When working in the online PDF editor by FormsPal, you may complete or change va workers compensation wage statement here. Our professional team is ceaselessly endeavoring to improve the tool and help it become much better for users with its many functions. Bring your experience to another level with continually improving and exceptional opportunities available today! To get the process started, go through these basic steps:

Step 1: Click the "Get Form" button in the top section of this page to get into our PDF editor.

Step 2: As you launch the online editor, you'll notice the form all set to be filled in. In addition to filling out different blanks, you can also perform various other actions with the file, namely writing your own text, changing the initial text, adding illustrations or photos, placing your signature to the PDF, and a lot more.

It is actually simple to finish the form using out practical guide! This is what you have to do:

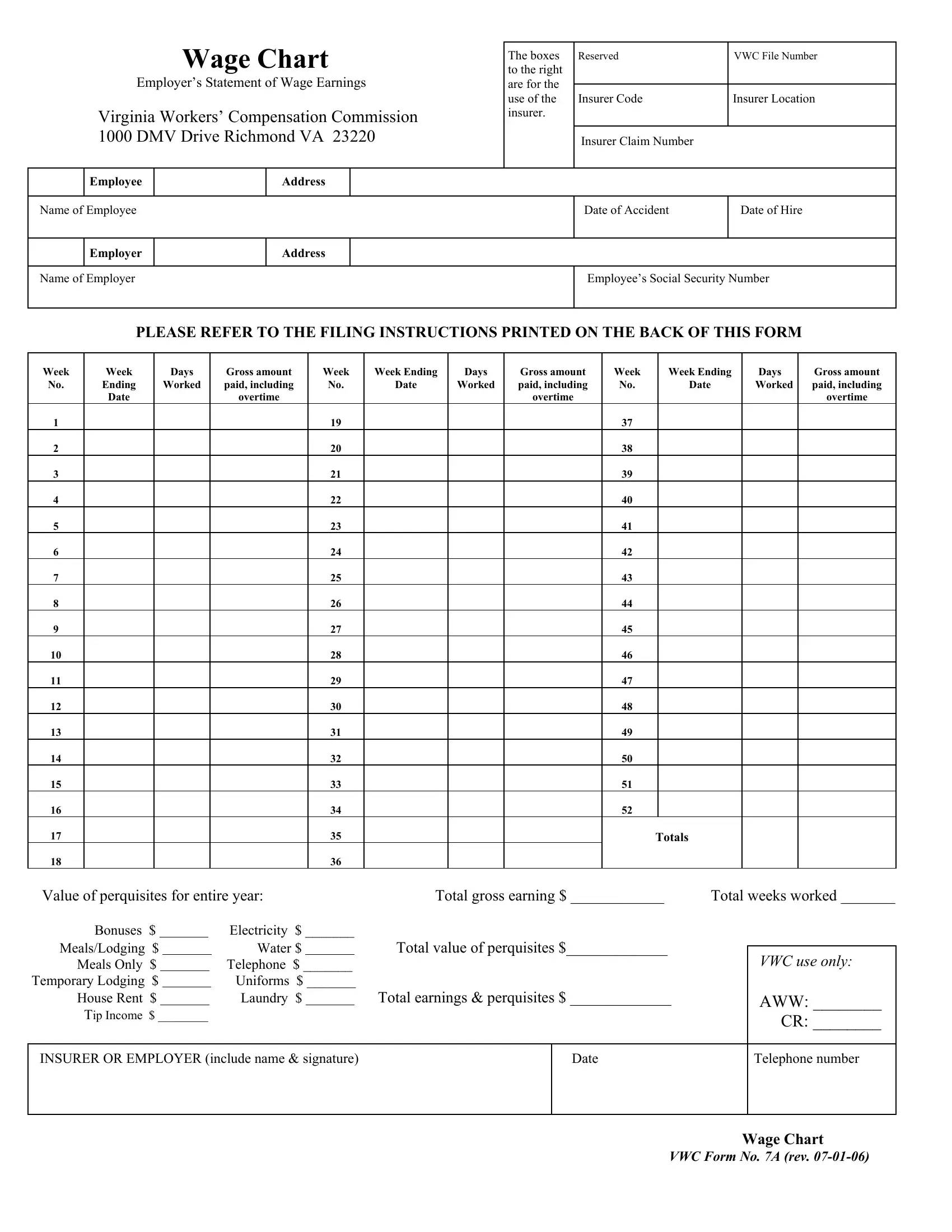

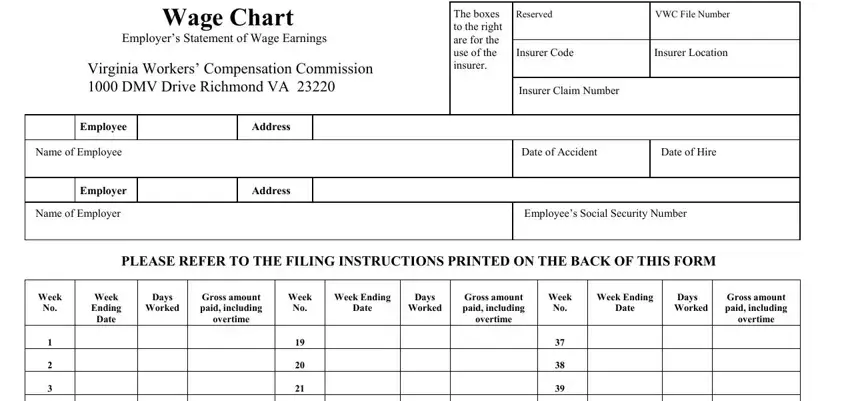

1. To begin with, when filling out the va workers compensation wage statement, begin with the form section that contains the following fields:

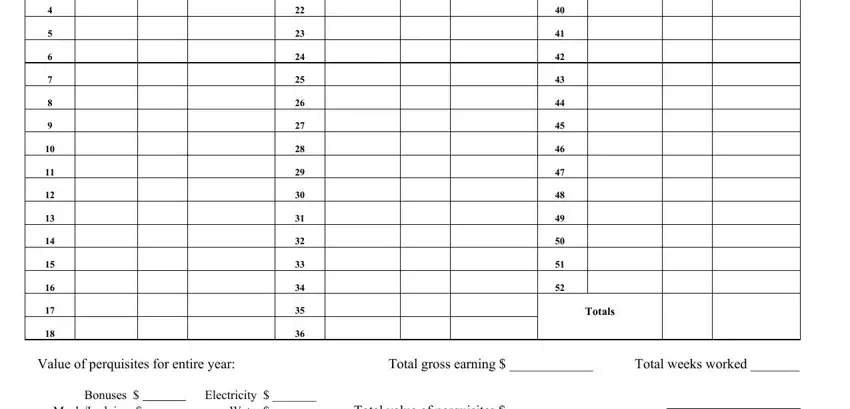

