Filling in world bank strequest is a breeze. Our experts developed our software to make it convenient to use and help you prepare any form online. Below are some steps you need to adhere to:

Step 1: You can click the orange "Get Form Now" button at the top of the following website page.

Step 2: When you have entered the world bank strequest edit page, you'll discover all actions it is possible to use regarding your file in the upper menu.

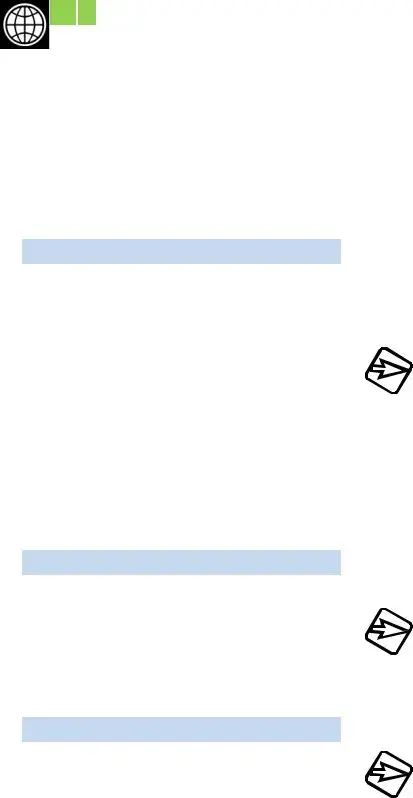

These sections will compose the PDF template that you will be filling out:

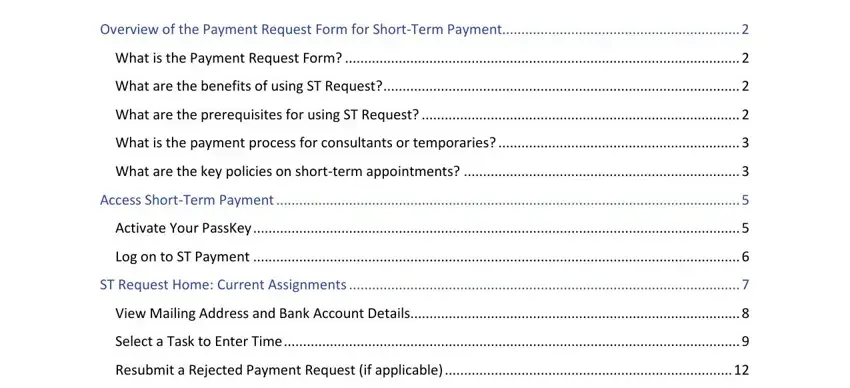

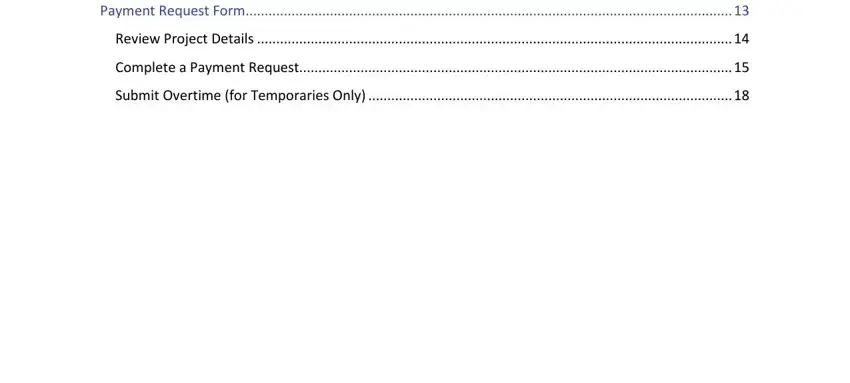

In the area Payment Request Form, Review Project Details, Complete a Payment Request, and Submit Overtime for Temporaries provide the details the system requests you to do.

