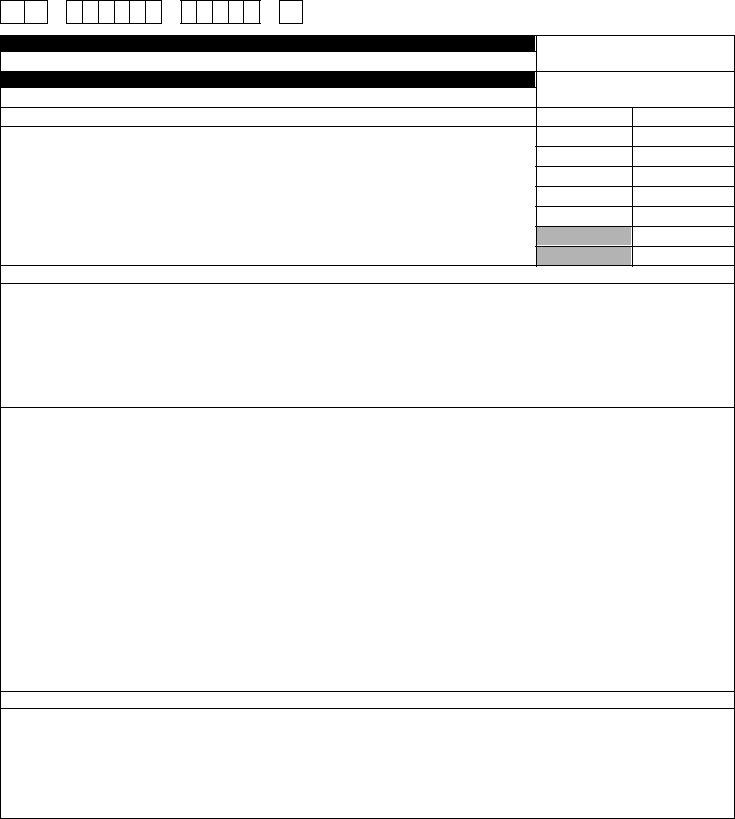

| Question | Answer |

|---|---|

| Form Name | Va 8879 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | VA-8879, 2011, form va 8879 2020, va 8879 form |

Virginia Individual Income Tax |

Tax Year |

|

Virginia Department |

Authorization |

2011 |

of Taxation |

DO NOT SEND THIS

IT MUST BE MAINTAINED IN YOUR FILES!

IRS Declaration Control Number (DCN)

0

0

-

-

-

2

Your Name

Spouse’s Name

BYour Social Security #

--

ASpouse’s Social Security #

--

Part I Tax Return Information |

A Spouse |

B Yourself |

1.Federal Adjusted Gross Income (Form 760CG, line 1; 760PY, line 1, columns A & B; Form 763, line 1)

2.Virginia Adjusted Gross Income (Form 760CG, line 9; 760PY, line 10, columns A & B; Form 763, line 9)

3.Taxable Income (Form 760CG, line 14; 760PY, line 17, columns A & B; Form 763, line 16)

4.Virginia Income Tax (Form 760CG, line 17; 760PY, line 18, columns A & B; Form 763 line 19)

5.Withholding (Form 760CG, line 18a and b; 760PY, lines 20a & 20b; Form 763, lines 20a & 20b)

6. Amount you Owe (Form 760CG; Form 760PY, line 32; Form 763, line 32)

7. Refund (Form 760CG; 760PY, line 33; Form 763, line 33)

Part II Declaration of Taxpayer and Signature Authorization

Under penalties of perjury, I declare that I have examined a copy of my individual income tax return and accompanying schedules and statements for the year ending December 31, 2011, and to the best of my knowledge and belief, it is true, correct and complete. I further declare that the information I provided to my Electronic Return Originator (ERO), Transmitter, or Intermediate Service Provider (including my name, address and social security number or individual tax identification number) and the amount shown in Part I above agree with the information and amounts shown on the corresponding lines of my electronic income tax return. If I am filing a balance due return, I understand that if the Virginia Department of Taxation does not receive full and timely payment of my tax liability, I remain liable for the tax liability and all applicable interest and penalties. I authorize my ERO, Transmitter or Intermediate Service Provider to transmit my complete return to the Virginia Department of Taxation. I have selected a personal identification number (PIN) as my signature for my electronic income tax return and, if applicable, the direct deposit of my refund or direct debit of my tax due. In choosing either direct deposit or direct debit, I certify that the transaction does not directly involve a financial institution outside of the territorial jurisdiction of the United States at any point in the process.

