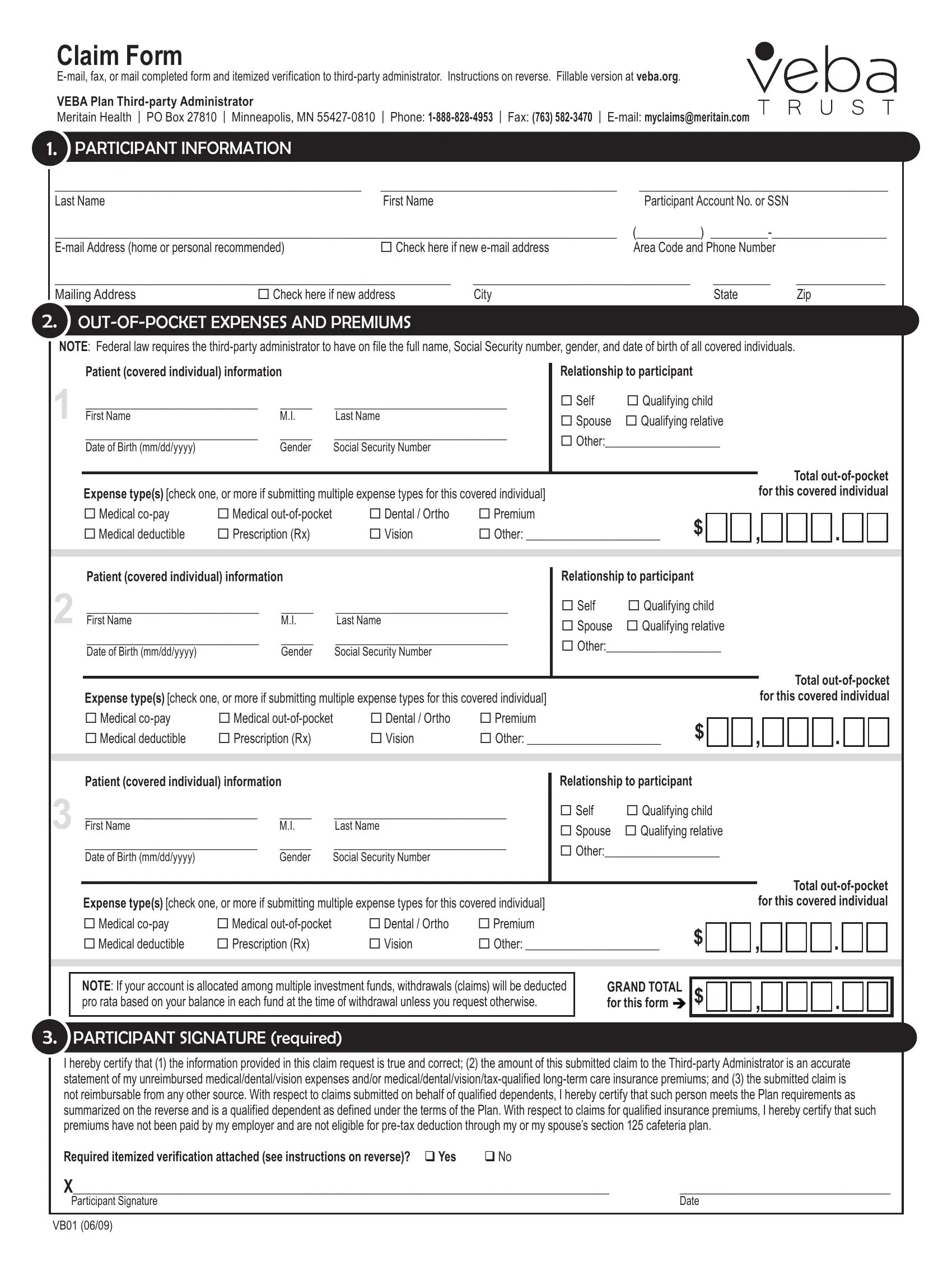

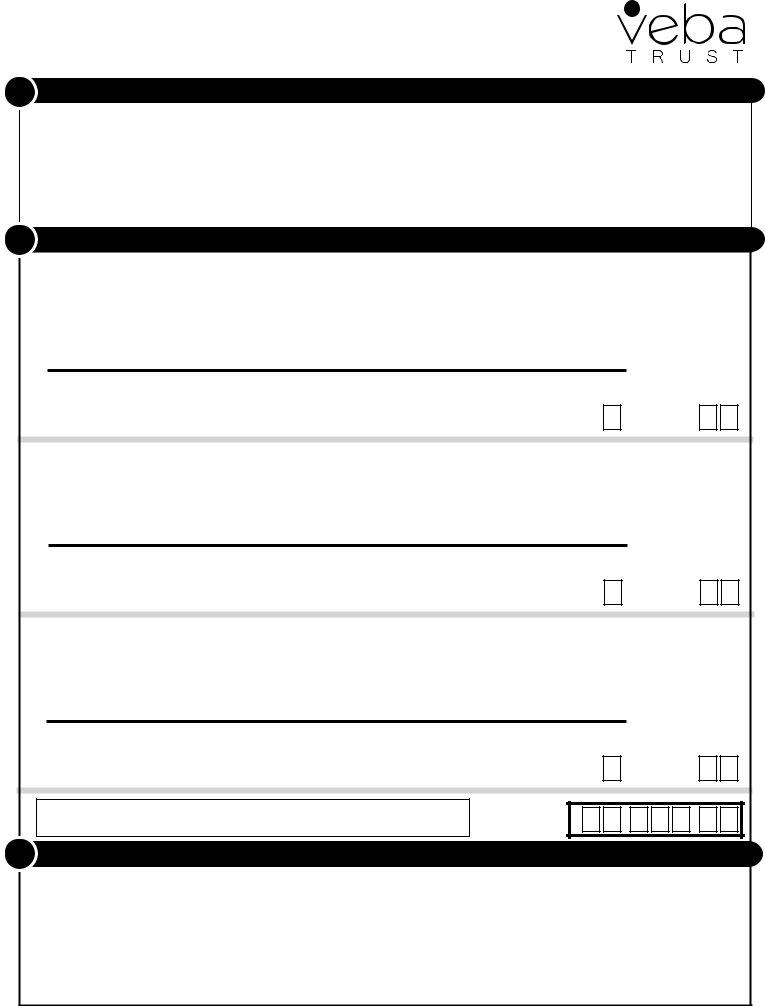

Claim Form

E-mail, fax, or mail completed form and itemized verification to third-party administrator. Instructions on reverse. Fillable version at veba.org.

