By using the online editor for PDFs by FormsPal, you are able to fill in or change 1982 here. To make our tool better and simpler to use, we constantly implement new features, considering feedback from our users. In case you are looking to get started, this is what it will take:

Step 1: Open the PDF file inside our editor by clicking the "Get Form Button" above on this webpage.

Step 2: As soon as you launch the online editor, you will see the form ready to be filled in. Apart from filling in various blanks, you can also perform other things with the PDF, specifically writing any textual content, editing the original textual content, inserting graphics, putting your signature on the document, and a lot more.

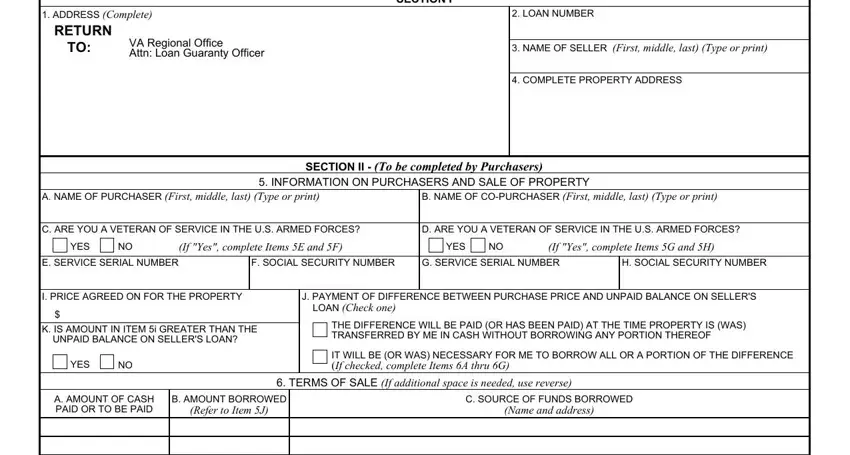

If you want to finalize this PDF form, be certain to type in the required details in each field:

1. Start completing your 1982 with a selection of essential blank fields. Note all of the necessary information and make certain not a single thing overlooked!

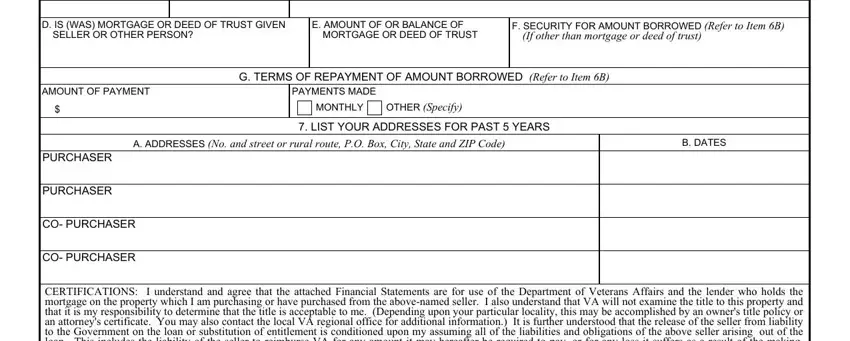

2. After completing the last section, head on to the next part and fill out the essential particulars in all these blanks - D IS WAS MORTGAGE OR DEED OF TRUST, E AMOUNT OF OR BALANCE OF MORTGAGE, F SECURITY FOR AMOUNT BORROWED, AMOUNT OF PAYMENT, PAYMENTS MADE, G TERMS OF REPAYMENT OF AMOUNT, MONTHLY, OTHER Specify, LIST YOUR ADDRESSES FOR PAST, A ADDRESSES No and street or rural, B DATES, PURCHASER, PURCHASER, CO PURCHASER, and CO PURCHASER.

It is possible to make errors while completing your MONTHLY, and so make sure you look again before you submit it.

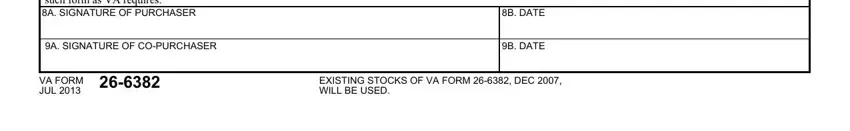

3. Completing CERTIFICATIONS I understand and, A SIGNATURE OF PURCHASER, A SIGNATURE OF COPURCHASER, B DATE, B DATE, VA FORM JUL, and EXISTING STOCKS OF VA FORM DEC is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Step 3: Once you've reviewed the details in the blanks, simply click "Done" to complete your form. Sign up with FormsPal now and immediately get access to 1982, prepared for download. Each and every edit made is conveniently kept , which enables you to modify the file later if required. FormsPal guarantees protected form completion without personal data recording or distributing. Feel comfortable knowing that your information is in good hands here!