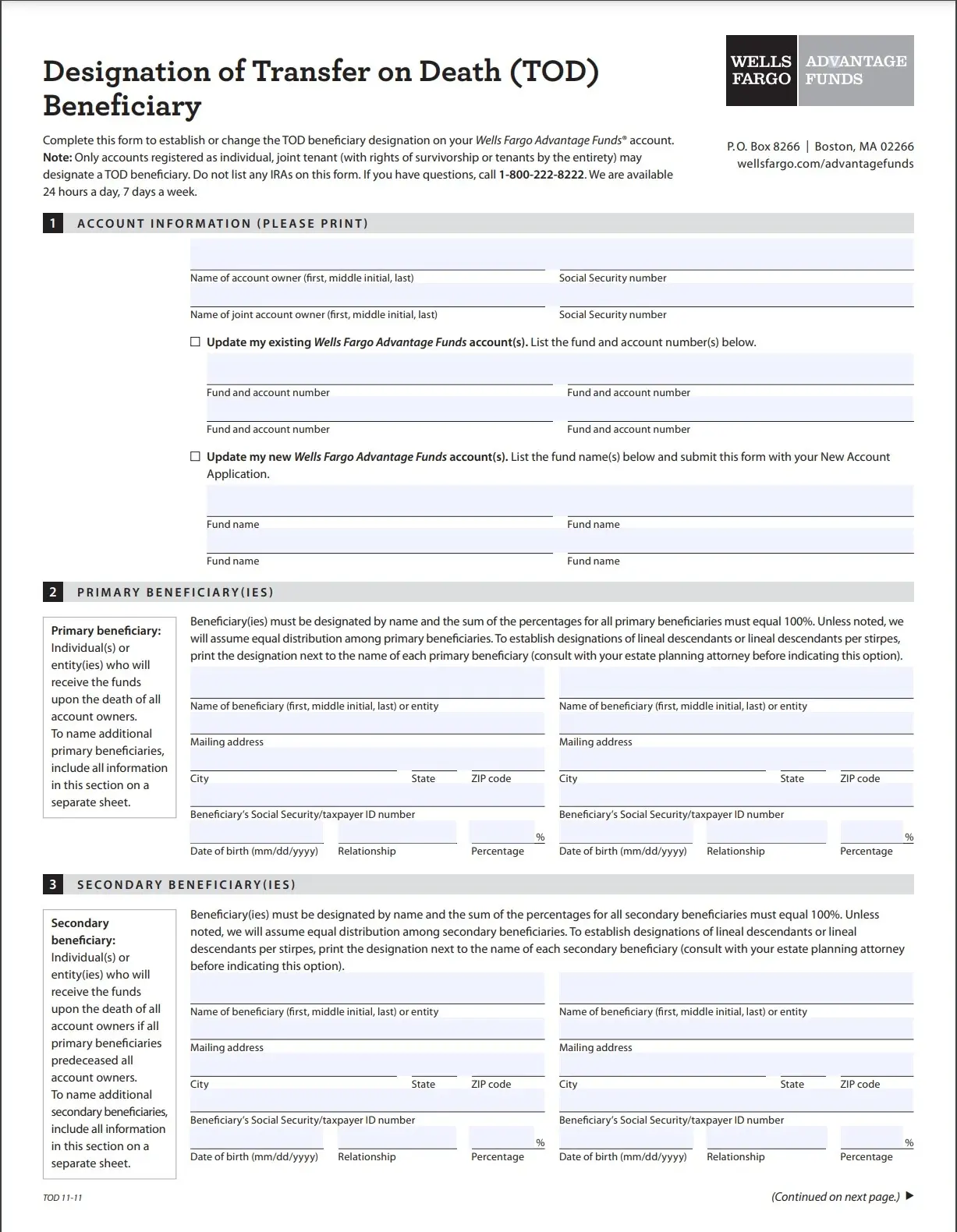

General Provisions

1.A separate account will be set up for each Beneficiary upon the Participant’s death, as evidenced by a certified death certificate or other proof of death acceptable to the Plan Administrator.

