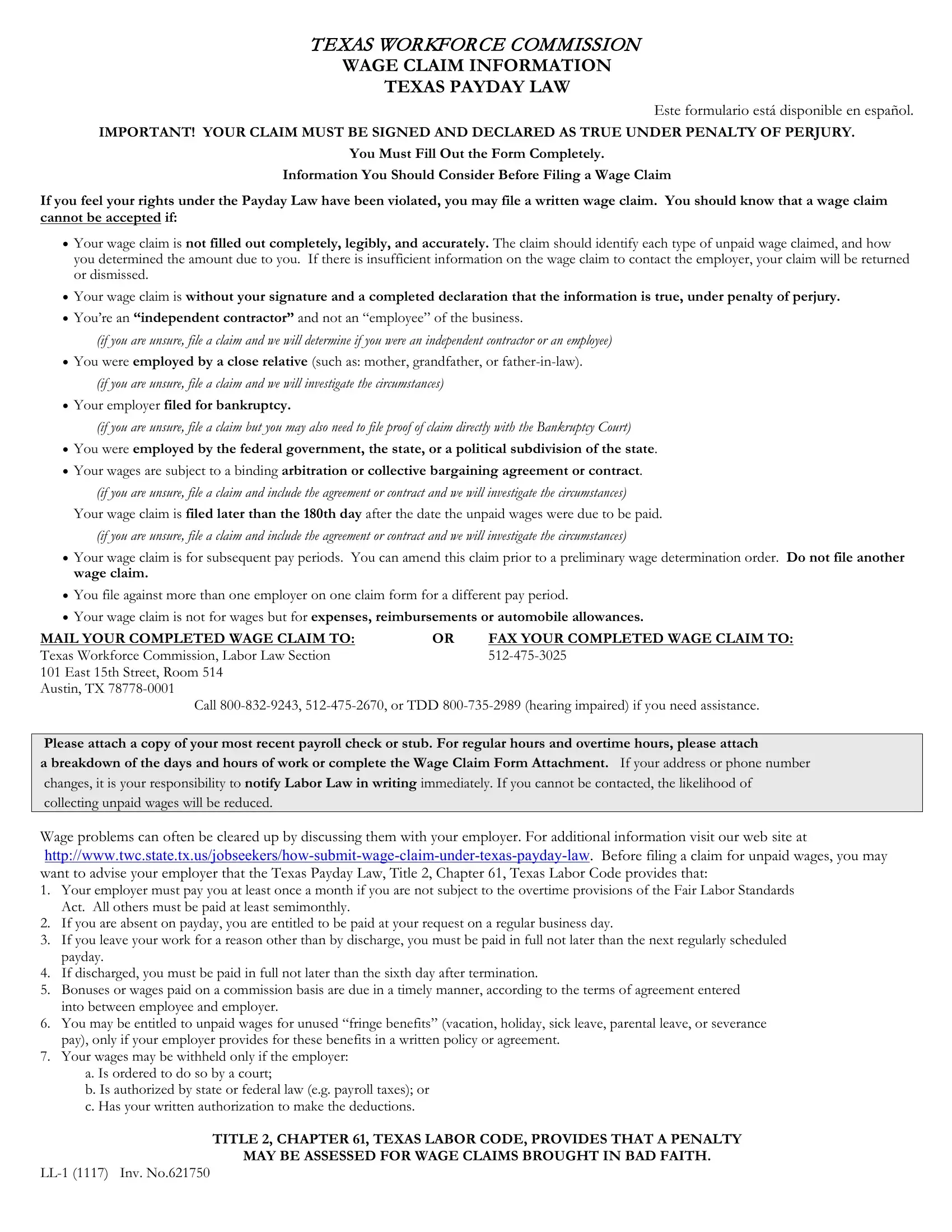

TEXAS WORKFORCE COMMISSION

WAGE CLAIM INFORMATION

TEXAS PAYDAY LAW

Este formulario está disponible en español.

IMPORTANT! YOUR CLAIM MUST BE SIGNED AND DECLARED AS TRUE UNDER PENALTY OF PERJURY.

You Must Fill Out the Form Completely.

