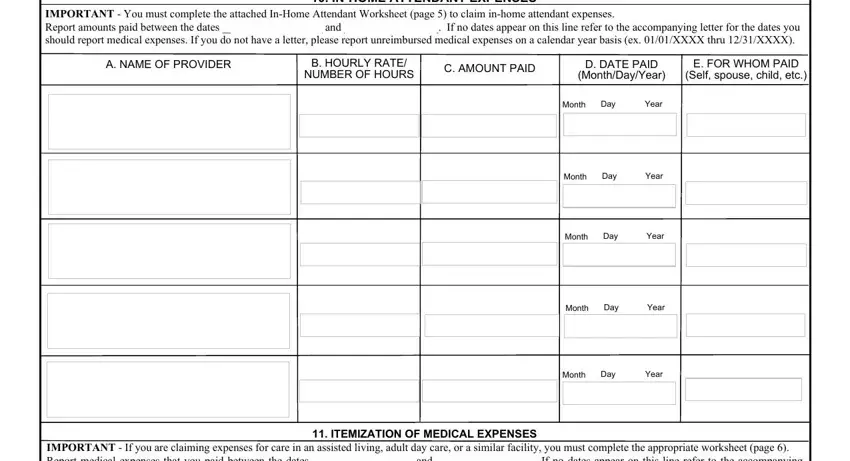

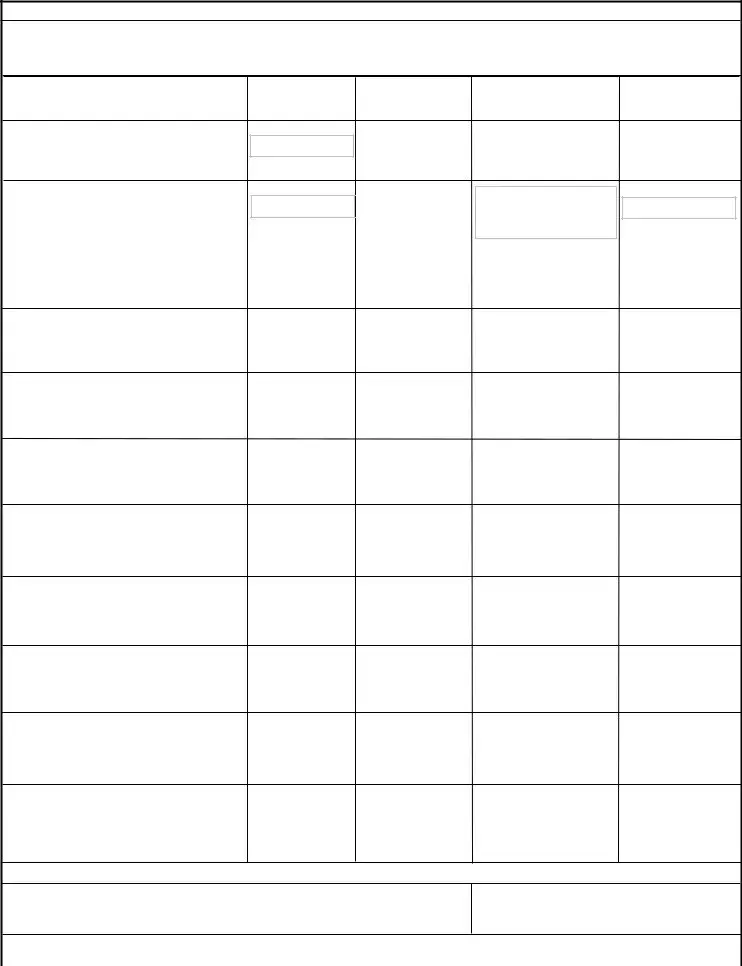

WORKSHEET FOR AN ASSISTED LIVING, ADULT DAY CARE, OR A SIMILAR FACILITY

NOTE: Only complete this worksheet if you are claiming expenses for an assisted living facility, adult day care or similar facility.

IMPORTANT: VA recognizes the following five activities as Activities of Daily Living (ADLs) for medical expense purposes:

(1)Eating

(2)Bathing/Showering

(3)Dressing

(4)Transferring (for example, from bed to chair)

(5)Using the toilet

Custodial Care is regular -

• assistance with two or more ADLs, or

• supervision because a person with a mental disorder is unsafe if left alone due to the mental disorder.

INSTRUCTIONS: Use this worksheet if you are claiming a disabled person's care in an assisted living facility, adult day care, or similar facility as unreimbursed medical expenses. Follow the steps below to determine whether VA may deduct all or some of your out-of-pocket payments to the facility.

