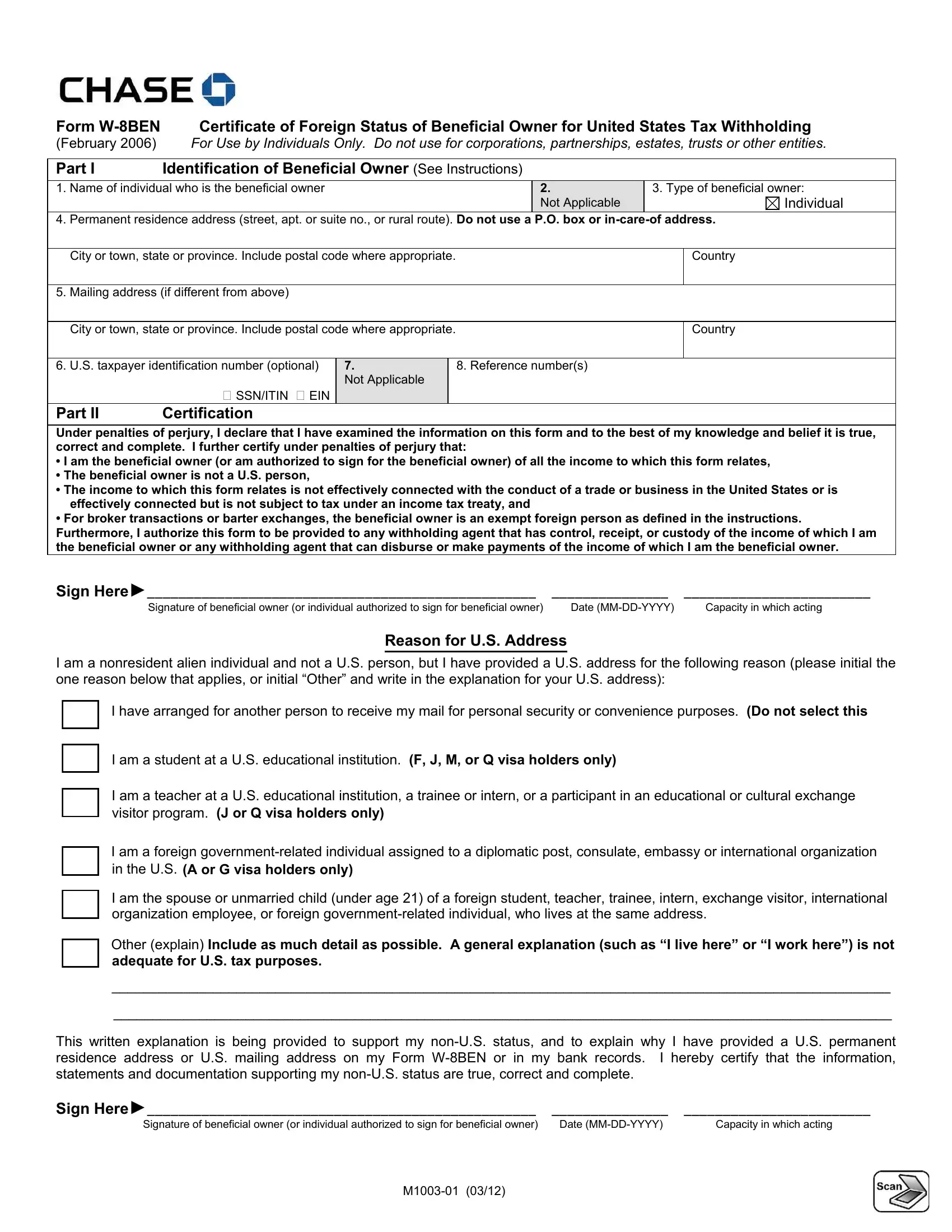

Form W-8BEN |

Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding |

(February 2006) |

For Use by Individuals Only. Do not use for corporations, partnerships, estates, trusts or other entities. |

