Whenever you would like to fill out Virginia Form Rdc, you don't have to download any software - just use our online PDF editor. Our editor is constantly evolving to give the very best user experience possible, and that's because of our resolve for continual development and listening closely to comments from customers. Getting underway is simple! What you need to do is stick to the following easy steps directly below:

Step 1: Press the orange "Get Form" button above. It will open up our pdf editor so you can begin filling out your form.

Step 2: The tool offers the opportunity to change PDF documents in a variety of ways. Enhance it by writing customized text, correct original content, and include a signature - all at your convenience!

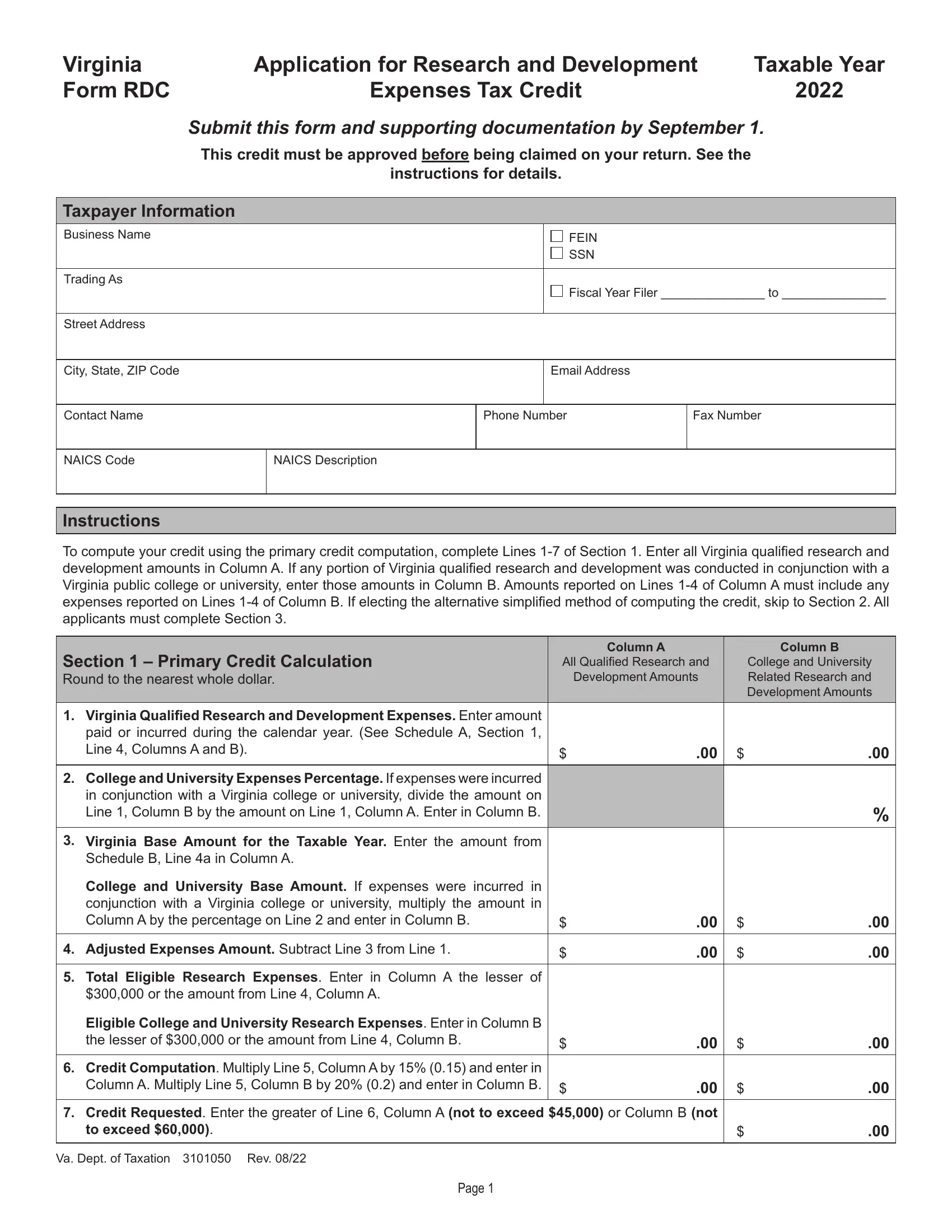

