GENERAL INSTRUCTIONS

FOR INCOME, NET WORTH, AND EMPLOYMENT STATEMENT

NOTE: Read these instructions very carefully, detach, and keep for your reference.

Frequently Asked Questions

How can I contact VA if I have a question?

If you have questions about this form, how to complete it, or about benefits, contact your nearest VA regional office. You can locate the address of the nearest VA regional office on the Internet at www.va.gov/directory, in your telephone book blue pages under "United States Government, Veterans." For information you may also call 1-877-294-6380 (Hearing Impaired TDD line 1-800-829-4833). You may also contact VA by the Internet at: https://iris.va.gov.

When do I use VA Form 21-527?

Use VA Form 21-527 to apply for disability pension if you have previously filed a claim for compensation and/or pension. If you have not filed a claim for compensation or pension previously, you must use VA Form 21-526, Veteran's Application for Compensation and/or Pension. For expeditious processing, use VA Form 21-527EZ, Fully Developed Claim (Pension). VA forms are available at www.va.gov/vaforms.

What is disability pension and how does VA decide what I will and will not receive?

You should apply for pension benefits if all of the following are true:

•Your income is limited

•You are permanently and totally disabled not necessarily as a result of your military service, or are age 65 or older

•At least part of your active duty was during a wartime period

VA pays disability pension based on the amount of income that the veteran and his/her family receive and the number of dependents in the family. VA must include all sources of income that Federal law specifies. You can find out what the current income limitations and rates of benefits are by contacting your nearest VA office.

VA may pay benefits from the date of receipt of your application unless severe disability prevented you from filing a claim for a period of at least 30 days. If you want this claim considered for retroactive payment, indicate so in Item 37, "Remarks," and identify the specific disability which prevented you from filing.

What is special monthly pension?

VA may pay a higher rate of disability pension to a veteran who is blind, a patient in a nursing home, otherwise needs regular aid and attendance, or who is permanently confined to his or her home because of a disability. If you wish to apply for this benefit, check "Yes" in Item 22A.

What medical evidence should I submit?

If you are age 65 or older or determined to be disabled by the Social Security Administration, you do not have to submit medical evidence with your application unless you are claiming special monthly pension. Otherwise, provide only those medical records that are related to the disabilities that prevent you from working.

If you wish to claim special monthly pension and are not in a nursing home, furnish a statement from your doctor showing the extent of your disabilities. If you are in a nursing home, attach a statement, signed by an official of the nursing home showing the date you were admitted to the nursing home, the level of care you receive, and whether Medicaid covers all or part of your nursing home costs.

If you want help getting medical records related to this claim, you may complete VA Form 21-4142, Authorization and Consent to Release Information to the Department of Veterans Affairs (VA) or VA Form 21-0779, Request for Nursing Home Information in Connection with Claim for Aid and Attendance. By signing VA Form 21-4142, you authorize any doctors, hospitals, or caregivers that have treated you to release information about your treatment to VA. You do not need to complete this form for any treatment you received at a VA facility. If you need a copy of the VA Form 21-4142 or VA Form 21-0779, you may contact VA as shown in "How can I contact VA if I have a question?" or download the forms from the VA web site www.va.gov/vaforms.

VA FORM |

21-527 |

SUPERSEDES VA FORM 21-527, JUN 2004, |

Page 1 |

MAR 2012 |

WHICH WILL NOT BE USED. |

|

GENERAL INSTRUCTIONS (Continued)

What do I do when I have completed my application?

When you have completed this application, mail it or take it to a VA regional office. You can locate the mailing address of your nearest VA regional office at www.va.gov/directory. Be sure to attach any materials that support and explain your claim. Also, for your records, make a photocopy of your application and everything that you submit to VA before you mail it.

How can I assign someone to act as my representative?

An accredited representative of a veteran's organization or other service organization recognized by the Secretary of Veterans Affairs may represent you without charge. An accredited attorney or agent may also represent you. However under 38 U.S.C. 5904(c), an accredited agent or attorney may only charge you for services performed after the date you file a Notice of Disagreement.

If you want to use a representative to help you with your application, contact the nearest VA office. Depending on the type of representative you want to designate, we will send you one of the following forms:

•VA Form 21-22, Appointment of Veterans Service Organization as Claimant's Representative or

•VA Form 21-22A, Appointment of Individual as Claimant's Representative

You may download these forms at: www.va.gov/vaforms. If you have already designated a representative, no further action is required on your part.

Net Worth

VA considers all of your (and your spouse's) assets ("net worth") in determining your eligibility for non service-connected pension. Transferring your cash or property to another person, trust, organization, corporation or any other entity does not reduce your net worth in order to qualify for pension unless it is clear that you have permanently given up all rights of ownership, including the right to control the cash or property. In completing this form, you must tell us about all assets you have transferred in the last two (2) years, along with any assets you transferred previously for any period of time if the value of the asset(s) exceeded a total of $20,000. In section VII, Items 29A and 29B, report all transferred assets. Note the conditions of transfer in Item 37, "Remarks," including any remaining right, privilege of ownership, benefit, or control you have over the asset.

PRIVACY ACT INFORMATION: The form will be used to determine allowance to pension benefits (38 U.S.C. 5101). The responses you submit are considered confidential (38 U.S.C. 5701). VA may disclose the information that you provide, including Social Security numbers, outside VA if the disclosure is authorized under the Privacy Act, including the routine uses identified in the VA system of records, 58VA21/22/28, Compensation, Pension, Education, and Vocational Rehabilitation and Employment Records - VA, published in the Federal Register. The requested information is considered relevant and necessary to determine maximum benefits under the law. Information submitted is subject to verification through computer matching programs with other agencies. VA may make a "routine use" disclosure for: civil or criminal law enforcement, congressional communications, epidemiological or research studies, the collection of money owed to the United States, litigation in which the United States is a party or has an interest, the administration of VA programs and delivery of VA benefits, verification of identity and status, and personnel administration. Your obligation to respond is required in order to obtain or retain benefits. Information that you furnish may be utilized in computer matching programs with other Federal or state agencies for the purpose of determining your eligibility to receive VA benefits, as well as to collect any amount owed to the United States by virtue of your participation in any benefit program administered by the Department of Veterans Affairs. Social Security information: You are required to provide the Social Security number requested under 38 U.S.C. 5101(c)(1). VA may disclose Social Security numbers as authorized under the Privacy Act, and, specifically may disclose them for purposes stated above.