|

|

|

|

|

|

|

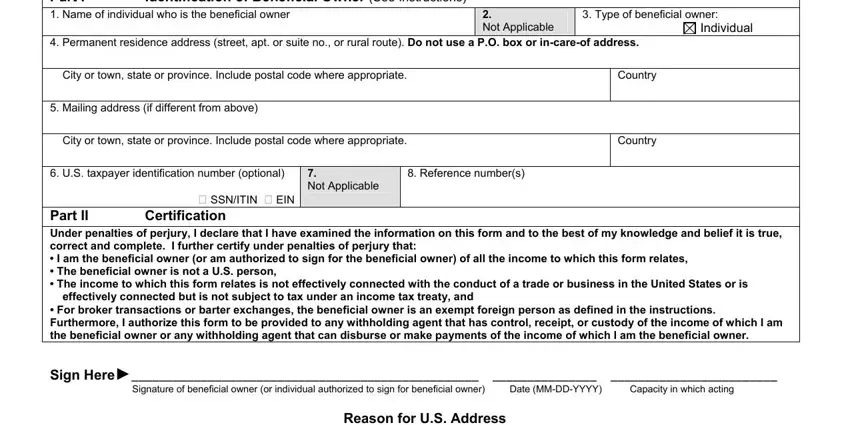

Part I |

Identification of Beneficial Owner (See Instructions) |

|

|

|

|

|

|

|

|

|

|

1. |

Name of individual who is the beneficial owner |

|

|

|

2. |

3. Type of beneficial owner: |

|

|

|

|

|

|

Not Applicable |

|

Individual |

4. |

Permanent residence address (street, apt. or suite no., or rural route). Do not use a P.O. box or in-care-of address. |

|

|

|

|

|

|

|

|

|

City or town, state or province. Include postal code where appropriate. |

|

|

|

Country |

|

|

|

|

|

|

|

|

5. |

Mailing address (if different from above) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City or town, state or province. Include postal code where appropriate. |

|

|

|

Country |

|

|

|

|

|

|

|

6. |

U.S. taxpayer identification number (optional) |

7. |

|

8. Reference number(s) |

|

|

|

|

|

Not Applicable |

|

|

|

|

|

|

|

� SSN/ITIN � EIN |

|

|

|

|

|

|

Part II |

Certification |

|

|

|

|

|

|

Under penalties of perjury, I declare that I have examined the information on this form AND to the best of my knowledge and belief it is true, correct and complete. I further certify under penalties of perjury that:

•I am the beneficial owner (or am authorized to sign for the beneficial owner) of all the income to which this form relates,

•The beneficial owner is not a U.S. person,

•The income to which this form relates is not effectively connected with the conduct of a trade or business in the United States or is effectively connected but is not subject to tax under an income tax treaty, and

•For broker transactions or barter exchanges, the beneficial owner is an exempt foreign person as defined in the instructions. Furthermore, I authorize this form to be provided to any withholding agent that has control, receipt, or custody of the income of which I am the beneficial owner or any withholding agent that can disburse or make payments of the income of which I am the beneficial owner.

Sign Here►

Signature of beneficial owner (or individual authorized to sign for beneficial owner) |

Date (MM-DD-YYYY) |

Capacity in which acting |

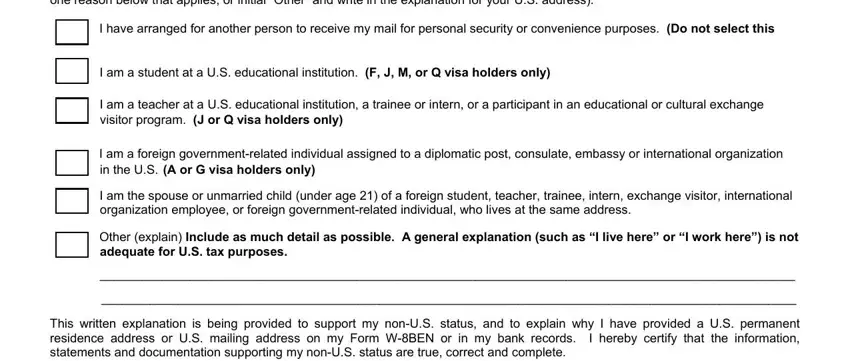

Reason for U.S. Address

I am a nonresident alien individual and not a U.S. person, but I have provided a U.S. address for the following reason (please initial the one reason below that applies, or initial “Other” and write in the explanation for your U.S. address):

