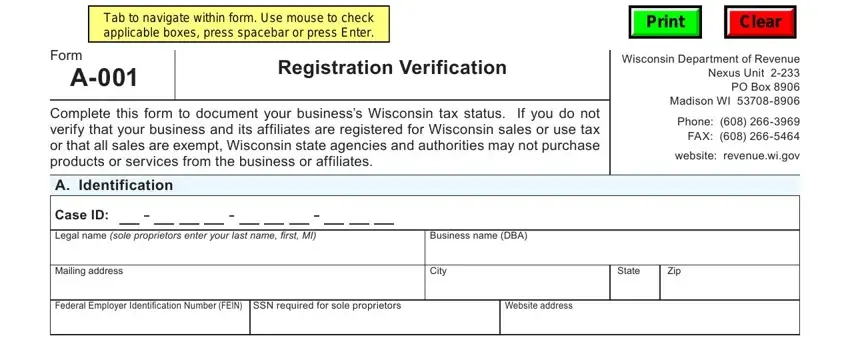

It won't be a challenge to fill out pi 1613 employment verification with the help of our PDF editor. This is how you could efficiently prepare your file.

Step 1: Click on the "Get Form Here" button.

Step 2: You can now modify the pi 1613 employment verification. Feel free to use the multifunctional toolbar to insert, eliminate, and adjust the text of the file.

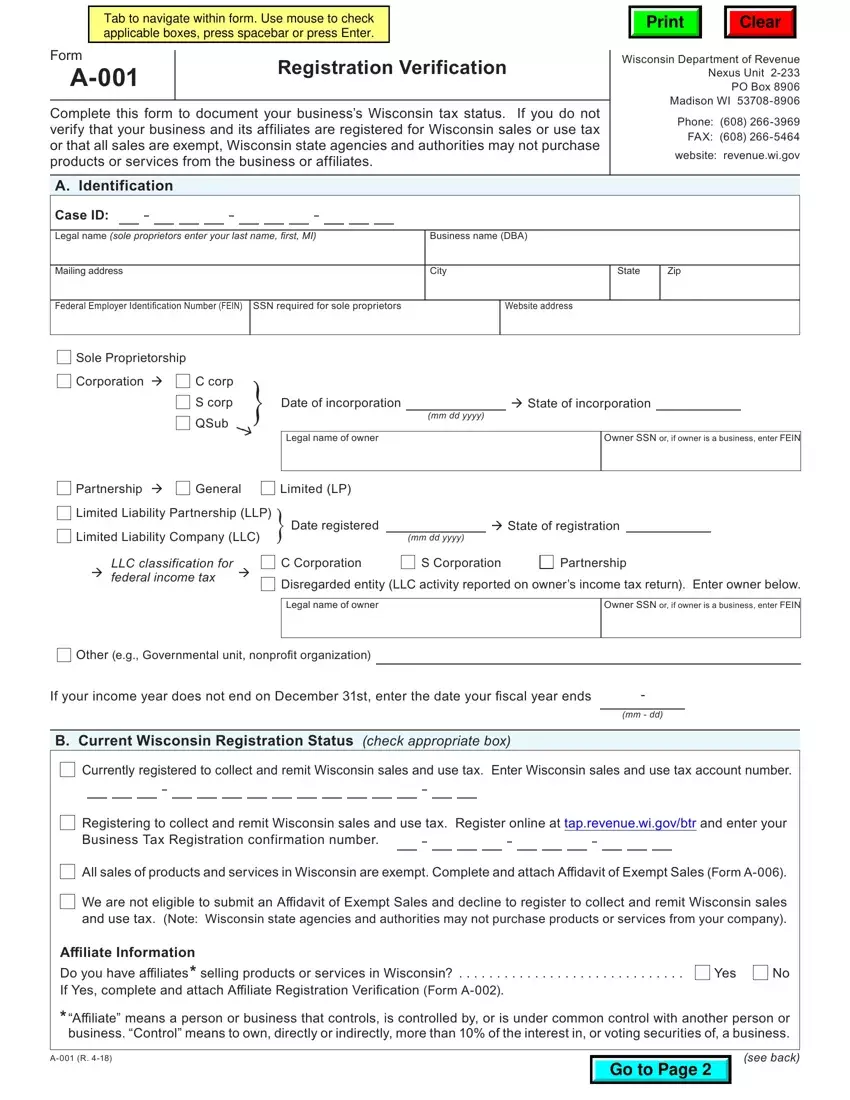

The next areas are inside the PDF form you will be filling out.

