It is possible to prepare wv form appraisement effectively with our PDFinity® editor. Our expert team is relentlessly working to improve the tool and insure that it is much easier for users with its multiple functions. Discover an ceaselessly innovative experience today - take a look at and uncover new possibilities as you go! If you're looking to start, here's what it's going to take:

Step 1: Open the PDF doc inside our tool by hitting the "Get Form Button" above on this webpage.

Step 2: The tool provides you with the opportunity to change PDF files in various ways. Modify it by writing customized text, adjust what's originally in the file, and place in a signature - all readily available!

It is easy to fill out the form using this detailed guide! Here is what you must do:

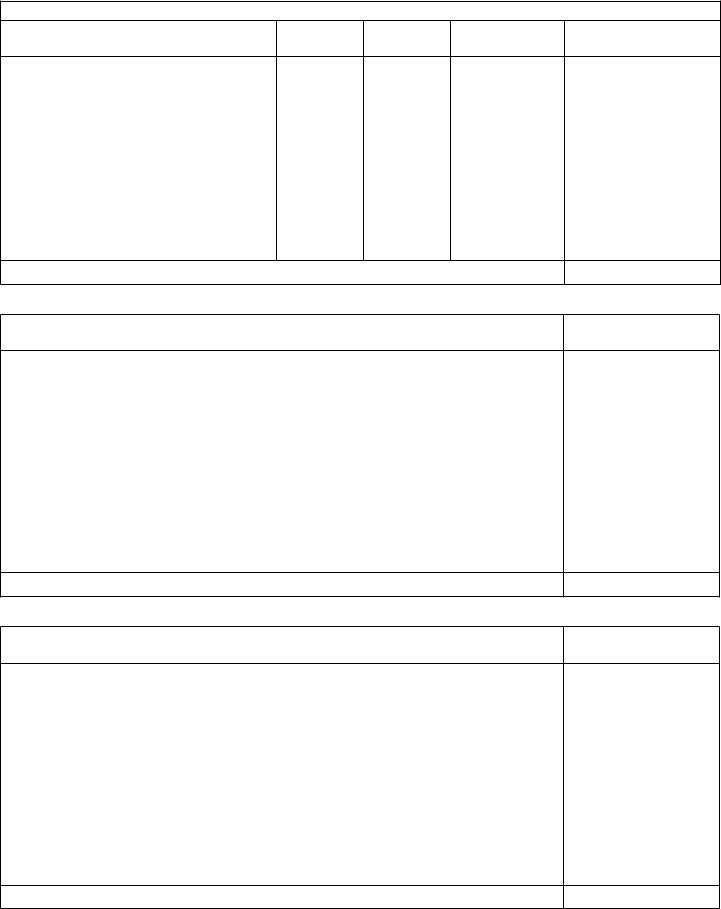

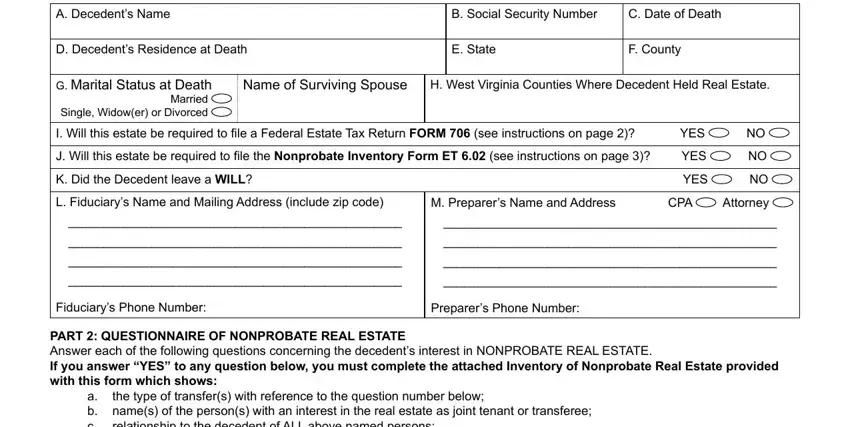

1. When completing the wv form appraisement, make sure to incorporate all of the important fields in their corresponding part. This will help hasten the process, making it possible for your details to be handled quickly and accurately.