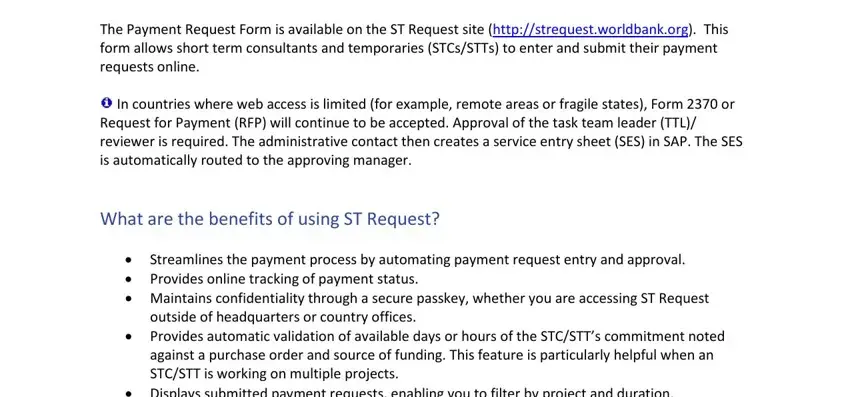

Remember to provide the fundamental data from the The Payment Request Form is, In countries where web access is, Request for Payment RFP will, What are the benefits of using ST, Streamlines the payment process, outside of headquarters or country, Provides automatic validation of, and Displays submitted payment area.

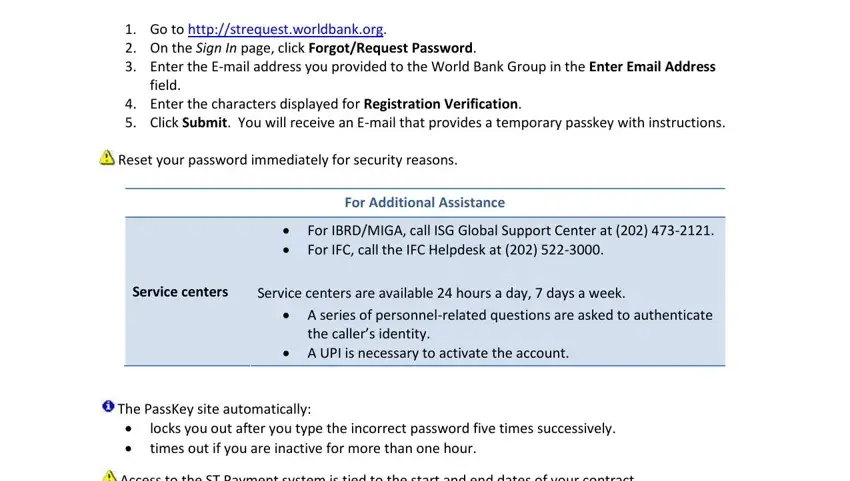

As part of section Go to httpstrequestworldbankorg, field, Enter the characters displayed, Reset your password immediately, For Additional Assistance, For IBRDMIGA call ISG Global, Service centers, Service centers are available, A series of personnelrelated, the callers identity, A UPI is necessary to activate, The PassKey site automatically, locks you out after you type the, and Access to the ST Payment system is, state the rights and responsibilities.

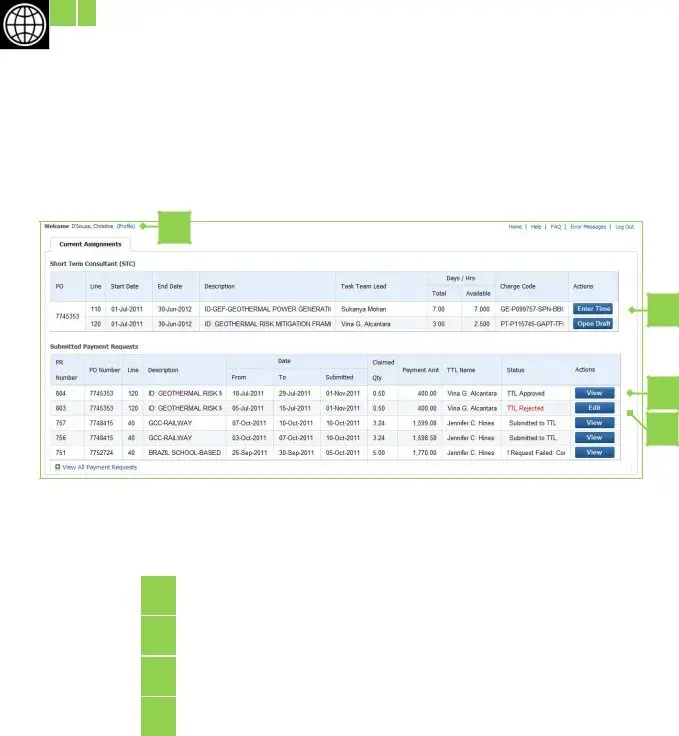

Prepare the file by analyzing all these areas: Verify mailing address and bank, Submit overtime for temporaries, For paymentrelated inquiries check, Access is tied to the start and, contract, Task Team Leaders TTLs or Reviewers, Can perform these tasks online, The intranet within the Bank IFC, or MIGA offices go to httpstrequest, External access from any PC or, Requires a passkey If you, and To log on as a TTLreviewer using.