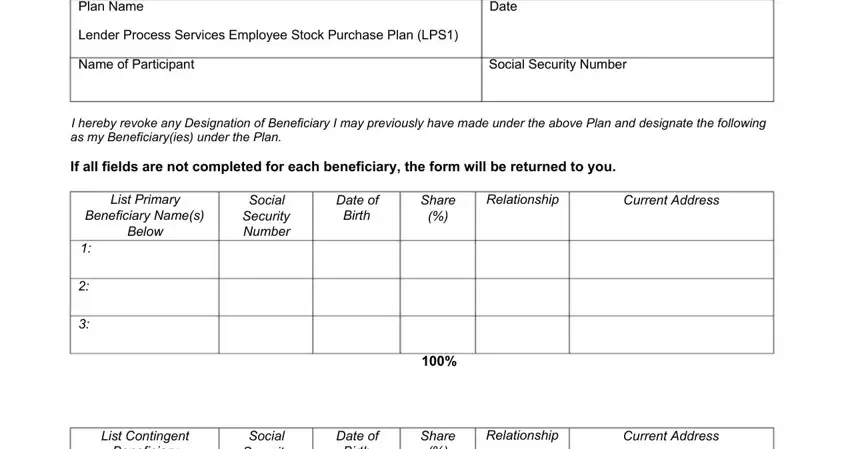

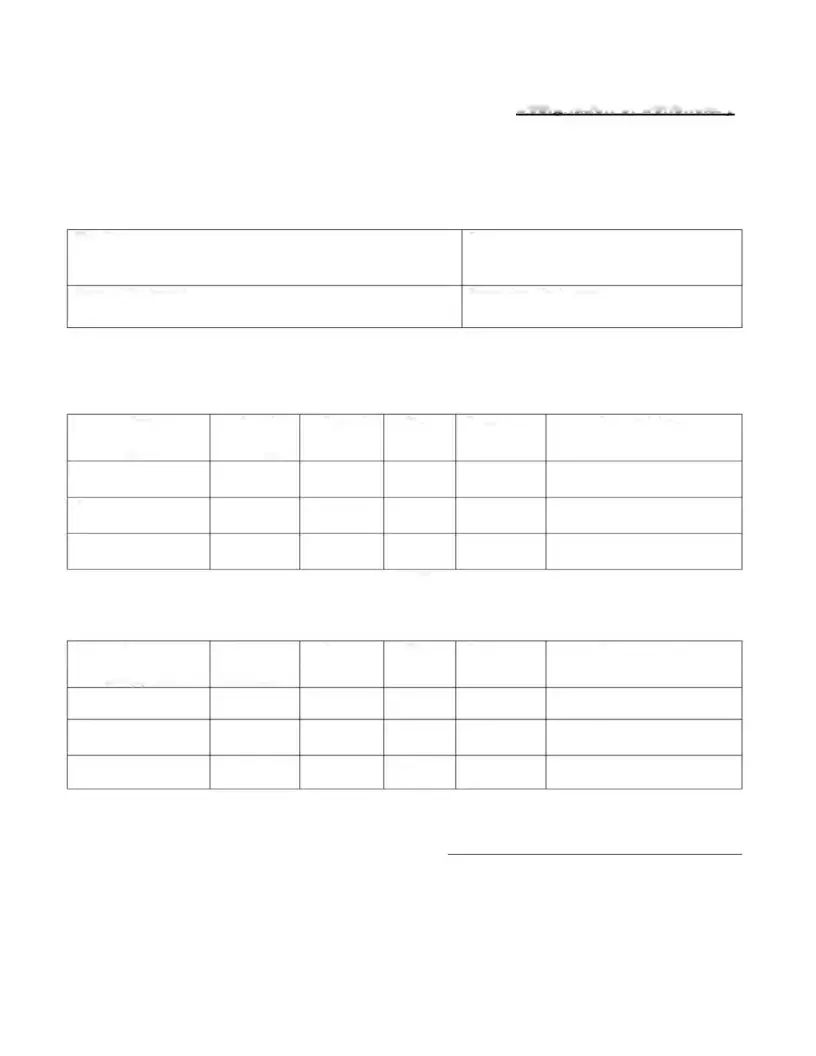

2.Unless otherwise expressly provided on the face of this Designation of Beneficiary, all sums payable under the Plan by reason of the death of the Participant shall be paid as follows:

(a)The entire death benefit shall be paid in equal shares to the Primary Beneficiaries who survive the Participant.

(b)If no Primary Beneficiary survives the Participant, the entire death benefit shall be paid in equal shares to the Contingent Beneficiaries who survive the Participant.

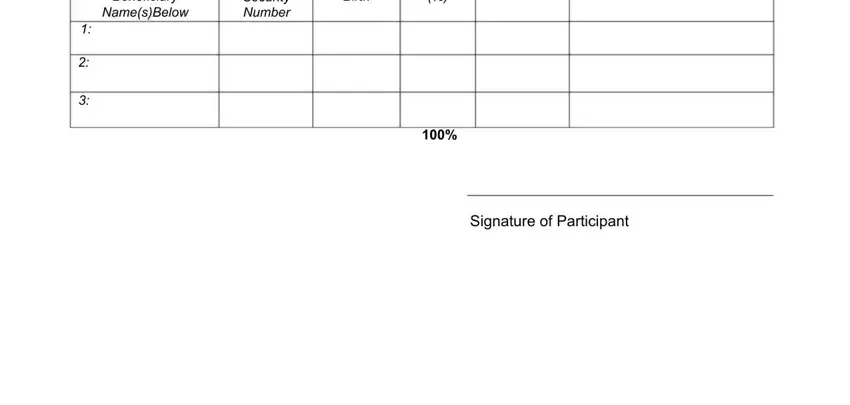

(c)If no Primary or Contingent Beneficiary survives the Participant, the entire death benefit shall be paid according to the terms of the Plan.

(d)If a Beneficiary is alive and otherwise eligible to receive a benefit on the date of the Participant’s death but dies before actually receiving payment of the entire benefit, the remaining benefit shall be paid to the deceased Beneficiary’s estate.

3.No Beneficiary will be allowed to designate a successor beneficiary.

4.The Participant may change this Designation of Beneficiary at any time without the consent of any person designated as a Beneficiary (other than any required consent by a spouse).

5.Neither this Designation nor any future change of Designation will be effective for any purpose unless filed with Wells Fargo prior to the death of the Participant.

6.This Designation of Beneficiary is subject to the terms of the Plan as it may be amended from time to time. All rights of the Participant, the designated Beneficiaries, and any other person to benefits under the Plan are governed by the terms of the Plan. The Employer has the right to amend the Plan in any manner that may affect this Designation without notice to, or consent of, any Participant or Beneficiary.

Return this form by mail to:

Wells Fargo Shareowner Services

Attn: Enrollment Specialist

P.O. Box 64856

South Saint Paul, MN 55164-0856

OR by FAX to: 866-729-7694