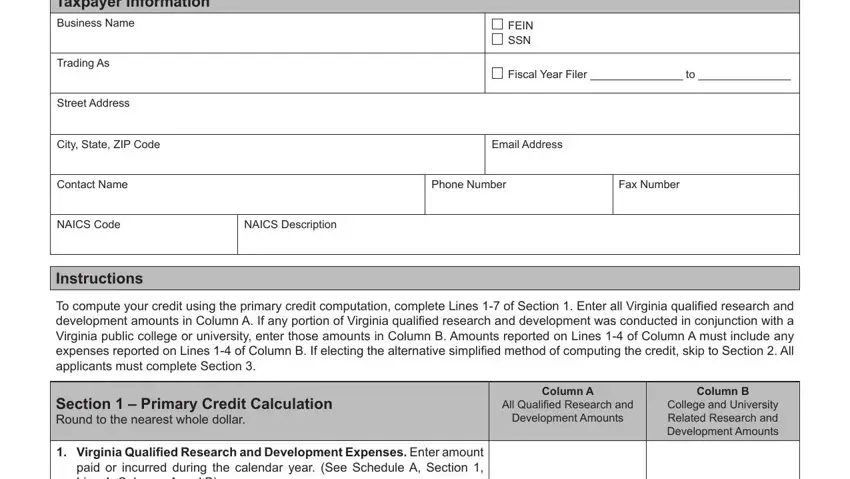

So as to finalize this form, ensure that you enter the information you need in every single blank field:

1. You will need to complete the Virginia Form Rdc accurately, so pay close attention when filling in the parts containing these particular blanks:

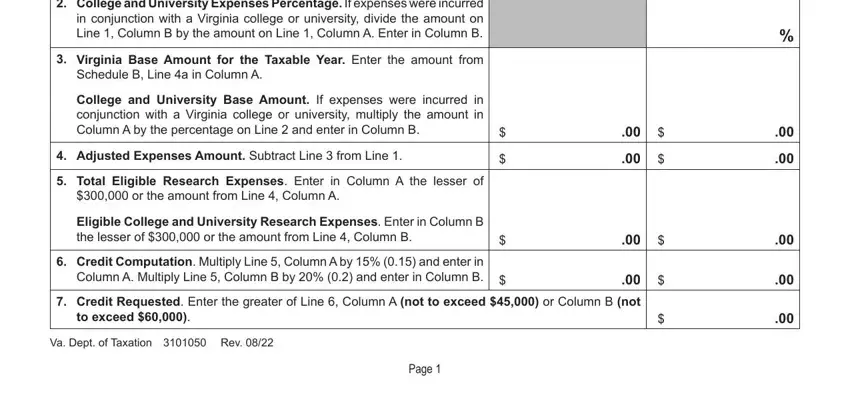

2. When the last array of fields is done, it's time to add the necessary specifics in College and University Expenses, Virginia Base Amount for the, Schedule B Line a in Column A, College and University Base Amount, Adjusted Expenses Amount Subtract, or the amount from Line Column A, Eligible College and University, Credit Computation Multiply Line, Credit Requested Enter the, to exceed, Va Dept of Taxation Rev, and Page in order to move on further.

