In the state of Wisconsin, the Homestead Credit form, officially known as Schedule H-EZ, plays an important role in providing financial relief to residents. Designed to assist homeowners and renters with low to moderate incomes, this form allows eligible individuals to claim a credit based on their housing costs relative to their income. The form requires claimants to provide detailed information including social security numbers, legal names, addresses, and the specifics of their living situation at the end of the specified tax year. It inquires about the claimant's and their spouse's ages to establish eligibility, as individuals under 18 or those claimed as dependents under specific conditions may not qualify. Moreover, the form assesses the household's income through various categories such as wages, interest, dividends, and non-taxable income components. The amount of allowable credit is computed by considering both property taxes for homeowners or a portion of rent for renters, alongside the household's total income, with strict criteria that disqualify higher earners. By guiding residents through the process of claiming what could be vital financial support, the Wisconsin Homestead Credit form underscores the state's commitment to aiding its economically vulnerable populations.

| Question | Answer |

|---|---|

| Form Name | Wisconsin Homestead Credit Form |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | www.revenue.state.mn.ushomeowners-homesteadHomeowner's Homestead Credit RefundMinnesota Department of ... |

H‑EZ Wisconsin homestead credit

Check here if

an amended return

2021

Claimant’s social security number |

Spouse’s social security number |

Check below then fill in either the name of the city, |

||||||||||||||||||

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

village, or town, and the county in which you lived |

|||||||||||||

|

|

|

|

|

|

|

at the end of 2021. |

|

|

|

|

|

|

|

|

|

|

|||

Claimant’s legal last name |

Claimant’s legal first name |

|

|

M.I. |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

Village |

|

|

|

Town |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s legal last name |

Spouse’s legal first name |

|

|

M.I. |

City, village, |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

or town |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current home address (number and street) |

|

|

|

|

Apt. no. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

County of |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City or post office |

|

State |

|

Zip code |

Special |

|

|

|

(See page 10 of the |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

conditions |

|

|

|

Schedule H instructions.) |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 a What was your age as of December 31, 2021? (If you were under 18, you do not qualify for |

|

|

homestead credit for 2021.) |

1a |

Fill in age |

b What was your spouse’s age as of December 31, 2021? |

1b |

Fill in age |

cIf you and your spouse were under age 62 as of December 31, 2021, were you or your spouse

disabled? (See instructions) |

1c |

|

Yes |

|

dIf you and your spouse were not disabled, did you or your spouse have positive earned income

(see Schedule H instructions) in 2021? (If “No”, you do not qualify see instructions) |

1d |

|

Yes |

|

|||

2 Were you a legal resident of Wisconsin from |

2 |

|

Yes |

|

3Were you claimed or will you be claimed as a dependent on someone else’s 2021 federal income

tax return? (If “Yes” and you were under age 62 on December 31, 2021, you do not qualify.) . . . . . 3 |

|

Yes |

|

No

No No

No

ATTACH rent certificate or property tax bill

Household Income |

Print numbers like this |

Not like this |

NO COMMAS; NO CENTS |

||

4 Wisconsin income from line 5 of Form 1 (see instructions) |

. . . . . . . . . . . . . . . . . . . . . |

. 4 |

.00 |

|

|

5If not filing a 2021 Wisconsin etu n, fill in Wisconsin taxable income below.

a Wages |

.00 + Interest |

.00 + Dividends |

.00 = . . . |

5a |

.00 |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

b Other taxable income (list type and amount) |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

5b |

.00 |

||||

c Medical and |

. . |

. . . . . . |

5c |

.00 |

||||||||

6 Nontaxable income not included on line 4, 5a, or 5b above. |

|

|

|

|

|

|||||||

a Unemployment compensation |

. . . . . . . . . |

. 6a |

.00 |

|||||||||

. . . . . . .b Social security, federal and state SSI, |

.00 |

|||||||||||

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .c Railroad retirement benefits |

. . . . . . . . . |

. 6c |

.00 |

|||||||||

d Pensions, annuities, and other retirement plan distributions |

|

|

. |

6d |

|

|||||||

.00 |

||||||||||||

e Contributions to deferred compensation plans (see box 12 of wage statements) |

|

|

. |

6e |

|

|||||||

. . . . . . . . . |

.00 |

|||||||||||

. . . . . . . . . . . . . .f Contributions to IRA and SIMPLE plans |

. . . . . . . . . . . . . . . . . . . |

. . . . |

. . . . . . . . . |

. 6f |

.00 |

|||||||

g Interest on United States bonds and notes and state and municipal bonds |

|

|

. |

6g |

|

|||||||

. . . . . . . . . |

.00 |

|||||||||||

h Child support, maintenance payments, and other support money (court ordered) |

|

|

. |

6h |

|

|||||||

. . . . . . . . . |

.00 |

|||||||||||

. . . i Wisconsin Works (W2) payments, county relief, kinship care, and other cash public assistance . |

