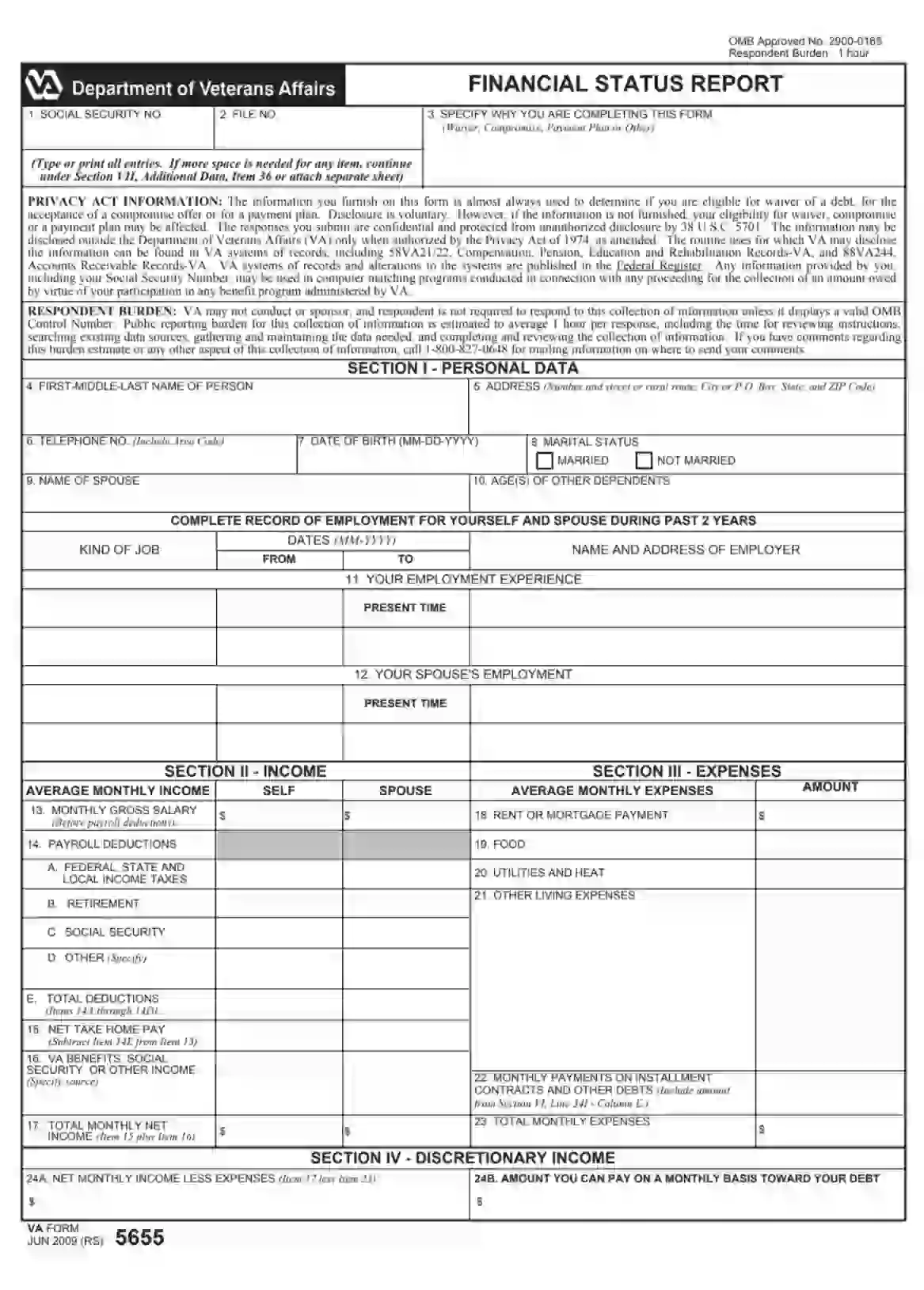

VA Form 5655, titled “Financial Status Report,” is typically required when a veteran needs to establish their eligibility for certain types of benefits or when negotiating a payment plan for existing VA debts. It collects comprehensive data about the veteran’s income, expenses, assets, and liabilities. The information provided helps the VA to assess the veteran’s financial situation thoroughly, which is crucial for determining qualifications for waiver requests of debts, entitlement to certain pensions, or participation in specific payment plans. This form plays a significant role in ensuring that veterans receive appropriate financial considerations based on their current economic status.