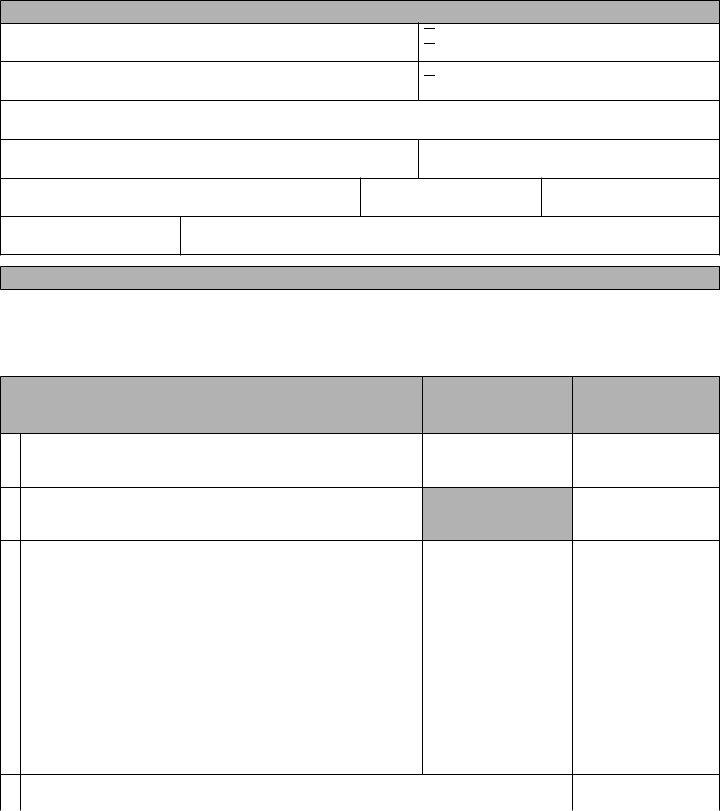

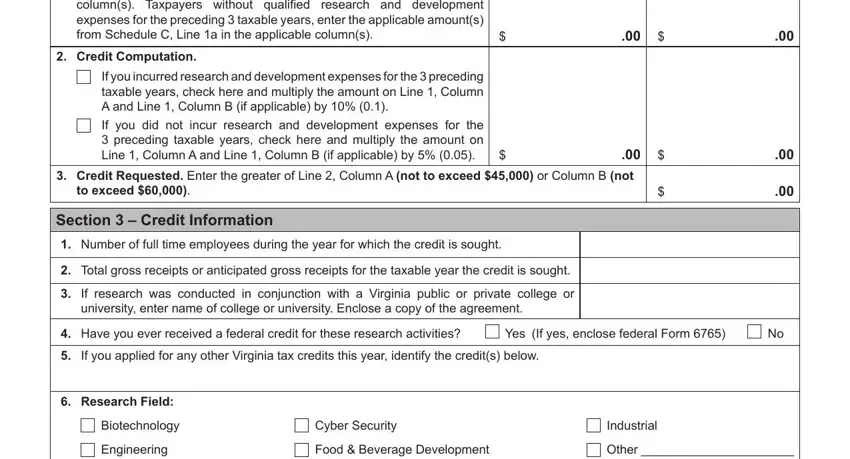

3. Completing Virginia Form RDC Page Section, Credit Computation, If you incurred research and, If you did not incur research and, Credit Requested Enter the, to exceed, Section Credit Information, Total gross receipts or, Have you ever received a federal, Yes If yes enclose federal Form, If you applied for any other, Research Field, Biotechnology, Engineering, and Cyber Security is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

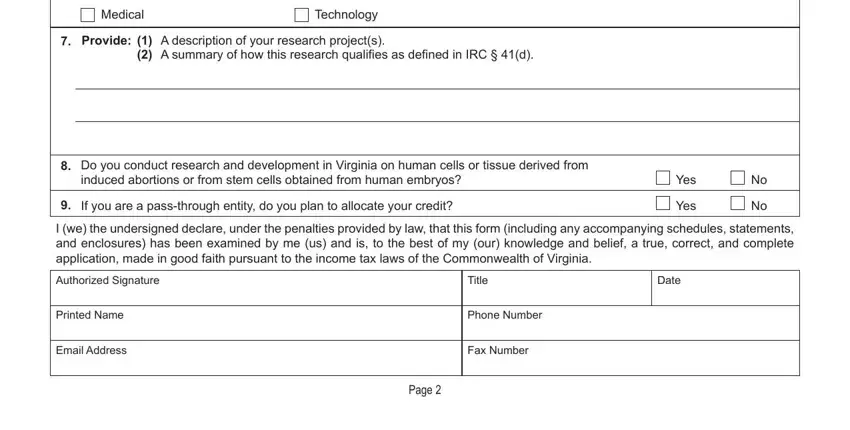

4. Now proceed to the next form section! In this case you have all these Medical, Technology, Provide A description of your, A summary of how this research, Do you conduct research and, induced abortions or from stem, Yes, If you are a passthrough entity do, I we the undersigned declare, Yes, Date, Title, Printed Name, Email Address, and Phone Number blank fields to do.