|

VEBA Plan Third-party Administrator |

|

|

|

|

|

|

Meritain Health | PO Box 27810 |

| Minneapolis, MN 55427-0810 |

| Phone: 1-888-828-4953 | Fax: (763) 582-3470 | E-mail: myclaims@meritain.com |

|

|

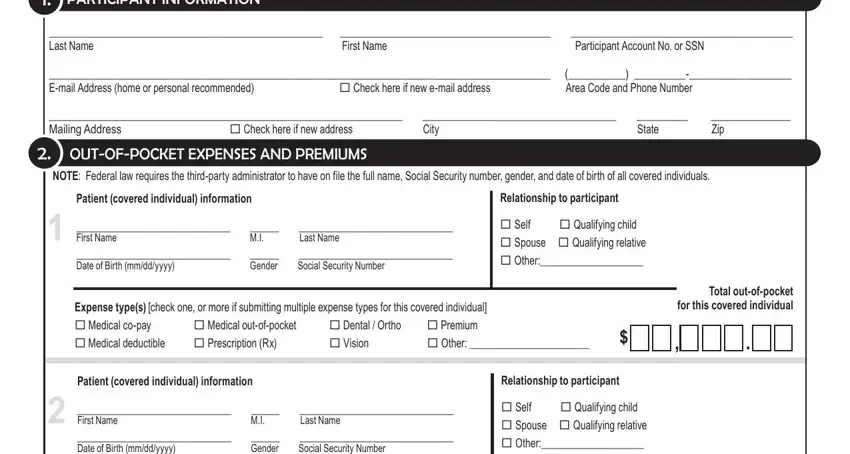

1.1. ParticiPant information |

|

|

|

|

|

________________________________________________ |

_____________________________________ |

_______________________________________ |

|

Last Name |

|

First Name |

|

Participant Account No. or SSN |

|

________________________________________________________________________________________ |

(__________) _________-__________________ |

|

E-mail Address (home or personal recommended) |

Check here if new e-mail address |

Area Code and Phone Number |

|

______________________________________________________________ |

__________________________________ |

_________ |

______________ |

|

Mailing Address |

Check here if new address |

City |

|

State |

Zip |

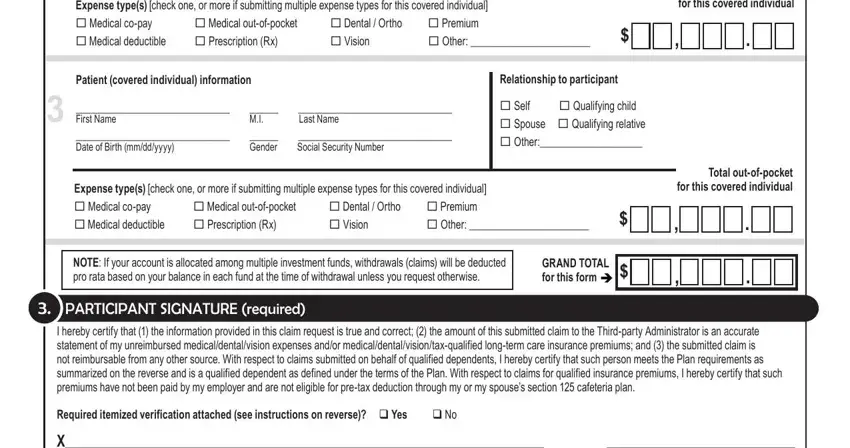

2.2. out-of-Pocket exPenses and Premiums

NOTE: Federal law requires the third-party administrator to have on file the full name, Social Security number, gender, and date of birth of all covered individuals.

|

Patient (covered individual) information |

|

|

Relationship to participant |

|

|

1 |

___________________________ |

_____ |

___________________________ |

Self |

Qualifying child |

First Name |

|

M.I. |

Last Name |

|

Spouse |

Qualifying relative |

|

___________________________ |

_____ |

___________________________ |

|

Other:__________________ |

|

Date of Birth (mm/dd/yyyy) |

|

Gender |

Social Security Number |

|

|

|

|

|

|

|

|

|

Expense type(s) [check one, or more if submitting multiple expense types for this covered individual] |

|

|

|

|

|

|

|

|

|

|

Medical co-pay |

Medical out-of-pocket |

Dental / Ortho |

Premium |

|

|

$ |

|

|

|

|

|

|

Medical deductible |

Prescription (Rx) |

Vision |

Other: _____________________ |

|

|

|

|

Total out-of-pocket for this covered individual

|

Patient (covered individual) information |

|

|

Relationship to participant |

|

|

2 |

___________________________ |

_____ |

___________________________ |

Self |

Qualifying child |

First Name |

|

M.I. |

Last Name |

|

Spouse |

Qualifying relative |

|

___________________________ |

_____ |

___________________________ |

|

Other:__________________ |