Information You Should Consider Before Filing a Wage Claim

If you feel your rights under the Payday Law have been violated, you may file a written wage claim. You should know that a wage claim cannot be accepted if:

•Your wage claim is not filled out completely, legibly, and accurately. The claim should identify each type of unpaid wage claimed, and how you determined the amount due to you. If there is insufficient information on the wage claim to contact the employer, your claim will be returned or dismissed.

•Your wage claim is without your signature and a completed declaration that the information is true, under penalty of perjury.

•You’re an “independent contractor” and not an “employee” of the business.

(if you are unsure, file a claim and we will determine if you were an independent contractor or an employee)

•You were employed by a close relative (such as: mother, grandfather, or father-in-law). (if you are unsure, file a claim and we will investigate the circumstances)

•Your employer filed for bankruptcy.

(if you are unsure, file a claim but you may also need to file proof of claim directly with the Bankruptcy Court)

•You were employed by the federal government, the state, or a political subdivision of the state.

•Your wages are subject to a binding arbitration or collective bargaining agreement or contract.

(if you are unsure, file a claim and include the agreement or contract and we will investigate the circumstances) Your wage claim is filed later than the 180th day after the date the unpaid wages were due to be paid.

(if you are unsure, file a claim and include the agreement or contract and we will investigate the circumstances)

•Your wage claim is for subsequent pay periods. You can amend this claim prior to a preliminary wage determination order. Do not file another wage claim.

•You file against more than one employer on one claim form for a different pay period.

•Your wage claim is not for wages but for expenses, reimbursements or automobile allowances.

MAIL YOUR COMPLETED WAGE CLAIM TO: |

OR |

FAX YOUR COMPLETED WAGE CLAIM TO: |

Texas Workforce Commission, Labor Law Section |

|

512-475-3025 |

101 East 15th Street, Room 514 |

|

|

Austin, TX 78778-0001 |

|

|

Call 800-832-9243, 512-475-2670, or TDD 800-735-2989 (hearing impaired) if you need assistance.

Please attach a copy of your most recent payroll check or stub. For regular hours and overtime hours, please attach

a breakdown of the days and hours of work or complete the Wage Claim Form Attachment. If your address or phone number changes, it is your responsibility to notify Labor Law in writing immediately. If you cannot be contacted, the likelihood of

collecting unpaid wages will be reduced.

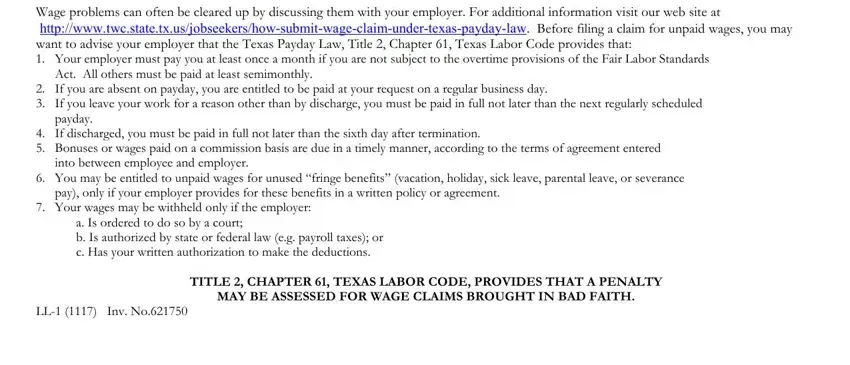

Wage problems can often be cleared up by discussing them with your employer. For additional information visit our web site at http://www.twc.state.tx.us/jobseekers/how-submit-wage-claim-under-texas-payday-law. Before filing a claim for unpaid wages, you may want to advise your employer that the Texas Payday Law, Title 2, Chapter 61, Texas Labor Code provides that:

1.Your employer must pay you at least once a month if you are not subject to the overtime provisions of the Fair Labor Standards Act. All others must be paid at least semimonthly.

2.If you are absent on payday, you are entitled to be paid at your request on a regular business day.

3.If you leave your work for a reason other than by discharge, you must be paid in full not later than the next regularly scheduled payday.

4.If discharged, you must be paid in full not later than the sixth day after termination.

5.Bonuses or wages paid on a commission basis are due in a timely manner, according to the terms of agreement entered into between employee and employer.