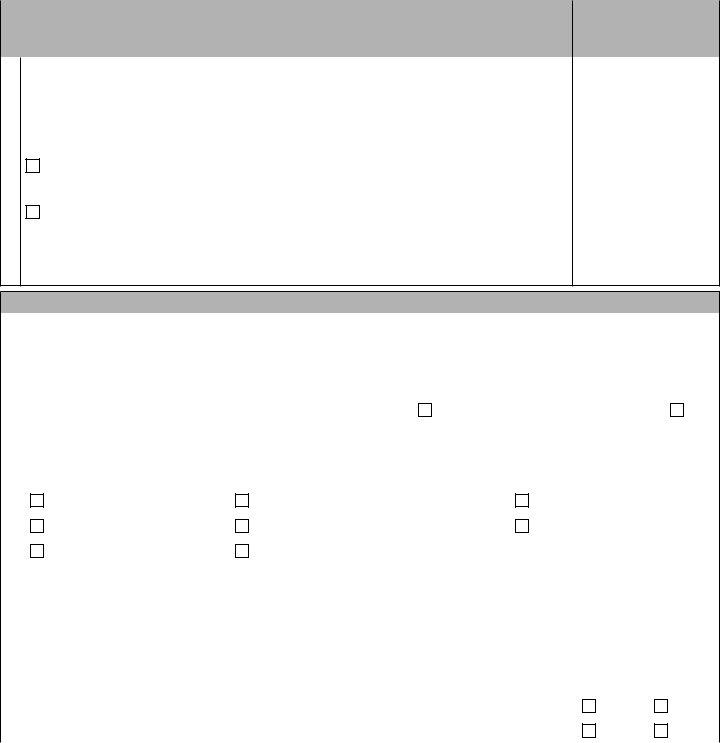

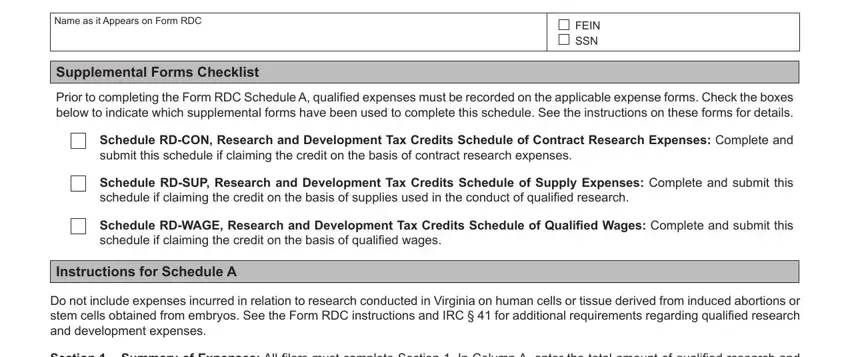

5. The form should be finished by filling in this area. Here there's a full set of blank fields that need specific details in order for your document submission to be complete: Form RDC Schedule A, Summary of Qualified Expenses, Name as it Appears on Form RDC, FEIN SSN, Supplemental Forms Checklist Prior, Schedule RDCON Research and, Schedule RDSUP Research and, Schedule RDWAGE Research and, Instructions for Schedule A, Do not include expenses incurred, and Section Summary of Expenses All.

As to Instructions for Schedule A and Form RDC Schedule A, be sure that you take a second look here. These two are definitely the key ones in this file.

Step 3: Confirm that your information is correct and click "Done" to proceed further. Join FormsPal today and easily get Virginia Form Rdc, prepared for downloading. Every single change made is handily preserved , which enables you to edit the file later on if required. Here at FormsPal, we do everything we can to guarantee that your information is stored protected.