It's simple to fill out the improved va spaces. Our software can make it almost effortless to prepare any sort of PDF. Down below are the primary four steps you need to follow:

Step 1: The initial step will be to pick the orange "Get Form Now" button.

Step 2: As soon as you've entered the editing page improved va, you should be able to see each of the actions readily available for your form at the top menu.

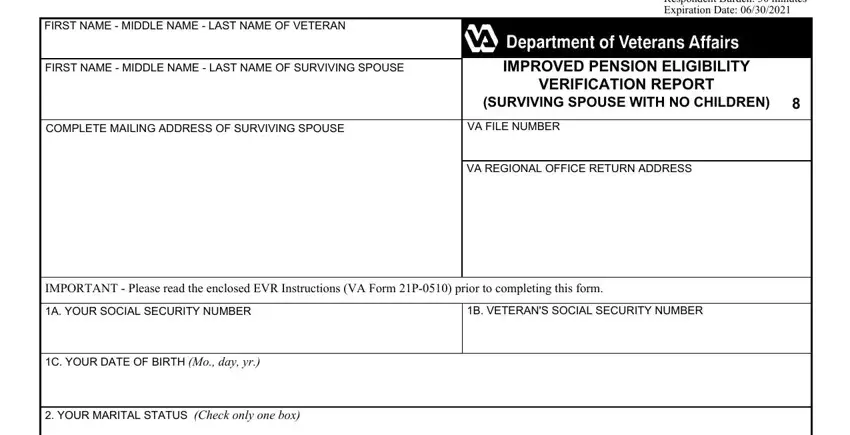

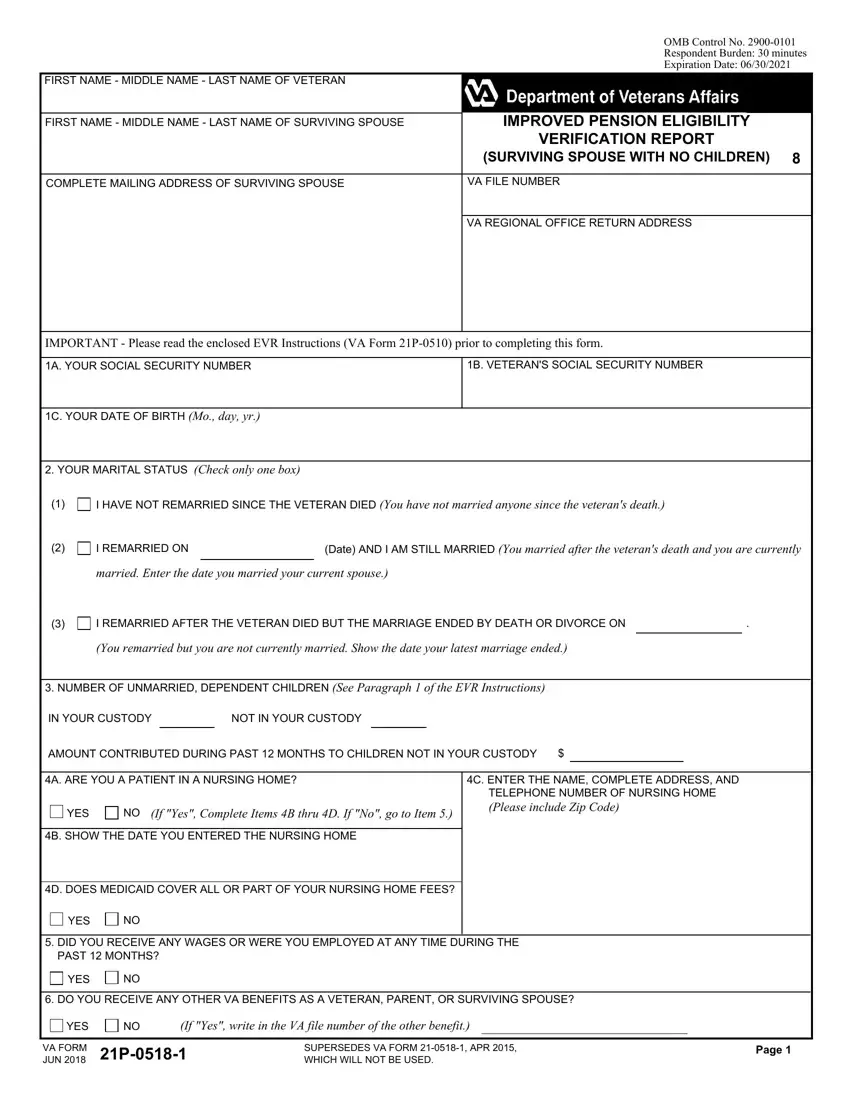

The PDF form you are going to complete will cover the following parts:

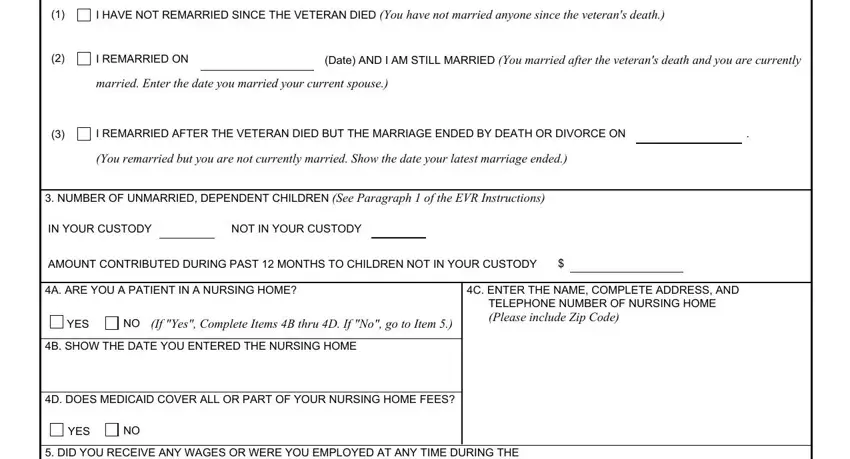

Write the expected particulars in the I HAVE NOT REMARRIED SINCE THE, I REMARRIED ON, Date AND I AM STILL MARRIED You, married Enter the date you married, I REMARRIED AFTER THE VETERAN DIED, You remarried but you are not, NUMBER OF UNMARRIED DEPENDENT, IN YOUR CUSTODY, NOT IN YOUR CUSTODY, AMOUNT CONTRIBUTED DURING PAST, A ARE YOU A PATIENT IN A NURSING, YES, If Yes Complete Items B thru D If, B SHOW THE DATE YOU ENTERED THE, and C ENTER THE NAME COMPLETE ADDRESS part.

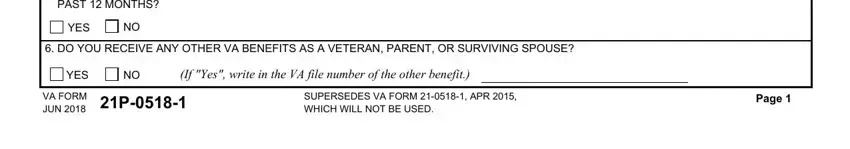

You have to write particular details inside the segment DID YOU RECEIVE ANY WAGES OR WERE, YES, DO YOU RECEIVE ANY OTHER VA, YES, If Yes write in the VA file number, VA FORM JUN, SUPERSEDES VA FORM APR WHICH, and Page.

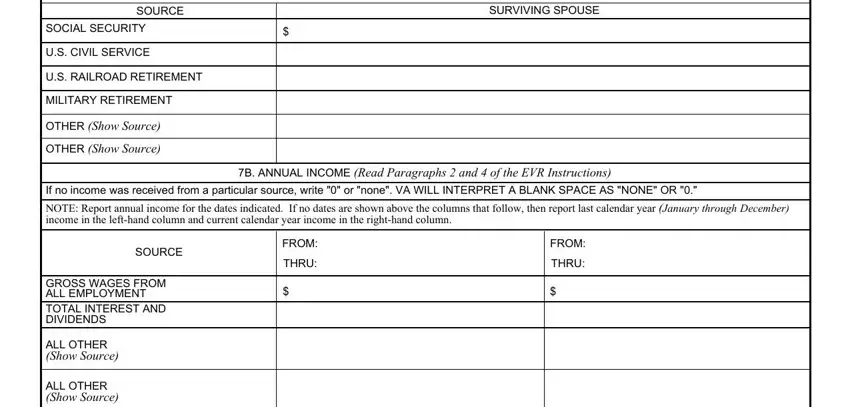

Be sure to describe the rights and responsibilities of the parties in the If no income or net worth was, SURVIVING SPOUSE, SOURCE, SOCIAL SECURITY, US CIVIL SERVICE, US RAILROAD RETIREMENT, MILITARY RETIREMENT, OTHER Show Source, OTHER Show Source, B ANNUAL INCOME Read Paragraphs, If no income was received from a, FROM, THRU, FROM, and THRU space.

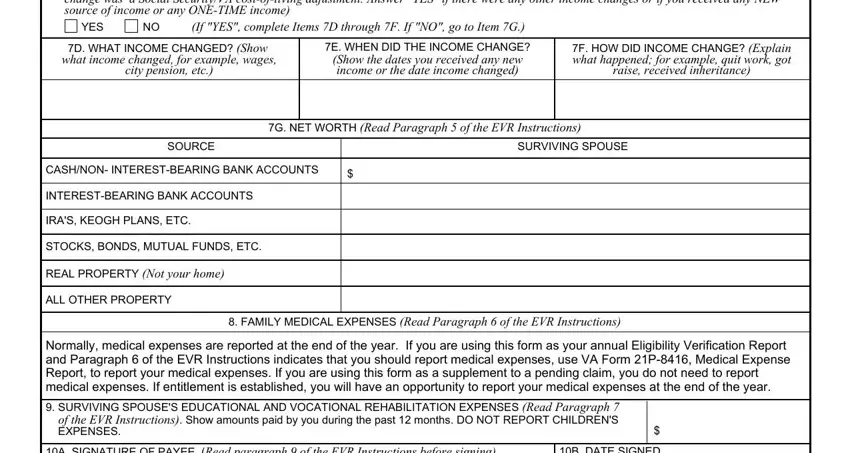

Finalize by reviewing the next fields and typing in the required details: C DID ANY INCOME CHANGE, YES, If YES complete Items D through F, D WHAT INCOME CHANGED Show what, E WHEN DID THE INCOME CHANGE Show, F HOW DID INCOME CHANGE Explain, G NET WORTH Read Paragraph of the, SOURCE, SURVIVING SPOUSE, CASHNON INTERESTBEARING BANK, INTERESTBEARING BANK ACCOUNTS, IRAS KEOGH PLANS ETC, STOCKS BONDS MUTUAL FUNDS ETC, REAL PROPERTY Not your home, and ALL OTHER PROPERTY.

Step 3: Click the Done button to save the document. So now it is ready for transfer to your device.

Step 4: You will need to generate as many duplicates of your form as you can to remain away from future misunderstandings.

YES

YES

NO

NO