Working with PDF forms online is actually very easy with this PDF editor. You can fill in vermont 813a form here within minutes. We at FormsPal are devoted to providing you the absolute best experience with our editor by continuously releasing new capabilities and upgrades. Our editor has become much more helpful thanks to the latest updates! At this point, filling out PDF documents is easier and faster than before. Should you be looking to start, here is what you will need to do:

Step 1: Click the "Get Form" button above on this page to access our editor.

Step 2: With this advanced PDF editor, you are able to accomplish more than merely fill in blank form fields. Try all of the features and make your forms appear sublime with custom text incorporated, or adjust the original input to perfection - all comes with an ability to insert your own graphics and sign the PDF off.

This PDF form requires some specific details; to ensure consistency, don't hesitate to pay attention to the following steps:

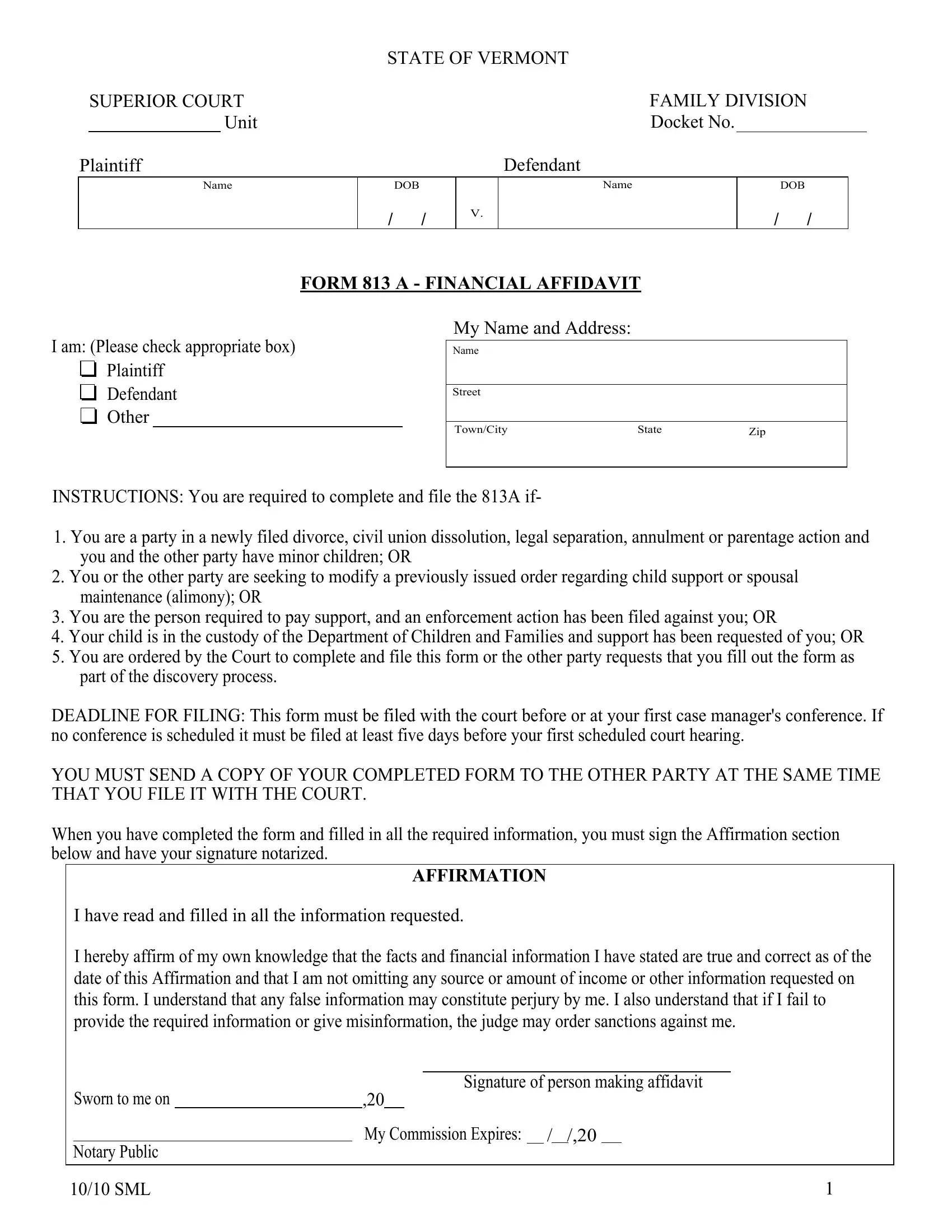

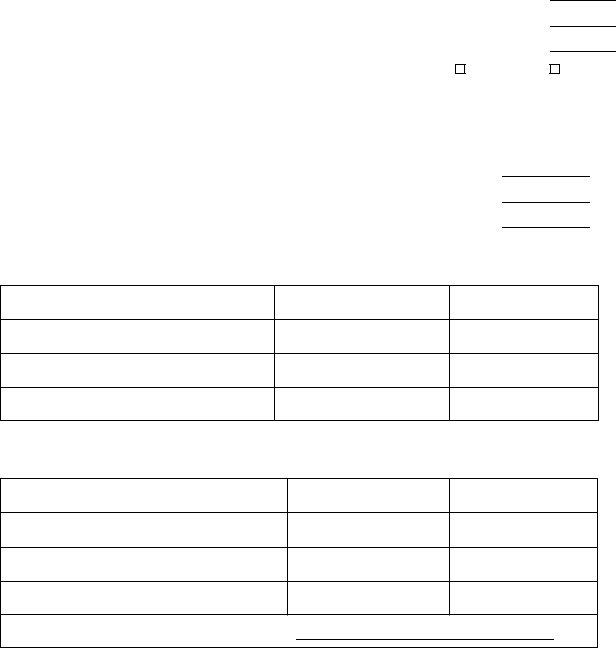

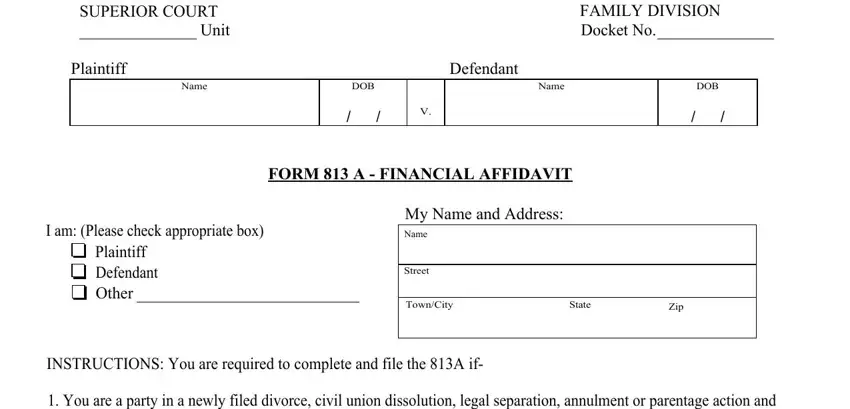

1. It's very important to complete the vermont 813a form properly, hence be mindful while working with the sections that contain these specific blanks:

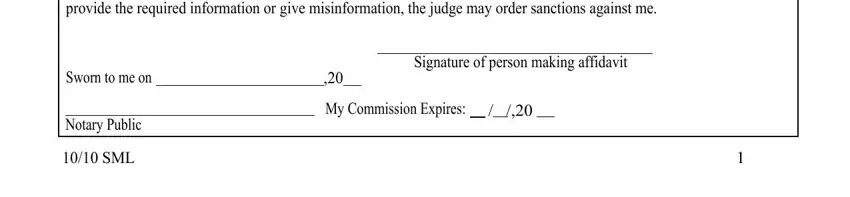

2. The third step would be to fill in these blanks: I hereby affirm of my own, Sworn to me on, Signature of person making, Notary Public, SML, and My Commission Expires.