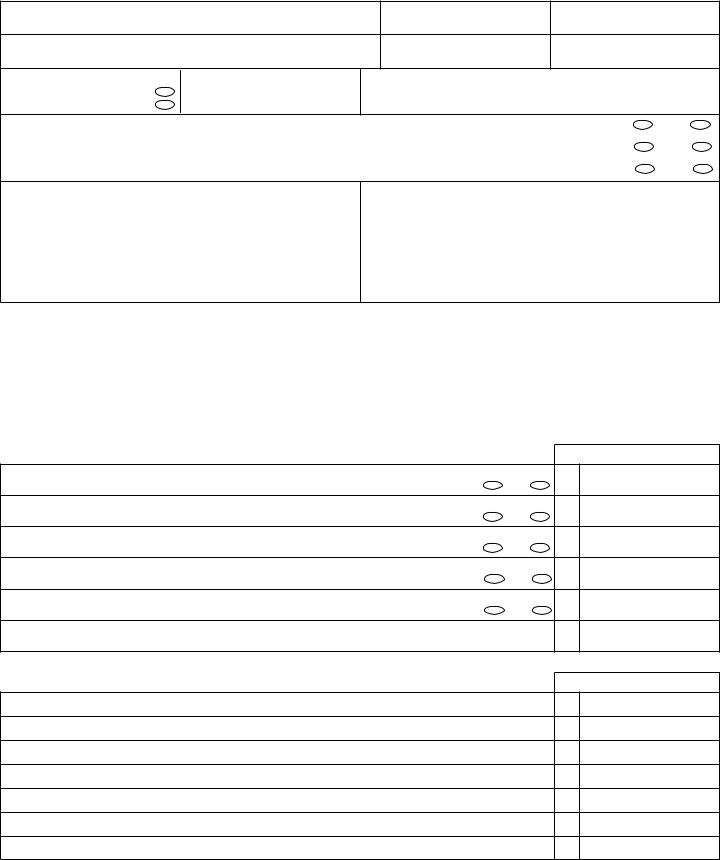

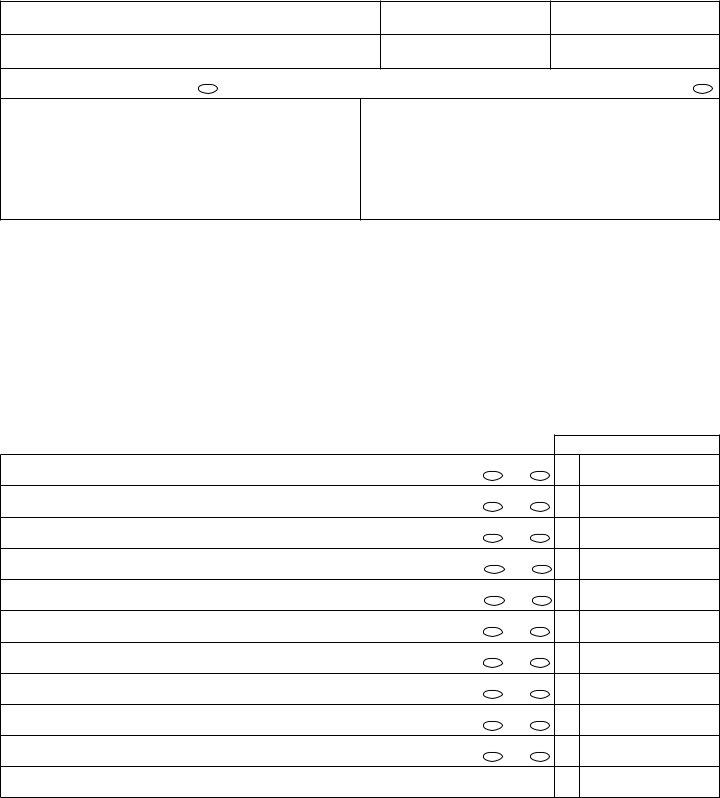

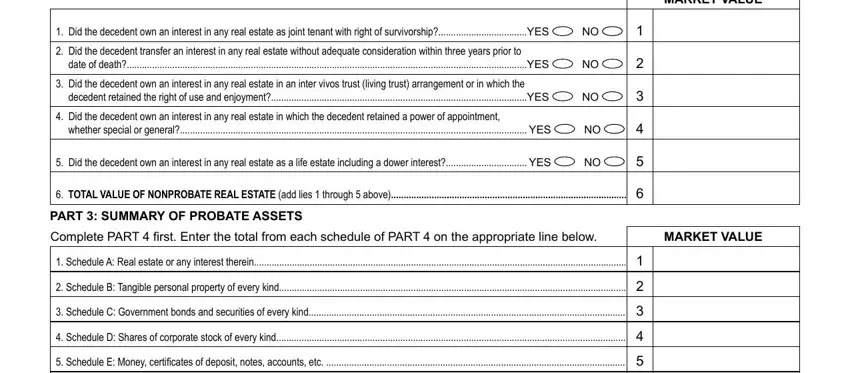

2. When the last section is completed, proceed to enter the relevant details in these - mArket VAlue, Did the decedent own an interest, Did the decedent transfer an, date of deathYES, Did the decedent own an interest, decedent retained the right of use, Did the decedent own an interest, whether special or general YES, Did the decedent own an interest, ToTal value of nonprobaTe real, pArt summAry of probAte Assets, mArket