6.You may be entitled to unpaid wages for unused “fringe benefits” (vacation, holiday, sick leave, parental leave, or severance pay), only if your employer provides for these benefits in a written policy or agreement.

7.Your wages may be withheld only if the employer:

a.Is ordered to do so by a court;

b.Is authorized by state or federal law (e.g. payroll taxes); or

c.Has your written authorization to make the deductions.

TITLE 2, CHAPTER 61, TEXAS LABOR CODE, PROVIDES THAT A PENALTY

MAY BE ASSESSED FOR WAGE CLAIMS BROUGHT IN BAD FAITH.

LL-1 (1117) Inv. No.621750

Wage Claim Form Attachment

Question #14 Hours Worked Per Week Breakdown

Instructions:

Enter the date of the starting day of the first workweek

Enter the start time for the first day on the time card

OEnter the starting hour in the Hour column

OEnter the minutes in the Min column

OEnter AM or PM in the AM/PM column

Example: If you started working at 8:30am enter;

|

Hour |

Min |

AM/PM |

8 |

30 |

AM |

|

|

|

|

|

|

|

|

|

Enter the stop time for any break or lunch period in the Stop Time section; following the example above |

|

|

Enter the start time when returning to work from any break or lunch period in the Start Time 2 section |

|

|

Enter the ending time in the Quit Time section |

|

|

|

|

|

|

|

|

|

|

|

|

Enter the total number of hours worked for the date |

|

|

|

|

|

|

|

|

|

|

Enter the total number of hours worked for the entire workweek |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hours |

|

Week 1 |

|

|

Start Time |

|

|

Stop Time |

|

Start Time 2 |

|

Quit Time |

Worked |

|

MM/DD/YY |

|

Hour |

|

Min |

AM/PM |

|

Hour |

|

Min |

AM/PM |

Hour |

|

Min |

AM/PM |

Hour |

|

Min |

AM/PM |

|

|

Ex: 12/01/16 |

|

8 |

00 |

AM |

|

12 |

00 |

PM |

1 |

00 |

PM |

5 |

00 |

PM |

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total weekly Hours |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hours |

Week 2 |

|

Start Time |

Stop Time |

Start Time 2 |

Quit Time |

Worked |

MM/DD/YY |

Hour |

|

Min AM/PM |

Hour Min AM/PM |

Hour Min AM/PM |

Hour Min AM/PM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total weekly Hours

Question #15 & 16 Commission or Bonus breakdown

Please include supporting information and mathematical computation for commission or bonus.

(Example: customers/sales/accounts X (multiplied by) commission/bonus rate = commission or bonus due on a sale) Please include supporting information for mileage, such as log sheets or city-to-city trips.

If you need additional spreadsheets, please make copies.

Wage Claim

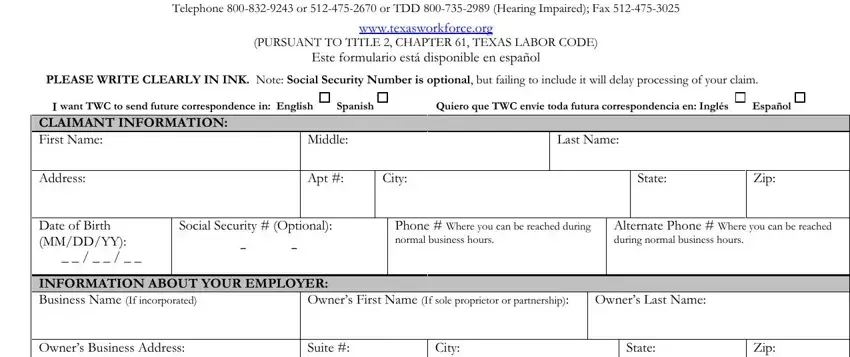

TEXAS WORKFORCE COMMISSION, LABOR LAW SECTION

101 EAST 15TH STREET, AUSTIN, TEXAS 78778-0001

Telephone 800-832-9243 or 512-475-2670 or TDD 800-735-2989 (Hearing Impaired); Fax 512-475-3025

www.texasworkforce.org

(PURSUANT TO TITLE 2, CHAPTER 61, TEXAS LABOR CODE)

Este formulario está disponible en español

PLEASE WRITE CLEARLY IN INK. Note: Social Security Number is optional, but failing to include it will delay processing of your claim.

