Through the online editor for PDFs by FormsPal, you are able to complete or edit yonkers property tax here and now. Our editor is consistently developing to give the best user experience attainable, and that's because of our commitment to continual enhancement and listening closely to user opinions. Starting is simple! Everything you should do is follow these easy steps below:

Step 1: Click the "Get Form" button above. It will open our pdf tool so you can begin filling out your form.

Step 2: With this advanced PDF tool, it's possible to accomplish more than merely complete blank form fields. Try all of the functions and make your documents seem sublime with customized textual content added, or tweak the file's original input to perfection - all accompanied by an ability to insert your own images and sign the PDF off.

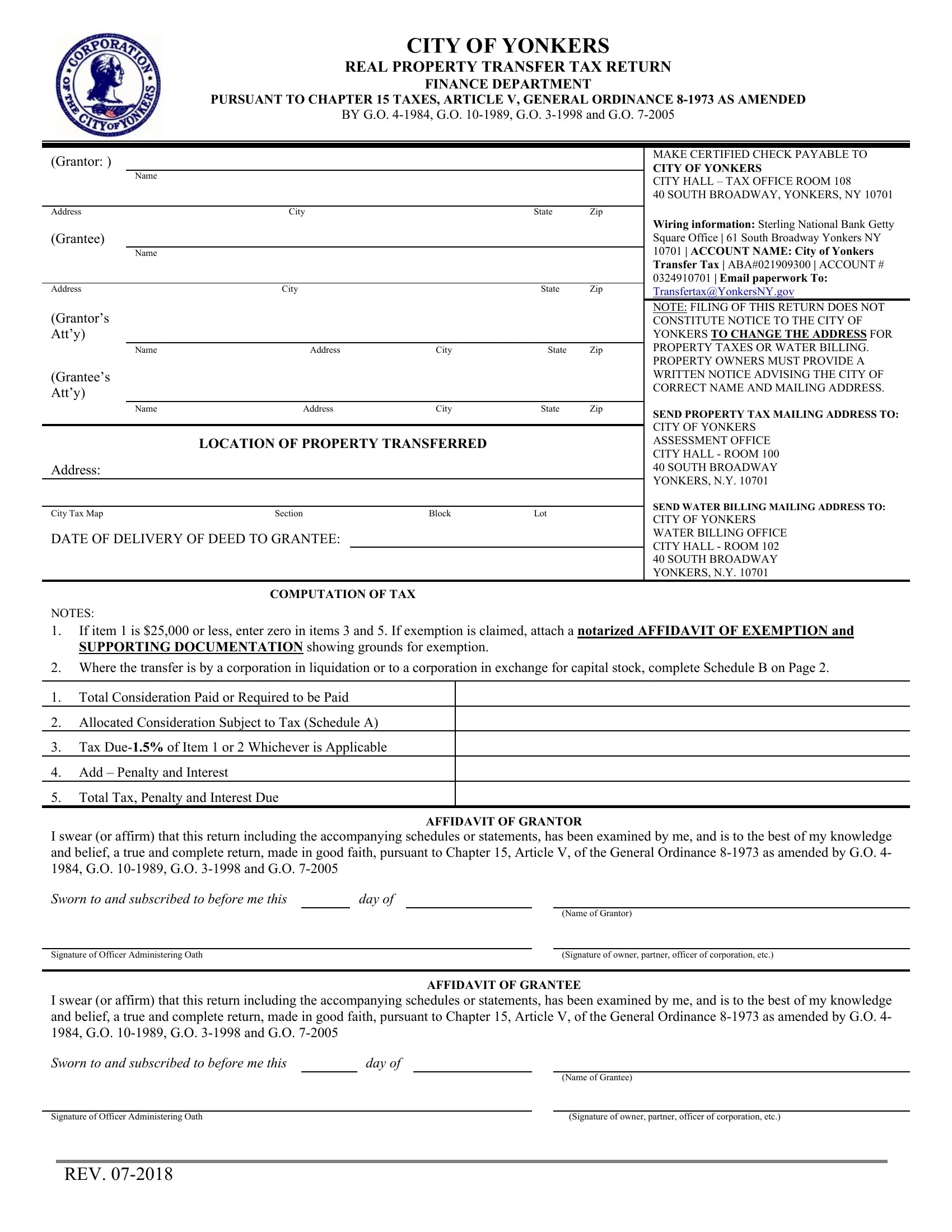

As for the fields of this particular form, this is what you should do:

1. The yonkers property tax requires specific details to be entered. Ensure the following fields are complete:

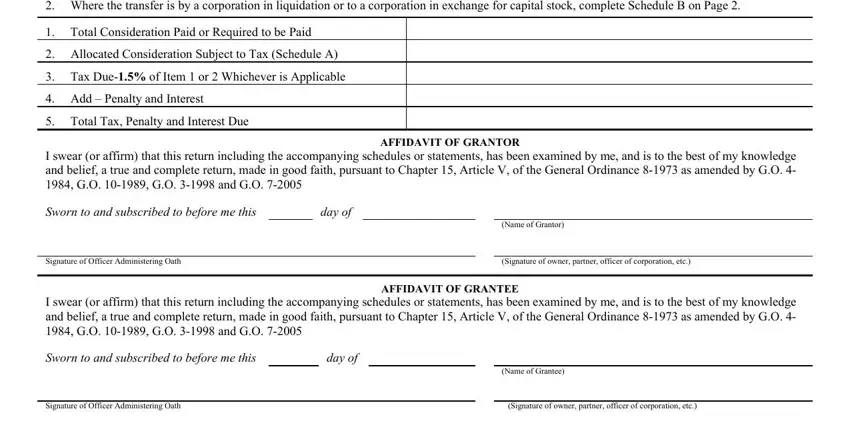

2. Immediately after the prior array of fields is done, go on to type in the applicable information in these: Where the transfer is by a, Total Consideration Paid or, Allocated Consideration Subject, Tax Due of Item or Whichever is, Add Penalty and Interest, Total Tax Penalty and Interest Due, I swear or affirm that this return, AFFIDAVIT OF GRANTOR, Sworn to and subscribed to before, day of, Signature of Officer Administering, Name of Grantor, Signature of owner partner officer, I swear or affirm that this return, and AFFIDAVIT OF GRANTEE.

