You are able to work with logon without difficulty with our online PDF tool. Our tool is continually evolving to present the very best user experience possible, and that is due to our dedication to continual improvement and listening closely to testimonials. In case you are seeking to start, here's what it takes:

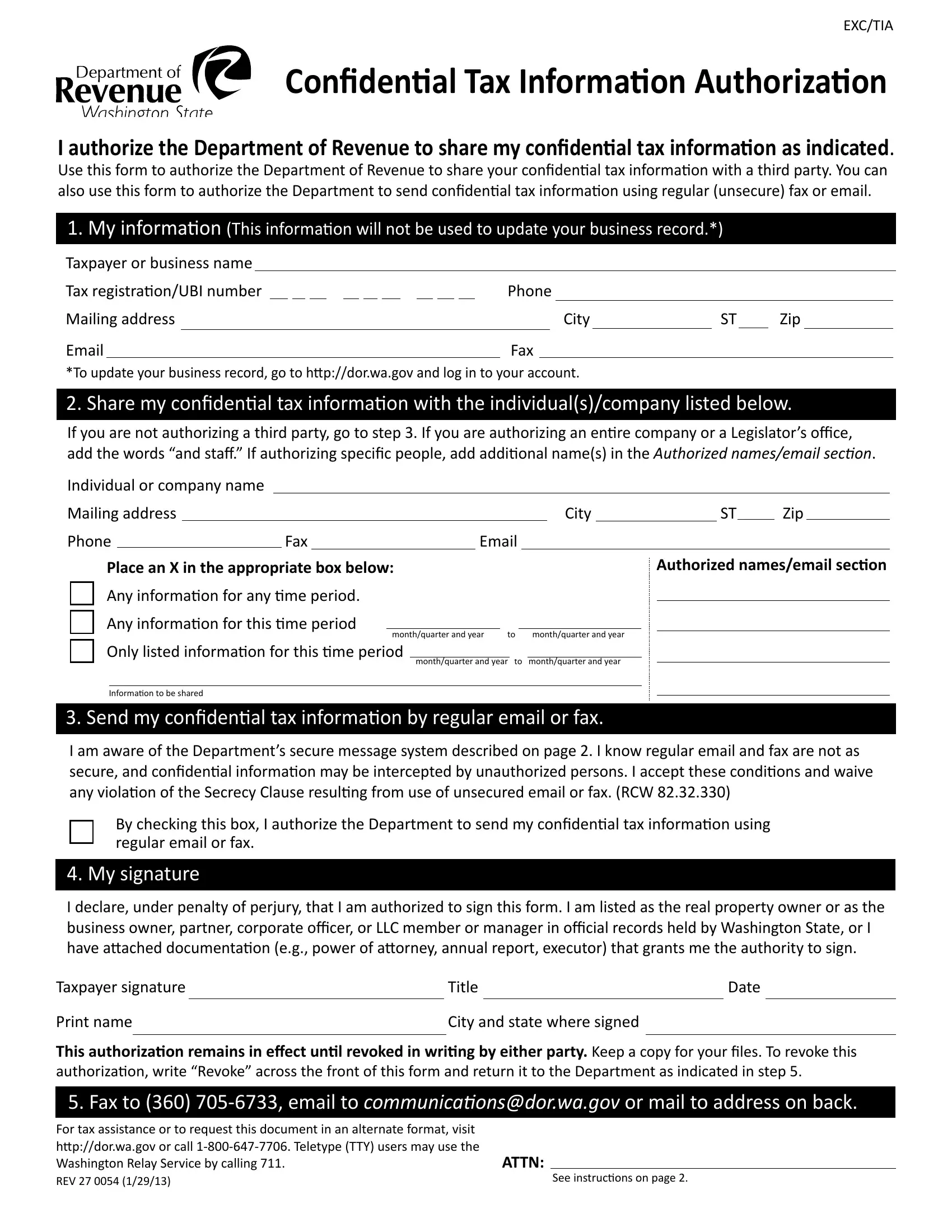

Step 1: Click on the orange "Get Form" button above. It will open up our editor so you can begin completing your form.

