Working with PDF documents online is very simple with our PDF tool. You can fill out wolfsberg questionnaire 2018 here painlessly. The tool is consistently maintained by our staff, getting awesome functions and turning out to be greater. Getting underway is simple! All you should do is stick to the next easy steps directly below:

Step 1: Just press the "Get Form Button" above on this webpage to access our pdf editing tool. This way, you will find all that is necessary to fill out your document.

Step 2: After you access the PDF editor, you'll see the form made ready to be filled in. In addition to filling out different blank fields, you may as well perform many other things with the Document, that is putting on any text, editing the initial text, adding images, placing your signature to the PDF, and a lot more.

Filling out this PDF requires attention to detail. Make certain all required blank fields are completed properly.

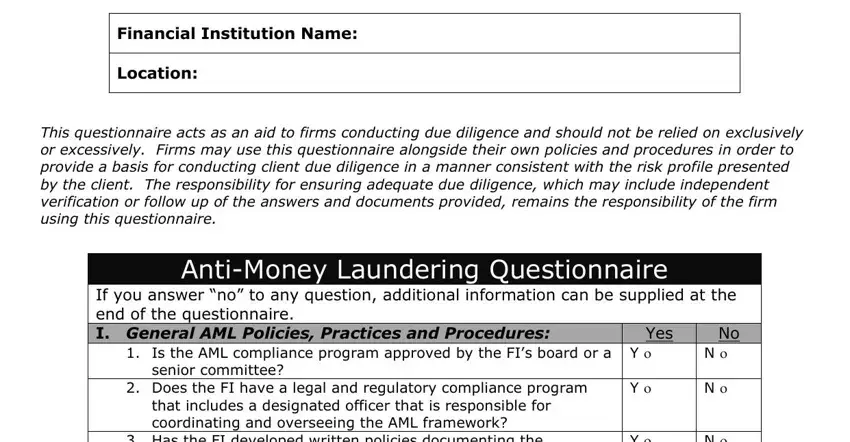

1. While completing the wolfsberg questionnaire 2018, ensure to complete all of the important fields in the corresponding area. This will help to facilitate the work, which allows your details to be handled without delay and properly.

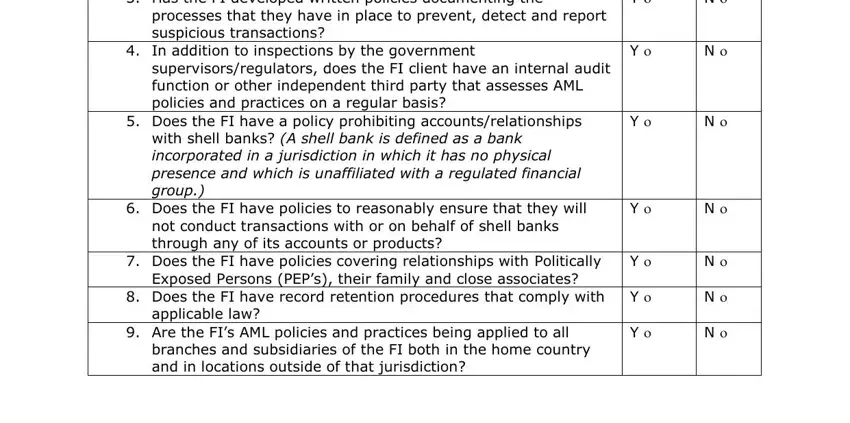

2. After the first part is completed, proceed to enter the relevant details in all these - Has the FI developed written, processes that they have in place, In addition to inspections by the, supervisorsregulators does the FI, Does the FI have a policy, with shell banks A shell bank is, Does the FI have policies to, not conduct transactions with or, Does the FI have policies, Exposed Persons PEPs their family, Does the FI have record retention, applicable law, Are the FIs AML policies and, and branches and subsidiaries of the.