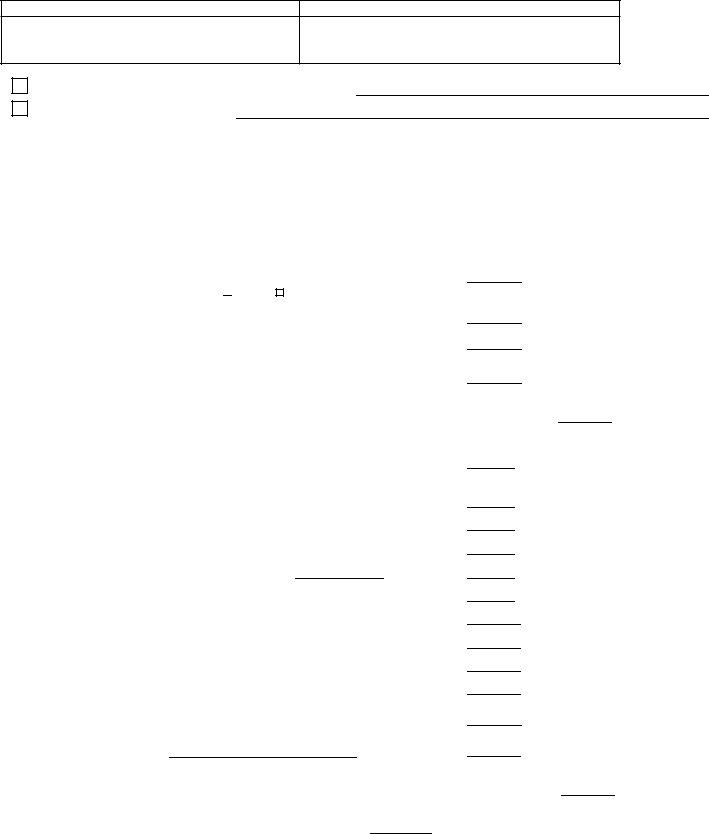

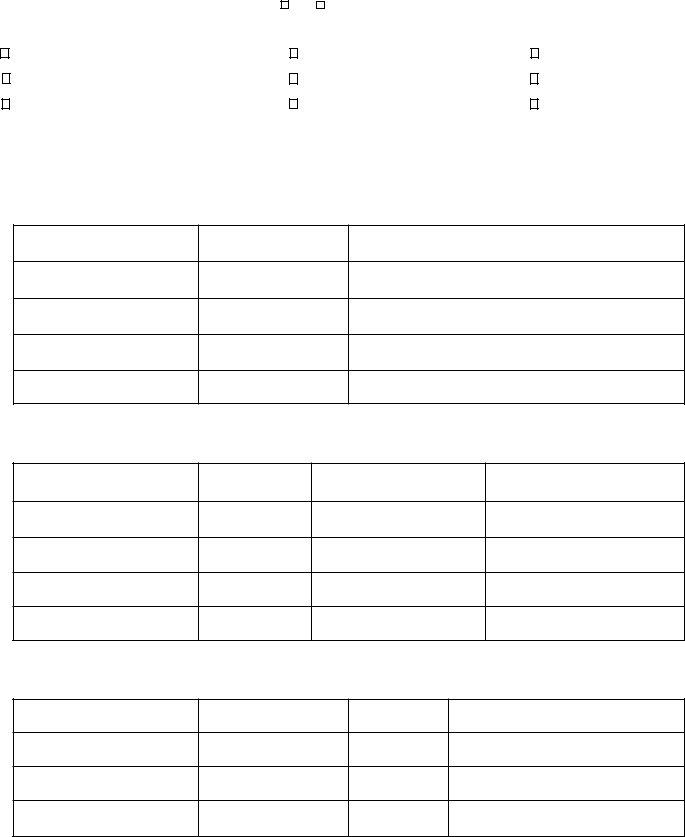

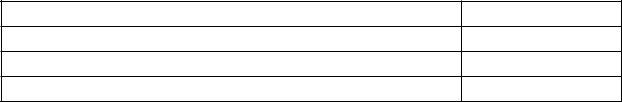

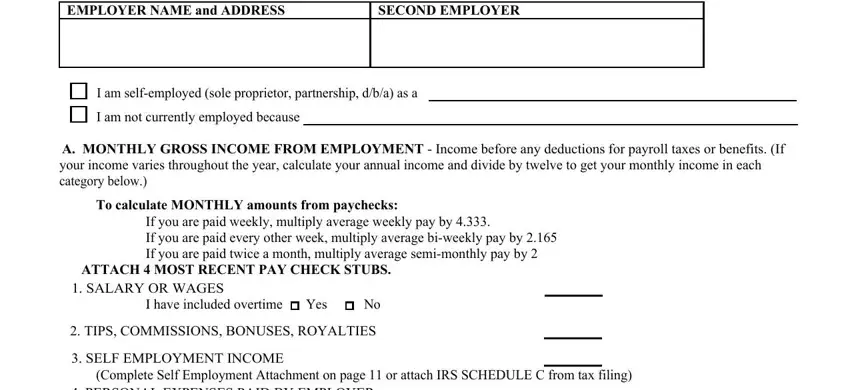

3. The following step is typically rather straightforward, EMPLOYER NAME and ADDRESS, SECOND EMPLOYER, I am selfemployed sole proprietor, I am not currently employed because, A MONTHLY GROSS INCOME FROM, To calculate MONTHLY amounts from, If you are paid weekly multiply, ATTACH MOST RECENT PAY CHECK STUBS, SALARY OR WAGES, I have included overtime, Yes, TIPS COMMISSIONS BONUSES ROYALTIES, SELF EMPLOYMENT INCOME, Complete Self Employment, and PERSONAL EXPENSES PAID BY EMPLOYER - each one of these blanks needs to be filled out here.

