When you would like to fill out Va Form 21 4165, there's no need to download any kind of applications - just use our PDF editor. We at FormsPal are devoted to giving you the perfect experience with our tool by regularly introducing new functions and enhancements. Our editor has become even more intuitive with the latest updates! Now, working with documents is a lot easier and faster than ever. To get started on your journey, take these simple steps:

Step 1: Firstly, open the editor by clicking the "Get Form Button" in the top section of this webpage.

Step 2: This tool will let you change your PDF in many different ways. Enhance it by writing customized text, correct existing content, and include a signature - all when you need it!

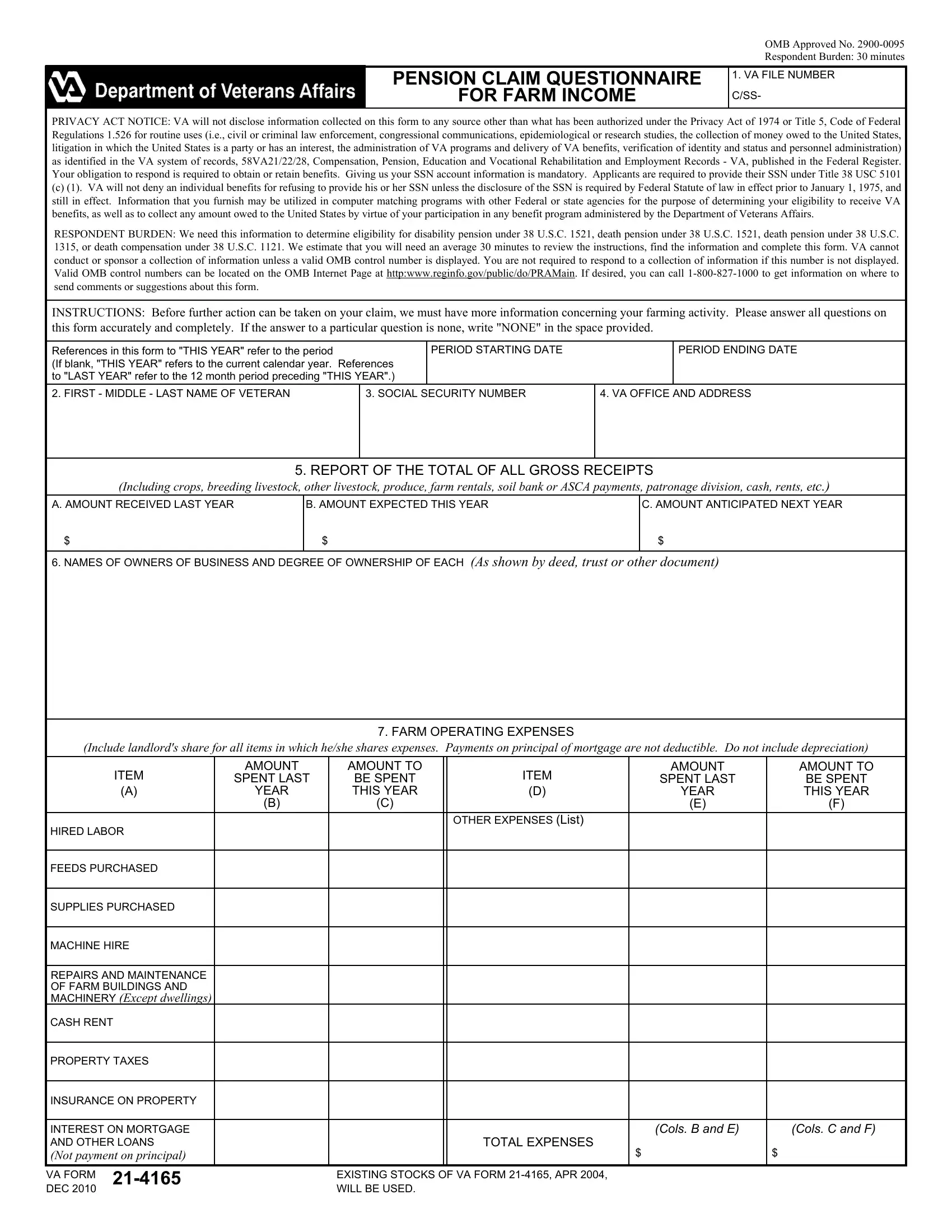

This form needs specific information; in order to guarantee correctness, please make sure to adhere to the suggestions hereunder:

1. Whenever completing the Va Form 21 4165, ensure to complete all of the important blank fields within the relevant section. This will help to hasten the process, allowing your details to be processed promptly and appropriately.