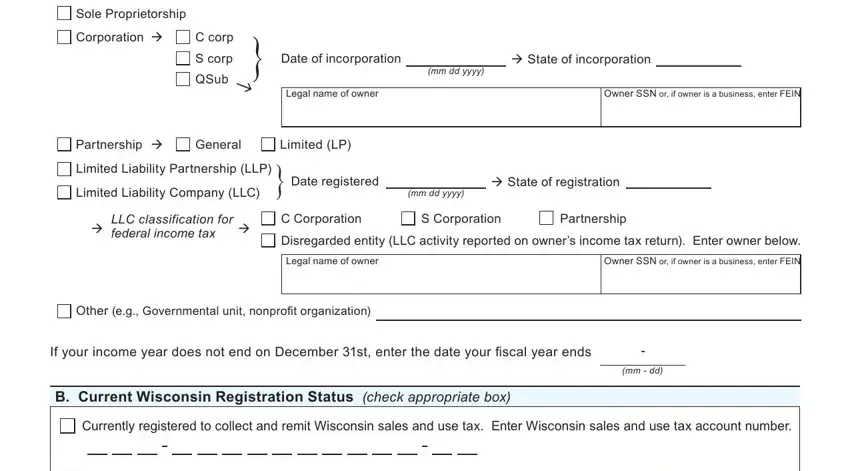

You have to fill out the Sole Proprietorship, Corporation C corp, S corp, QSub, Date of incorporation, State of incorporation, mm dd yyyy, Legal name of owner, Owner SSN or if owner is a, Partnership General, Limited LP, Limited Liability Partnership LLP, Limited Liability Company LLC, Date registered, and State of registration area with the expected information.

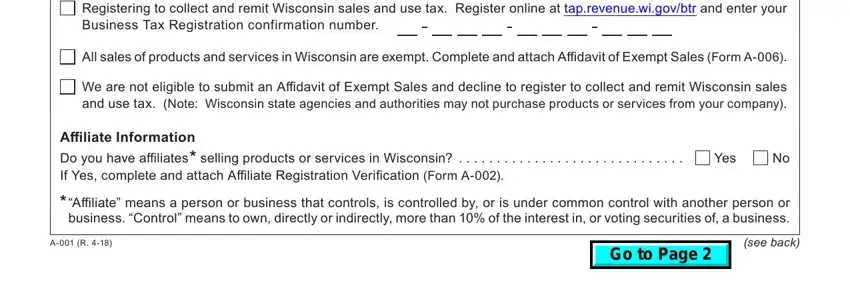

In the section talking about Registering to collect and remit, All sales of products and services, We are not eligible to submit an, Affiliate Information Do you have, Yes, Affiliate means a person or, and see back, you have got to note some essential information.