2. Once your current task is complete, take the next step – fill out all of these fields - Totals, Value of perquisites for entire, and Bonuses Electricity with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Always be extremely attentive while completing Bonuses Electricity and Totals, since this is the part in which a lot of people make some mistakes.

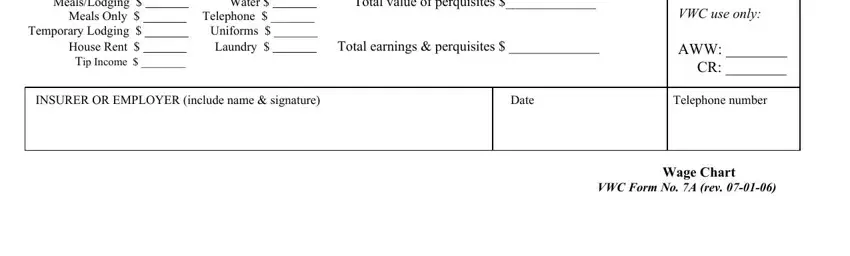

3. Completing Bonuses Electricity, Meals Only Telephone, Temporary Lodging Uniforms, House Rent Laundry Total, VWC use only AWW CR, INSURER OR EMPLOYER include name, Date Telephone number, VWC Form No A rev, and Wage Chart is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Step 3: Before finishing the form, you should make sure that blank fields are filled out right. The moment you’re satisfied with it, press “Done." Acquire the va workers compensation wage statement when you subscribe to a 7-day free trial. Readily view the form in your FormsPal account page, along with any modifications and changes being all saved! FormsPal guarantees your information confidentiality by using a secure method that never records or shares any sort of private information provided. Be confident knowing your paperwork are kept protected each time you use our services!