RESPONDENT BURDEN: We need this information to determine your eligibility for pension. Title 38, United States Code, allows us to ask for this information. We estimate that you will need an average of 1 hour to review the instructions, find the information, and complete this form. VA cannot conduct or sponsor a collection of information, unless a valid OMB Control Number is displayed. You are not required to respond to a collection of information if this number is not displayed. Valid OMB control numbers can be located on the OMB Internet Page at www.reginfo.gov/public/do/PRAMain. If desired, you can call 1-800-827-1000 to get information on where to send comments or suggestions about this form.

VA FORM 21-527, MAR 2012 |

Page 2 |

|

OMB Approved No. 2900-0002

Respondent Burden: 1 Hour

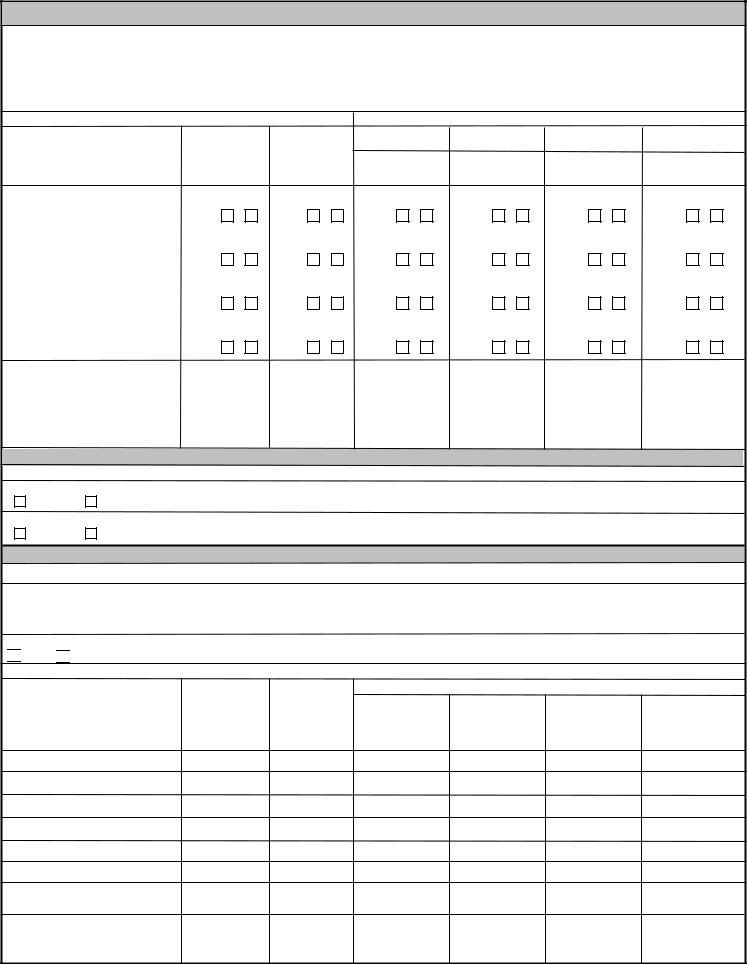

INCOME, NET WORTH, AND EMPLOYMENT STATEMENT

IMPORTANT - Read Privacy Act and Respondent Burden Information and Instructions carefully before completing the form. Type, print, or write plainly.

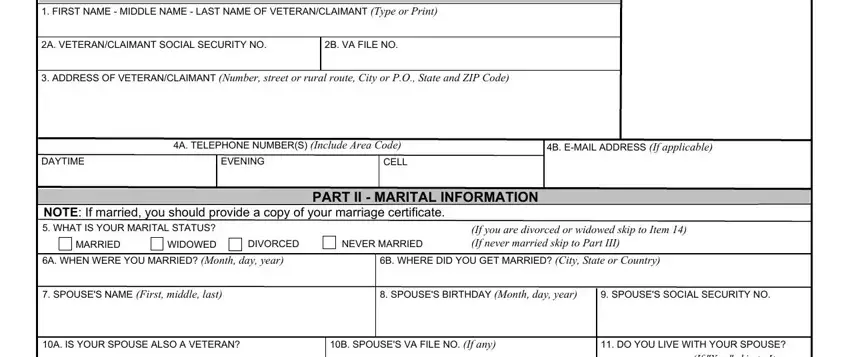

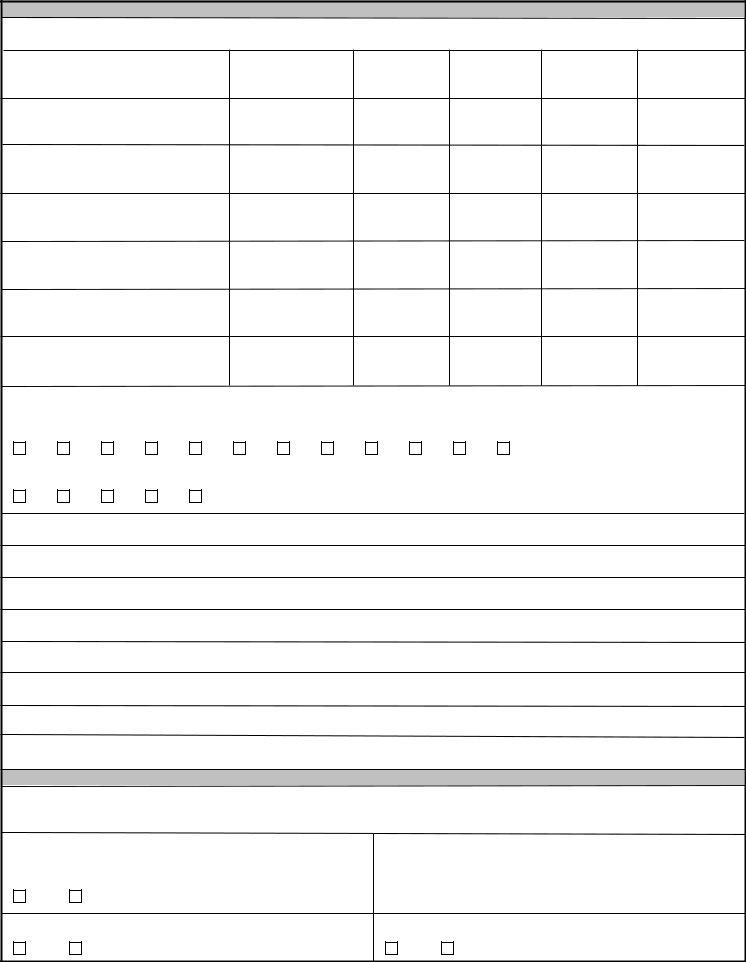

PART I - VETERAN/CLAIMANT INFORMATION

1. FIRST NAME - MIDDLE NAME - LAST NAME OF VETERAN/CLAIMANT (Type or Print)

(DO NOT WRITE IN THIS SPACE)

(VA DATE STAMP)

2A. VETERAN/CLAIMANT SOCIAL SECURITY NO.