VAlue, Schedule A Real estate or any, Schedule B Tangible personal, and Schedule C Government bonds and.

Be really attentive when filling out mArket VAlue and decedent retained the right of use, as this is the section in which many people make mistakes.

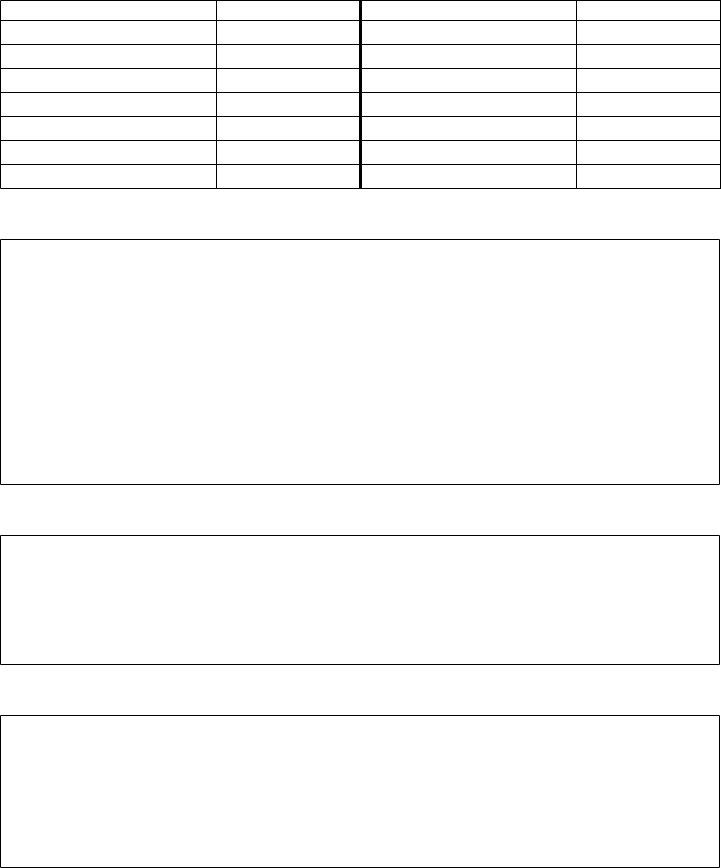

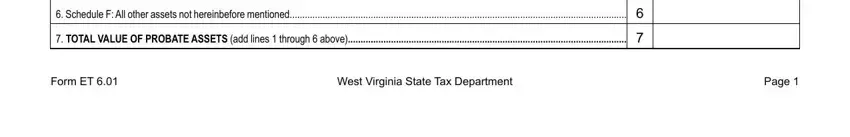

3. Within this stage, examine Schedule F All other assets not, ToTal value of probaTe asseTs add, Form ET, West Virginia State Tax Department, and Page. All these need to be completed with highest accuracy.

