The West Virginia Estimated Tax form serves as a vital tool for individuals who anticipate owing at least $600 in state tax by the end of the fiscal year. Issued by the State Tax Department's Tax Account Administration Division, this form guides taxpayers through the process of calculating and remitting their estimated income tax payments. As detailed in the instructions provided (Form IT-140ESI available on the department's official website), the form not only outlines the method for determining the amount due but also sets forth the payment deadlines to ensure taxpayers avoid any penalties for late or insufficient payments. Moreover, it includes provisions for taxpayers who need to update their address information, ensuring the State Tax Department has the most current details for correspondence. By facilitating online filing through the state's tax website and offering both telephone and in-person support, West Virginia aims to streamline the estimated tax payment process. Mailing instructions for those who prefer or need to submit payments via post are clearly articulated, encompassing where and how to send payments to meet state tax obligations effectively.

| Question | Answer |

|---|---|

| Form Name | West Virginia Estimated Tax Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | estimated tax wv, wv quarterly tax payment form, west virginia estimated tax, wv estimated tax payments 2021 form |

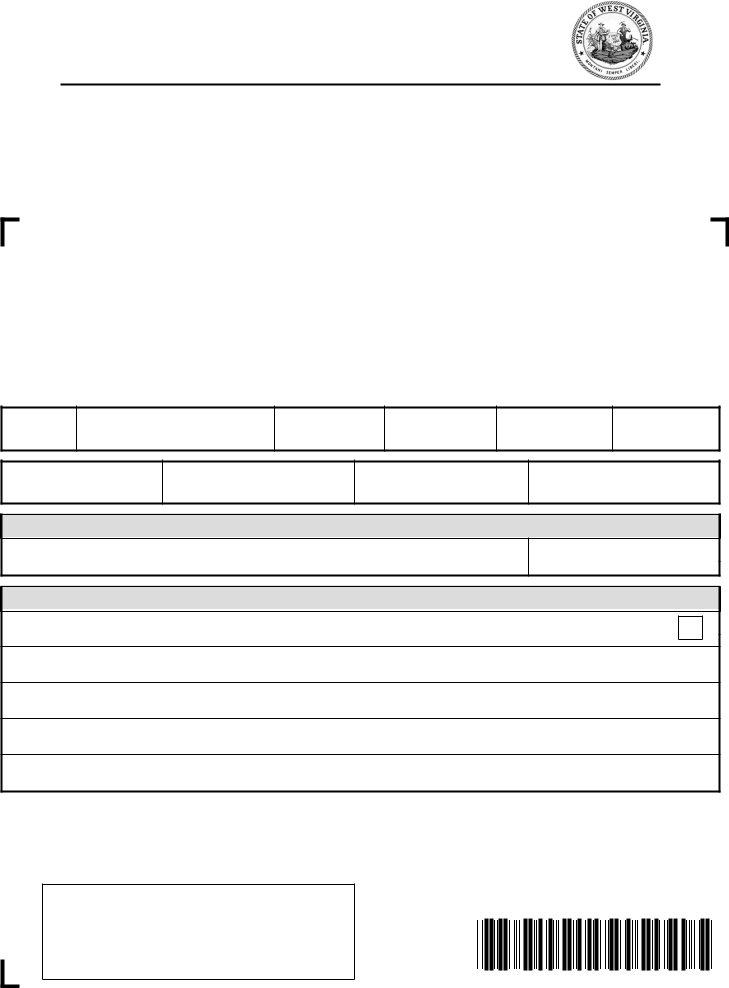

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 342

Charleston, WV

_____________________________________________________________ |

Letter Id: |

L0045367296 |

||

DONNA J. AAROE |

|

|

||

Name |

|

|

|

|

17 CLUB HOUSE DR |

|

|

Issued: |

02/01/2019 |

_____________________________________________________________ |

||||

EVANS WV |

|

|

Account #: |

|

Address |

|

|

|

|

_____________________________________________________________ |

Period: |

12/31/2018 |

||

City |

State |

Zip |

||

INDIVIDUAL ESTIMATED INCOME TAX PAYMENT

Account #:

Taxable Year End:

Payment Due Date:

Your Social Security Number:

Spouse's Social Security Number:

Part 1: Payment

Amount of This Payment

Part 2: Change of Address

Check here and complete the CHANGE OF ADDRESS if any information preprinted on this form is incorrect or changed:

Name(s):

Mailing Address:

City:

State and Zip Code:

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

P.O. Box 342 , Charleston, WV

FOR ASSISTANCE CALL (304)

For more information visit our web site at: www.tax.wv.gov

File online at https://mytaxes.wvtax.gov

P 0 9 0 9 1 8 0 1 W

INSTRUCTIONS FOR MAKING ESTIMATED PAYMENTS

If you expect to owe at least $600 in State tax when you file your annual income tax return, you are required to make estimated tax payments using this form.

Determine your estimated tax using the instruction brochure (Form

Write the amount of your payment on this form. You must pay at least the minimum amount calculated using the instructions to avoid being penalized; however, you may pay more than the minimum if you wish.

Be sure to post your payment in the payment table. If you are not a calendar year taxpayer, you should see the instructions to determine the due dates of your payments.

Estimated tax payments should be mailed by the due date to:

State Tax Department

Tax Account Administration Division - EST P.O. Box 342

Charleston WV