3.ADDRESS OF VETERAN/CLAIMANT (Number, street or rural route, City or P.O., State and ZIP Code)

|

4A. TELEPHONE NUMBER(S) (Include Area Code) |

DAYTIME |

|

EVENING |

|

CELL |

|

|

|

|

|

|

|

4B. E-MAIL ADDRESS (If applicable)

PART II - MARITAL INFORMATION

NOTE: If married, you should provide a copy of your marriage certificate.

5. WHAT IS YOUR MARITAL STATUS? |

|

|

|

|

|

(If you are divorced or widowed skip to Item 14) |

|

|

|

|

|

|

|

|

|

|

DIVORCED |

|

|

NEVER MARRIED |

(If never married skip to Part III) |

|

|

|

|

MARRIED |

|

|

WIDOWED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6A. WHEN WERE YOU MARRIED? (Month, day, year) |

|

|

6B. WHERE DID YOU GET MARRIED? (City, State or Country) |

|

7. SPOUSE'S NAME (First, middle, last) |

|

|

|

|

8. SPOUSE'S BIRTHDAY (Month, day, year) |

|

9. SPOUSE'S SOCIAL SECURITY NO. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10A. IS YOUR SPOUSE ALSO A VETERAN? |

|

|

10B. SPOUSE'S VA FILE NO. (If any) |

|

11. DO YOU LIVE WITH YOUR SPOUSE? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(If "Yes," skip to Item |

|

|

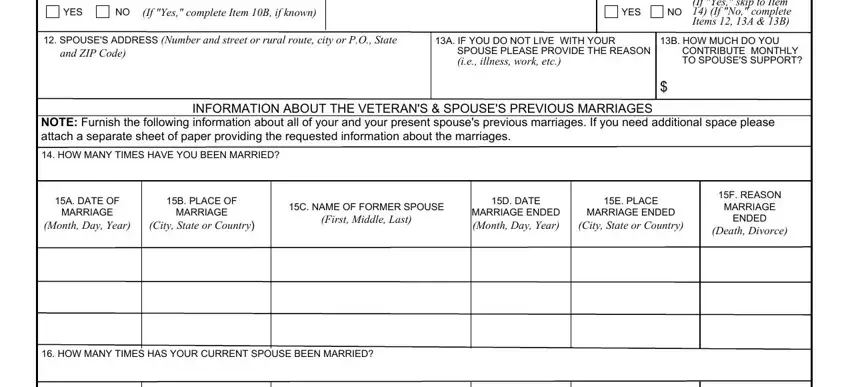

YES |

|

NO |

(If "Yes," complete Item 10B, if known) |

|

|

|

|

|

|

|

YES |

|

NO 14) (If "No," complete |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Items 12, 13A & 13B) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12.SPOUSE'S ADDRESS (Number and street or rural route, city or P.O., State and ZIP Code)

13A. IF YOU DO NOT LIVE WITH YOUR SPOUSE PLEASE PROVIDE THE REASON

(i.e., illness, work, etc.)

13B. HOW MUCH DO YOU CONTRIBUTE MONTHLY TO SPOUSE'S SUPPORT?

$

INFORMATION ABOUT THE VETERAN'S & SPOUSE'S PREVIOUS MARRIAGES

NOTE: Furnish the following information about all of your and your present spouse's previous marriages. If you need additional space please attach a separate sheet of paper providing the requested information about the marriages.

14. HOW MANY TIMES HAVE YOU BEEN MARRIED?

15A. DATE OF |

15B. PLACE OF |

MARRIAGE |

MARRIAGE |

(Month, Day, Year) |

(City, State or Country) |

|

|

15C. NAME OF FORMER SPOUSE

(First, Middle, Last)

15D. DATE |

15E. PLACE |

MARRIAGE ENDED |

MARRIAGE ENDED |

(Month, Day, Year) |

(City, State or Country) |

|

|

15F. REASON

MARRIAGE

ENDED

(Death, Divorce)

16. HOW MANY TIMES HAS YOUR CURRENT SPOUSE BEEN MARRIED?

|

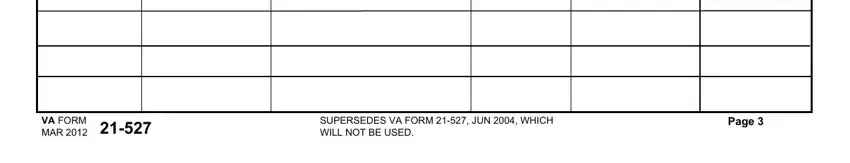

17A. DATE OF |

17B. PLACE OF |

17C. NAME OF FORMER SPOUSE |

|

MARRIAGE |

MARRIAGE |

|

(First, Middle, Last) |

|

(Month, Day, Year) |

(City, State or Country) |

|

|

|

|

|

|

17D. DATE |

17E. PLACE |

MARRIAGE ENDED |

MARRIAGE ENDED |

(Month, Day, Year) |

(City, State or Country) |

|

|

17F. REASON

MARRIAGE

ENDED

(Death, Divorce)