6i |

.00 |

||||||||||

7 a Add lines 4 through 6i (if less than the total of lines 8, 9a, and 9c, see instructions) |

|

|

. |

7a |

|

|||||||

. . . . . . . . . |

.00 |

|||||||||||

b Fill in number of qualifying dependents (do not count yourself or your spouse) |

|

|

x $500 = |

7b |

.00 |

|||||||

c Household income. Subtract line 7b from line 7a (if $24,680 or more, no credit is allowed) |

|

|

. |

7c |

|

|||||||

. . . . . . . . . |

.00 |

|||||||||||

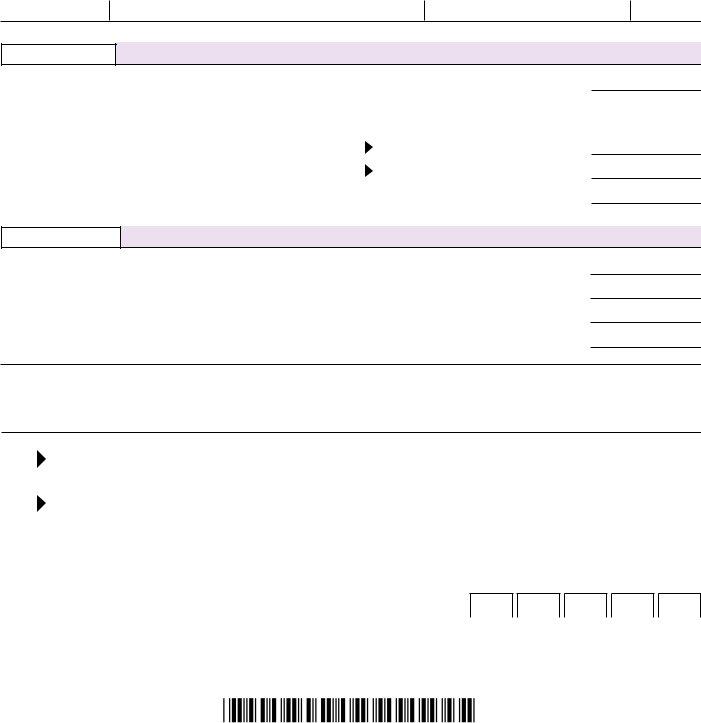

2021 Schedule

Name

SSN

Page 2 of 2

Taxes and/or Rent

Before completing this section, see instructions for taxes and/or rent (STEP 4). NO COMMAS; NO CENTS

8 Homeowners – Net 2021 property taxes on your homestead. Attach your 2021 tax bill . . . . . . . . . . . . 8

9

Schedule.

Heat included (8b of rent certificate is “Yes”) |

9a |

.00 |

x .20 (20%) |

= |

9b |

. . . . . . . .Heat not included (8b of rent certificate is “No”) |

9c |

.00 |

x .25 (25%) |

= |

9d |

10 Add lines 8, 9b, and 9d (or enter amount from line 6 of Taxes/Rent Reduction Schedule) |

. . |

10 |

|||

.00

.00

.00

.00

Credit Computation

NO COMMAS; NO CENTS

11 Fill in the smaller of the amount on line 10 or $1,460 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 12 Using the amount on line 7c, fill in the appropriate amount from Table A (page 25) . . . . . . . . . . . . 12 13 Subtract line 12 from line 11 (if line 12 is more than line 11, fill in 0; no credit is allowable) . . . . . 13 14 Homestead credit – Using the amount on line 13, fill in the credit from Table B (page 26) . . . . . . . 14

.00

.00

.00

.00

Under penalties of law, I declare this homestead credit claim and all attachments are true, correct, and complete to the best of my knowledge and belief.

Sign |

Claimant’s signature |

D |

te |

Daytime phone number |

Wisconsin Identity Protection PIN (7 characters) |

|||||||||||||||

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

here |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sign |

Spouse’s signature |

D |

te |

Daytime phone number |

Wisconsin Identity Protection PIN (7 characters) |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

here |

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Department Use Only

C