worksheet verification can be completed very easily. Just make use of FormsPal PDF editing tool to complete the job quickly. To maintain our editor on the leading edge of practicality, we work to adopt user-driven features and enhancements on a regular basis. We're at all times grateful for any feedback - assist us with revolutionizing PDF editing. In case you are looking to begin, this is what it will require:

Step 1: Click the "Get Form" button above. It'll open our pdf editor so you can begin completing your form.

Step 2: As you start the PDF editor, you will notice the document all set to be filled out. Other than filling out various blanks, you could also do some other things with the form, particularly adding custom text, modifying the initial textual content, inserting illustrations or photos, placing your signature to the document, and a lot more.

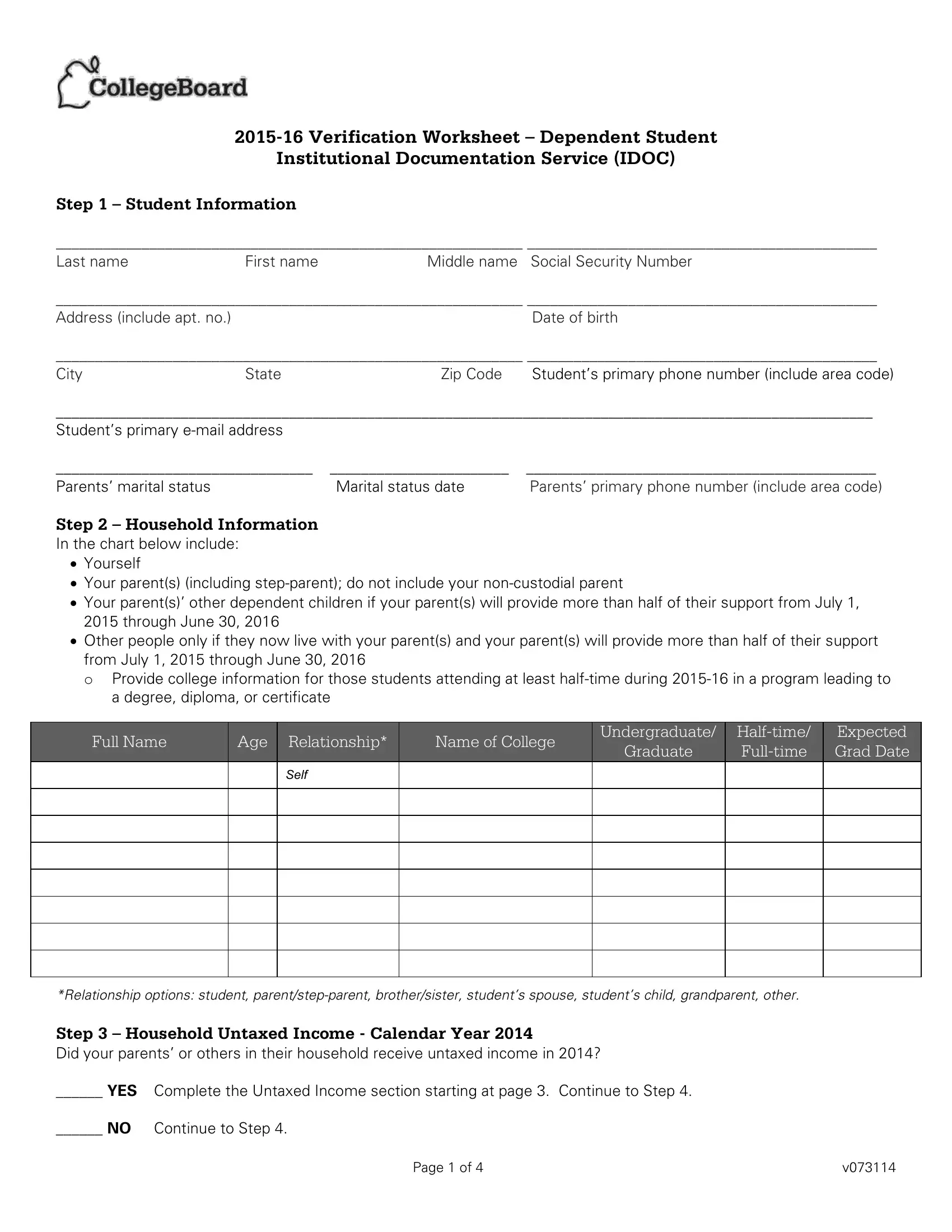

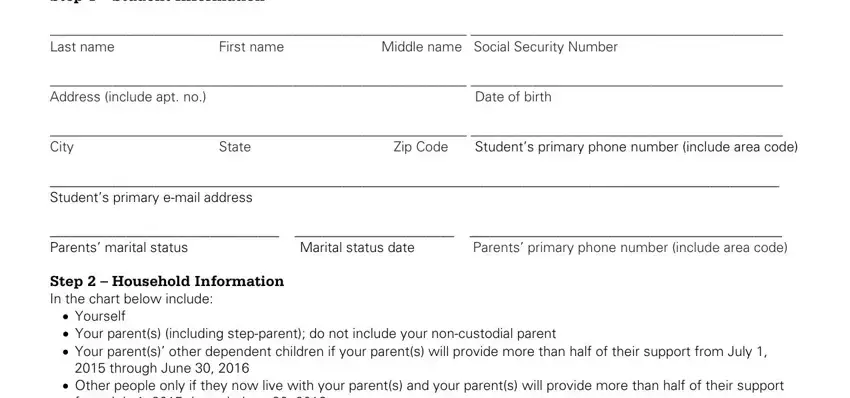

As for the fields of this precise PDF, here's what you need to do:

1. Whenever completing the worksheet verification, make sure to complete all of the important fields in their relevant section. It will help facilitate the work, allowing for your details to be processed promptly and accurately.