VA FORM |

21-527 |

SUPERSEDES VA FORM 21-527, JUN 2004, WHICH |

Page 3 |

MAR 2012 |

WILL NOT BE USED. |

|

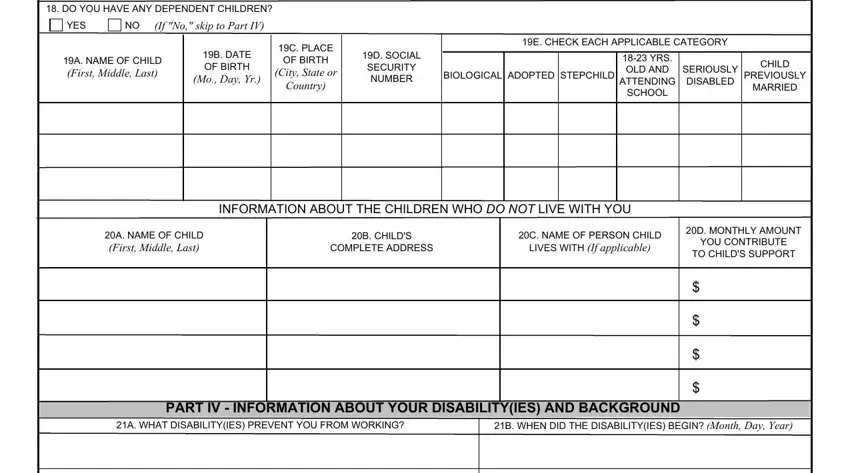

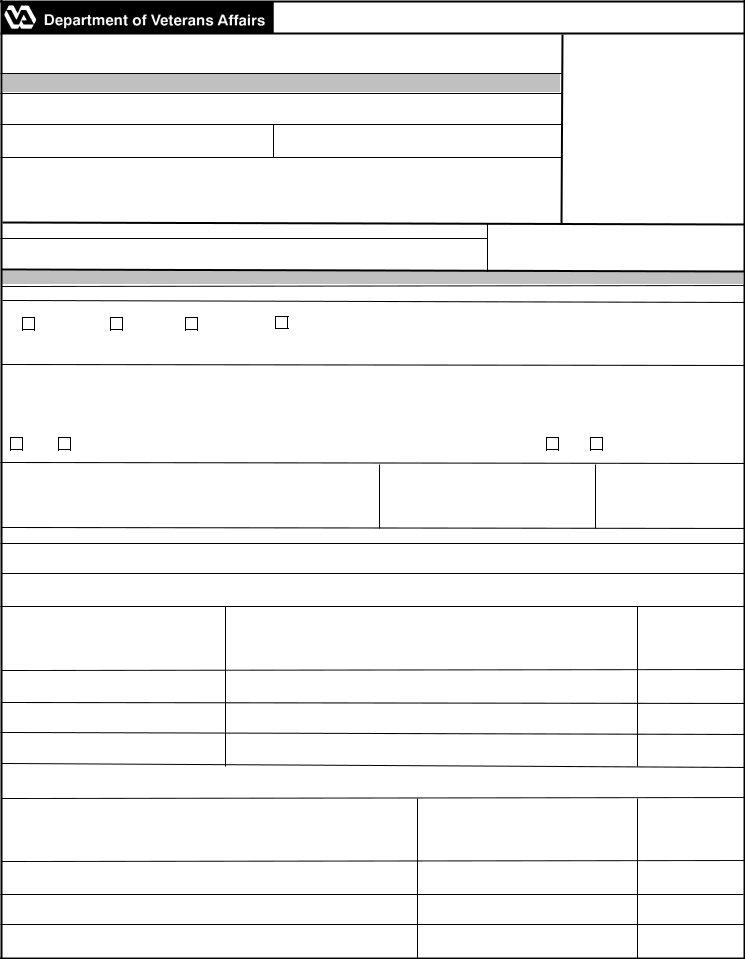

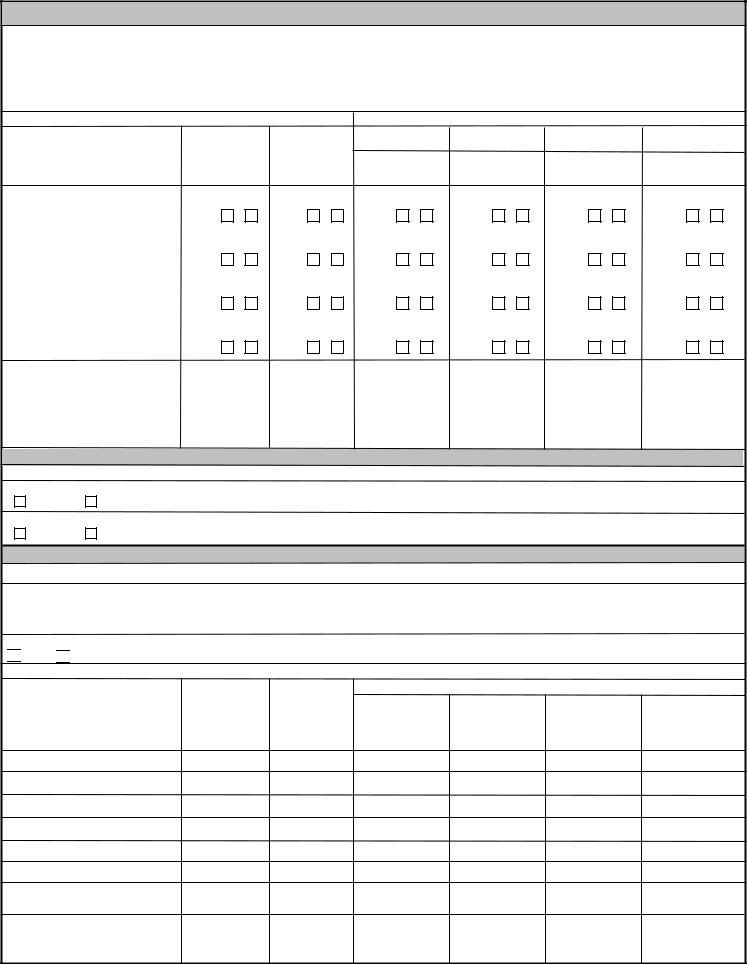

PART III - INFORMATION ABOUT YOUR UNMARRIED DEPENDENT CHILDREN

VA recognizes your biological children, adopted children, and stepchildren as dependents. These children must be unmarried and:

•under age 18, or

•between 18 and 23 and pursuing an approved course of education, or

•of any age if they became seriously disabled and permanently unable to support themselves before reaching age 18.

"Seriously disabled" means that the child became permanently unable to support himself/herself before reaching age 18.

Furnish a statement from an attending physician or other medical evidence which shows the nature and extent of the physical or mental impairment. If you need additional space, please attach a separate sheet of paper providing the requested information about each child.

Note: You should provide a copy of the public record of birth for each child or a copy of the court record of adoption for each adopted child.