Other VA Forms

If you would like find more VA documents you can edit and fill in here, here are several of the forms searched often by our visitors. Besides that, do not forget that you can easily upload, fill out, and edit any PDF form at FormsPal.

Filling Out Financial Status Report VA Form 5655

We encourage you to use our illustrated guide to avoid challenges while completing the respected form. Begin with generating an up-to-date PDF file using our advanced software. The document should be completed in a type or print manner. Also, if the declarant needs extra space, they can use additional sheets and file the attachments with Form 5655 or express the ideas in Unit 36 Part VII of the respected report.

Through this form, the Department of Veterans Affairs determines whether the declarant is qualified for debt exemption, acceptance of a compromise, or a payment program. Though providing the information is not mandatory or enforceable, renunciation of submitting the requested data may affect the adjudge. If the declarant is purposefully entering false info, they can become subject to penalties, including imprisonment and fines. The disclosure of the data is strictly confidential and protected by law.

- Submit SSN

In the first Unit of the respected VA Form 5655, the declarant should enter their Social Security number.

- Enter File Number

Here, you need to submit your VA file number. Often this data correlates with the SSN. Blank 5655 Forms appear to be attachments that the Debt Management Center (DMC) serves to the debtors. Thus, the declarant can check their File number in the top right corner of the letters.

- Describe the Purpose

In Unit 3, the debtor should explain the purpose of completing VA Form 5655. Select from the suggested alternatives or shortly describe the idea in a free format.

