To transfer some or all of your authority over tax matters, you will need to use the Arizona Tax Power of Attorney form. The Arizona Revised Statutes regulate taxation in Arizona. Arizona Department of Revenue (ADOR) is the central state authority responsible for resolving tax matters and issuing all kinds of legal documents.

Before proceeding to the fillable power of attorney form, let us get acquainted with the local legal procedures and peculiarities. Usually, preparers deal with all tax-related issues. They are specialists responsible for:

- Ensuring accurate tax returns

- Completion of forms

- Excecutingrepresentation during tax-related hearings.

You might need a preparer to take care of all proceedings and ensure that your documents comply with the existing requirements. The ADOR has an electronic filing system that makes the whole process much simpler. Yet, according to the revised legislation, the Department retains the right to decline your electronic filing. Preparers are familiar with the order and will do the work more efficiently. But to use the preparer’s services, you need to assign them the authority to act on your behalf in tax matters.

Find out all the Arizona POA documents you can use by following this link to our Arizona guide.

Any tax report contains confidential information. Therefore, this particular sphere of socio-economic relations, including the transfer of authority, is regulated differently. You can transfer your powers over tax matters to a specialist using the State of Arizona Office of Administrative Hearings Supplemental Power of Attorney (Form 01-5414). The purpose of this document is to allow the appointed representative access to the taxpayer’s records and take action on the contested matter.

ADOR has transferred its authority to resolve tax cases to the state Office of Administrative Hearings. Thus, the Arizona Statutes make it obligatory to provide written authorization before the Office of Administrative Hearings reveals confidential tax data.

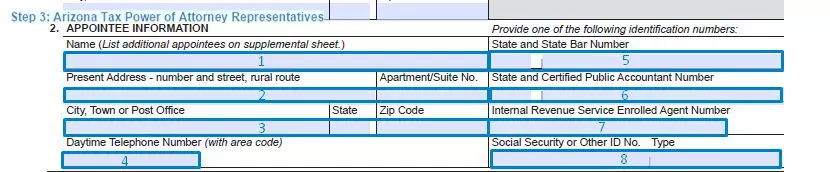

For personal income matters, use the Arizona Individual Income Tax Disclosure/Representation Authorization Form (285-I). This document allows the principal to delegate some or all of their power over tax matters to an appointed agent in case of incapacitation.

Arizona Tax Power of Attorney Form Details

| Document Name | Arizona Tax Power of Attorney Form |

| State Form Name | Arizona Form 285-I |

| Relevant Link | Arizona Department of Revenue |

| Where to File? | Arizona Department of Revenue Individual Income Tax Section 1600 W. Monroe Phoenix, AZ 85007 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 36 |

| Available Formats | Adobe PDF |

Filling Out Arizona Tax POA Form

You may find and download the Arizona Tax Power of Attorney form on the official website of the Department of Revenue. But for your convenience, we suggest using our software tools to build and download the template.