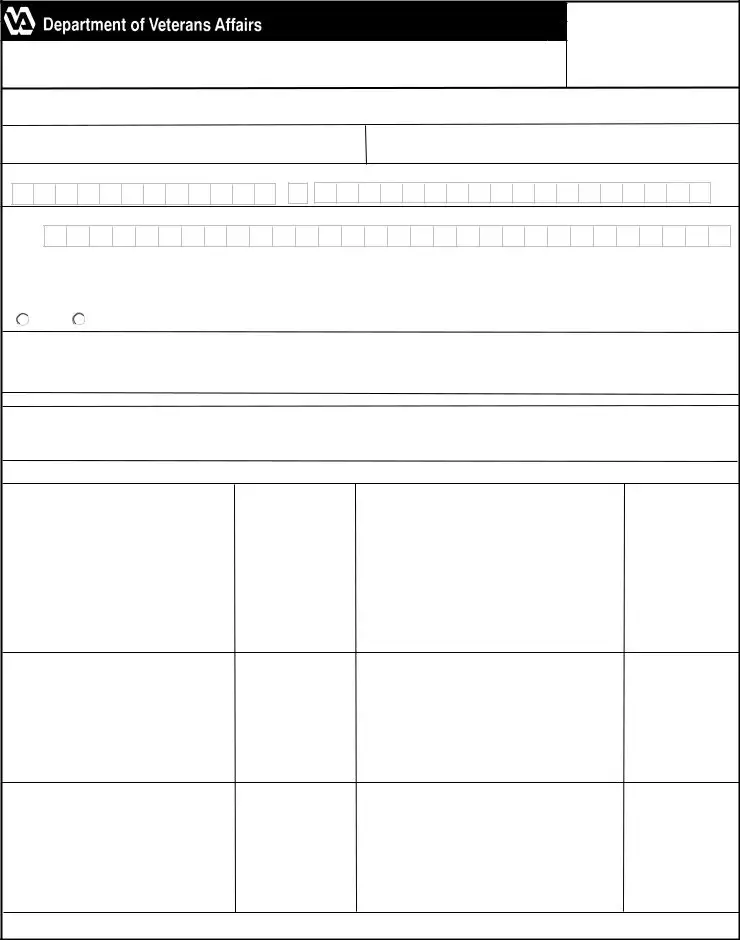

STEP 1. Are the expenses you wish to claim due to the disabled person's treatment in a hospital, inpatient treatment center, nursing home, or VA approved medical foster home?

YES

YES  NO

NO

STEP 2. Do all of the following apply to the facility?

•The facility is licensed (if the State or country requires it)

•The facility's staff (or the facility's contracted staff) provides the disabled person with health care or custodial care or both.

•If the facility is residential, it is staffed 24 hours per day with caregivers

YES |

NO |

(If "NO," payments to the facility do not qualify as medical expenses. You are finished completing this worksheet) |

STEP 3. Are you (the claimant) the disabled person? Are you a veteran, surviving spouse, or Parents' DIC claimant?

YES |

NO |

(If "NO," to either of these questions, skip to Step 8) |

STEP 4. Has VA determined that you are eligible for special monthly pension? (Special monthly pension means pension at the aid and attendance or housebound rate or Parents' DIC at the aid and attendance level)

YES |

NO |

(If "NO," skip to Step 6) |

|

|

STEP 5. If you answered "YES" in Step 2, you stated that the facility provides you with health care and/or custodial care.

|

|

Is this the primary reason you live in the facility (or attend day care in the facility)? |

|

YES |

NO |

(If "YES," all payments to this facility qualify as medical expenses. You may claim these expenses in Item 11. Skip to Step 10) |

|

(If "NO," payments to this facility for meals and lodging do not qualify as medical expenses. Only claim amounts you pay the facility for |

|

|

|

health care services or custodial care)

