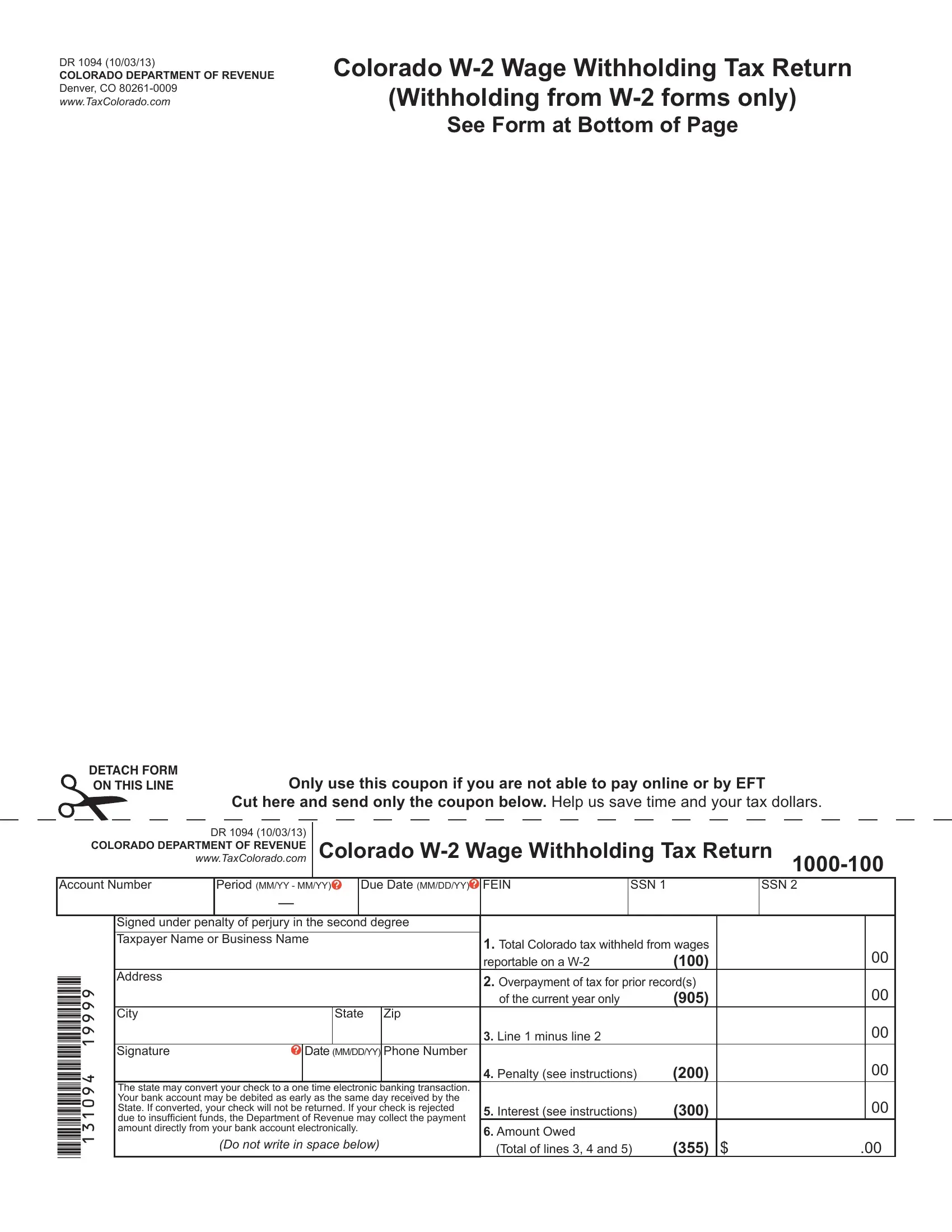

Using the online PDF tool by FormsPal, you may fill in or modify W2 Colorado Form right here. Our tool is constantly evolving to provide the very best user experience achievable, and that's due to our commitment to constant development and listening closely to user opinions. For anyone who is seeking to get going, this is what you will need to do:

Step 1: Access the PDF file inside our tool by pressing the "Get Form Button" above on this webpage.

Step 2: Using this state-of-the-art PDF editor, you can actually accomplish more than just fill in blank form fields. Express yourself and make your docs appear great with custom textual content put in, or modify the file's original content to perfection - all comes along with an ability to incorporate your personal pictures and sign the PDF off.

Be attentive while completing this pdf. Make sure that each blank field is completed accurately.

1. When submitting the W2 Colorado Form, be certain to complete all needed blanks within its associated section. This will help to expedite the work, allowing for your details to be processed without delay and accurately.

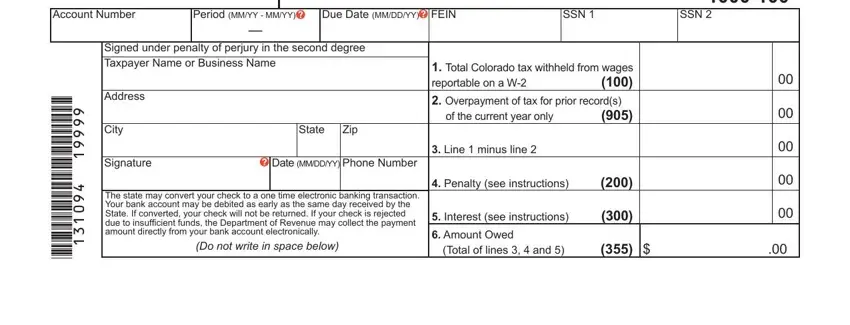

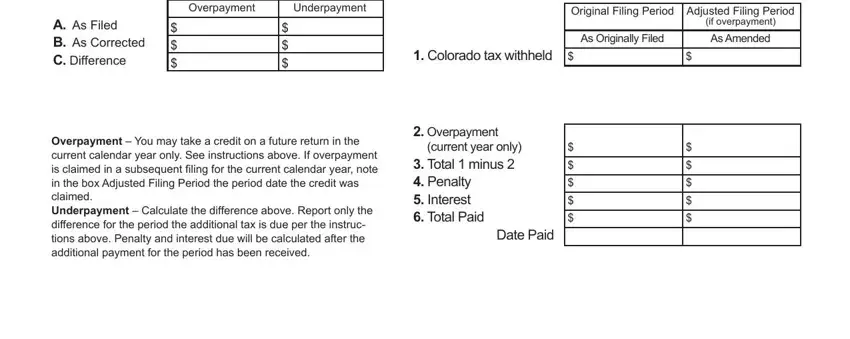

2. The next stage would be to fill out these blank fields: Overpayment, Underpayment, A As Filed B As Corrected C, Overpayment You may take a credit, Original Filing Period Adjusted, if overpayment, As Originally Filed, As Amended, Colorado tax withheld, Overpayment, current year only, Total minus Penalty Interest, and Date Paid.

Be very mindful while completing Date Paid and Underpayment, as this is where a lot of people make errors.

Step 3: Once you've looked over the information you filled in, simply click "Done" to complete your document creation. Obtain your W2 Colorado Form as soon as you sign up for a free trial. Quickly get access to the pdf file within your personal cabinet, along with any modifications and changes automatically synced! FormsPal offers risk-free document editing without data record-keeping or sharing. Feel safe knowing that your information is secure with us!