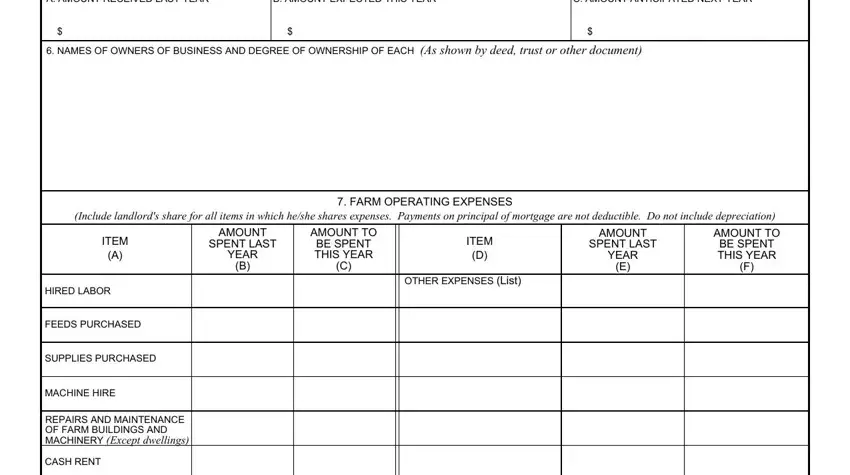

2. Given that the last array of fields is completed, you're ready to put in the required particulars in A AMOUNT RECEIVED LAST YEAR, B AMOUNT EXPECTED THIS YEAR, C AMOUNT ANTICIPATED NEXT YEAR, NAMES OF OWNERS OF BUSINESS AND, Include landlords share for all, FARM OPERATING EXPENSES, ITEM, AMOUNT, SPENT LAST, YEAR, AMOUNT TO, BE SPENT THIS YEAR, ITEM, OTHER EXPENSES List, and AMOUNT so that you can move on further.

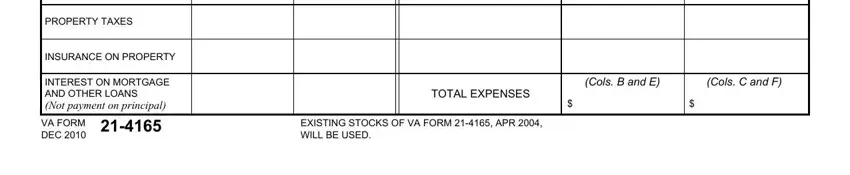

3. Completing PROPERTY TAXES, INSURANCE ON PROPERTY, INTEREST ON MORTGAGE AND OTHER, VA FORM DEC, TOTAL EXPENSES, Cols B and E, Cols C and F, and EXISTING STOCKS OF VA FORM APR is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

A lot of people generally make some errors when filling out INSURANCE ON PROPERTY in this area. Don't forget to revise everything you type in right here.