INFORMATION ABOUT THE CHILDREN WHO LIVE WITH YOU

18. DO YOU HAVE ANY DEPENDENT CHILDREN? |

|

|

|

YES |

|

NO (If "No," skip to Part IV) |

|

|

|

|

|

|

|

|

|

|

19B. DATE |

|

19C. PLACE |

|

|

|

|

|

|

|

|

19A. NAME OF CHILD |

|

OF BIRTH |

|

|

OF BIRTH |

|

|

|

(First, Middle, Last) |

|

(City, State or |

|

|

(Mo., Day, Yr.) |

|

|

|

|

|

|

|

|

Country) |

|

|

|

|

|

|

|

|

19D. SOCIAL

SECURITY

NUMBER

19E. CHECK EACH APPLICABLE CATEGORY

|

|

|

18-23 YRS. |

|

CHILD |

|

|

|

OLD AND |

SERIOUSLY |

BIOLOGICAL |

ADOPTED |

STEPCHILD |

PREVIOUSLY |

|

|

|

ATTENDING |

DISABLED |

MARRIED |

|

|

|

SCHOOL |

|

|

|

|

|

|

|

|

|

|

|

|

INFORMATION ABOUT THE CHILDREN WHO DO NOT LIVE WITH YOU

20A. NAME OF CHILD

(First, Middle, Last)

20B. CHILD'S

COMPLETE ADDRESS

20C. NAME OF PERSON CHILD

LIVES WITH (If applicable)

20D. MONTHLY AMOUNT

YOU CONTRIBUTE

TO CHILD'S SUPPORT

$

$

$

$

PART IV - INFORMATION ABOUT YOUR DISABILITY(IES) AND BACKGROUND

21A. WHAT DISABILITY(IES) PREVENT YOU FROM WORKING?

21B. WHEN DID THE DISABILITY(IES) BEGIN? (Month, Day, Year)

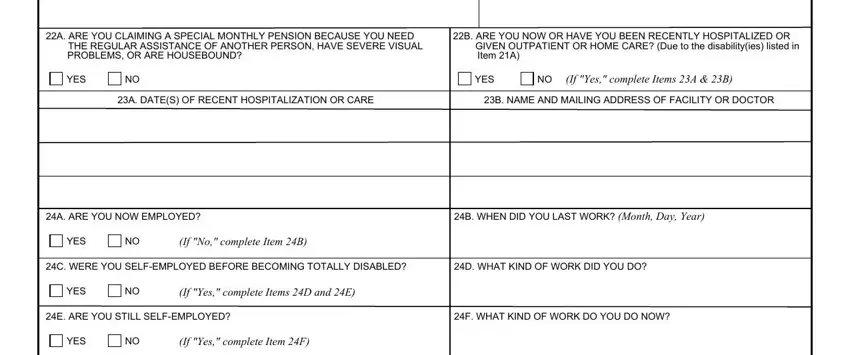

22A. ARE YOU CLAIMING A SPECIAL MONTHLY PENSION BECAUSE YOU NEED |

22B. ARE YOU NOW OR HAVE YOU BEEN RECENTLY HOSPITALIZED OR |

THE REGULAR ASSISTANCE OF ANOTHER PERSON, HAVE SEVERE VISUAL |

GIVEN OUTPATIENT OR HOME CARE? (Due to the disability(ies) listed in |

PROBLEMS, OR ARE HOUSEBOUND? |

Item 21A) |

|

|

YES |

|

NO |

|

YES |

|

NO (If "Yes," complete Items 23A & 23B) |

|

|

|

|

|

|

|

|

|

|

|

|

23A. DATE(S) OF RECENT HOSPITALIZATION OR CARE |

|

23B. NAME AND MAILING ADDRESS OF FACILITY OR DOCTOR |

24A. ARE YOU NOW EMPLOYED? |

24B. WHEN DID YOU LAST WORK? (Month, Day, Year) |

|

|

YES |

|

NO |

(If "No," complete Item 24B) |

|

|

|

|

|

|

|

|

|

|

|

|

24C. WERE YOU SELF-EMPLOYED BEFORE BECOMING TOTALLY DISABLED? |

24D. WHAT KIND OF WORK DID YOU DO? |

|

|

YES |

|

NO |

(If "Yes," complete Items 24D and 24E) |

|

|

|

|

|

24E. ARE YOU STILL SELF-EMPLOYED? |

24F. WHAT KIND OF WORK DO YOU DO NOW? |

|

|

YES |

|

NO |

(If "Yes," complete Item 24F) |

|

|

|

|

|

|

|

|

|

|

|

|

VA FORM 21-527, MAR 2012 |

|

Page 4 |

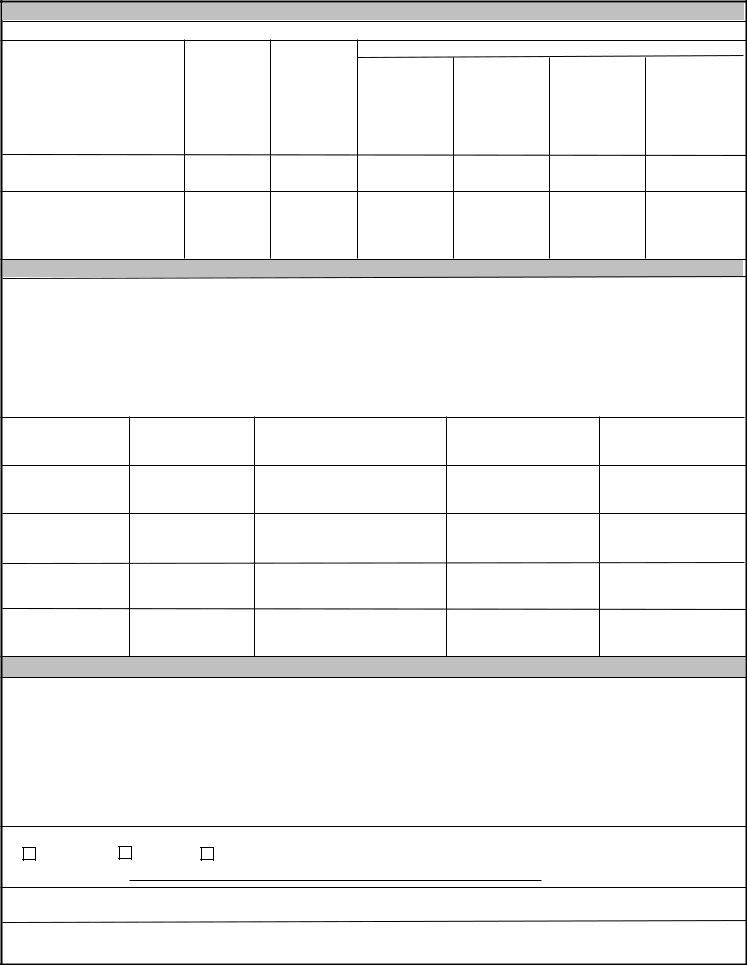

PART IV - INFORMATION ABOUT YOUR DISABILITY AND BACKGROUND (Continued)

NOTE: In the table below, tell us about all of your employment, including self-employment, dating from one year before you became disabled to the present.