Taxpayer’s PIN: check one box only

I authorize the ERO named below to enter my PINas my signature on my 2011

Do not enter all zeros

_____________________________________________________________________________________________________________________________

ERO Firm Name

I will enter my PIN as my signature on my 2011

Your signature ► ________________________________________________________________________ Date ► _________________________________________

Spouse’s PIN: check one box only

I authorize the ERO named below to enter my PINas my signature on my 2011

Do not enter all zeros

____________________________________________________________________________________________________________________________

ERO Firm Name

I will enter my PIN as my signature on my 2011

Spouse’s signature ► ______________________________________________________________________ Date ► _______________________________________

Part III Certification and Authentication – Practitioner PIN Method Only

ERO’s EFIN/PIN: Enter your six digit EFIN followed by your five digit

Do not enter all zeros

I certify that the above numeric entry is my PIN, which is my signature for the 2011 Virginia individual income tax return for the taxpayer(s) indicated above. I confirm that I am submitting this return in accordance with the requirements of the Practitioner PIN method and Virginia’s publication VA1345, 2011 Handbook for Electronic Filers of Individual Income Tax Returns. EROs may sign the form using a rubber stamp, mechanical device, such as a signature pen, or computer software program.

ERO’s signature ► ________________________________________________________________________ Date ► _______________________________________

Form

Purpose of Form

Note. This form should be retained by the ERO. Do not send this form to the Virginia Department of Taxation or the IRS.

Complete form

When and How To Complete

IF the ERO is…… |

THEN…. |

|

|

Not using the Practitioner |

Do not complete Form |

PIN method and the taxpayer |

|

enters his or her own PIN |

|

|

|

Submitting Form |

Do not complete Form |

|

|

|

|

Using the Practitioner PIN |

Complete form |

method and is authorized to |

Parts I, II and III. |

enter or generate the |

|

taxpayer’s PIN. |

|

|

|

Using the Practitioner’s PIN |

Complete form |

method and the taxpayer |

Parts I, II and III. |

enters his or her own PIN. |

|

|

|

Not using the Practitioner |

Complete form |

PIN method and is |

Parts I and II. |

authorized to enter or |

|

generate the taxpayer’s PIN. |

|

|

|

ERO Responsibilities

The ERO will:

1.Enter the name(s) and social security number(s) of the taxpayer(s) at the top of the form.

2.Complete Part I using the amount from the taxpayer’s 2011 tax return.

3.Enter or generate, if authorized by the taxpayer, the taxpayer’s PIN and enter it in the boxes provided in Part II.

4.Enter on the authorization line in Part II the ERO firm name (not the name of the individual preparing the return) if the ERO is authorized to enter the taxpayer’s PIN.

5.After completing (1) through (4), give the taxpayer Form

6.Enter the

7.ERO’s may sign Part III of the form using the alternative signature methods using a rubber stamp, mechanical device, such as a signature pen, or computer software program. The signature must include either a facsimile of the Individual ERO’s signature or of the ERO’s printed name.

Note. The ERO must receive the completed and signed Form

Taxpayer Responsibilities

Taxpayers have the following responsibilities:

1.Verify the accuracy of the prepared income tax return, including direct deposit information.

2.Check the appropriate box in Part II to authorize the ERO to enter or generate his or her PIN or choose to do it in person.

3.Indicate or verify his or her PIN when authorizing the ERO to enter or generate it (the PIN must be five numbers other than all zeros).

4.Sign and date Form

5.Return the completed Form

6.New federal banking regulations have imposed additional reporting requirements on all electronic banking transactions that directly involve a financial institution outside of the territorial jurisdiction of the United States at any point in the process. These are called International ACH Transactions (IAT) and include both electronic debit (tax payments) and credit (direct deposit of refunds) transactions. At present, The Virginia Department of Taxation (TAX) does not support IAT. Taxpayers who instruct TAX to process electronic banking transactions on their behalf are certifying that the transactions do not directly involve a financial institution outside of the territorial jurisdiction of the United States at any point in the process. If transactions are IAT, the taxpayer should request refunds to be issued by paper check or pay tax dues by paper check attached to Form

Note. The return or request will not be transmitted to the Virginia Department of Taxation until the ERO receives the signed Form

Form