|

Date of Birth (mm/dd/yyyy) |

|

Gender |

Social Security Number |

|

|

|

|

|

|

|

|

|

Expense type(s) [check one, or more if submitting multiple expense types for this covered individual] |

|

|

|

|

|

|

|

|

|

|

Medical co-pay |

Medical out-of-pocket |

Dental / Ortho |

Premium |

|

|

$ |

|

|

|

|

|

|

Medical deductible |

Prescription (Rx) |

Vision |

Other: _____________________ |

|

|

|

|

Total out-of-pocket for this covered individual

|

Patient (covered individual) information |

|

|

Relationship to participant |

|

|

3 |

___________________________ |

_____ |

___________________________ |

Self |

Qualifying child |

First Name |

|

M.I. |

Last Name |

|

Spouse |

Qualifying relative |

|

___________________________ |

_____ |

___________________________ |

|

Other:__________________ |

|

Date of Birth (mm/dd/yyyy) |

|

Gender |

Social Security Number |

|

|

|

|

|

|

|

|

|

Expense type(s) [check one, or more if submitting multiple expense types for this covered individual] |

|

|

|

|

|

|

|

|

|

|

Medical co-pay |

Medical out-of-pocket |

Dental / Ortho |

Premium |

|

|

$ |

|

|

|

|

|

|

Medical deductible |

Prescription (Rx) |

Vision |

Other: _____________________ |

|

|

|

|

Total out-of-pocket for this covered individual

NOTE: If your account is allocated among multiple investment funds, withdrawals (claims) will be deducted pro rata based on your balance in each fund at the time of withdrawal unless you request otherwise.

3.3. ParticiPant signature (required)

GRAND TOTAL for this form

I hereby certify that (1) the information provided in this claim request is true and correct; (2) the amount of this submitted claim to the Third-party Administrator is an accurate statement of my unreimbursed medical/dental/vision expenses and/or medical/dental/vision/tax-qualified long-term care insurance premiums; and (3) the submitted claim is not reimbursable from any other source. With respect to claims submitted on behalf of qualified dependents, I hereby certify that such person meets the Plan requirements as summarized on the reverse and is a qualified dependent as defined under the terms of the Plan. With respect to claims for qualified insurance premiums, I hereby certify that such premiums have not been paid by my employer and are not eligible for pre-tax deduction through my or my spouse’s section 125 cafeteria plan.

