______________________________________________________

Customer

This agreement between the Bank (named above) and the Customer and its authorized agents (hereafter “Customer”) governs origination and receipt of wire transfers on behalf of the Customer. The terms of this agreement are construed in accordance with the laws of the United States when applicable and with the laws of the State where the Bank branch is located (hereafter, “State”). Should these related laws be amended, this agreement shall be deemed amended to the extent necessary to comply. Unless otherwise defined, terms used in this agreement shall have the meanings provided in the State Uniform Commercial Code, Article 4A. Any controversy or claim between the Bank and the Customer relating to this agreement or transfers made in connection herewith shall be determined in accordance with the dispute resolution terms, conditions and procedures detailed in Bank’s deposit account agreement (the “Deposit Agreement”) as amended from time to time. (If Customer does not have a deposit account at Bank, then Customer (a) hereby waives any right to a jury trial and agrees that any such claim or controversy shall be decided in a trial to a state or federal judge sitting without a jury in the state and county where Bank is headquartered, or in the county of the physical Bank branch at which Customer requested the transfer, and (b) hereby waives the right to litigate such claim or controversy in a class action as a class member or class representative.) This agreement supersedes any prior agreements between the Bank and the Customer on the subject matter hereof, and shall also be binding upon the Customer’s heirs, representatives, and successors. In the event of any inconsistency between this agreement and the Deposit Agreement with respect to wire transfers, this agreement shall govern. If any part of this agreement is invalid, illegal, or unenforceable, the remaining provisions shall remain in effect. Any written notice to the Bank by the Customer must be hand delivered or sent by U.S. mail or express carrier.

1)Customer Liability: The Customer shall be liable to the Bank for and shall indemnify and hold the Bank harmless from any and all claims, causes of action, damages, expenses (including reasonable attorney’s fees and other legal expenses), liabilities and other losses resulting from acts, omissions, or provision of invalid or inaccurate data by the Customer or any other person acting in the customer’s behalf, including without limitation; a) a breach by the Customer of any provision of this agreement; b) the Bank’s debiting or crediting of the account of any person as requested by the Customer; and c) the failure to act or the delay by any financial institution other than the Bank.

2)Bank Liability: The Bank shall be responsible only for performing the funds transfer services provided in this agreement and shall be liable only for its negligence or willful misconduct in performing these services. The Bank shall not be liable for acts or omissions by the Customer or any other person including, without limitation, any funds transfer system, any Federal Reserve Bank, any beneficiary’s bank, and any beneficiary, none of which shall be deemed the Bank’s agent. Without limitation, the Bank shall be excused from delaying or failing to act if caused by legal constraint, interruption of transmission or communications facilities, equipment failure, war, emergency conditions, strikes, or other circumstances beyond the Bank’s control. In addition, the Bank shall be excused from delaying or failing to execute a transfer if it would result in the Bank’s exceeding any limitation on its intra-day net funds position established through Federal Reserve guidelines or if it would result in violating any present or future risk control program of the Federal Reserve or a rule or regulation of other governmental regulatory authorities. In no event shall the Bank be liable for any consequential, special, punitive, or indirect losses or damages incurred relating to this agreement including, without limitation, subsequent wrongful dishonor resulting from the Bank’s acts or omissions. Any liability of the Bank for loss of interest resulting from its error or delay shall be calculated using a rate equal to the Federal Funds Rate at the Federal Reserve Bank of New York for the period involved. Payment will be made by crediting the appropriate account involved in the funds transfer.

3)Reconcilement: All transfers will appear on the Customer’s regular account statement. It is the Customer’s obligation to examine the statement for any discrepancy concerning any payment order. If the Customer fails to notify the Bank of any such discrepancy within fourteen (14) days after the Customer receives the statement or other sufficient information to detect such discrepancy, the Bank shall not be liable for and the Customer shall indemnify and hold the Bank harmless from any loss of interest with respect to the payment order and any other loss which could have been avoided had the Customer given such notice. If the Customer fails to notify the Bank within three (3) months after receiving the statement, the Customer is precluded from any claim against the Bank.