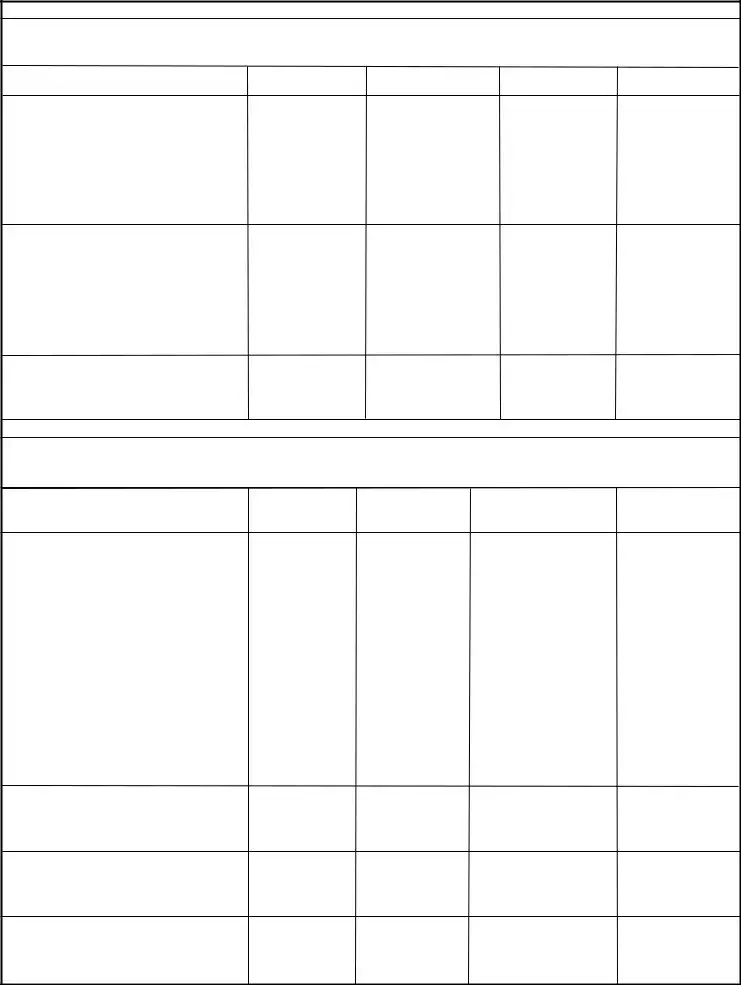

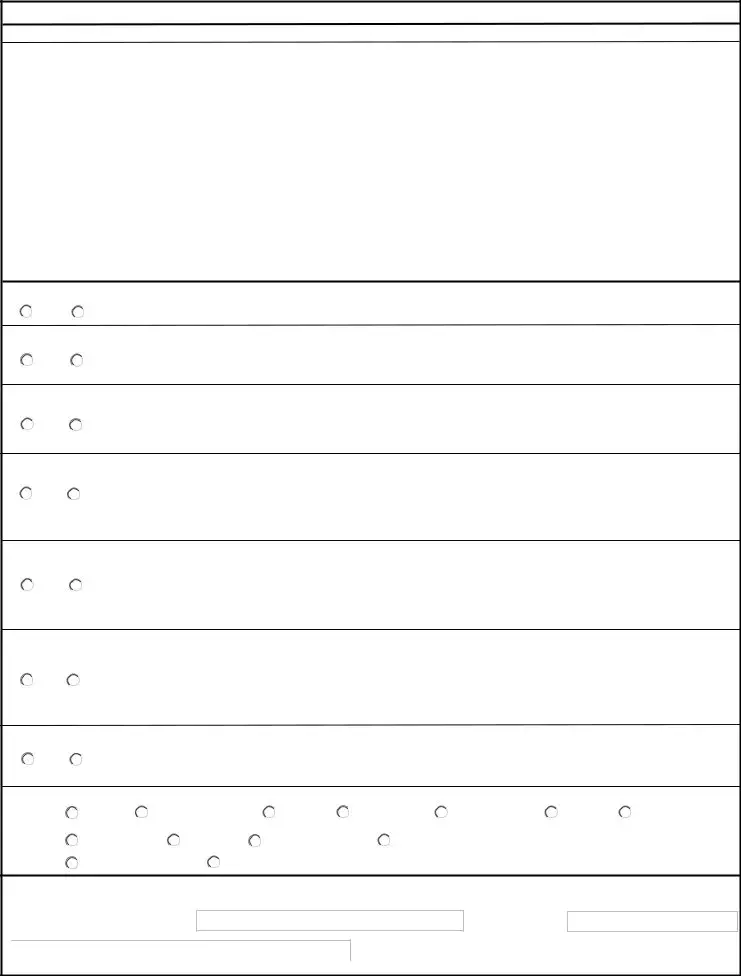

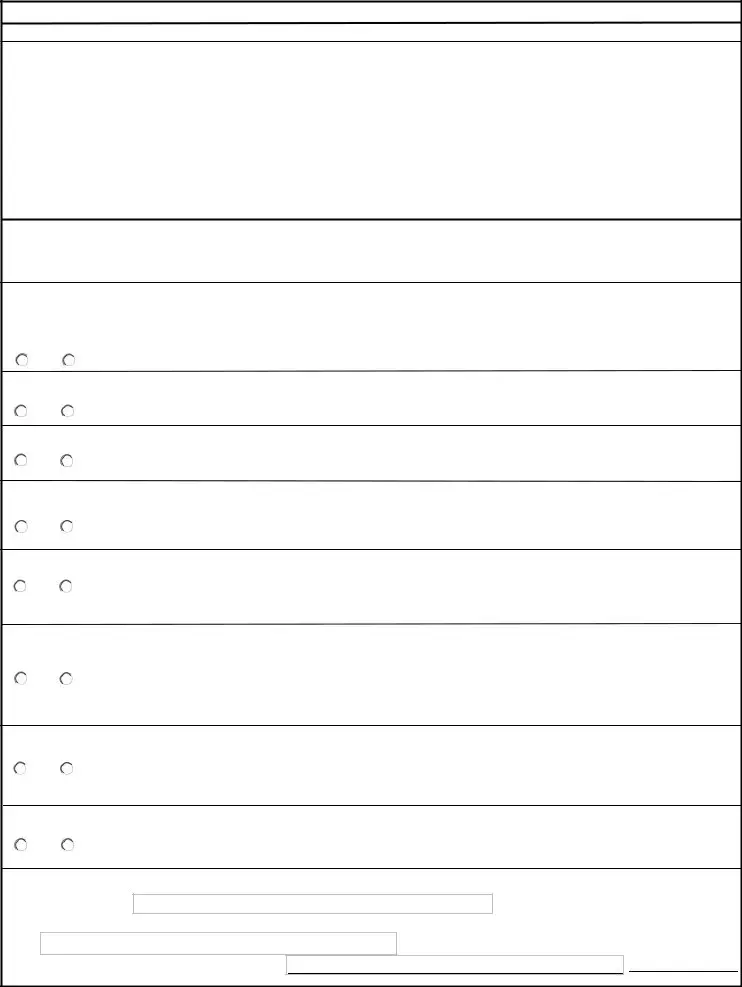

STEP 6. Are you claiming special monthly pension?

(If "YES," please complete and attach with this application VA Form 21-2680, Examination for Housebound Status or Permanent Need

YES NOfor Regular Aid and Attendance. Please make sure every item is complete and the form is signed by a Physician, Physician Assistant (PA), Certified Nurse Practitioner (CNP), or Clinical Nurse Specialist (CNS))

(If "NO," payments to this facility for meals and lodging do not qualify as medical expenses. Only claim amounts you pay the facility for health care services or assistance with ADLs provided by a health care provider in Item 11. Skip to Step 10)

STEP 7. If you answered "YES" in Step 2, you stated that the facility provides you with health care and/or custodial care. Is this the primary reason you live in the facility (or attend day care in the facility)?

|

|

(If "YES," all payments to this facility may qualify as medical expenses if VA rates you as eligible for special monthly pension or Parents' |

YES |

NO |

DIC. Please report separately in Item 11 applicable amounts you pay the facility for: (1) lodging and meals, (2) health care services or |

assistance with ADLs provided by a health care provider, and (3) custodial care. Skip to Step 10) |

(If "NO," payments to this facility for meals and lodging do not qualify as medical expenses. Please report separately in Item 11 applicable amounts you pay the facility for: (1) health care services or assistance with ADLs provided by a health care provider, and (2) custodial care. Skip to Step 10)