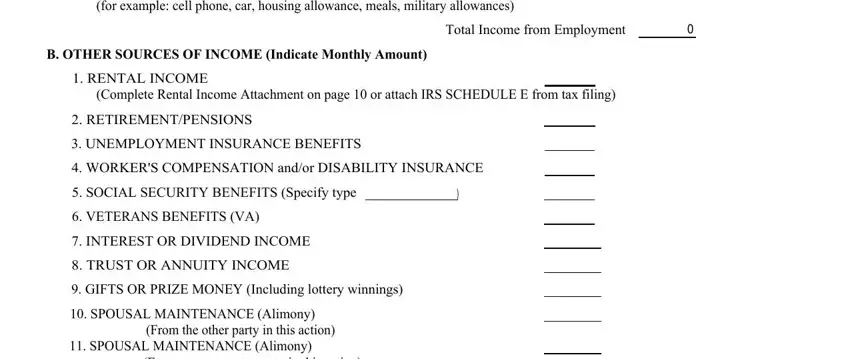

4. All set to fill in this next form section! Here you'll have all these for example cell phone car housing, Total Income from Employment, B OTHER SOURCES OF INCOME Indicate, RENTAL INCOME, Complete Rental Income Attachment, RETIREMENTPENSIONS, UNEMPLOYMENT INSURANCE BENEFITS, WORKERS COMPENSATION andor, SOCIAL SECURITY BENEFITS Specify, VETERANS BENEFITS VA, INTEREST OR DIVIDEND INCOME, TRUST OR ANNUITY INCOME, GIFTS OR PRIZE MONEY Including, SPOUSAL MAINTENANCE Alimony, and From the other party in this action form blanks to complete.

People frequently make errors while filling in From the other party in this action in this part. Be sure to reread what you type in right here.

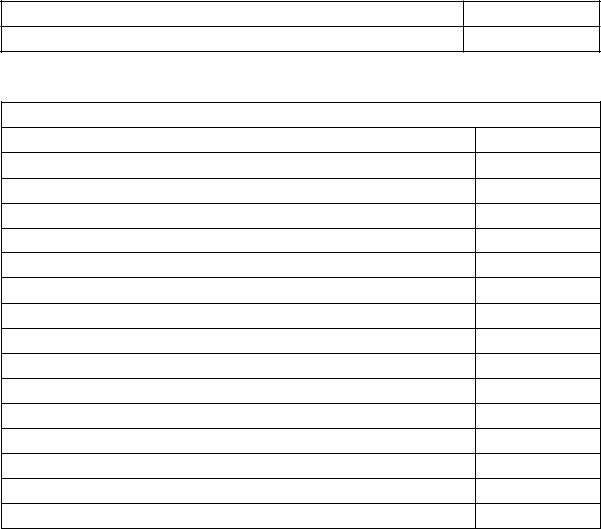

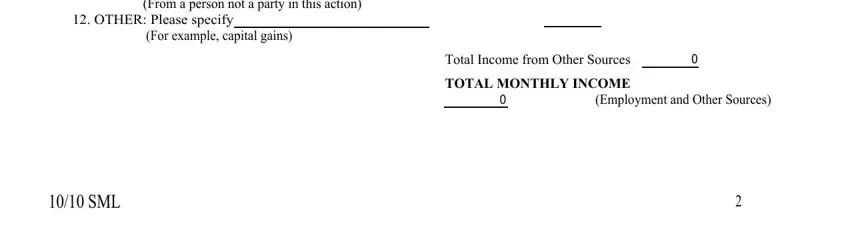

5. Last of all, the following last subsection is precisely what you have to finish prior to finalizing the form. The blanks at issue include the next: From a person not a party in this, OTHER Please specify, For example capital gains, Total Income from Other Sources, TOTAL MONTHLY INCOME, Employment and Other Sources, and SML.

Step 3: Before obtaining the next stage, double-check that blanks have been filled out right. The moment you believe it is all good, click “Done." Make a 7-day free trial option with us and gain immediate access to vermont 813a form - download, email, or edit in your FormsPal account page. When you use FormsPal, it is simple to complete documents without having to be concerned about information incidents or records being shared. Our secure platform ensures that your personal information is maintained safe.