I have arranged for another person to receive my mail for personal security or convenience purposes. (DO NOT SELECT THIS

I am a student at a U.S. educational institution. (F, J, M, or Q visa holders only)

I am a teacher at a U.S. educational institution, a trainee or intern, or a participant in an educational or cultural exchange visitor program. (J or Q visa holders only)

I am a foreign government-related individual assigned to a diplomatic post, consulate, embassy or international organization in the U.S. (A or G visa holders only)

I am the spouse or unmarried child (under age 21) of a foreign student, teacher, trainee, intern, exchange visitor, international organization employee, or foreign government-related individual, who lives at the same address.

Other (explain) Include as much detail as possible. A general explanation (such as “I live here” or “I work here”) is not adequate for U.S. tax purposes.

____________________________________________________________________________________________________

____________________________________________________________________________________________________

This written explanation is being provided to support my non-U.S. status, and to explain why I have provided a U.S. permanent residence address or U.S. mailing address on my Form W-8BEN or in my bank records. I hereby certify that the information, statements and documentation supporting my non-U.S. status are true, correct and complete.

Sign Here►

Signature of beneficial owner (or individual authorized to sign for beneficial owner) |

Date (MM-DD-YYYY) |

Capacity in which acting |

M1003-01 (03/12)

INSTRUCTIONS

Do not complete Form W-8BEN or the Reason for U.S. Address form if you are a U.S. citizen or other U.S. person (including a resident alien individual). Instead, use Form W-9 to give us your Social Security Number or Individual Taxpayer Identification Number.

The Form W-8BEN and Reason for U.S. Address form on this page should be used only by individuals, with respect to their bank deposit accounts. Corporations, partnerships, estates, trusts, and other entities should not use these forms. Individuals should not use these forms for accounts other than bank deposit accounts.

Before you complete Form W-8BEN:

•Review the Form W-8BEN instructions. The instructions will explain the purpose of the form, and how to complete it to certify your tax status.

•If you have entered either a permanent residence or mailing address inside the U.S. on this form, you must also (i) complete, sign and date the Reason for U.S. Address form to support your non-U.S. status, and (ii) give us a legible copy of your current foreign passport, foreign driver’s license, national identification card or other official government-issued document that supports your claim of foreign (non-U.S.) status. This document must not be expired, and must not contain a U.S. address.

•If you select "Other" on the Reason for U.S. Address form as the reason you have a U.S. address, include as much detail as possible in your explanation. A general explanation (such as "I live here" or "I work here") does not support your claim of foreign status for U.S. tax purposes. If you need more room to write your explanation, attach an additional page, with your name and account number clearly printed at the top. If we do not have an acceptable explanation for your U.S. address, the IRS requires us to backup withhold on your account.

•For Joint Accounts: Each account holder must complete a separate Form W-8BEN. If any joint account holder does not complete a separate Form W-8BEN, or does not provide a Reason for U.S. Address form and documentation of foreign status, if required, the account may be subject to backup withholding.

IRS Forms W-8 and Form W-9 and their instructions can be found in the Forms and Publications section of the IRS website http://www.irs.ustreas.gov/formspubs/index.html Or, you may contact the IRS at 1-800-829-3676.

Definitions

Beneficial Owner (Line 1): The beneficial owner of income is generally the person who is required under U.S. tax principles to include the income in gross income on a tax return. A person is not a beneficial owner of income, however, to the extent that person is receiving the income as a nominee, agent, or custodian, or to the extent the person is a conduit whose participation in a transaction is disregarded. In the case of amounts paid that do not constitute income, beneficial ownership is determined as if the payment were income.

Permanent Residence Address (Line 4): Your permanent residence address is the address in the country where you claim to be a resident for purposes of that country’s income tax. Do not show the address of a financial institution, a post office box, or an address used solely for mailing purposes. If you are an individual who does not have a tax residence in any country, your permanent residence is where you normally reside.

M1003-01 (03/12)