STEP 8. Does the disabled person require the health care services or custodial care that the facility provides to him or her because of the disabled person's mental or physical disability?

(If "YES," you must submit a statement from a physician or physician assistant that: (1) the disabled person requires the health care

YES NOservices or custodial care that the facility provides to him or her because of mental or physical disability, and (2) describes the mental or physical disability)

(If "NO," claim only amounts you pay the facility for health care services or assistance with ADLs provided by a health care provider in Item 11. Skip to Step 10)

STEP 9. If you answered "YES" in Step 2, you stated that the facility provides the disabled person with health care and/or custodial care. Is this the primary reason the disabled person lives in the facility or attends day care in the facility?

|

YES |

NO |

(If "YES," claim all payments to this facility (to include meals and lodging) as medical expenses in Item 11) |

|

(If "NO," payments to this facility for meals and lodging do not qualify as medical expenses. Only claim amounts you pay the facility for |

|

|

|

|

|

|

health care services or custodial care in Item 11) |

STEP 10. Facility Certification: Please submit a current statement showing the fees claimant pays to your facility and breakdown of the care received.

I CERTIFY that the information stated within this WORKSHEET FOR AN ASSISTED LIVING, ADULT DAY CARE, OR SIMILAR FACILITY is accurate and reflects the current environment pertaining to _______________________________________________________________________________________ and his or her care at this

YES

YES  NO

NO