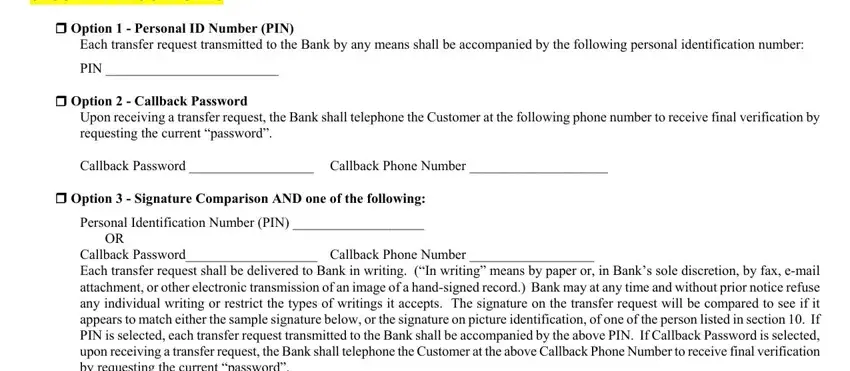

4)Security Procedure and Transfer Requests: The Bank and the Customer have agreed to any security procedure option(s) selected below and the format requirements as shown on the Bank’s current Wire Transfer Request form for each transfer request (and cancellation of a transfer request) transmitted to the Bank. (NOTE: If Customer has enrolled in a service providing for submitting wire transfer requests online or electronically (collectively “Online Wire Requests”), then Customer will transmit transfer requests in accordance with the applicable Online Wire Requests service agreement, and the security procedures for Online Wire Requests shall be Customer’s access credentials and the submitter’s actual access to the Online Wire Request system. If the Online Wire Request system is unavailable, however, then the option checked below will be used as backup for offline wire transfer requests.) In some cases the Bank may take additional actions to those selected to verify the identification of the Customer or its agent, or to detect an error in the transmission or content of the transfer request. Any of these additional actions will not be considered part of this agreement and may only be used periodically. Provided the Bank complies with the security procedure selected by the Customer, the Customer shall be liable for payment of the transferred amount plus transfer fees, even if the transfer request was not actually transmitted or authorized by the Customer. If the Bank does not follow the agreed security option, but can prove the transfer request was originated by the Customer, the Customer will still be liable for the transfer amount plus transfer fees. The Customer authorizes the Bank to record electronically or otherwise any telephone calls relating to any transfer under this agreement.

237-0003 8/11

SECURITY PROCEDURES

Option 1 - Personal ID Number (PIN)

Each transfer request transmitted to the Bank by any means shall be accompanied by the following personal identification number:

PIN _________________________

Option 2 - Callback Password

Upon receiving a transfer request, the Bank shall telephone the Customer at the following phone number to receive final verification by requesting the current “password”.

Callback Password __________________ Callback Phone Number ____________________

Option 3 - Signature Comparison AND one of the following:

Personal Identification Number (PIN) ___________________

OR

Callback Password___________________ Callback Phone Number __________________

Each transfer request shall be delivered to Bank in writing. (“In writing” means by paper or, in Bank’s sole discretion, by fax, e-mail attachment, or other electronic transmission of an image of a hand-signed record.) Bank may at any time and without prior notice refuse any individual writing or restrict the types of writings it accepts. The signature on the transfer request will be compared to see if it appears to match either the sample signature below, or the signature on picture identification, of one of the person listed in section 10. If PIN is selected, each transfer request transmitted to the Bank shall be accompanied by the above PIN. If Callback Password is selected, upon receiving a transfer request, the Bank shall telephone the Customer at the above Callback Phone Number to receive final verification by requesting the current “password”.

Multiple Options - Check here only if you request all selected options to be used for each transfer request. Otherwise any one selected option will be used.

Transmittals shall be made to the Central Wire Department. The Customer shall maintain records of each transfer request for six (6) months following the requested transfer date and agrees to provide such records to the Bank upon request to allow reconstruction. Transmittal must be received by the Bank before the local times listed below and in time to complete the requested security procedure. Transfer requests received after these times will be treated as being received on, and may be executed on, the following funds transfer business day. Times may vary at the Bank’s discretion.