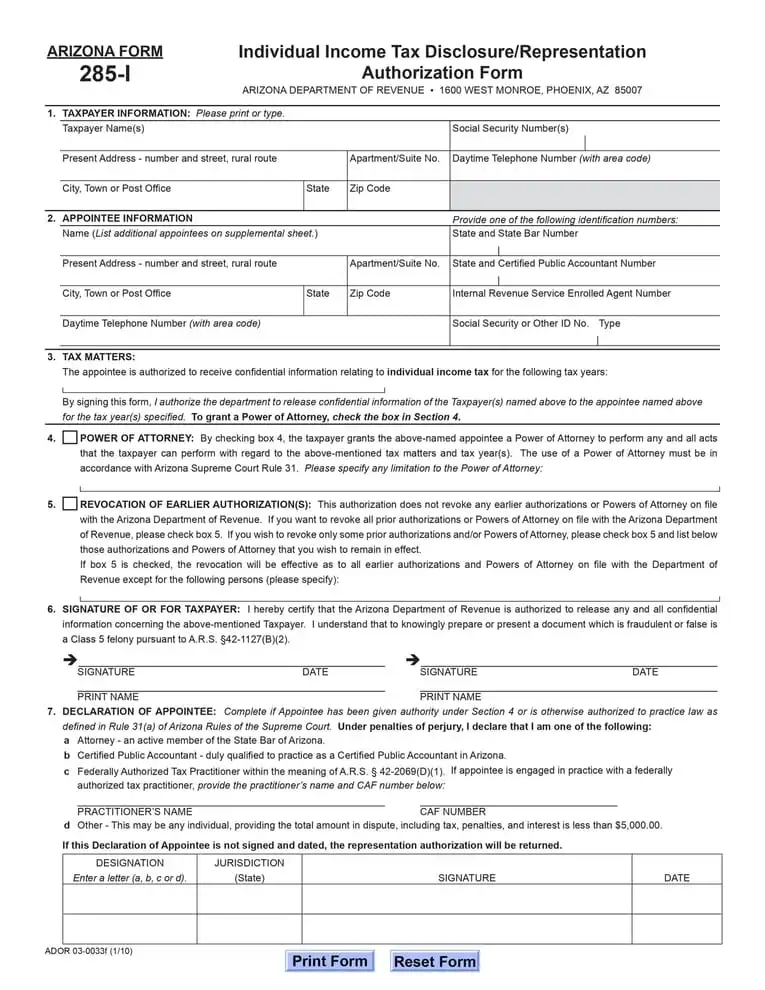

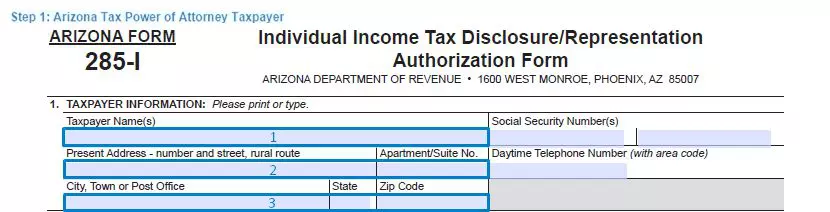

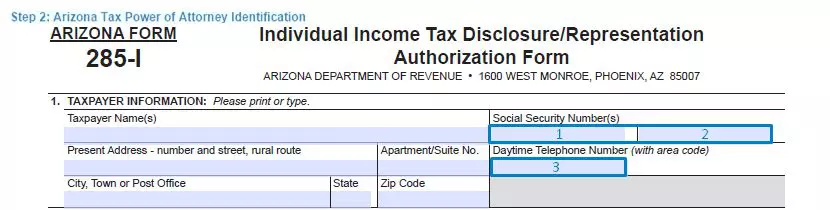

Please, take a look at the guidelines on filling out the POA form below:

1. Start filling out the form by inserting the taxpayer’s information. Enter the name and physical address, including state, city, and zip code. Leave your daytime contact number at the top right corner of the first section.

2. Section two requires corresponding identification information. Insert your Arizona transaction privilege tax number, Federal employer identification number, and Social Security number. If any of these is missing, just put a dash in the box.

3. The next step is filling in information regarding the taxpayer’s legal representatives. Enter the name and physical address of the potential representative. In the next column, insert their ID number and contact information (telephone number and fax number). If there is more than one representative, enter their personal data, too.

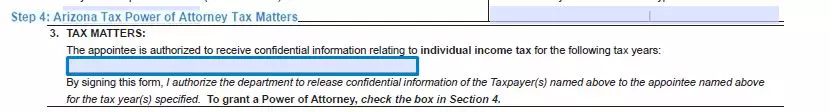

4. Identify the tax matters that the representatives get to decide over. Tick the corresponding boxes to do that. Pick Transaction Privilege Tax, Use, or Other Specific Tax Type and indicate the enterprise type (Sole Proprietorship, Corporation, or Partnership). Fill in the case numbers in the last column.

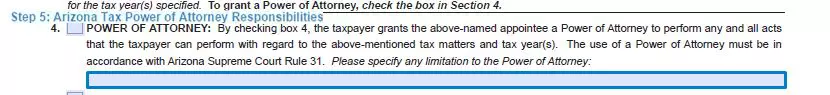

5. Section five provides for a full list of responsibilities that the legal representatives obtain upon the form authorization. If you would like to restrict the representatives’ authority, write them down in the blank spaces.

6. Pick the way of communication and the recipient of the notices. You can indicate either one of your representatives or two, but not more. Tick the corresponding box for your answer.

7. The taxpayer’s appointee(s) have to verify the document as a sign of their consent. Pay special attention to this section. Only the signature of the Attorney-in-Fact is required. Without proper verification, the document will not be accepted.

All legal representatives will have to put down their printed names, signatures, and titles (if applicable). By expressing their consent, the representatives confirm that the state Director of Administrative Hearings Office can release confidential information on the concerned tax matters and is not liable for this action.

Upon completion, you will need to mail the signed form to the state Office of Administrative Hearings. You will find the necessary address at the bottom of the second page of your form.