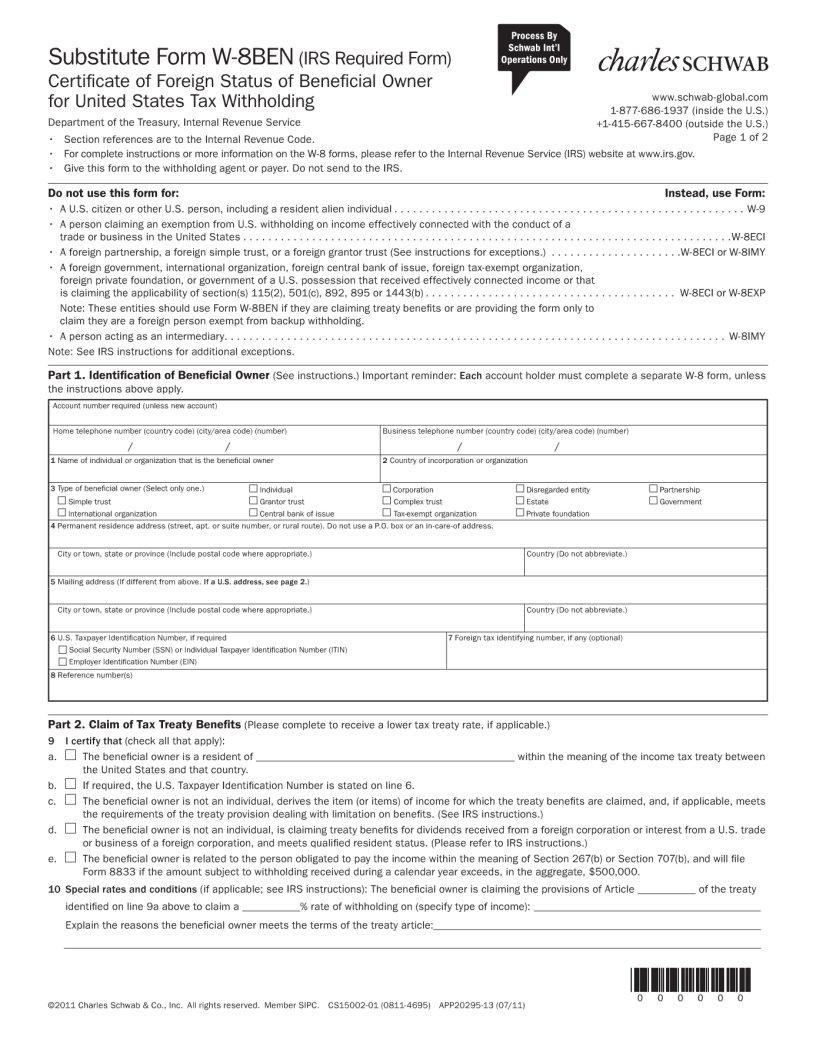

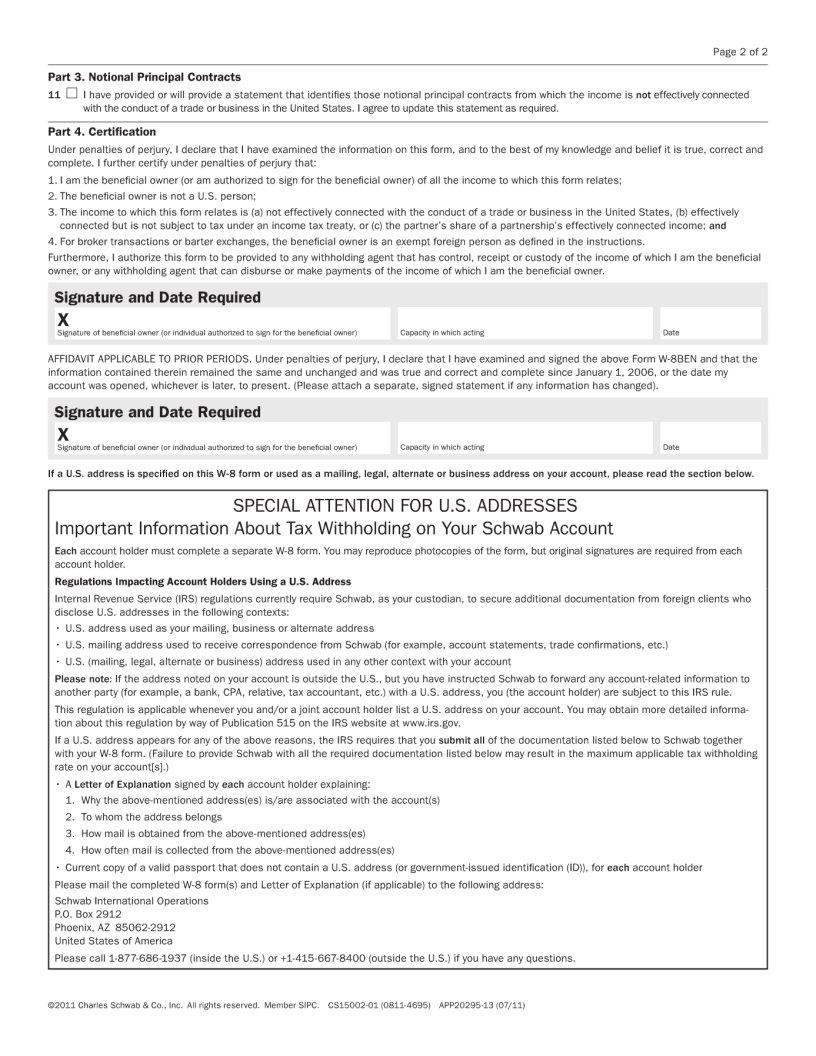

Understanding the nuances of the W-8EXP form is essential for foreign individuals and entities navigating U.S. tax regulations, particularly those looking to establish their foreign status for tax purposes. This form plays a critical role for foreign persons, including nonresident aliens, foreign corporations, partnerships, trusts, and estates, in claiming beneficial ownership of income and potentially securing a reduced rate of, or exemption from, U.S. withholding tax. This might apply if there's a tax treaty between their country of residence and the United States. The form requires detailed information about the beneficial owner's identity and tax residency, aiming to ascertain that the income for which the form is submitted is rightfully owned by a foreign person and not subject to tax withholding at the standard 30% rate applied to foreign entities. The implications of correctly or incorrectly filling out this form are significant, affecting the amount of income received from U.S. sources after taxes. Furthermore, it is vital for foreign entities to understand the specific requirements, such as providing a permanent residence address and substantiating claims to tax treaty benefits, including proving a substantive connection to a treaty country and compliance with any Limitation on Benefits (LOB) provisions. Changes in circumstances, such as a shift in residency status or becoming a U.S. person, necessitate prompt notification to the withholding agent and potentially, the submission of a new form. The expiry period of the form without a U.S. Taxpayer Identification Number, stretching over three calendar years unless a change necessitates an earlier update, underscores the importance of maintaining accurate, up-to-date documentation for compliance and to avoid unnecessary withholding.

| Question | Answer |

|---|---|

| Form Name | W 8Exp Tax Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | w8 ben form, forms w 8ben, form w8, w 8 ben form |