I want TWC to send future correspondence in: English

Quiero que TWC envíe toda futura correspondencia en: Inglés |

Español |

CLAIMANT INFORMATION:

First Name: |

|

|

|

|

|

|

Middle: |

|

|

|

|

|

|

|

Last Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

Apt #: |

|

City: |

|

|

|

|

|

|

|

|

|

State: |

|

|

Zip: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Birth |

|

Social Security # (Optional): |

|

|

Phone # Where you can be reached during |

|

Alternate Phone # Where you can be reached |

(MM/DD/YY): |

|

|

- |

|

- |

|

|

|

|

normal business hours. |

|

|

|

during normal business hours. |

|

_ _ / _ _ / _ _ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INFORMATION ABOUT YOUR EMPLOYER: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Name (If incorporated) |

|

|

|

|

Owner’s First Name (If sole proprietor or partnership): |

|

Owner’s Last Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owner’s Business Address: |

|

|

|

|

Suite #: |

|

|

|

City: |

|

|

|

|

|

|

|

State: |

|

|

Zip: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YOUR Work Location (Street Address, City, State, Zip): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer’s Work Phone #: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer’s E-mail or Web Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PLEASE COMPLETE THE FOLLOWING EMPLOYMENT INFORMATION: |

|

|

|

1. |

What work did you perform? _________ |

|

__________________________________________________________________________________________________________________________________________________________________________ |

|

Beginning date of employment_______ |

|

__________________________________________________________________________________________________________________________________________________________________________ |

|

Employment status with this employer: |

Still employed |

Quit date ____ |

____________________ |

Termination date ____ |

|

_____________ |

|

Reason for separation: ________ |

________________________________________________________________________________________________________________________________________________________________________________________ |

2. |

When were your regularly scheduled paydays? _____ |

______________________________________________________________________________________________________________________________________________ |

|

What was your rate of pay? (Examples: $3/hour, $1,000/month, $.50/piece, $2/sq. ft.) ______ |

______________________________________________________________ |

|

What was the agreed work schedule? ______ |

|

|

_________________ Hrs. per day, ________ |

_____ Days per wk, ___ |

|

|

|

_____ other _______ |

_________ |

3. |

Was your compensation agreement |

Oral |

|

Written (please attach a copy) __ |

____________________________________________________________________ |

4. |

Were the claimed wages earned in Texas? |

|

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

If not, was the job contracted in Texas? |

|

|

|

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

5. |

Were taxes deducted from your paycheck? |

|

Yes |

|

|

No |

|

|

Don’t Know |

|

|

|

|

|

6. |

Is the employer still in business? |

|

|

|

|

|

Yes |

|

|

No |

|

|

Don’t Know |

|

|

|

|

|

|

What is the employer’s home address and phone number? ___ |

______________________________________________________________________________________________________________________ |

|

___________________________________________________________________________________________________________________________________________________________________________________________________________________________________________ |

|

What is the name and phone number of your supervisor during the period claimed? ____ |

____________________________________________________________________ |

|

___________________________________________________________________________________________________________________________________________________________________________________________________________________________________________ |

7. |

Is the employer in bankruptcy? |

Yes |

No |

Don’t Know |

|

Are you in bankruptcy? |

|

Yes |

No |

|

|

|

If yes, what is the bankruptcy filing date? __ |

____________________________________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

Chapter: |

_______________ Case No: _ |

|

______________________________________ Where filed: ______ |

______________________________________________________________________________________________ |

|

What is the bankruptcy attorney’s name, address, and phone number? |

_______________________________________________________________________________________ |

|

|

|

___________________________________________________________________________________________________________________________________________________________________________________________________________________________________________ |

|

8. |

If you are related to the employer, please state the relationship. |

_______________________________________________________________________________________________ |

|

9. |

Did the employer give a reason for not paying you? If so, explain: __ |

__________________________________________________________________________________________________________ |

_________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

LL-1 (1117) Inv. No.621750 (Continued on Back)

10. Choose the type(s) of unpaid wages below that best describe your claim, and write the amount of unpaid wages, listing

the gross amount of wages due. Note: You cannot file for recovery of any type of expenses or reimbursement, since expenses and reimbursements are not wages.