25A. WHAT WAS THE NAME AND ADDRESS OF YOUR EMPLOYER?

25B. WHAT WAS YOUR

JOB TITLE?

25C. WHEN DID

YOUR WORK

BEGIN?

(Mo., day, year)

25D. WHEN DID |

25E. HOW MANY |

25F. WHAT WERE |

YOUR WORK END? DAYS WERE MISSED |

YOUR TOTAL |

(Mo., day, year) DUE TO DISABILITY? ANNUAL EARNINGS? |

$

$

$

$

$

$

26A. CHECK THE HIGHEST YEAR OF EDUCATION YOU COMPLETED:

Grade school:

|

|

1 |

|

2 |

|

3 |

|

4 |

|

5 |

|

6 |

|

7 |

|

8 |

|

9 |

|

10 |

|

11 |

|

12 |

College: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

3 |

|

4 |

|

Over 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26B. LIST THE OTHER TRAINING OR EXPERIENCE YOU HAVE AND ANY CERTIFICATES THAT YOU HOLD:

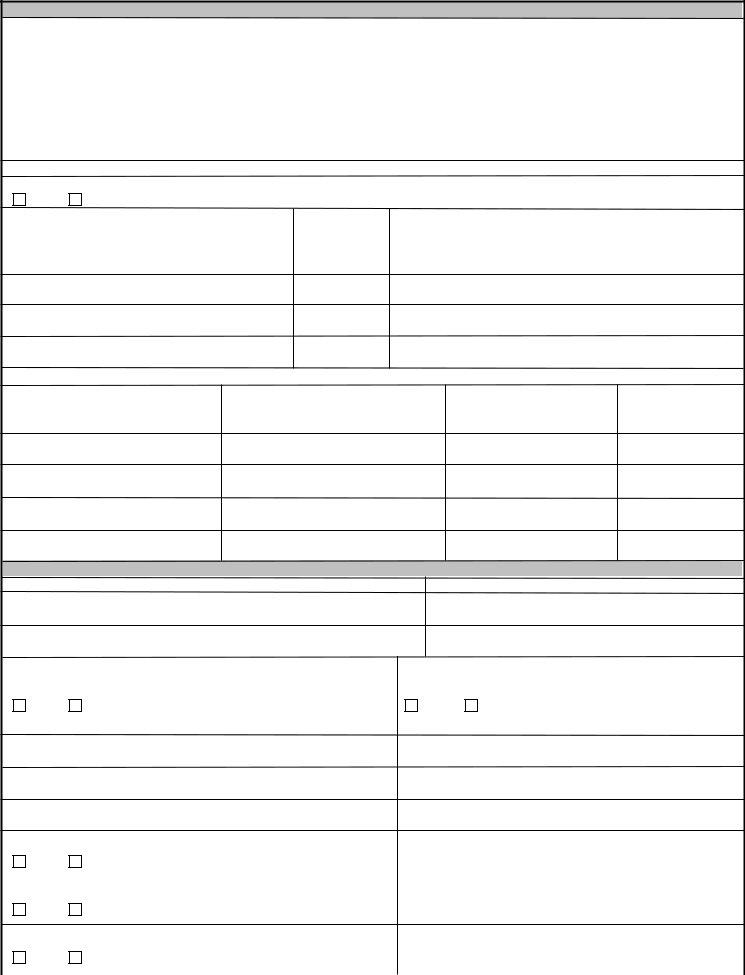

PART V - NURSING HOME INFORMATION

NOTE: To get your claim processed faster, provide a statement by an official of the nursing home that tells VA that you are a patient in the nursing home because of a physical or mental disability. Also tell us the amount you pay out-of-pocket for your care.

27A. ARE YOU NOW IN A NURSING HOME?

|

YES |

|

NO |

(If "Yes," complete Item 27B) |

27C. DOES MEDICAID COVER ALL OR PART OF YOUR NURSING HOME COSTS?

|

YES |

|

NO |

(If "No," complete Item 27D) |

27B. WHAT IS THE NAME AND COMPLETE MAILING ADDRESS OF THE FACILITY?

27D. HAVE YOU APPLIED FOR MEDICAID?