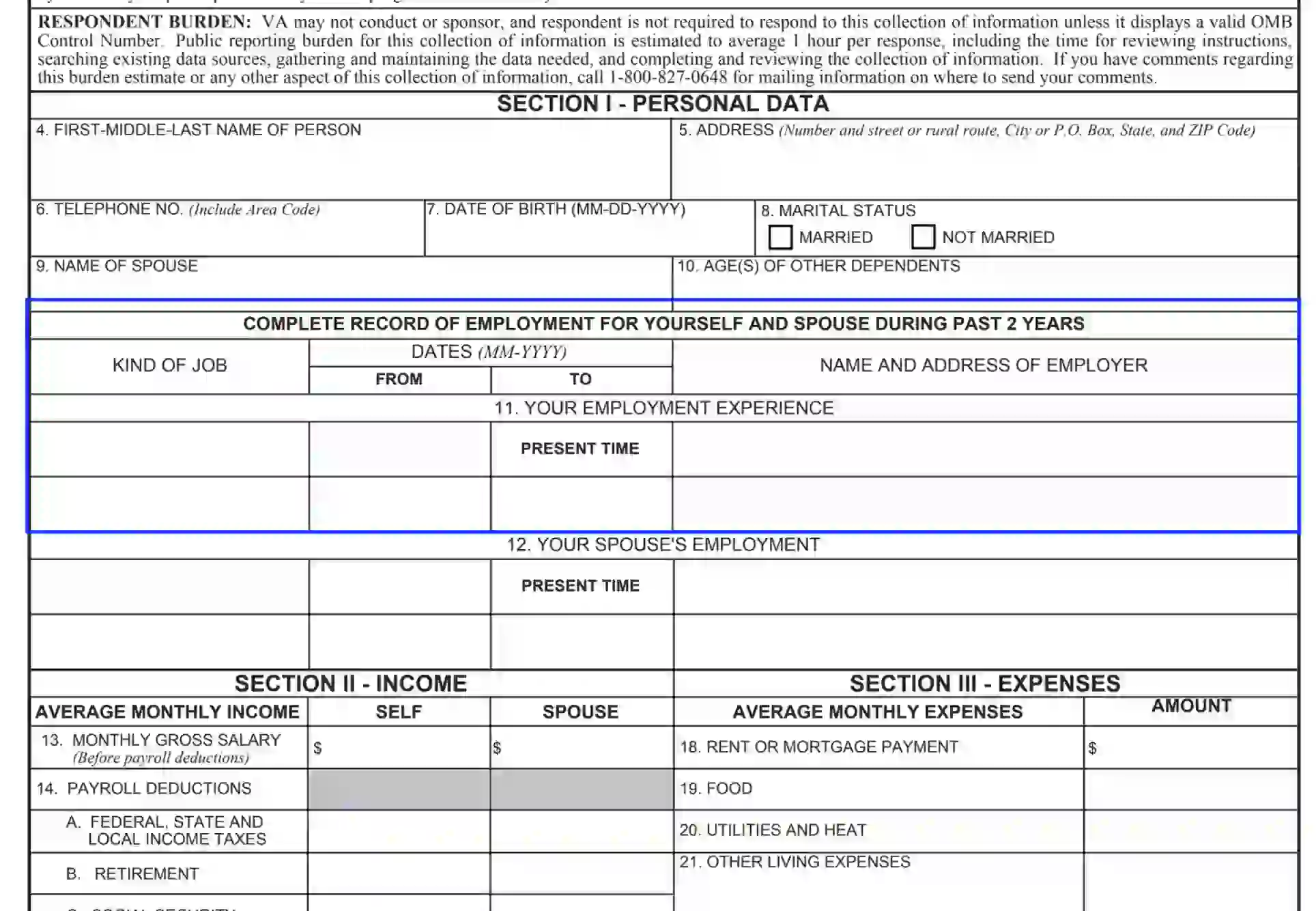

- Introduce Yourself

In this section, the declarant needs to provide the required information regarding their identification and marital status:

- First and last name, including middle initials (if appropriate)

- Living address, including the street and apartment (room) number, city, state, and ZIP. You can also enter the P. O. box.

- Contact phone number and area code

- Birthdate in a month-day-year format

- Married or not — checkbox the appropriate variant.

- If married, enter the spouse’s name.

- List all dependents, including their age, in your household (if any).

- Describe Your Employment Background

In this Unit, the debtor should list the employment history for the past two years. Use extra space in Unit 36 or an additional sheet of paper if needed. Provide the following info:

- Type of job

- Effective period

- Employer details, including the name and location

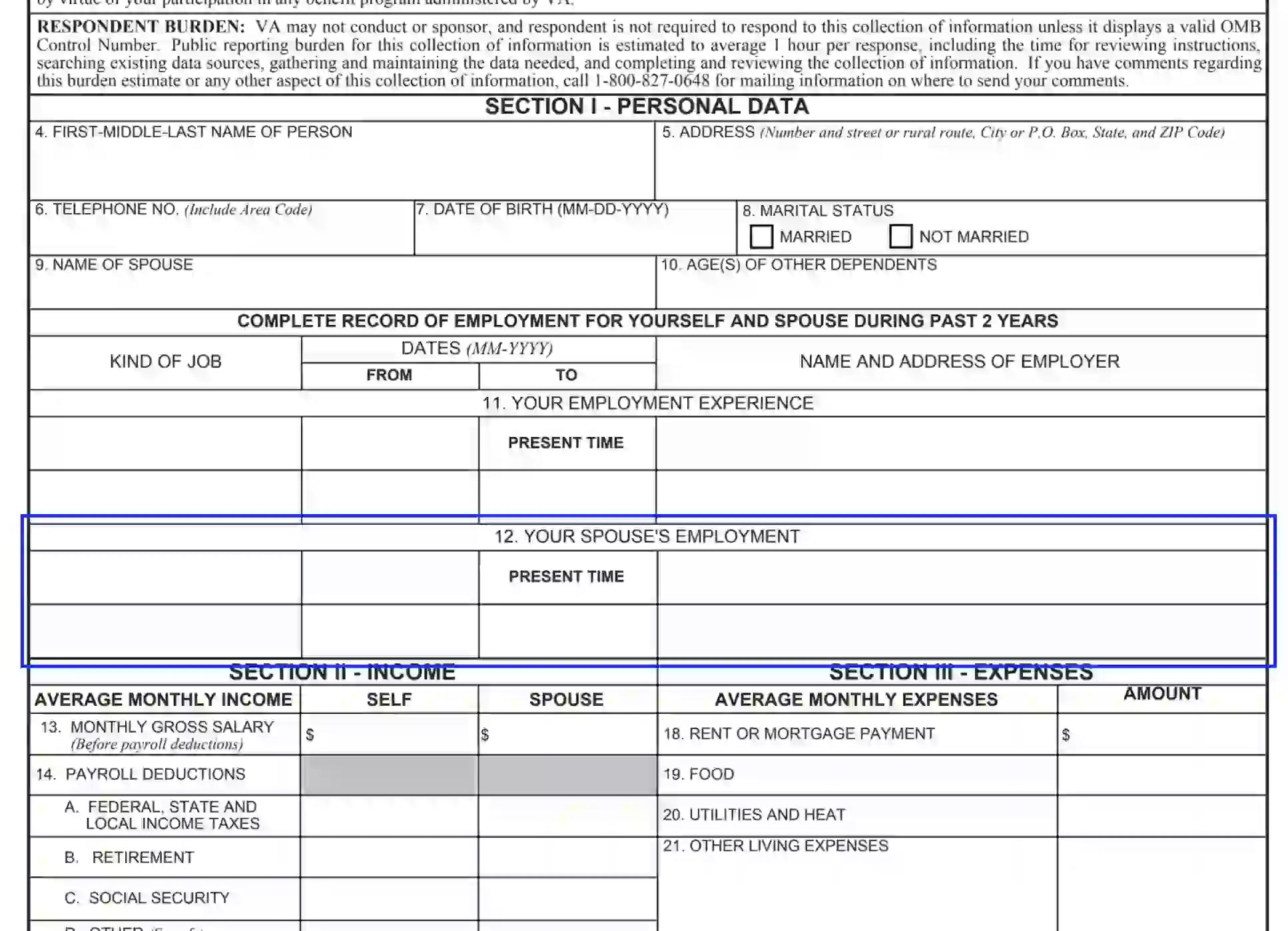

- Specify the Spouse’s Employment Background

Similar to the previous section, here, you need to list your spouse’s jobs for the past two years. Follow the requirements of the table and enter the relevant data.

- Submit the Income Details

In this Unit, the declarant needs to list their and their spouse’s income sources in USD. Make sure to submit the following data:

- Gross Income per month

- Payroll payments

- Taxes

- Retirement and Social Security charges

- Total deductions should be calculated by summing 14A through14D.

- Net Take Home pay

- VA privileges and other types of refunds

- Total Net per month should be calculated by summing Unit 15 and Unit 16.

The Department of Veterans Affairs requires this information to understand the declarant’s ability to pay the debt every month. If you have part-time employment, you are encouraged to list your average income. Should you have any challenges regarding the income aspect, you can search for assistance on the governmental VA website in the FAQs section.

- Describe Your Expenses

In Units 18-23, the declarant should submit their household expenses. Fill out the table and include the following costs in USD:

- Shelter payments, including rent and mortgage

- Nutrition expences

- Community utilities

- Other living costs and expenses

- Other contract expenses

- Total expenses

- Calculate the Discretionary Income

In Unit 24A, you should submit the difference between total income and total expenses. Consider the aforementioned amount and specify how much you can pay monthly to cover the VA debt. Record the amount in Unit 24B.

- List Your Personal Assets

The section covers Units 25-33, where the debtor needs to list all private properties, accounts, and assets. The section can comprise the following aspects:

- Savings, accounts, and loans

- Cash on hand

- Vehicles

Here you need to list the automobiles, including the year, make, and model. Also, include watercraft, trailers, or campers (if any).

- Stocks and bonds

- Real estate property

- Other personal estates

Estimate your assets relying on the fair market price in your location and record the numbers. In Unit 33, indicate the total evaluation amount.

