When you wish to fill out anthem enrollment form, you won't have to download any software - simply use our online tool. FormsPal team is aimed at giving you the ideal experience with our tool by regularly adding new capabilities and improvements. With all of these improvements, using our tool becomes easier than ever before! Here's what you will want to do to get going:

Step 1: First of all, open the pdf tool by clicking the "Get Form Button" in the top section of this site.

Step 2: Once you open the PDF editor, you'll notice the form ready to be completed. Aside from filling in various blanks, you may also perform some other things with the PDF, namely adding custom words, editing the initial textual content, inserting illustrations or photos, affixing your signature to the form, and a lot more.

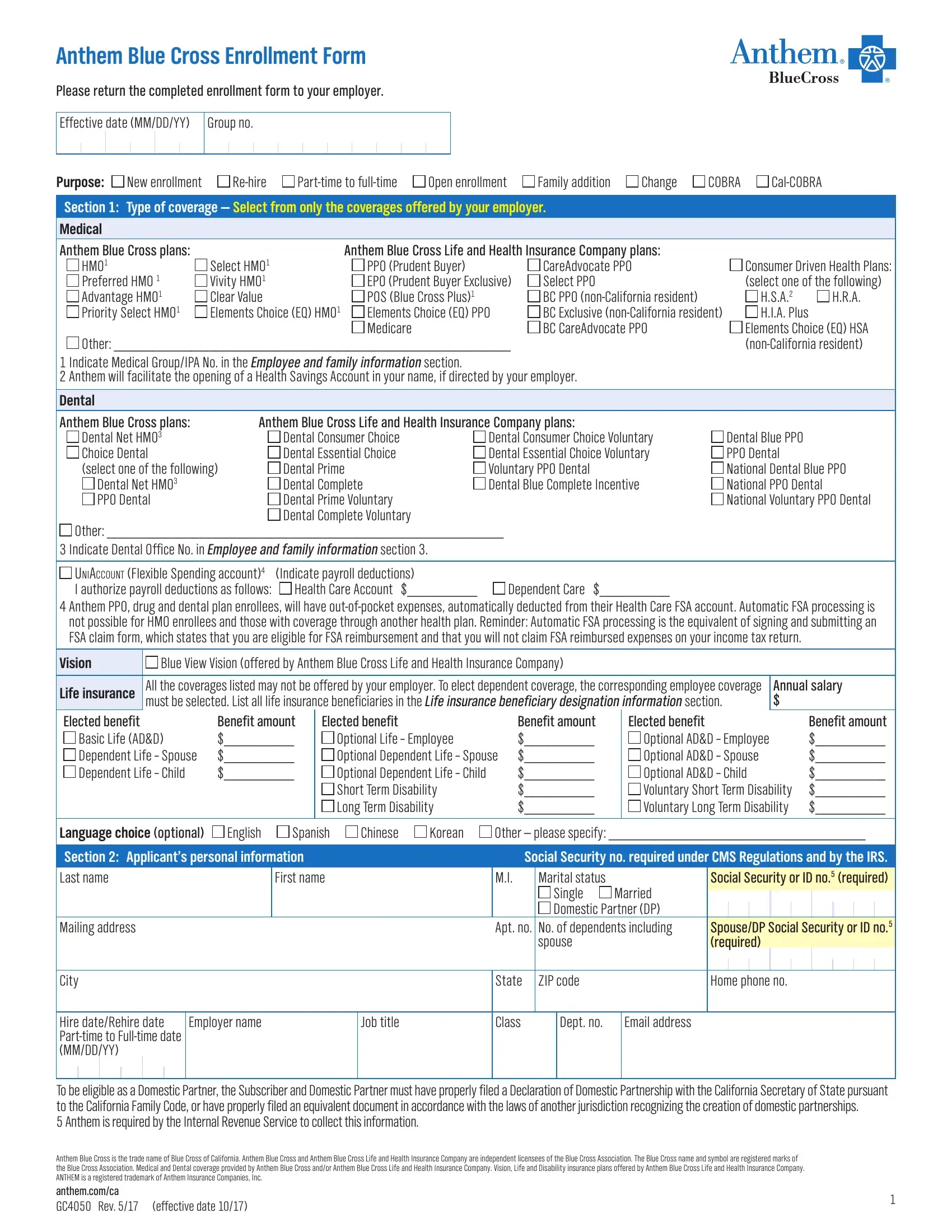

As for the blanks of this particular document, here is what you need to know:

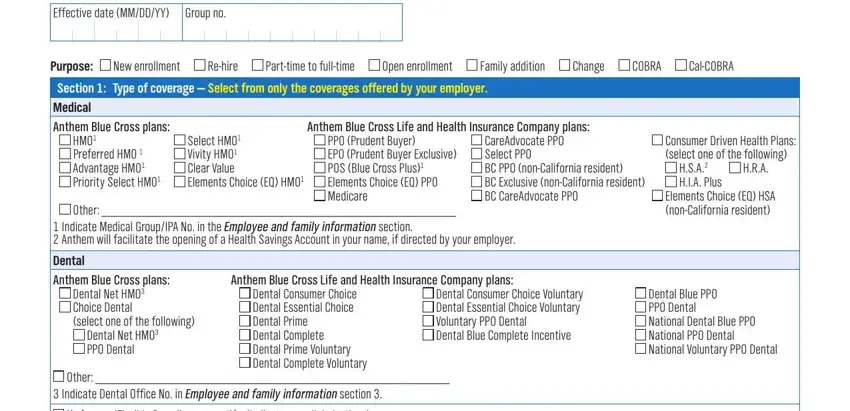

1. It's important to fill out the anthem enrollment form accurately, so pay close attention when filling in the areas comprising all of these blanks:

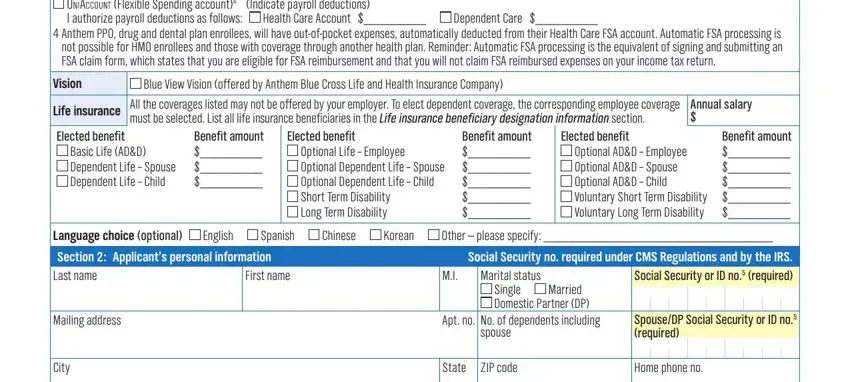

2. Once your current task is complete, take the next step – fill out all of these fields - UNIACCOUNT Flexible Spending, Health Care Account, Dependent Care, Anthem PPO drug and dental plan, Vision, Blue View Vision offered by Anthem, Life insurance, Elected benefit, Basic Life ADD Dependent Life, All the coverages listed may not, Annual salary, Benefit amount, Elected benefit, Optional Life Employee Optional, and Benefit amount with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Regarding Benefit amount and Life insurance, be certain you do everything properly here. Those two are certainly the most important ones in the document.

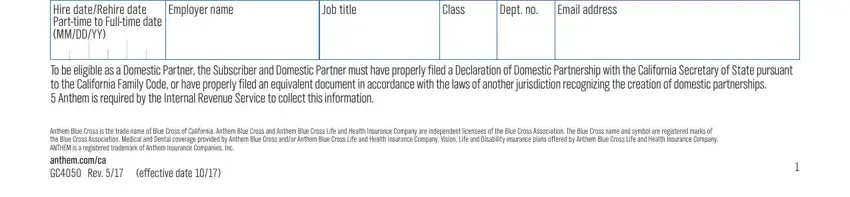

3. Completing Employer name, Job title, Class, Dept no, Email address, Hire dateRehire date Parttime to, To be eligible as a Domestic, Anthem Blue Cross is the trade, and effective date is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

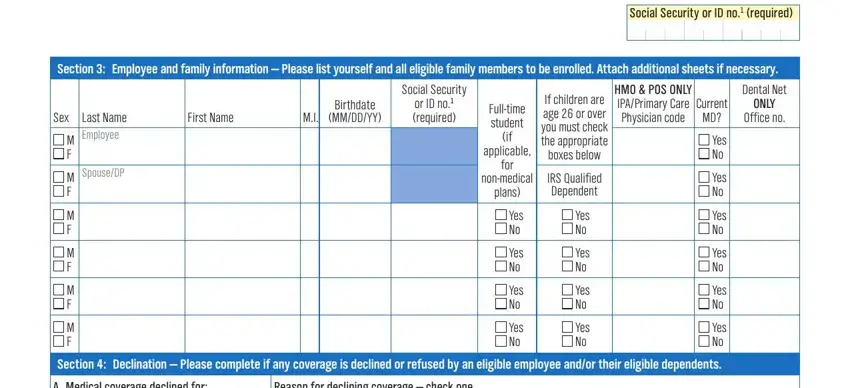

4. The fourth section comes next with the next few empty form fields to consider: Section Employee and family, Social Security or ID no required, Last Name Employee, SpouseDP, Sex, M F, M F, M F, M F, M F, M F, First Name, Birthdate MMDDYY, Social Security, and or ID no required.

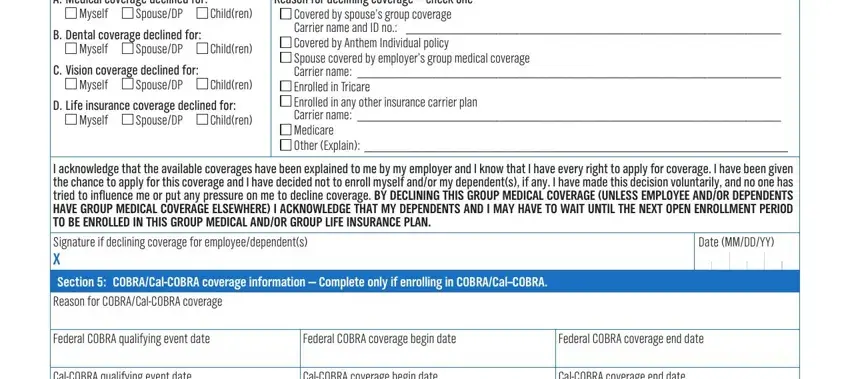

5. To finish your document, the last area has a couple of extra fields. Entering A Medical coverage declined for, Reason for declining coverage, Myself, SpouseDP, Children, B Dental coverage declined for, Myself, SpouseDP, Children, C Vision coverage declined for, Myself, SpouseDP, Children, D Life insurance coverage declined, and Myself will wrap up the process and you're going to be done very fast!

Step 3: Before finalizing this form, make certain that form fields were filled in right. When you believe it is all fine, click “Done." Get your anthem enrollment form the instant you register online for a free trial. Conveniently use the document from your personal cabinet, with any edits and adjustments conveniently preserved! We do not sell or share the details you type in while dealing with documents at our website.