VA FORM 21-527, MAR 2012 |

Page 5 |

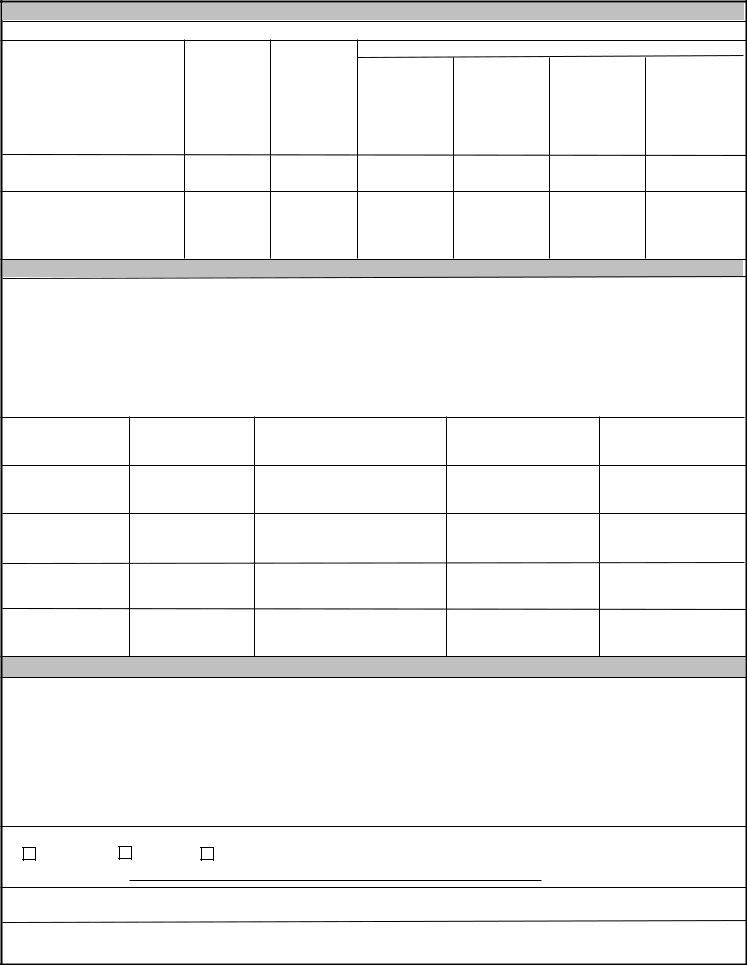

PART Vl - INFORMATION ABOUT THE NET WORTH OF YOU AND YOUR DEPENDENTS

NOTE: VA must generally consider all assets in determining eligibility for non service-connected pension. You must report net worth for yourself and all persons for whom you are claiming benefits. VA cannot pay you a pension if your net worth is sizeable. Net worth is the market value of all interest and rights you have in any kind of property less any mortgages, liens or other claims against the property. However, net worth does not include the house you live in or a reasonable area of land it sits on. Net worth also does not include the value of personal things you use everyday like your vehicle, clothing, and furniture. VA does not allow anyone to transfer cash, property, or any other asset in order to qualify for non service-connected pension. If property is owned jointly by yourself and your spouse, report one-half of the total Value Held jointly for each of you. You do not reduce net worth for VA purposes as long as you maintain some right, privilege of ownership, benefit, or control of asset.

For Items 28A through 28F, provide the amounts. If none, write "0" or "None." |

|

CHILD(REN) |

|

|

|

|

Name |

Name |

Name |

Name |

SOURCE OF ASSETS |

VETERAN |

SPOUSE |

(First, middle, last) |

(First, middle, last) |

(First, middle, last) |

(First, middle, last) |

|

|

|

|

28A. Cash, bank accounts, |

$ |

|

|

|

|

$ |

|

|

|

|

$ |

|

|

|

|

$ |

|

|

|

|

$ |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

certificates of deposit (CDs) |

Interest |

|

y |

|

n |

Interest |

|

y |

|

n |

Interest |

|

y |

|

n |

Interest |

|

y |

|

n |

Interest |

|

y |

|

n |

Interest |

|

y |

|

n |

|

|

|

|

|

|

|

|

|

|

|

|

|

bearing: |

|

|

bearing: |

|

|

bearing: |

|

|

bearing: |

|

|

bearing: |

|

|

bearing: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28B. IRAs, Keogh Plans, etc. |

Interest |

|

y |

|

n |

Interest |

|

y |

|

n |

Interest |

|

y |

|

n |

Interest |

|

y |

|

n |

Interest |

|

y |

|

n |

Interest |

|

y |

|

n |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

bearing: |

|

|

|

|

bearing: |

|

|

|

|

bearing: |

|

|

|

|

bearing: |

|

|

|

|

bearing: |

|

|

|

|

bearing: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28C. Stocks, bonds, mutual funds |

Interest |

|

y |

|

n |

Interest |

|

y |

|

n |

Interest |

|

y |

|

n |

Interest |

|

y |

|

n |

Interest |

|

y |

|

n |

Interest |

|

y |

|

n |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

bearing: |

|

|

|

|

bearing: |

|

|

|

|

bearing: |

|

|

|

|

bearing: |

|

|

|

|

bearing: |

|

|

|

|

bearing: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28D. Value of business assets |

Interest |

|

y |

|

n |

Interest |

|

y |

|

n |

Interest |

|

y |

|

n |

Interest |

|

y |

|

n |

Interest |

|

y |

|

n |

Interest |

|

y |

|

n |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28E. Real property |

bearing: |

|

|

|

|

bearing: |

|

|

|

|

bearing: |

|

|

|

|

bearing: |

|

|

|

|

bearing: |

|

|

|

|

bearing: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Not your home) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28F. All other property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART VlI - INFORMATION ABOUT TRANSFERRED ASSETS

NOTE - Provide the conditions of the transfer in Item 37, "Remarks," including any remaining right, privilege of ownership, benefit, or control you have over the asset.

29A. HAVE YOU TRANSFERRED ANY ASSETS IN THE LAST TWO (2) YEARS?

NO (If "Yes," provide the date of transfer___________________________ and the value $______________________)

29B. HAVE YOU TRANSFERRED ANY ASSET(S) AT ANY TIME IN EXCESS OF $20,000?

NO (If "Yes," provide the date of transfer___________________________ and the value $______________________)

PART VIlI - INFORMATION ABOUT YOU AND YOUR DEPENDENTS EXPECTED ANNUAL INCOME

IMPORTANT - Report payments from any source, unless the law says not to count them. Report all income and its sources and VA will determine whether to count it.

NOTE: Report the total amounts before you take out deductions for taxes, insurance, etc. Do not report the same information in both tables. If you expect to receive a payment, but you don't know how much it will be, give your closest estimate in the space. If you do not receive any payments from one of the sources that we list, write "0" or "None" in the space. If you are receiving monthly benefits, give us a copy of your most recent award letter. This will help us determine the amount of benefits we should pay you.

30.HAVE YOU CLAIMED OR ARE YOU RECEIVING DISABILITY BENEFITS FROM THE SOCIAL SECURITY ADMINISTRATION (SSA)? YES NO

MONTHLY INCOME - TELL US THE INCOME YOU AND YOUR DEPENDENTS RECEIVE EVERY MONTH

|

|

|

|

|

CHILD(REN) |

|

|

|

|

|

Name |

Name |

Name |

Name |

SOURCE OF MONTHLY INCOME |

VETERAN |

|

SPOUSE |

(First, middle, last) |

(First, middle, last) |

(First, middle, last) |

(First, middle, last) |

|

|

|

|

|

31A. Gross Wages & Salary |

$ |

$ |

|

$ |

$ |

$ |

$ |

31B. Social Security

31C. U.S. Civil Service

31D. U.S. Railroad Retirement

31E. Military Retirement

31F. Black Lung Benefits

31G. Supplemental Security Income

(SSI)/Public Assistance

31H. Other income received monthly (Please write source below)