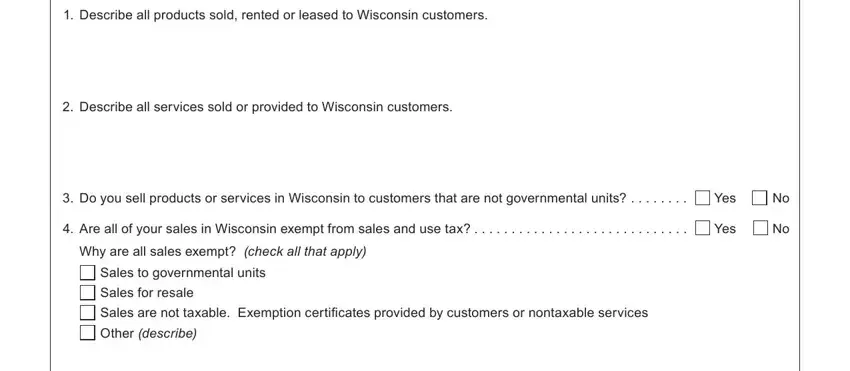

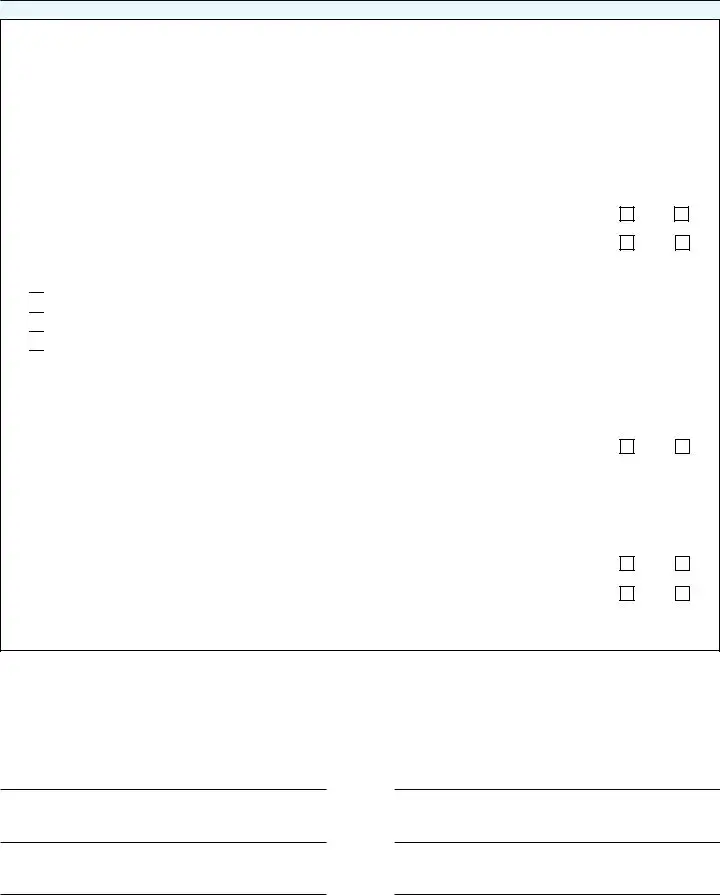

Describe the rights and responsibilities of the sides inside the paragraph Describe all products sold rented, Describe all services sold or, Do you sell products or services, Yes, Are all of your sales in, Yes, Why are all sales exempt check all, Sales to governmental units, Sales for resale, Sales are not taxable Exemption, and Other describe.

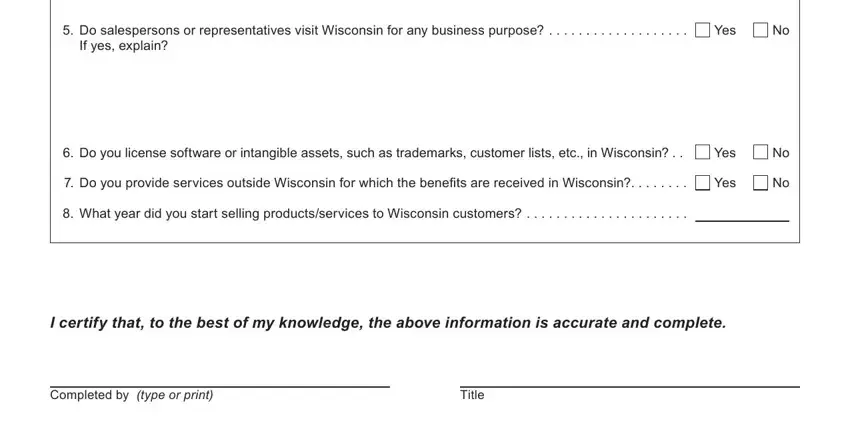

Finish by reviewing the next areas and filling them in as needed: Do salespersons or, Yes, If yes explain, Do you license software or, Yes, Do you provide services outside, Yes, What year did you start selling, I certify that to the best of my, Completed by type or print, and Title.

Step 3: In case you are done, select the "Done" button to upload your PDF file.

Step 4: Generate duplicates of the file - it may help you prevent forthcoming issues. And don't worry - we cannot disclose or look at your details.

Currently registered to collect and remit Wisconsin sales and use tax. Enter Wisconsin sales and use tax account number.

Currently registered to collect and remit Wisconsin sales and use tax. Enter Wisconsin sales and use tax account number.

Registering to collect and remit Wisconsin sales and use tax. Register online at

Registering to collect and remit Wisconsin sales and use tax. Register online at

All sales of products and services in Wisconsin are exempt. Complete and attach Affidavit of Exempt Sales

All sales of products and services in Wisconsin are exempt. Complete and attach Affidavit of Exempt Sales

Sales to governmental units

Sales to governmental units

Sales for resale

Sales for resale

Sales are not taxable. Exemption certificates provided by customers or nontaxable services

Sales are not taxable. Exemption certificates provided by customers or nontaxable services