Regular $____ |

_______________ Commissions $_________ |

__________ *Fringe Benefits $_____ |

_________________ Pay Deductions $_________ |

__________ |

Overtime $______ |

_________________________ Unpaid Bonus $_________ |

____________________ Pay Below Minimum Wage $_________ |

____________________________ |

TOTAL UNPAID WAGES CLAIMED $_____________ |

|

___________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

*The only fringe benefits that can be claimed are vacation pay, holiday pay, severance, sick leave, parental leave, paid time off, or paid days off. These benefits cannot be claimed unless

provided for in a written agreement or a written policy of the employer.

|

|

|

|

|

11. |

What was the scheduled payday(s) for these claimed wages? Date(s) Date(s) ______ |

__________________________________________________________________________________________ |

12. |

If claiming regular, overtime, and/or minimum wage, what were the dates you worked for which you received no wages? |

|

From ______ |

____________________________________________________________________ to _______________ |

______________________________________________________________. |

Please explain how you determined the amount claimed and provide a breakdown of the days and hours worked. (Example: 20 hours

regular pay at $5 per hour and 5 hours overtime pay at $7.50 per hour; or Example: 30 items at a piece rate of $.75 per item). If available, attach a copy of timecards or timesheets. Use the attachment located on the backside of the instructions to provide a breakdown of

the days and hours worked. __________________________________________________________________________________________________________________________________________________________________________________________________

____________________________________________________________________________________________________

____________________________________________________________________________________________________

13. If claiming commissions or bonus, what was the period in which the wages were earned?

From ______ |

____________________________________________________________________ to _______________ |

______________________________________________________________. |

Are you aware of any agreement to pay commissions or bonus after termination?

Please explain how you determined the amount due. If available attach information to support your claim, such as written agreement, sales records, check stubs, etc. Use the attachment located on the backside of the instructions to provide a breakdown of commissions or bonus.

____________________________________________________________________________________________________

____________________________________________________________________________________________________

____________________________________________________________________________________________________

14.If claiming a covered fringe benefit, please explain which benefit(s) you are claiming and indicate how you determined the amount due. We must obtain a copy of a written policy or agreement providing a payment after separation, please attach a copy. Also attach evidence of the amount owed (hours left) such as check stubs or other documents.

___________________________________________________________________________________________________

___________________________________________________________________________________________________

15. If claiming deductions, did you sign any authorization for deductions other than regular payroll taxes?

If yes, please explain (attach a copy). _____________________________________________________________________________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

16.Are you aware of any agreement (such as arbitration, collective bargaining agreement, union contract, ERISA, Service Contract Act, etc.) that existed between you and the employer? Yes No If yes, please attach a copy.

17.Additional Comments: ___________________________________________________________________________________________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

I UNDERSTAND THAT I MAY BE ASSESSED AN ADMINISTRATIVE PENALTY IF THIS CLAIM IS FOUND TO BE

BROUGHT IN BAD FAITH.

To be considered valid, your Wage Claim must be completed below and signed as true under penalty of perjury.

My name is _ |

_________ _ |

___________ _ |

________________, my date of birth is _ |

____________ |

(First) |

|

(Middle) |

(Last) |

|

|

(month/day/year) |

and my address is _ |

____________________, _ |

______, _ ___, |

__ |

__, and _ |

____________. |

|

(Street) |

|

|

(City) |

(State) |

(Zip Code) |

(Country) |

|

I declare under penalty of perjury that the foregoing is true and correct. |

|

Executed in _ |

__________ County, State of __ |

________, on the _ |

_ day of_ |

___, |

________. |

|

|

|

|

|

|

|

(Month) |

(Year) |

|

|

|

|

______________________________ |

|

|

|

|

Declarant Signature

Completed forms, inquiries, or corrections to the individual information contained in this form shall be sent to the TWC Labor Law Section, 101 E. 15th St., Rm. 514, Austin, TX 78778-0001, (512) 475-2670. Individuals may receive and review information that TWC collects about the individual by emailing to open.records@twc.state.tx.us or writing to TWC Open Records, 101 E. 15th St., Rm. 266, Austin, TX 78778-0001.