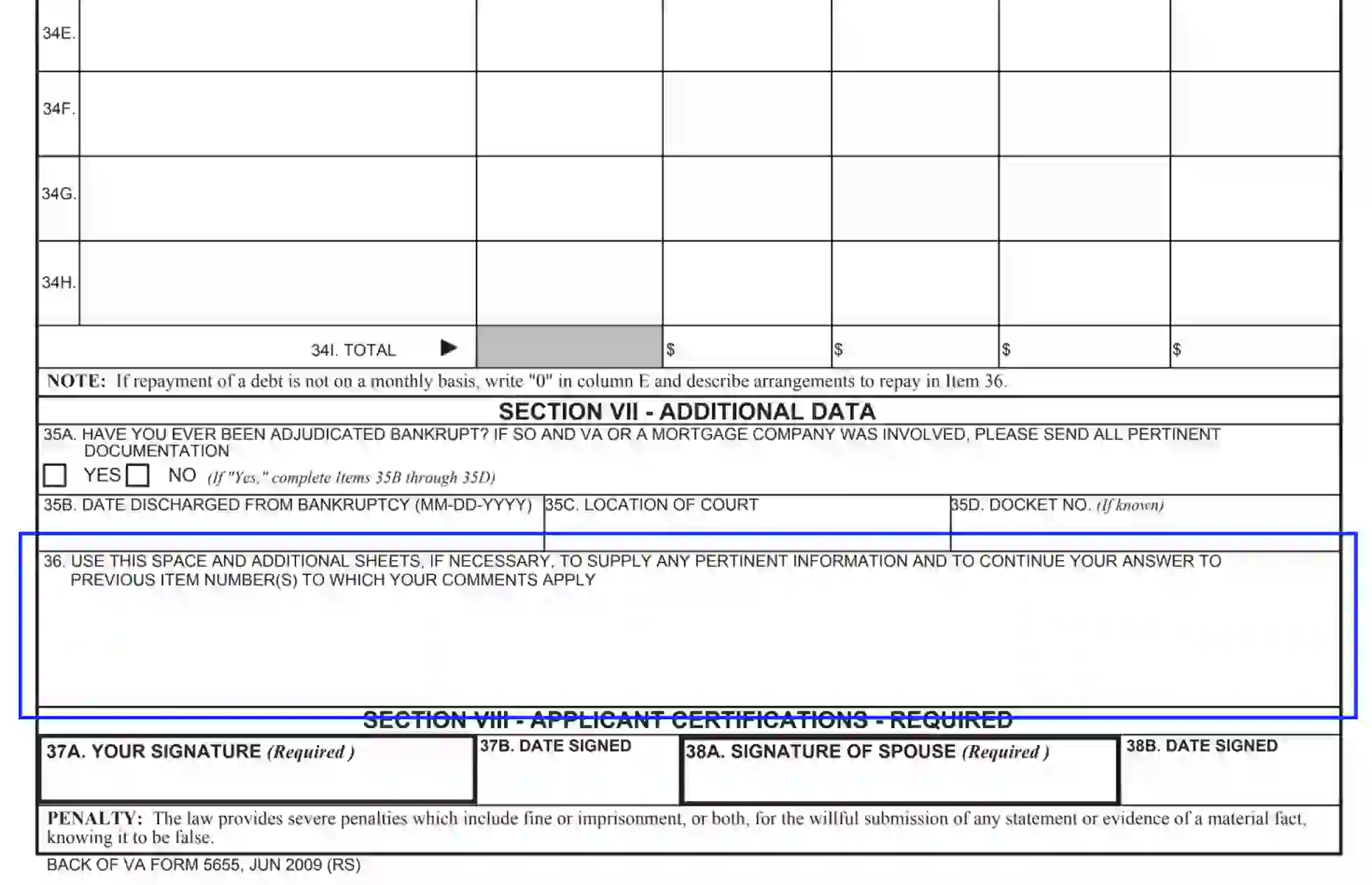

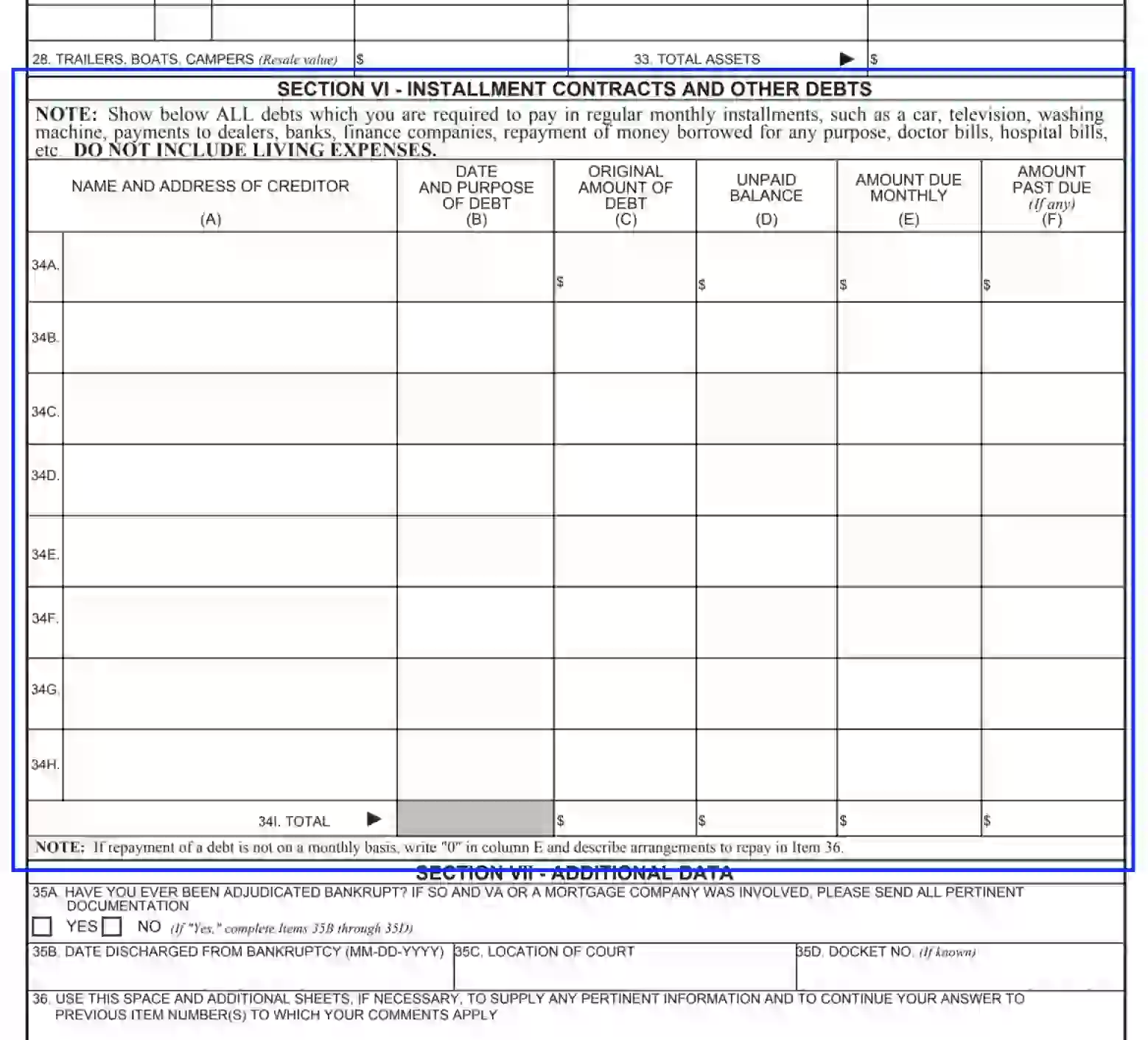

- Declare Your Installment Contracts

In this part, the declarant should speak about their installment contracts and other liabilities they need to pay each month. Follow the requirements of the table and list the data:

- Creditor’s name and address

- Purpose of the credit

- Amount credited

- Unpaid balance

- Payments per month

- Past due amounts

After you report the liabilities and contract debts, you need to calculate and submit the total in Unit 34-I for each column. The declarants should include such expenses as medicare bills, car credits, household assets, refunds to banks and other creditors. It is worth noting that if any repayment is on a different but monthly basis, the declarant needs to insert “0” (zero) in column E and input the date later in Unit 36.