Foreign wires and wire requests using the Online Wire Request system 2:00pm MT

Domestic wires |

3:00pm MT |

Tax wires |

2:30pm MT |

5)Processing Wire Transfers: The Bank shall process transfer requests based solely upon information received from the Customer. The Bank may, at its discretion, process the wire transfer request through either the Federal Reserve Bank System or the Society for Worldwide Interbank Financial Telecommunication (S.W.I.F.T.). In the case where the beneficiary’s bank is the Bank, the Bank may simply debit and credit the appropriate accounts as requested in the authorized wire transfer request. At the time the Bank executes a wire transfer or internal transfer, the Customer agrees to pay the Bank with available funds on deposit for the amount of the wire plus the current Wire Transfer Fee as listed in the Bank’s fee schedule. If the Customer fails to pay in accordance with this agreement, the Bank shall be entitled to request cancellation of the transfer, or to undertake any other legal means to collect the amount of the transfer if unable to cancel, including exercise of right of offset as detailed in the Bank’s Deposit Agreement.

6)Errors and Rejections by Bank: If a wire transfer request indicates an intermediary bank or a beneficiary’s bank inconsistently by name and identifying number, execution of the request might be based solely upon the number, even if the number identifies a bank different from the named bank or a person who is not a bank. If a wire transfer request describes a beneficiary inconsistently by name and account number, payment might be made by the beneficiary’s bank based solely upon the account number, even if the account number identifies a person different from the named beneficiary. Customer’s obligations shall not be excused in these circumstances. The Bank shall reject any transfer request or incoming wire transfer which does not conform to the limitations, security procedures, and/or other requirements set forth in this agreement, such as availability of funds on deposit. The Bank may reject, except when prohibited by law, at its sole discretion any transfer request it receives from the Customer for any reason. The Bank shall notify the Customer of the Bank’s rejection of the transfer request by telephone, electronic message, or U.S. mail. The Bank will comply with regulations issued by the US Treasury’s Office of Foreign Assets Control (OFAC). If any transfer request is to an entity listed on OFAC’s list of Specially Designated Nationals and Blocked Persons, by law the Bank shall not complete the transfer and shall “block” the funds until such time OFAC issues a written release to the Bank. The Bank shall have no liability to the Customer as a result of the Bank’s rejection of any transfer request or internal transfer if it complies with the terms of this agreement.

7)Rejection of the Bank’s Transfer Request: If the Bank receives notice that a wire transfer transmitted by the Bank has been rejected, the Bank shall notify the Customer of such rejection including the reason given for rejection by telephone, electronic message, or U.S. mail. The Bank will have no further obligation to transmit the rejected wire transfer if it complied with this agreement with respect to the original transfer request.

8)Cancellation and Change by Customer: The Customer shall have no right to cancel or amend any transfer request after received by the Bank;

237-0003 8/11

however, the Bank shall use reasonable efforts to act on a cancellation or change request as long as it is received from the Customer or its authorized agent in accordance with the security procedures set forth in this agreement. The Bank shall have no liability if the cancellation or change is not effected.

9)Amendments, Assignment, and Termination of Agreement: The Bank shall be entitled to amend this agreement at any time which will become effective immediately upon the Customer’s receipt of notification or upon a later date specified in such notification. The Customer may amend the “fill-in” portions of this agreement at any time by completing a new agreement. Such amendments will not be effective until presented to and signed by the branch listed at the bottom of this agreement. The Customer may not amend other portions of this agreement without the Bank’s prior written consent. The Customer may not assign this agreement to any other person or entity without the Bank’s prior written consent, at which time a new agreement will be established. Either the Bank or the Customer may terminate this agreement at any time by giving written notice to the other party. Termination by the Bank shall be effective immediately upon the Customer’s receiving written notice. Termination by the Customer shall be effective the second business day following receipt of written notice. Any termination shall not affect any obligations occurring prior to termination.