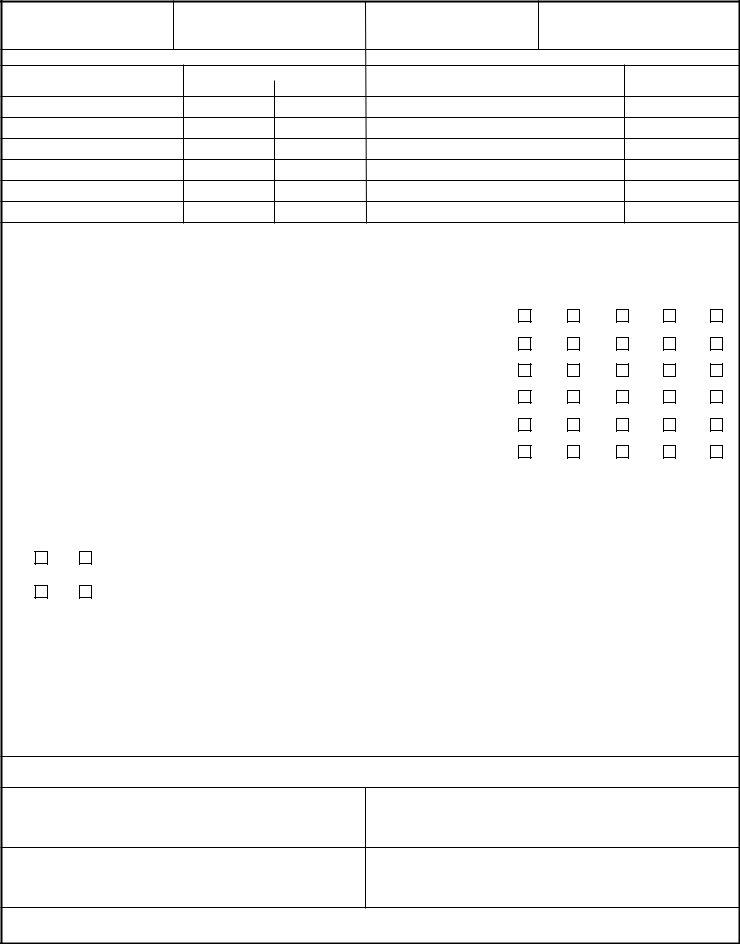

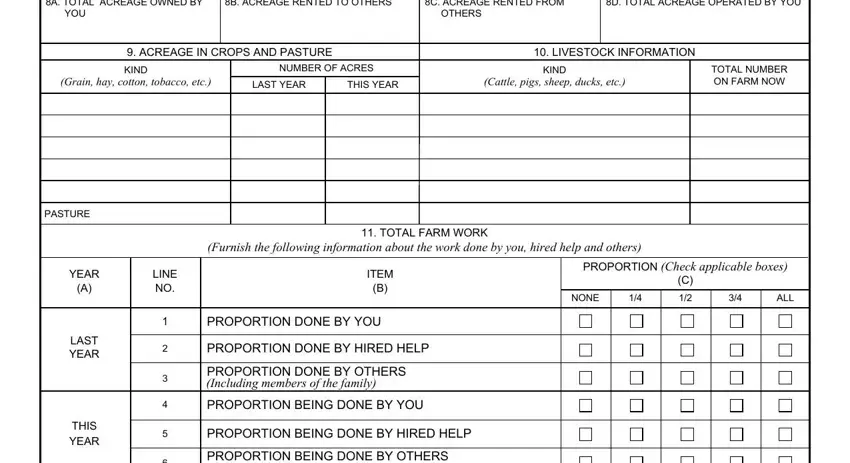

4. This particular section comes next with the next few fields to fill out: A TOTAL ACREAGE OWNED BY YOU, B ACREAGE RENTED TO OTHERS, C ACREAGE RENTED FROM OTHERS, D TOTAL ACREAGE OPERATED BY YOU, ACREAGE IN CROPS AND PASTURE, KIND, NUMBER OF ACRES, LIVESTOCK INFORMATION, KIND, Grain hay cotton tobacco etc, LAST YEAR, THIS YEAR, Cattle pigs sheep ducks etc, TOTAL NUMBER ON FARM NOW, and PASTURE.

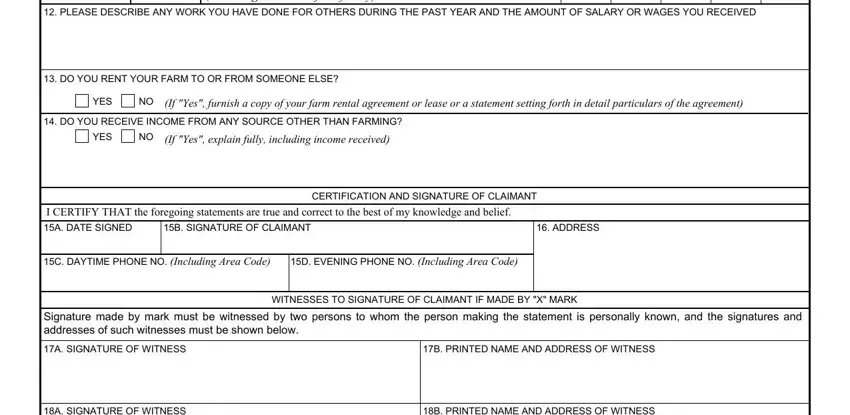

5. Last of all, this final part is what you have to finish prior to using the document. The blanks you're looking at are the following: PROPORTION BEING DONE BY OTHERS, PLEASE DESCRIBE ANY WORK YOU HAVE, DO YOU RENT YOUR FARM TO OR FROM, YES, If Yes furnish a copy of your farm, DO YOU RECEIVE INCOME FROM ANY, YES, If Yes explain fully including, I CERTIFY THAT the foregoing, A DATE SIGNED, B SIGNATURE OF CLAIMANT, ADDRESS, CERTIFICATION AND SIGNATURE OF, C DAYTIME PHONE NO Including Area, and D EVENING PHONE NO Including Area.

Step 3: Prior to finalizing this document, check that all blank fields have been filled in properly. As soon as you determine that it's fine, click “Done." Join FormsPal now and easily access Va Form 21 4165, prepared for downloading. Each and every modification made is handily kept , allowing you to customize the form at a later point if required. FormsPal is invested in the confidentiality of our users; we always make sure that all personal data going through our system is kept secure.