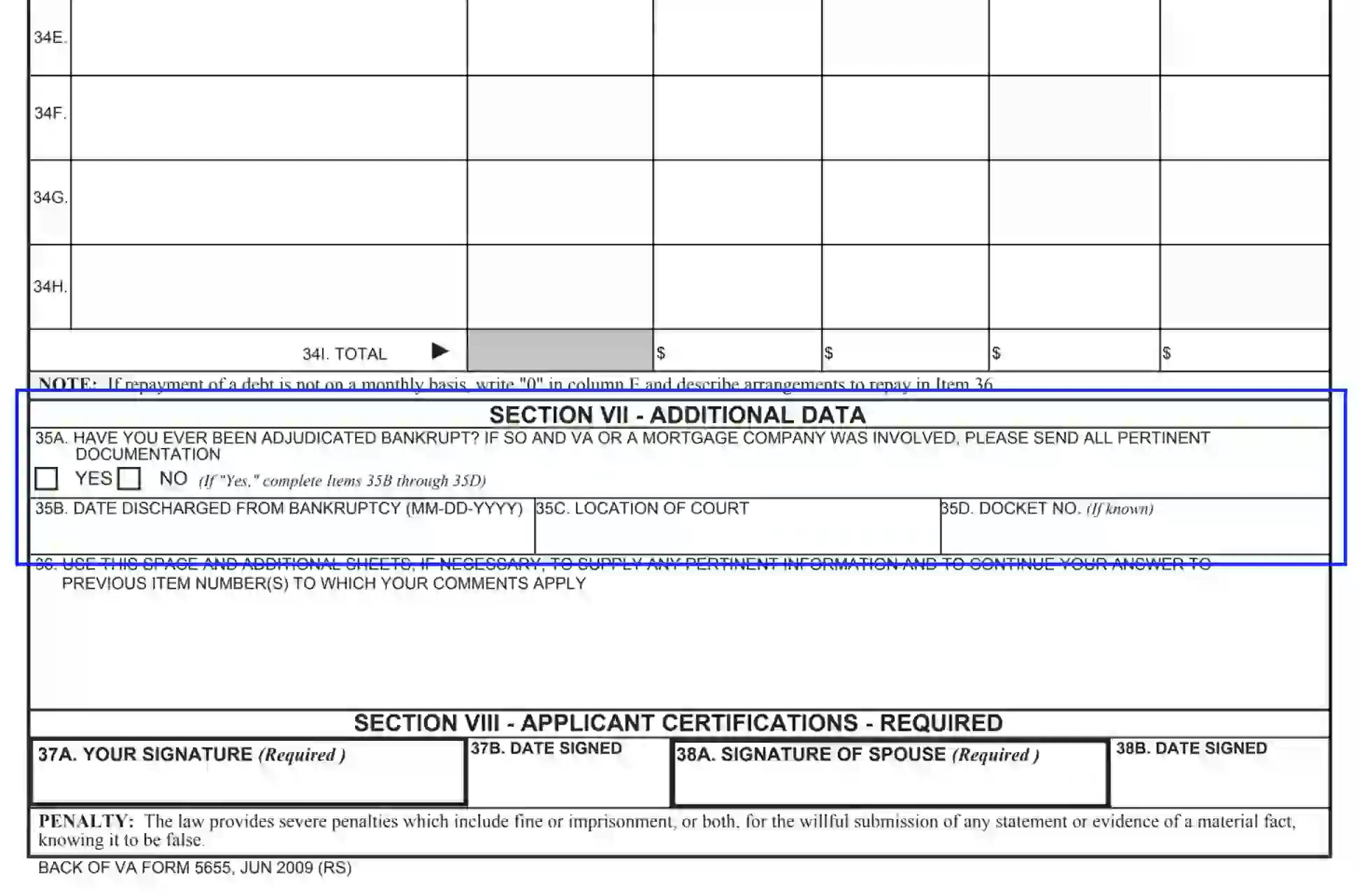

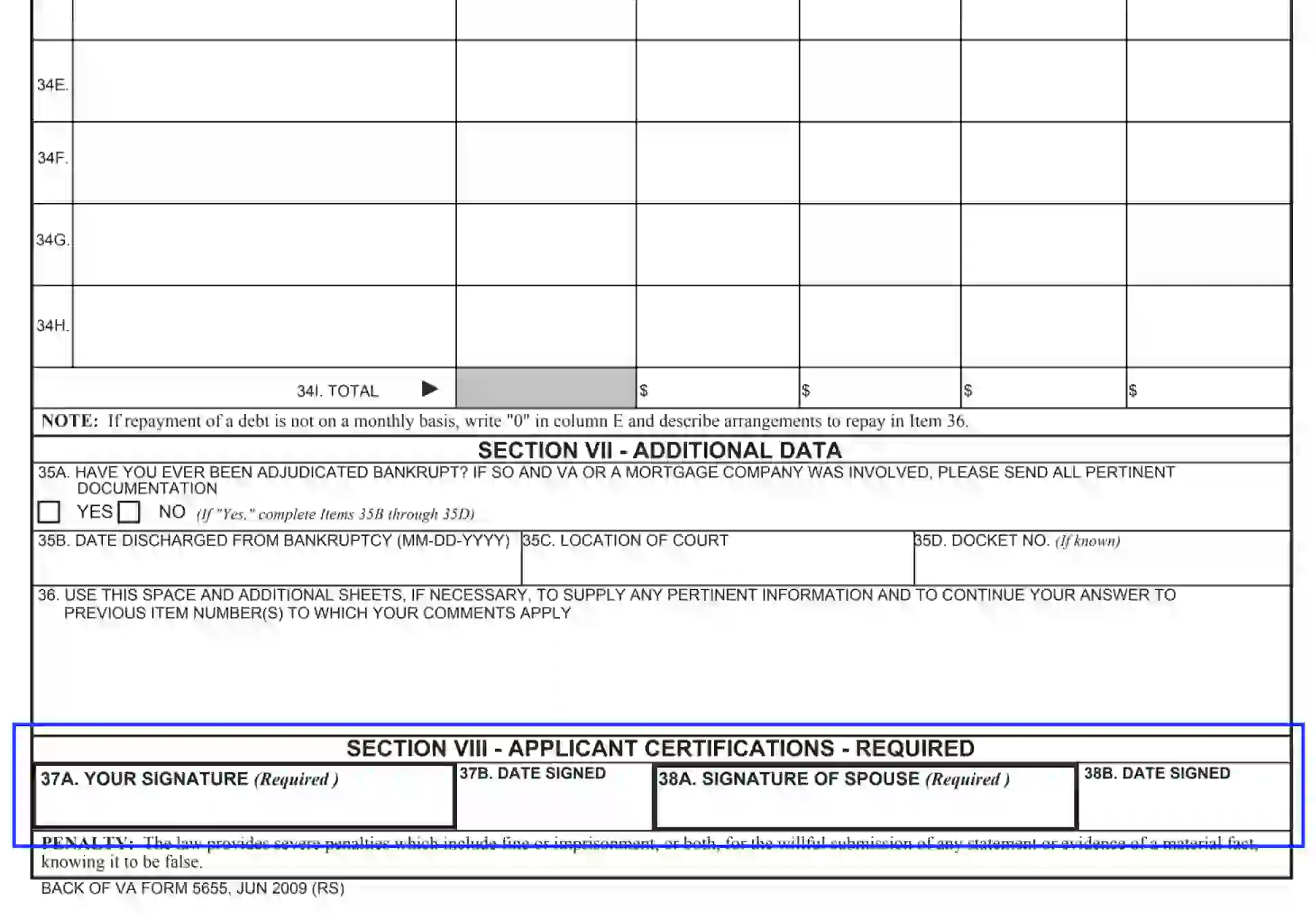

- Submit Bankruptcy Details

If the declarant has ever been recognized as a bankrupt involving VA or other contract organization assets, they need to checkbox the “Yes” slot and provide details in Units 35 B through D.

- Authorize the VA Form 5655

To authorize the document, both the declarant and their spouse should append signatures and place the current calendar date.

- Report VA Form 5655

After the paper is filled out and authorized, you need to file it with the Debt Management Center of DVA. Serve the form by mail to P.O. Box 11930, St. Paul, MN 55111 or by fax to 1-612-970-5688.