Step 2: With our handy PDF editing tool, it is possible to accomplish more than just fill out blank fields. Edit away and make your forms appear professional with customized text incorporated, or adjust the original input to perfection - all backed up by the capability to add any kind of photos and sign the document off.

This document requires particular data to be entered, therefore you must take some time to provide what's asked:

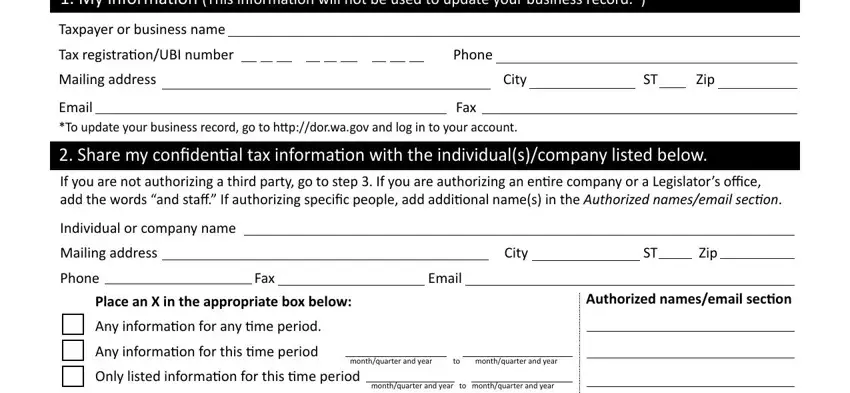

1. While filling in the logon, be sure to include all important blanks in their corresponding part. This will help to facilitate the work, making it possible for your information to be handled quickly and accurately.

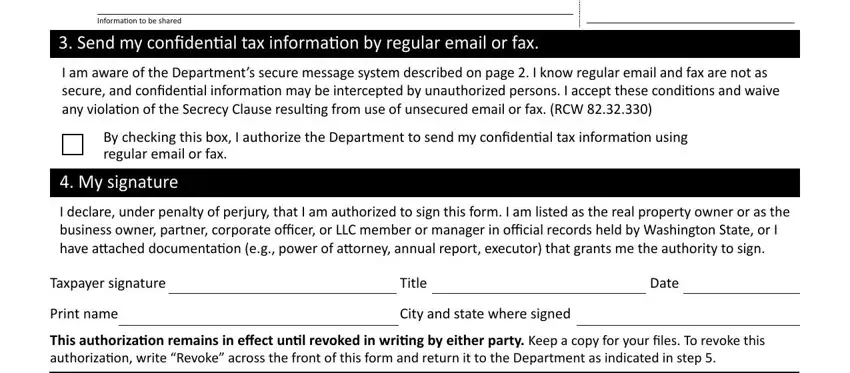

2. Soon after completing the last step, head on to the next part and enter the essential details in these fields - Informaion to be shared, Send my conidenial tax informaion, I am aware of the Departments, By checking this box I authorize, My signature, I declare under penalty of perjury, Taxpayer signature, Print name, Title, Date, City and state where signed, and This authorizaion remains in efect.

3. In this stage, take a look at This authorizaion remains in efect, See instrucions on page, and ATTN. These have to be filled out with greatest precision.

Concerning This authorizaion remains in efect and See instrucions on page, ensure that you do everything properly in this current part. Both these are surely the key ones in this document.

Step 3: Make sure your information is right and click "Done" to complete the process. Sign up with us today and immediately access logon, available for downloading. Each and every edit made is conveniently preserved , allowing you to modify the pdf later if needed. When using FormsPal, you can fill out forms without being concerned about personal information incidents or records getting shared. Our protected software helps to ensure that your private details are kept safe.