VA FORM 21-527, MAR 2012 |

Page 6 |

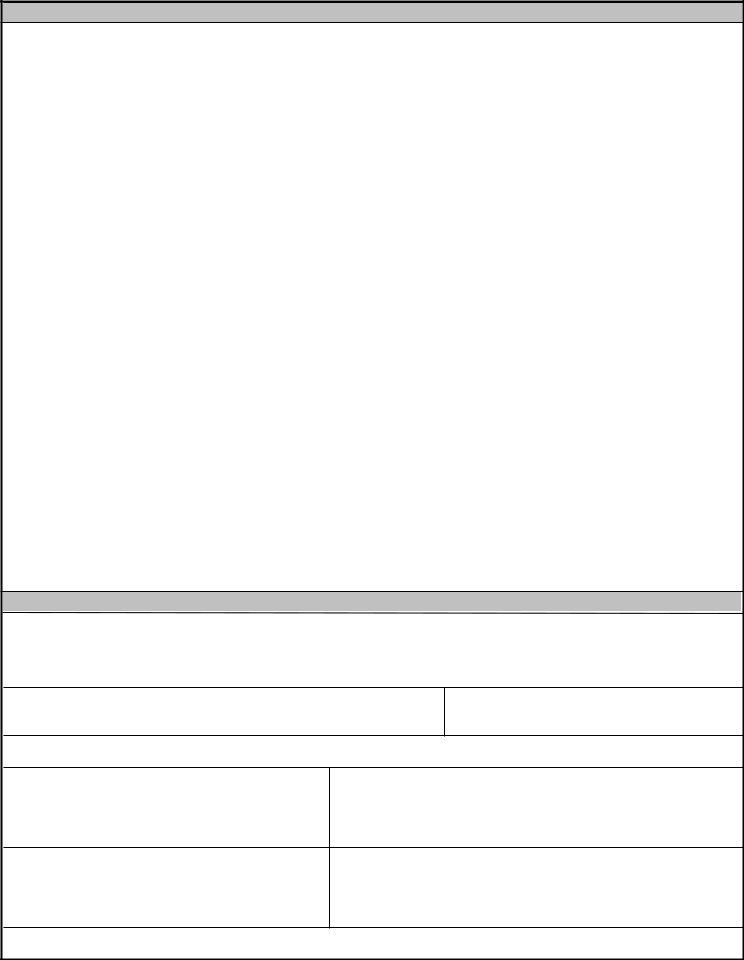

PART VIlI - INFORMATION ABOUT YOU AND YOUR DEPENDENTS EXPECTED ANNUAL INCOME (Continued)

EXPECTED INCOME FOR THE NEXT 12 MONTHS - TELL US ABOUT OTHER INCOME YOU AND YOUR DEPENDENTS RECEIVE

|

|

|

|

CHILD(REN) |

|

SOURCE OF INCOME FOR THE |

|

|

Name |

Name |

Name |

Name |

|

|

(First, middle, last) |

(First, middle, last) |

(First, middle, last) |

(First, middle, last) |

NEXT 12 MONTHS |

VETERAN |

|

SPOUSE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32A. Total interest and dividends $ |

|

$ |

$ |

$ |

$ |

$ |

32B. Worker's compensation or unemployment compensation

32C. Other income expected (Please write source below)

PART IX - INFORMATION ABOUT YOUR MEDICAL, LEGAL OR OTHER UNREIMBURSED EXPENSES

NOTE: Family medical expenses and certain other expenses you actually paid may be deductible from your income. Show the amount of unreimbursed medical expenses, including the Medicare deduction, you paid over the last year for yourself or relatives who are members of your household. Also, show unreimbursed last illness and burial expenses and educational or vocational rehabilitation expenses you paid. Last illness and burial expenses are unreimbursed amounts you paid for the last illness and burial of a spouse or child at any time prior to the end of the year following the year of death. Educational or vocational rehabilitation expenses are amounts you paid for courses of education including tuition, fees, and materials. Show medical, legal or other expenses you paid because of a disability for which you were awarded civilian disability benefits. When determining your income we may be able to deduct them from the disability benefits for the year in which the expenses are paid. Do not include any expenses for which you were reimbursed. If more space is needed, attach a separate sheet.

33B. DATE PAID (Month, day, year)

33C. PURPOSE (Doctor's fees, hospital

charges, attorney fees, etc.)

33D. PAID TO

(Name of doctor, hospital,

pharmacy, etc.)

33E. DISABILITY OR RELATIONSHIP OF PERSON FOR WHOM EXPENSES PAID

$

$

$

PART X - DIRECT DEPOSIT INFORMATION

If benefits are awarded we will need more information in order to process any payments to you. Please read the paragraph below and then either:

1.Attach a voided check, or

2.Answer Items 34-36.

The Department of Treasury requires all Federal benefit payments be made by electronic funds transfer (EFT), also called direct deposit. Please attach a voided personal check or deposit slip or provide the information requested in Items 34, 35 and 36 to enroll in direct deposit. If you do not have a bank account, you must receive your payment through Direct Express Debit MasterCard. To request a Direct Express Debit MasterCard you must apply at www.usdirectexpress.com or by telephone at 1-800-333-1795. If you elect not to enroll, you must contact representatives handling waiver requests for the Department of Treasury at 1-888-224-2950. They will encourage your participation in EFT and address any questions or concerns you may have.

34. ACCOUNT NUMBER - PLEASE CHECK THE APPROPRIATE BOX AND PROVIDE THE ACCOUNT NUMBER, IF APPLICABLE

CHECKING SAVINGS I CERTIFY THAT I DO NOT HAVE AN ACCOUNT WITH A FINANCIAL INSTITUTION OR A CERTIFIED PAYMENT AGENT

ACCOUNT NUMBER

35.NAME OF FINANCIAL INSTITUTION

36.ROUTING OR TRANSIT NUMBER

VA FORM 21-527, MAR 2012 |

Page 7 |

PART XI - REMARKS

37. REMARKS - USE THIS SPACE FOR ANY ADDITIONAL STATEMENTS THAT YOU WOULD LIKE TO MAKE CONCERNING YOUR APPLICATION

PART XII - CERTIFICATION AND SIGNATURE

I certify and authorize that the statements in this document are true and complete to the best of my knowledge. I authorize any person or entity, including but not limited to any organization, service provider, employer, or government agency, to give the Department of Veterans Affairs any information about me except protected health information, and I waive any privilege which makes the information confidential.

38A. SIGNATURE OF CLAIMANT

If signature of claimant made by "X" mark, you must have 2 people you know witness as you sign. They must then sign the form and print their names and addresses.

39A. SIGNATURE AND PRINTED NAME OF WITNESS

40A. SIGNATURE AND PRINTED NAME OF WITNESS

PENALTY: The law provides severe penalties which include fine or imprisonment, or both, for the willful submission of any statement or evidence of a material fact, knowing it to be false, or for the fraudulent acceptance of any payment to which you are not entitled.

VA FORM 21-527, MAR 2012 |

Page 8 |