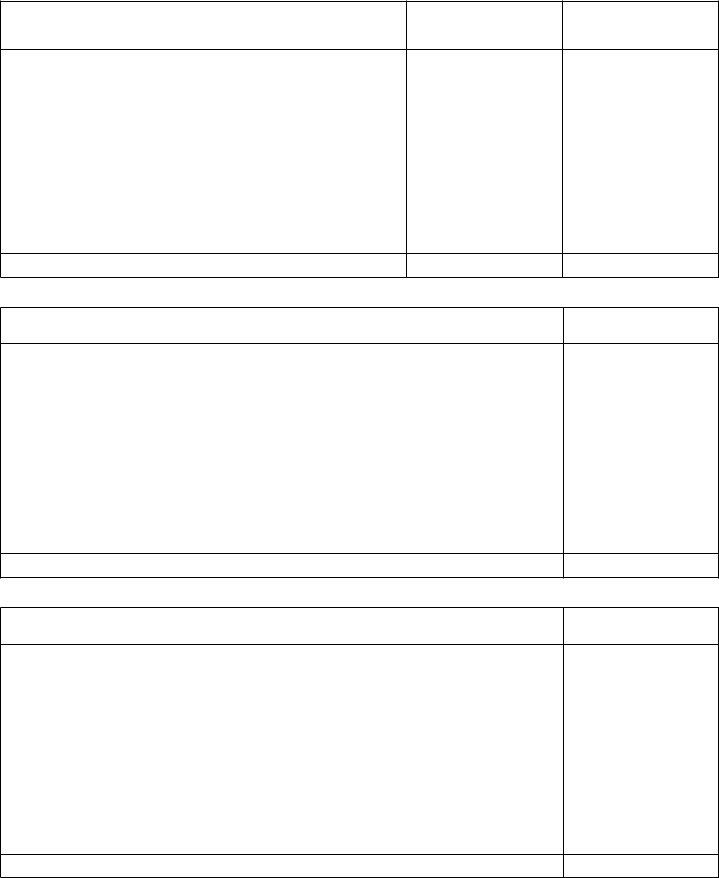

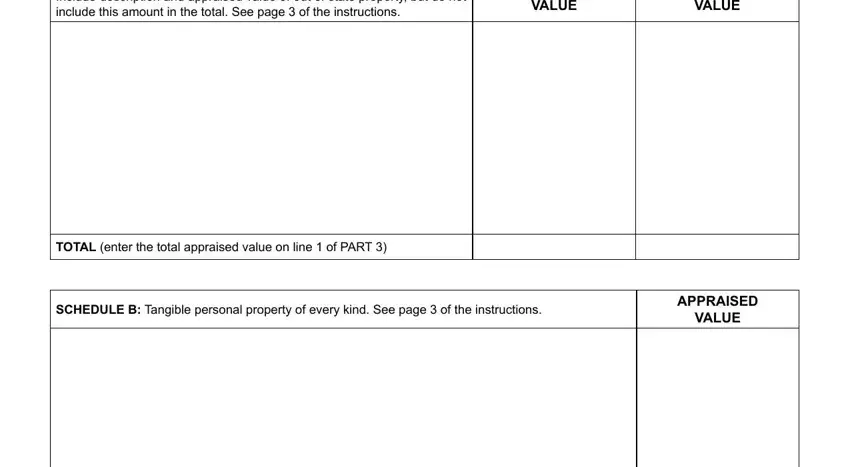

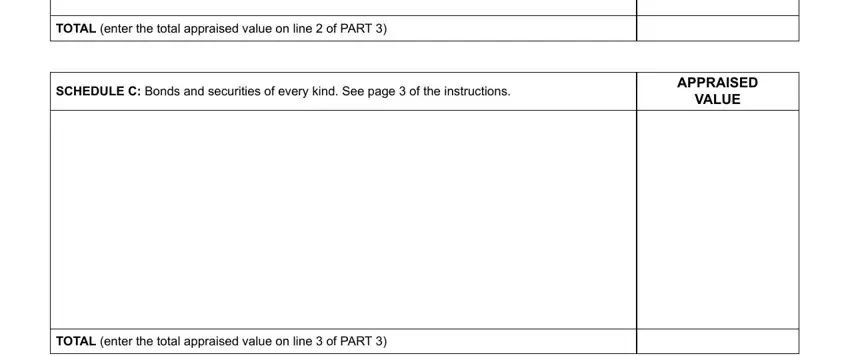

4. This fourth part comes with all of the following empty form fields to complete: scheDule A Describe any real, VAlue, VAlue, totAl enter the total appraised, scheDule b Tangible personal, ApprAiseD, and VAlue.

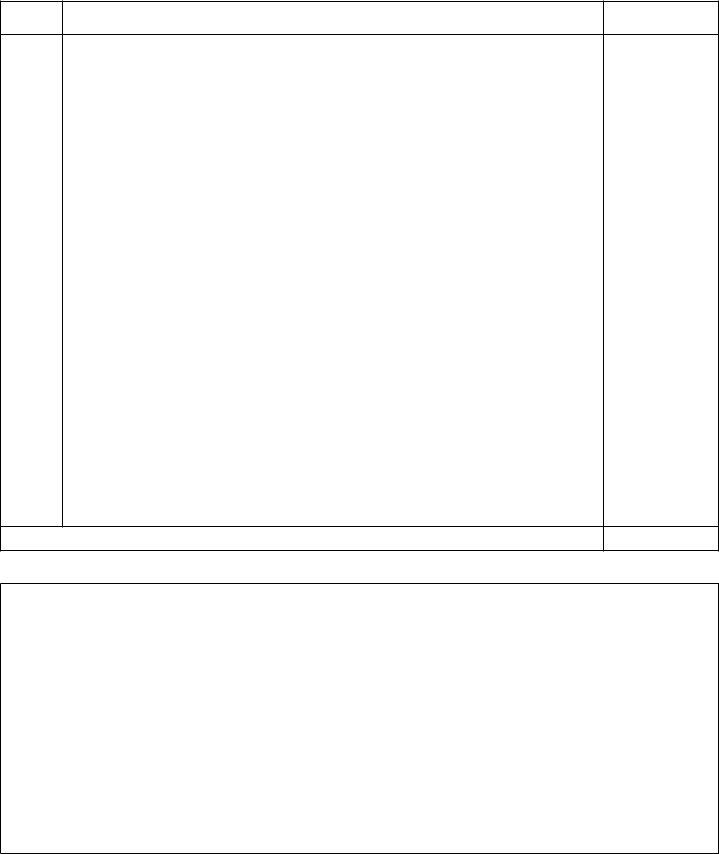

5. Lastly, this last part is precisely what you'll have to finish prior to submitting the PDF. The blank fields in question are the following: totAl enter the total appraised, scheDule c Bonds and securities of, ApprAiseD, VAlue, and totAl enter the total appraised.

Step 3: Spell-check the information you've typed into the blanks and click on the "Done" button. Sign up with FormsPal now and instantly obtain wv form appraisement, set for downloading. Each and every edit made is handily saved , enabling you to change the pdf further when necessary. FormsPal guarantees your data confidentiality via a protected system that never records or shares any type of personal information provided. Feel safe knowing your documents are kept protected every time you use our tools!