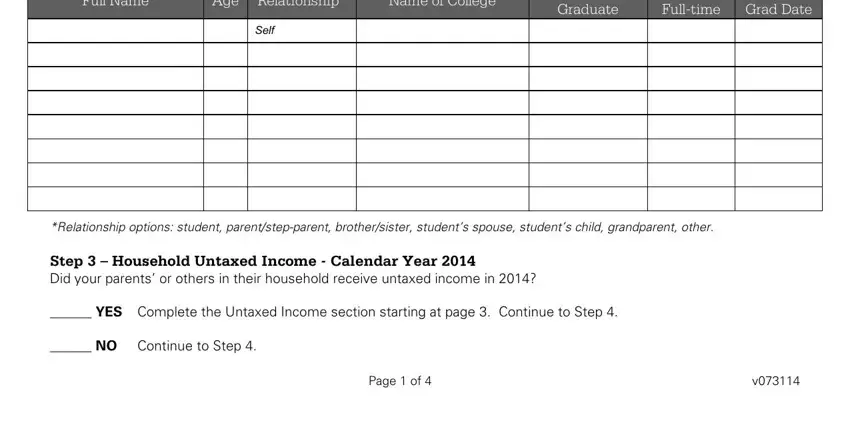

2. Once your current task is complete, take the next step – fill out all of these fields - Full Name, Age Relationship, Name of College, Undergraduate, Graduate, Halftime Fulltime, Self, Expected Grad Date, Relationship options student, and Page of with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

In terms of Full Name and Page of, be certain that you take another look in this current part. Both these are the most significant fields in the PDF.

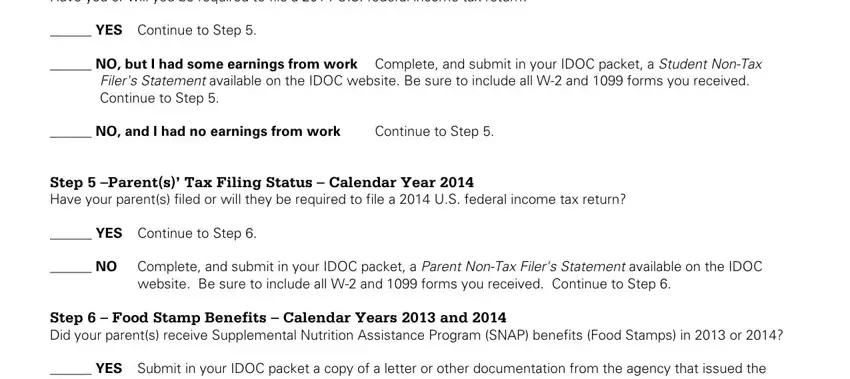

3. The following section should be relatively straightforward, Step Students Tax Filing Status, Filers Statement available on the, Continue to Step, NO and I had no earnings from, website Be sure to include all W, and Step Food Stamp Benefits - every one of these blanks is required to be filled out here.

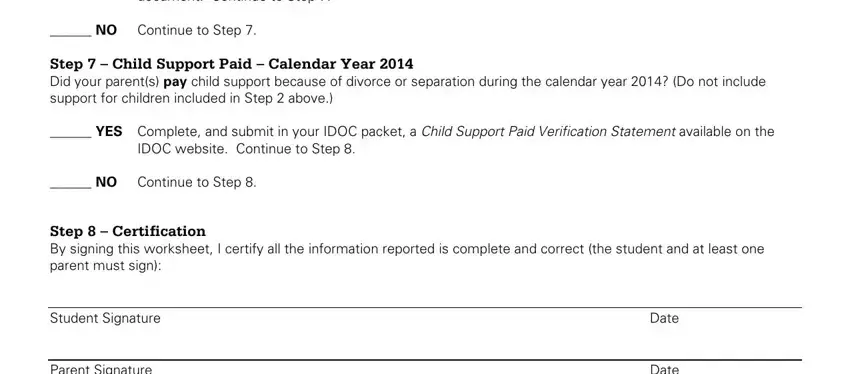

4. This next section requires some additional information. Ensure you complete all the necessary fields - Food Stamps your family received, NO Continue to Step Step Child, IDOC website Continue to Step, NO Continue to Step, Step Certification By signing, Date, and Date - to proceed further in your process!

5. As a final point, the following final section is precisely what you'll want to finish before submitting the document. The blank fields in this instance are the following: Step Certification By signing, and Page of.

Step 3: Spell-check all the information you have entered into the blanks and hit the "Done" button. Create a free trial subscription at FormsPal and acquire direct access to worksheet verification - with all adjustments kept and available inside your personal cabinet. We don't share or sell any details you provide whenever filling out documents at FormsPal.