There's nothing hard regarding filling in the printable form 1 es wisconsin when you use our PDF editor. By following these simple actions, you will have the fully filled out document within the minimum period possible.

Step 1: To begin, choose the orange button "Get Form Now".

Step 2: Once you have entered the editing page printable form 1 es wisconsin, you'll be able to discover all the functions intended for the form within the upper menu.

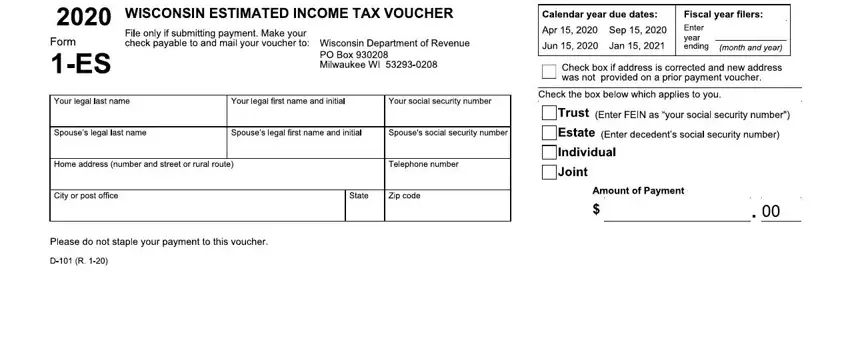

The next segments will make up your PDF document:

Step 3: Hit the "Done" button. So now, you may transfer the PDF file - save it to your electronic device or forward it via email.

Step 4: Create as much as a couple of copies of your file to avoid any specific possible future issues.