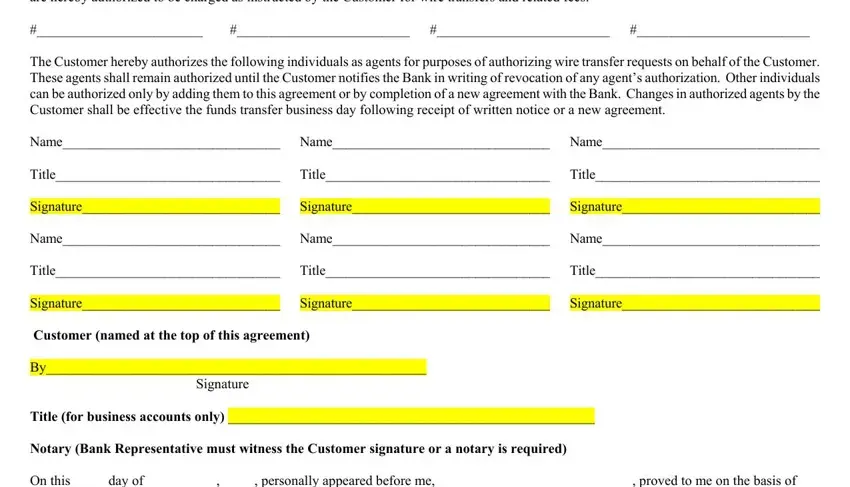

10)Authorization: The Customer represents and warrants that the accounts listed below are owned entirely by the within-named Customer, and are hereby authorized to be charged as instructed by the Customer for wire transfers and related fees:

#________________________ #_________________________ #_________________________ #_________________________

The Customer hereby authorizes the following individuals as agents for purposes of authorizing wire transfer requests on behalf of the Customer. These agents shall remain authorized until the Customer notifies the Bank in writing of revocation of any agent’s authorization. Other individuals can be authorized only by adding them to this agreement or by completion of a new agreement with the Bank. Changes in authorized agents by the Customer shall be effective the funds transfer business day following receipt of written notice or a new agreement.

Name________________________________ Name________________________________ Name________________________________

Title_________________________________ Title_________________________________ Title_________________________________

Signature_____________________________ Signature_____________________________ Signature_____________________________

Name________________________________ Name________________________________ Name________________________________

Title_________________________________ Title_________________________________ Title_________________________________

Signature_____________________________ Signature_____________________________ Signature_____________________________

Customer (named at the top of this agreement)

By_______________________________________________________

Signature

Title (for business accounts only) _____________________________________________________

Notary (Bank Representative must witness the Customer signature or a notary is required)

On this _____day of __________,_____, personally appeared before me, ____________________________, proved to me on the basis of

satisfactory evidence to be the person whose name is subscribed to on this instrument, and acknowledged that he (she) executed the same.

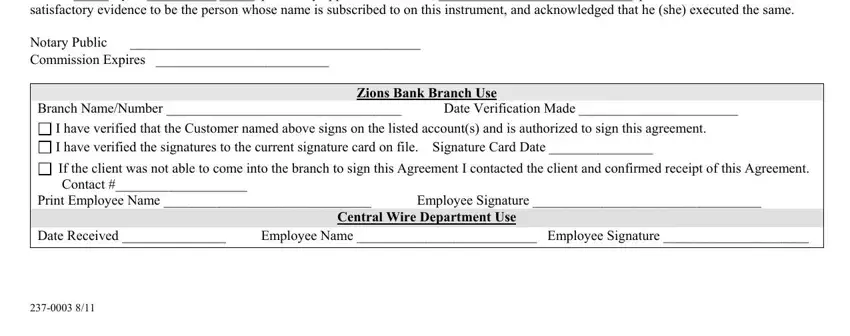

Notary Public |

__________________________________________ |

Commission Expires _________________________ |

|

|

|

|

|

|

Zions Bank Branch Use |

Branch Name/Number __________________________________ |

Date Verification Made _______________________ |

I have verified that the Customer named above signs on the listed account(s) and is authorized to sign this agreement. |

I have verified the signatures to the current signature card on file. Signature Card Date _______________ |

If the client was not able to come into the branch to sign this Agreement I contacted the client and confirmed receipt of this Agreement. |

Contact #___________________ |

|

|

Print Employee Name ______________________________ |

Employee Signature _________________________________ |

|

|

Central Wire Department Use |

Date Received _______________ |

Employee Name __________________________ Employee Signature _____________________ |

|

|

|

|