Step 3: At the time you click on the Done button, your finalized document is simply exportable to each of your devices. Or, you might send it by using mail.

Step 4: Make a copy of any form. It will certainly save you some time and permit you to stay clear of worries in the future. By the way, your information is not distributed or analyzed by us.

Payment

Payment In countries where web access is limited (for example, remote areas or fragile states), Form 2370 or Request for Payment (RFP) will continue to be accepted. Approval of the task team leader (TTL)/ reviewer is required. The administrative contact then creates a service entry sheet (SES) in SAP. The SES is automatically routed to the approving manager.

In countries where web access is limited (for example, remote areas or fragile states), Form 2370 or Request for Payment (RFP) will continue to be accepted. Approval of the task team leader (TTL)/ reviewer is required. The administrative contact then creates a service entry sheet (SES) in SAP. The SES is automatically routed to the approving manager.

Payment

Payment Payments cannot be processed for any work done before the start date in the contract.

Payments cannot be processed for any work done before the start date in the contract.

Payment

Payment

Payment

Payment Reset your password immediately for security reasons.

Reset your password immediately for security reasons. The PassKey site automatically:

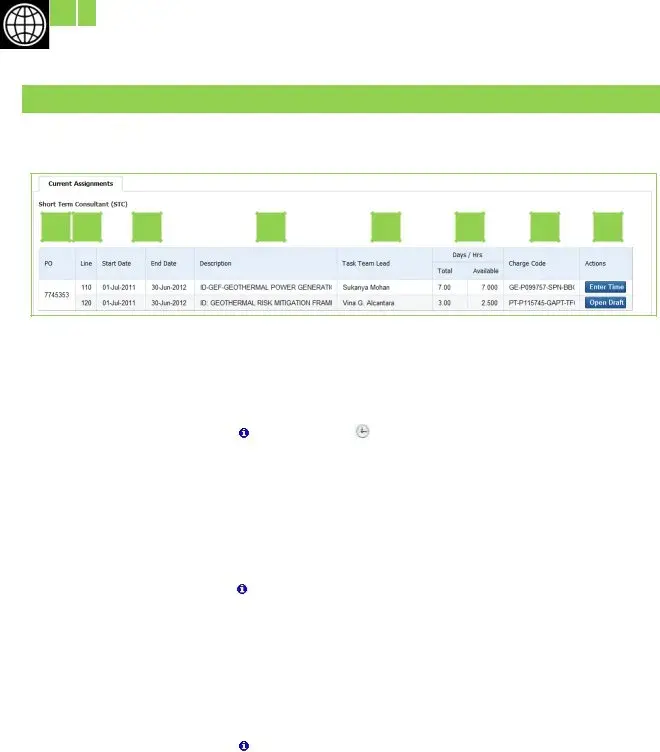

The PassKey site automatically: Access to the ST Payment system is tied to the start and end dates of your contract.

Access to the ST Payment system is tied to the start and end dates of your contract.

Payment

Payment Access is tied to the start and end dates of your contract.

Access is tied to the start and end dates of your contract.

Payment

Payment

Payment

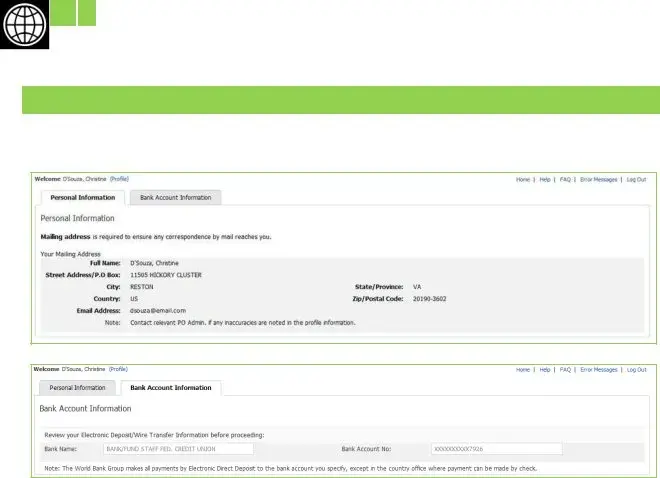

Payment For security reasons, the last four digits of your

For security reasons, the last four digits of your

Payment

Payment

Payment

Payment For additional information, check with the administrative contact listed in your Letter of Appointment.

For additional information, check with the administrative contact listed in your Letter of Appointment.