Required itemized verification attached (see instructions on reverse)? q Yes |

q No |

|

X____________________________________________________________________________________ |

_________________________________ |

Participant Signature |

|

Date |

VB01 (06/09)

instructions for submitting claims

Use this form to request reimbursement of qualiied healthcare expenses and/or insurance premiums you have incurred on behalf of yourself, your spouse, and/or your eligible dependents (illable version available at veba.org). Qualiied expenses and premiums submitted for reimbursement must have been incurred after you became a participant eligible to ile claims. Want to see your claims in progress and claims history? Go to veba.org and

click myVEBA Plan online to login to your account.

To expedite your claim:

1.Fully complete all requested information. Missing information may delay the processing of your claim and could result in your claim being denied. Don’t forget to sign and date the form.

2.You must attach itemized veriication for each expense or service. Generally, veriication should contain (1) patient (covered individual)

name; (2) date item was purchased or service was provided; (3) description of expense or service; and (4) out-of-pocket amount. Acceptable forms of veriication include (1) an explanation of beneits (EOB); (2) an itemized billing or statement from your provider; or (3) a detailed receipt for prescription or over-the-counter (OTC) medications. Cancelled checks and balance forward statements are not acceptable.

3.For qualiied insurance premium reimbursement, you must attach documentation which includes the following: (1) name(s) of covered individual(s); (2) premium amount(s); (3) policy period; and (4) insurance provider name and address. This information is typically contained on your premium billing notice. NOTE: Premiums paid by an employer, or premiums that are or could be deducted pre-tax through your or your spouse’s employer, are not eligible for reimbursement.

4.Sign up for direct deposit; its faster and more secure. Go to veba.org and click myVEBA Plan online.

To set up systematic reimbursement of monthly insurance premiums, go to veba.org and click myVEBA Plan online to login to your account. Or,

submit a completed Systematic Premium Reimbursement Form.

Questions? Contact the third-party administrator, Meritain Health, at myVEBAPlan@meritain.com or 1-888-828-4953.

qualified exPenses and Premiums

Internal Revenue Code § 213(d) deines qualiied expenses and premiums, in part, as “medical care” amounts paid for insurance or “for the diagnosis, cure, mitigation, treatment, or prevention of disease…” Expenses solely for cosmetic reasons generally are not eligible (e.g. facelifts, hair transplants,

hair removal, etc.).

Common expenses include co-pays, coinsurance, deductibles, and prescriptions. Common insurance premiums include medical, dental, vision, tax- qualiied long-term care (subject to IRS limits), Medicare Part B, Medicare Part D, and Medicare supplement plans. Go to veba.org to view a more

extensive list.

Please note the following:

1.Insurance premiums paid by an employer, or premiums that are or could be deducted pre-tax through your or your spouse’s section 125 cafeteria plan, are not eligible for reimbursement.

2.If you or your spouse have a section 125 healthcare lexible spending account (FSA), you must exhaust the FSA beneits before submitting claims.

3.Claims for over-the-counter (OTC) medicines and drugs should be for reasonable quantities expected to be consumed within a reasonable period of time. Sales tax can be included.

qualified dePendents

Generally, dependents must satisfy the IRS deinition of Qualifying Child or Qualifying Relative as of the end of the calendar year in which expenses were incurred to be eligible for beneits. These requirements are deined by Internal Revenue Code § 152 and described in IRS Publication 502. These deinitions supersede and may differ from state deinitions. Go to veba.org for more information.

Qualifying Child. A qualifying child is a child who: (1) is your son, daughter, stepchild, foster child, brother, sister, stepbrother, stepsister, or a descen- dant of any of them (for example, your grandchild, niece, or nephew); and (2) at the end of the calendar year in which expenses were incurred will be (a) under age 19, or (b) under age 24 and a full-time student, or (c) permanently and totally disabled; and (3) is younger than you; and (4) is unmarried; and

(5)lives with you for more than half the year; and (6) does not provide more than half of his or her own support; and (7) is a citizen, national, or resident of the U.S. or a resident of Canada or Mexico.

Qualifying Relative. A qualifying relative is a person who: (1) is your (a) son, daughter, stepchild, foster child, or a descendant of any of them (e.g. your grandchild); or (b) brother, sister, or a son or daughter of either of them; or (c) father, mother, or an ancestor or sibling of either of them (for ex- ample, your grandmother, grandfather, aunt, or uncle); or (d) stepbrother, stepsister, stepfather, stepmother, son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law, or sister-in-law; or (e) any other person (other than your spouse) who lived with you all year as a member of your house- hold; and (2) will not be a qualifying child of any other person as of the last day of the calendar year in which expenses were incurred; and (3) does not provide more than half of his or her own support; and (4) is a citizen, national, or resident of the U.S. or a resident of Canada or Mexico.