Illinois General Financial Power of Attorney Form

The Illinois general financial power of attorney is a legal document that grants one person, known as the agent or attorney-in-fact, the authority to act on behalf of another person, known as the principal. This power can include managing financial affairs, making business decisions, and handling personal matters.

Unlike a limited version that restricts the agent’s authority, a general power of attorney typically grants expansive rights to oversee the principal’s financial and business matters. At the same time, the agent must act in the principal’s best interest, maintain accurate records, keep the principal’s property separate from their own, and avoid conflicts of interest.

The general power of attorney is essential for estate planning, ensuring your affairs are managed as you wish. By the way, you can get Illinois power of attorney forms online to ensure you meet all legal requirements for granting the authority to manage your affairs.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

In Idaho, the laws governing a general power of attorney are outlined under the Illinois Power of Attorney Act (755 ILCS 45). This legal framework allows an agent to act on the principal’s behalf, with extensive authority, as specified in the power of attorney agreement. This authority includes various activities, from financial decisions to daily business operations. Signing requirements include:

- Acknowledgment by at least one witness; a second witness is optional.

- Notarization by a notary public (755 ILCS 45/3-3).

Meeting these legal requirements establishes a power of attorney as valid, allowing the agent to oversee all matters effectively. Also, the principal can revoke a power of attorney form at any time as long as they are competent. Additionally, the authority granted through a general power of attorney automatically ends upon the principal’s death.

Illinois General Power of Attorney Form Details

| Document Name | Illinois General Power of Attorney Form |

| Other Name | Illinois Financial Power of Attorney |

| Relevant Laws | 755 ILCS 45 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 41 |

| Available Formats | Adobe PDF |

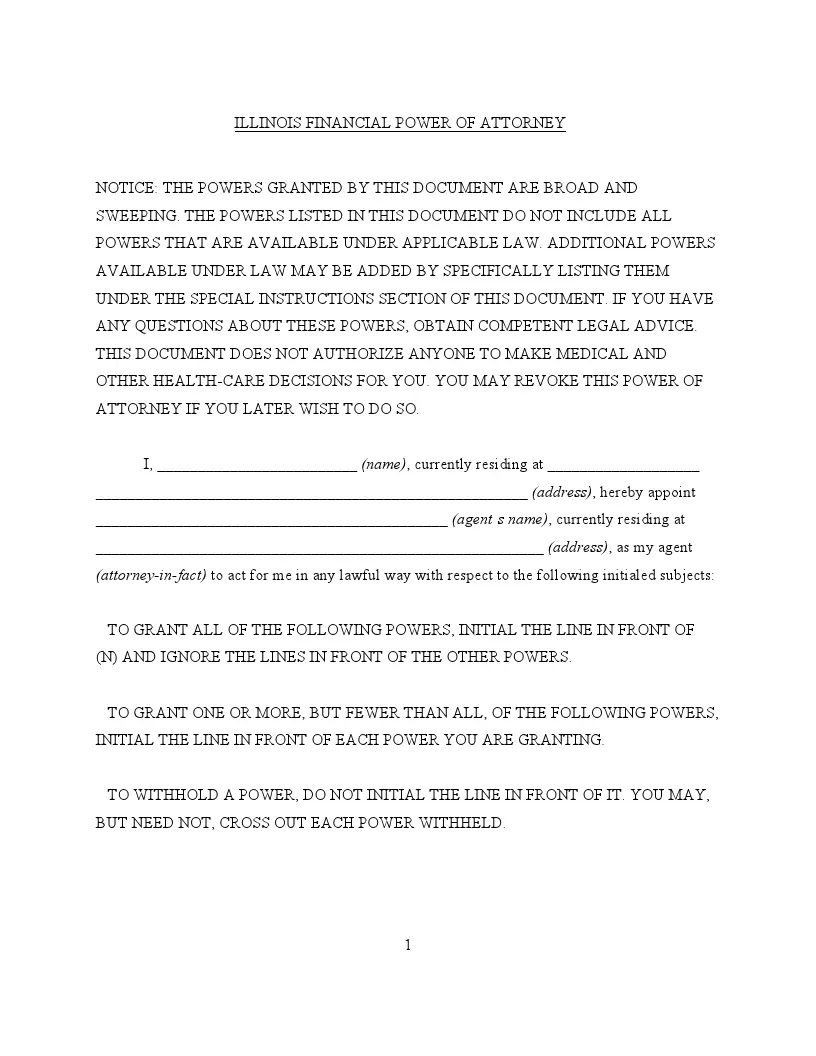

Filling Out Illinois General (Financial) POA Form

Completing the Illinois general power of attorney form accurately ensures your financial matters are handled according to your wishes. Below is a step-by-step guide.

1. Understanding the Form

Begin by thoroughly reading each section of the form to comprehend the powers being granted and the implications of each decision. This document will empower your chosen agent to act in a broad range of financial matters on your behalf.

2. Choosing an Agent

Select a person you trust implicitly to manage your financial affairs prudently as your agent (attorney-in-fact). You must enter your chosen agent’s full legal name and current address on the form.

3. Specifying Powers

Decide which powers to grant to your agent. You can grant all powers listed by initialing next to option (N), or you may select specific powers by initialing the lines corresponding to each power you wish to grant.

4. Setting the Effective Date

Determine when the powers granted by the POA will take effect. You can opt for immediate effectiveness or specify a date by marking the line corresponding to your choice. This clarity will establish when these powers will begin.

5. Acknowledging the Signatory Requirements

Ensure the document’s signing adheres to Illinois legal standards, which include your signature, the signature of at least one witness, and notarization. The presence of a witness during the signing and subsequent notarization helps to affirm your identity and voluntary signatory.

6. Final Review and Execution

Before executing the document, review it thoroughly to ensure all information is accurate and reflects your wishes. Confirm that all entries and initials are correct and that no section has been overlooked or improperly filled out. Once satisfied, sign and date the form in the presence of your witness and notary.