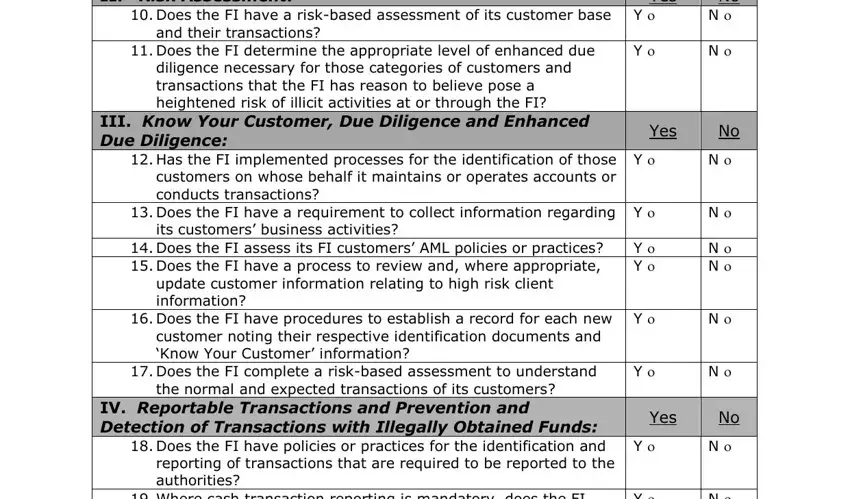

3. The third step is generally straightforward - fill in every one of the blanks in II Risk Assessment, Does the FI have a riskbased, and their transactions, Does the FI determine the, diligence necessary for those, III Know Your Customer Due, Has the FI implemented processes, Does the FI have a requirement to, its customers business activities, Does the FI assess its FI, Yes, No N, Yes, Y Y, and N N in order to finish the current step.

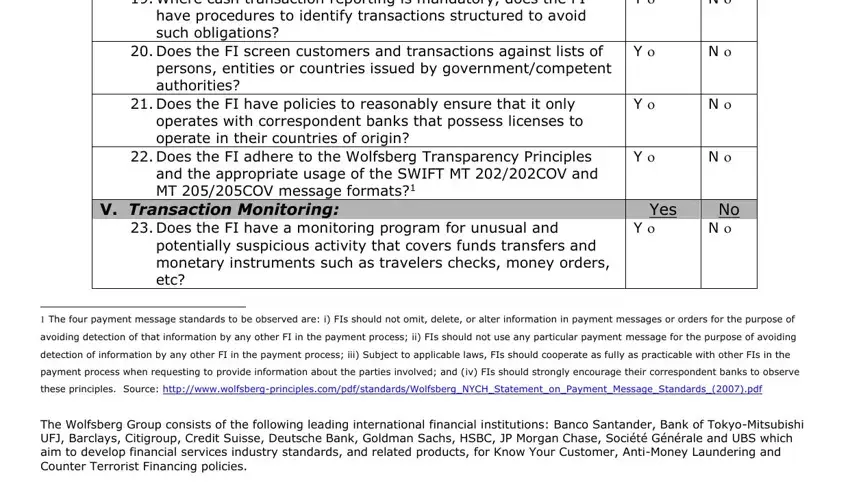

4. It is time to proceed to this next form section! Here you've got these Where cash transaction reporting, Does the FI screen customers and, persons entities or countries, Does the FI have policies to, operates with correspondent banks, Does the FI adhere to the, V Transaction Monitoring, Does the FI have a monitoring, potentially suspicious activity, Yes, No N, The four payment message, detection of information by any, payment process when requesting to, and these principles Source fields to fill out.

It is possible to get it wrong while filling in the Does the FI screen customers and, for that reason make sure you take another look prior to deciding to send it in.

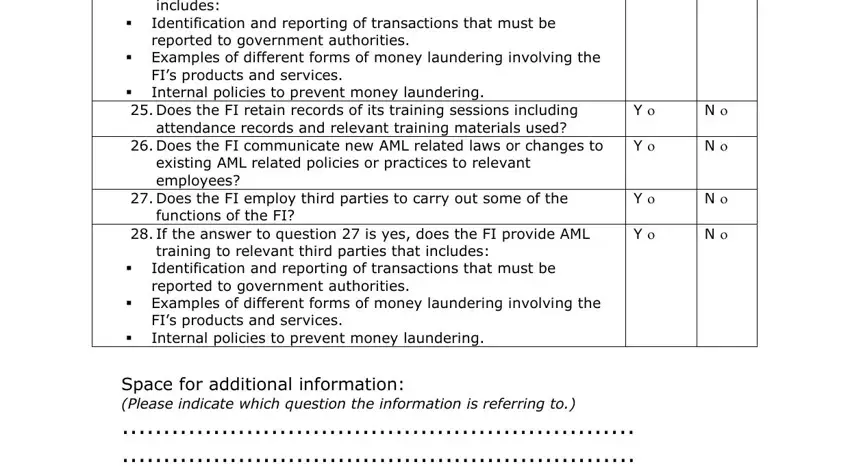

5. This pdf should be wrapped up by filling in this area. Further there's a full list of fields that require accurate information to allow your form usage to be accomplished: Does the FI employ third parties, functions of the FI, If the answer to question is yes, Does the FI communicate new AML, attendance records and relevant, existing AML related policies or, FIs products and services Internal, FIs products and services Internal, training to relevant third parties, includes Identification and, and Examples of different forms of.

Step 3: Ensure that the information is correct and then press "Done" to complete the project. Right after getting afree trial account with us, you will be able to download wolfsberg questionnaire 2018 or email it right off. The form will also be readily available from your personal cabinet with your every edit. Whenever you work with FormsPal, you can complete forms without being concerned about personal data incidents or data entries getting shared. Our protected system ensures that your personal information is stored safe.