The wells fargo poa online filling in process is very simple. Our editor enables you to work with any PDF form.

Step 1: First, hit the orange button "Get Form Now".

Step 2: After you enter our wells fargo poa online editing page, you will notice all of the options it is possible to undertake regarding your form in the upper menu.

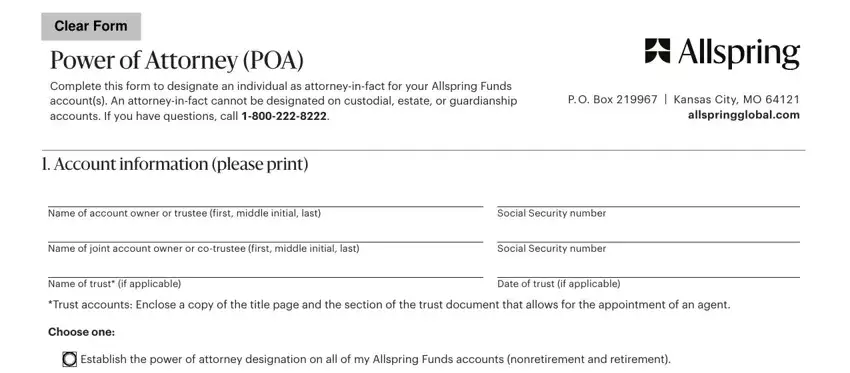

Provide the essential details in every single segment to get the PDF wells fargo poa online