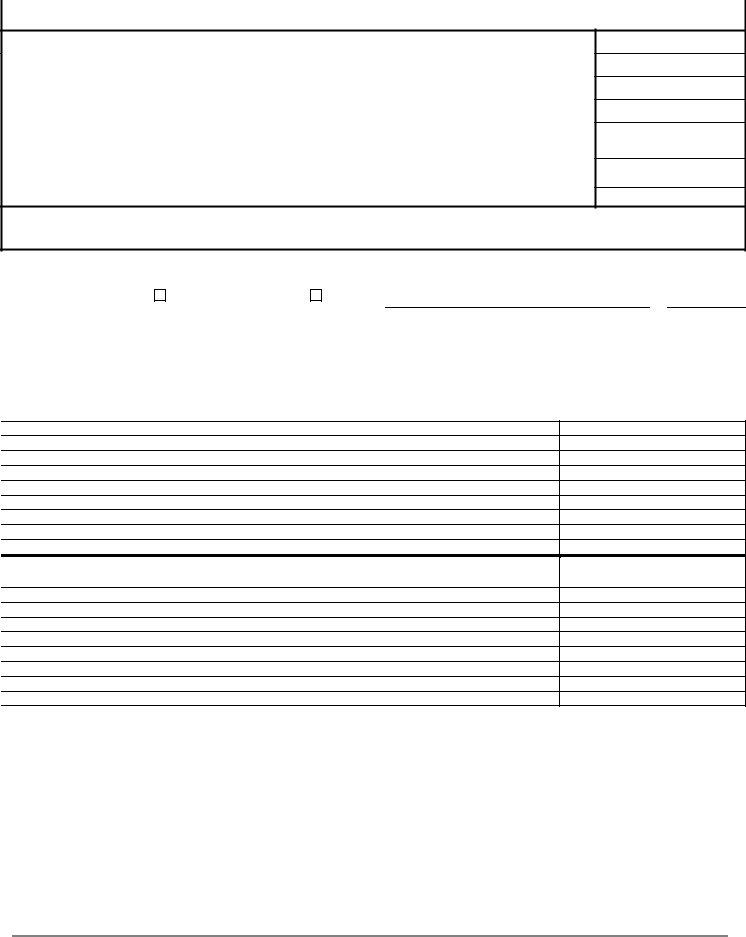

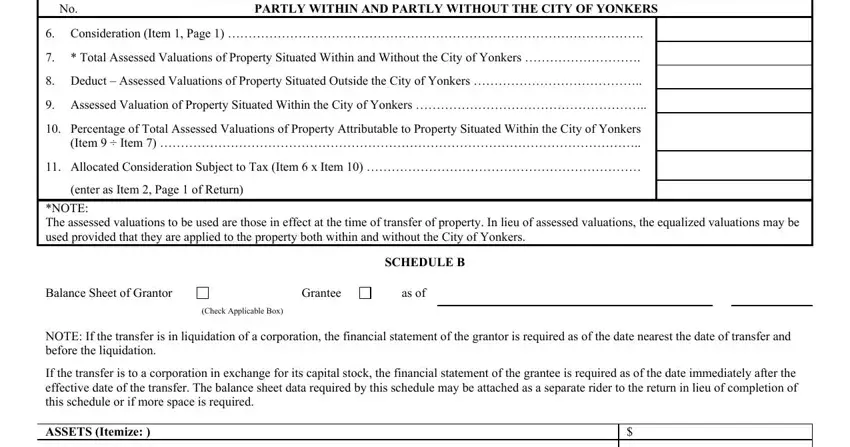

3. This next step is pretty simple, Item No, ALLOCATION OF CONSIDERATION WHERE, PARTLY WITHIN AND PARTLY WITHOUT, Consideration Item Page, Total Assessed Valuations of, Deduct Assessed Valuations of, Assessed Valuation of Property, Percentage of Total Assessed, Allocated Consideration Subject, enter as Item Page of Return, NOTE The assessed valuations to be, SCHEDULE B, Balance Sheet of Grantor, Grantee, and as of - each one of these fields has to be filled in here.

People often make errors while completing ALLOCATION OF CONSIDERATION WHERE in this section. Ensure that you double-check what you enter right here.

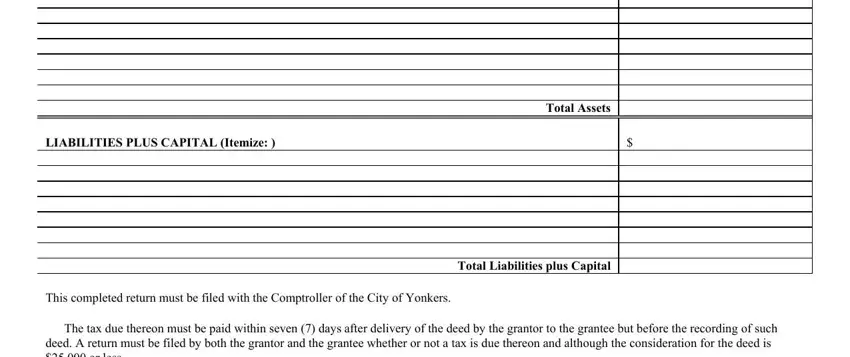

4. This next section requires some additional information. Ensure you complete all the necessary fields - If the transfer is to a, Total Assets, LIABILITIES PLUS CAPITAL Itemize, This completed return must be, Total Liabilities plus Capital, and The tax due thereon must be paid - to proceed further in your process!

Step 3: Prior to moving on, it's a good idea to ensure that all blanks are filled in right. Once you believe it is all good, click “Done." Right after getting afree trial account with us, you will be able to download yonkers property tax or email it promptly. The PDF will also be available through your personal account menu with your every single change. FormsPal offers safe form completion with no personal information record-keeping or any sort of sharing. Be assured that your information is in good hands here!