Using the online PDF editor by FormsPal, you'll be able to fill in or change dt1556 right here. Our expert team is ceaselessly endeavoring to enhance the tool and ensure it is even better for clients with its many functions. Uncover an ceaselessly revolutionary experience now - check out and find new possibilities as you go! Here's what you will need to do to get started:

Step 1: Just hit the "Get Form Button" at the top of this page to see our form editor. There you will find all that is necessary to work with your file.

Step 2: As soon as you start the file editor, you will notice the document made ready to be completed. In addition to filling in different fields, you may as well do many other actions with the PDF, namely writing your own textual content, editing the initial textual content, inserting graphics, signing the form, and a lot more.

It really is simple to fill out the pdf with this helpful guide! This is what you need to do:

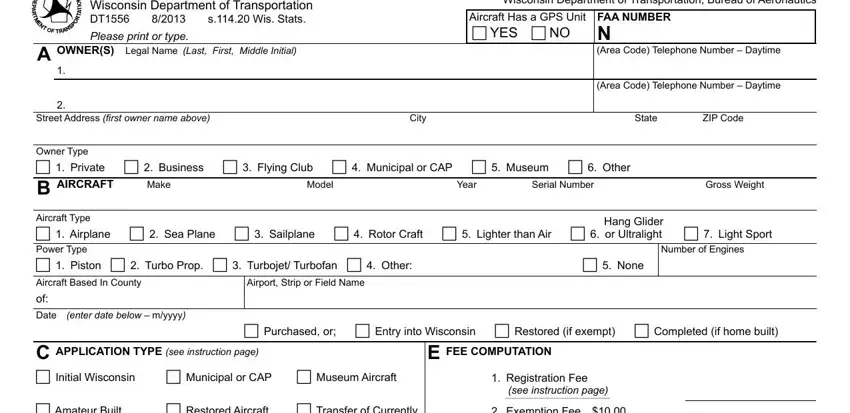

1. The dt1556 will require specific information to be typed in. Ensure the next blank fields are finalized:

2. Once your current task is complete, take the next step – fill out all of these fields - Amateur Built, Restored Aircraft, Transfer of Currently, Previously Exempted, Registered, Antique, Incomplete Amateur Built, Unairworthy Aircraft complete, D SELLER INFORMATION Send a Copy, Seller Name, Area Code Telephone Number, Street Address, City, State, and ZIP Code with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Concerning Seller Name and ZIP Code, make sure you double-check them here. The two of these are thought to be the most important ones in this document.

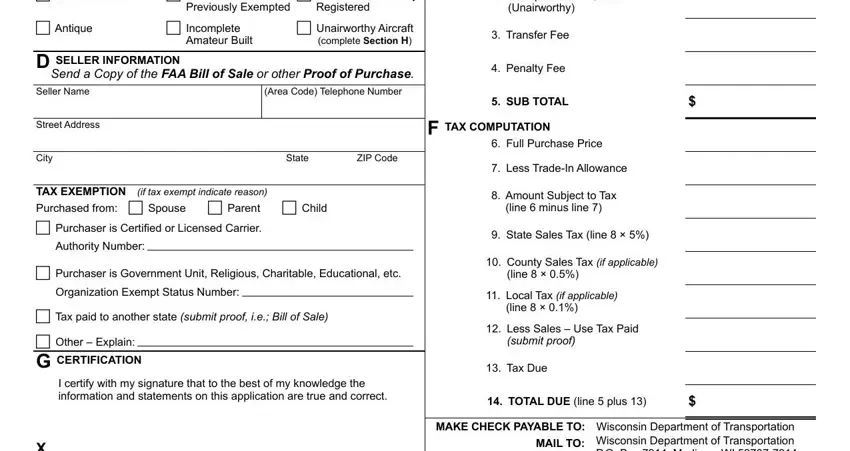

3. Completing X Owner Signature, X CoOwner Signature, Wisconsin Department of, Date mdyy, DATE, FOR WisDOT USE ONLY, AMOUNT, Date mdyy, Registration, Sales Tax, County Tax, Local Tax, TOTAL PAID, and Please make a copy of the is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

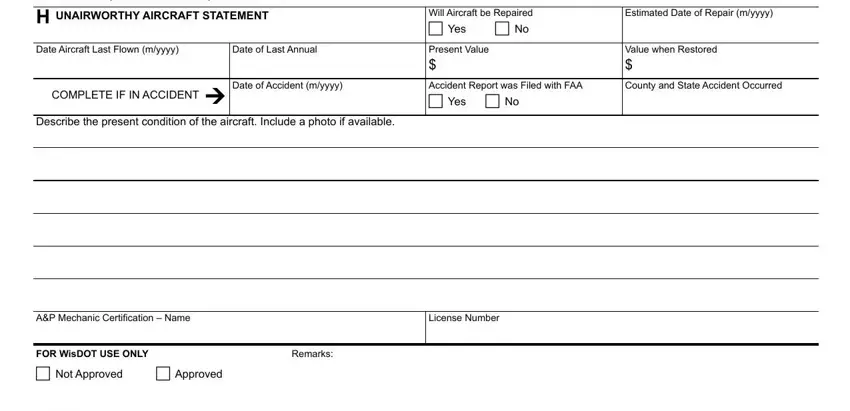

4. Completing Estimated Date of Repair myyyy, Value when Restored, County and State Accident Occurred, AIRCRAFT REGISTRATION or EXEMPTION, Will Aircraft be Repaired Yes No, Date Aircraft Last Flown myyyy, Date of Last Annual, COMPLETE IF IN ACCIDENT Date of, Describe the present condition of, Present Value, Accident Report was Filed with, AP Mechanic Certiication Name, License Number, FOR WisDOT USE ONLY Not Approved, and Approved is crucial in the fourth step - always don't rush and fill in every empty field!

Step 3: Look through all the information you've typed into the blank fields and hit the "Done" button. Sign up with us today and easily get dt1556, prepared for downloading. Each and every change you make is conveniently saved , letting you change the form at a later time when required. FormsPal ensures your data privacy by having a secure system that never saves or shares any type of personal information used. Be confident knowing your docs are kept protected when you use our service!