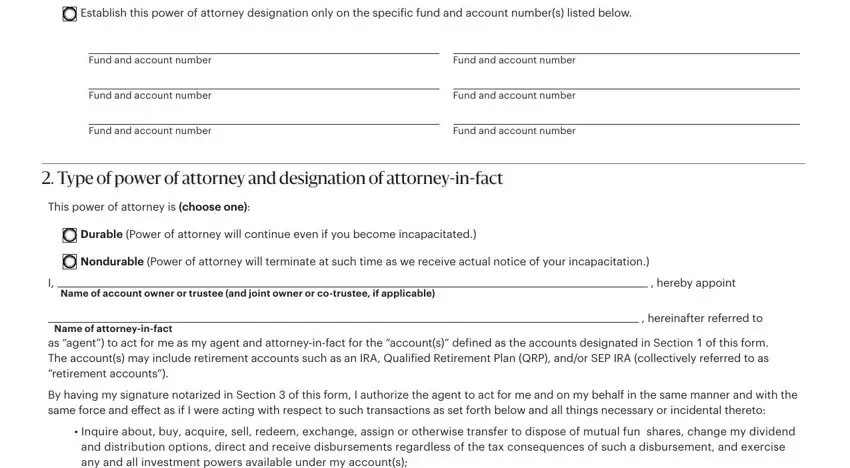

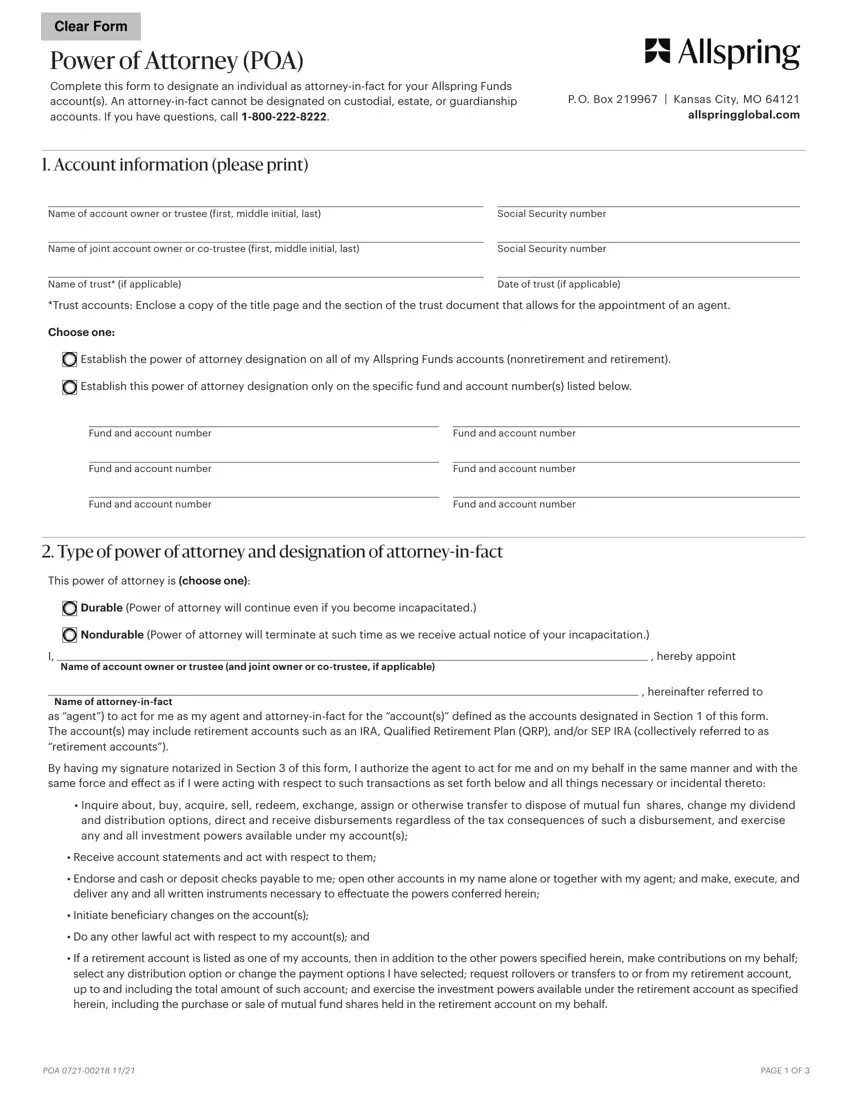

Note the required data in Fund, and, account, number Fund, and, account, number Fund, and, account, number Fund, and, account, number Fund, and, account, number Fund, and, account, number This, power, of, attorney, is, choose, one hereby, appoint and here, in, after, referred, to part.

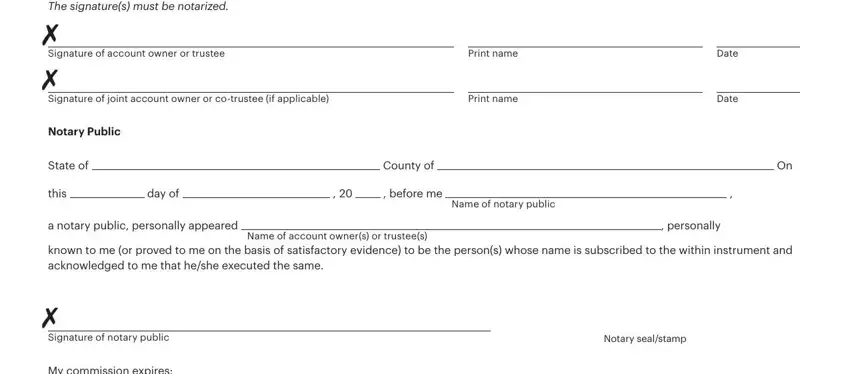

It's essential to emphasize the essential data within the Signature, of, account, owner, or, trustee Print, name Print, name Notary, Public State, of this, day, of before, me Name, of, notary, public County, of Date, Date, a, notary, public, personally, appeared Name, of, account, owners, or, trustees and personally part.

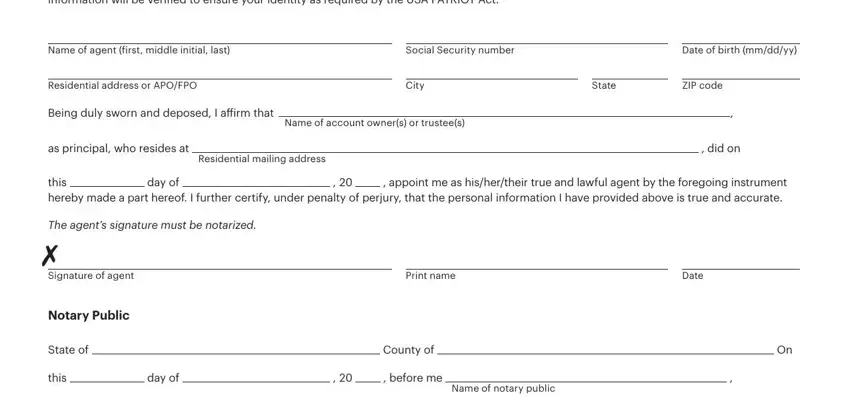

The Name, of, agent, first, middle, initial, last Social, Security, number Dateofbirth, mm, dd, yy Residential, address, or, AP, OF, PO Being, duly, sworn, and, deposed, I, affirm, that as, principal, who, resides, at Residential, mailing, address Name, of, account, owners, or, trustees City, State, ZIP, code did, on day, of The, agents, signature, must, be, notarized and Signature, of, agent field is going to be place to indicate the rights and responsibilities of each side.

Finalize by checking the next sections and filling them out as required: Signature, of, notary, public My, commission, expires Notary, seal, stamp and PAGE, OF

Step 3: Select the Done button to save the form. At this point it is accessible for upload to your gadget.

Step 4: Generate minimally a couple of copies of your form to remain away from different forthcoming concerns.

Establish the power of attorney designation on all of my Allspring Funds accounts (nonretirement and retirement).

Establish the power of attorney designation on all of my Allspring Funds accounts (nonretirement and retirement).

Establish this power of attorney designation only on the specific fund and account number(s) listed below.

Establish this power of attorney designation only on the specific fund and account number(s) listed below.