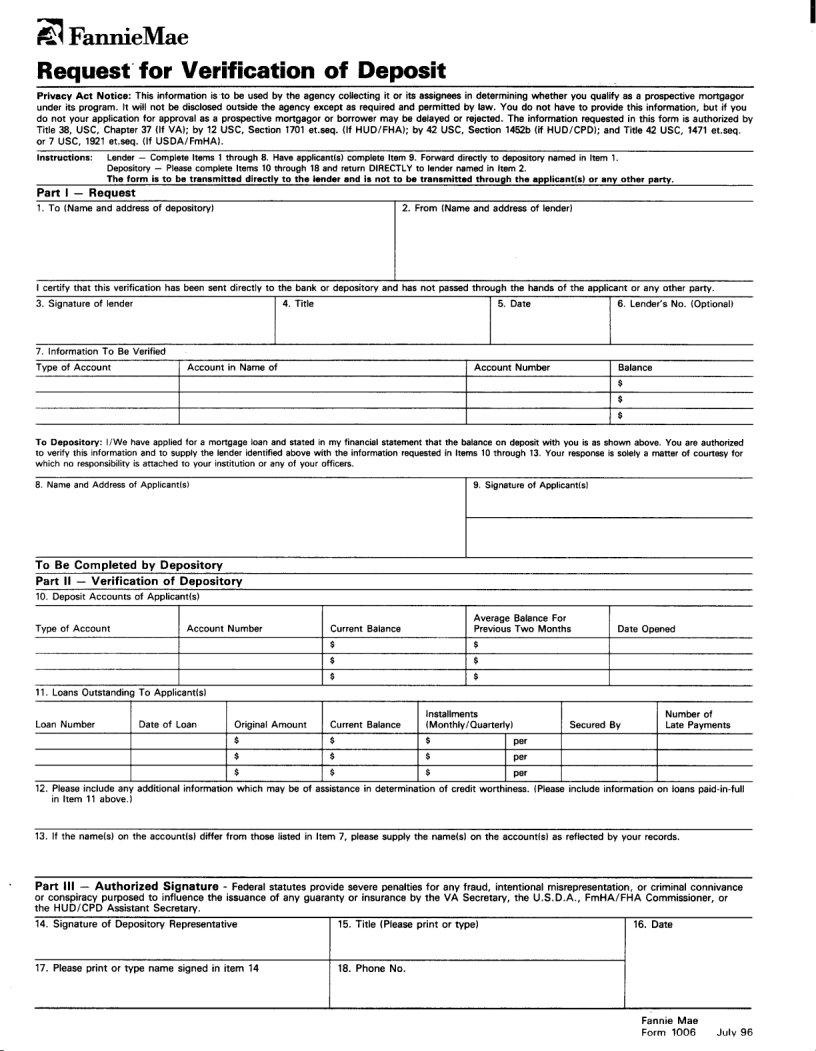

In the world of financial transactions, accuracy and verification are paramount. One tool that plays a crucial role in ensuring these elements is the Verification Deposit form. This form serves as a key component in verifying the authenticity of deposit information between parties, typically in the context of banking and financial institutions. It acts as a safeguard, ensuring that the deposited funds are accurately recorded and acknowledged by the receiving party. Through its detailed structure, the form captures essential information such as the account holder's details, the transaction date, and the amount deposited, making it a vital document for financial reconciliation and auditing purposes. Not only does it facilitate smooth financial operations by minimizing discrepancies, but it also helps in maintaining transparency and trust between entities involved in financial transactions. Understanding how to properly fill out and utilize the Verification Deposit form can significantly contribute to the efficiency and reliability of financial exchanges.

| Question | Answer |

|---|---|

| Form Name | Verification Deposit Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | fannie verification, verification of deposit form, verification completion requested deposit amount 875 e cosign, fannie verification deposit |