Iowa General Financial Power of Attorney Form

The Iowa general financial power of attorney is a legal document that allows one person (the principal) to authorize another person (the agent or attorney-in-fact) to act on their behalf in a broad range of legal and financial matters. Examples include handling transactions, buying or selling property, managing business activities, and dealing with government agencies. A general power of attorney gives the agent broad powers to perform almost any transaction the principal could do, unlike in a limited form.

Also, a general power of attorney is only valid if you are mentally competent and able to make decisions. It terminates if the principal becomes incapacitated or dies. On the other hand, a durable power of attorney continues in effect even if the principal loses mental capacity, although it also terminates upon death. FormsPal provides all Iowa power of attorney forms for your legal needs.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

The legal requirements for creating a power of attorney are detailed in the Iowa Code, ensuring that the authority granted is recognized and regulated. The main requirements for executing this document include:

- The POA must be written according to the general provisions of the Iowa Code regarding powers of attorney.

- The document should explicitly grant specific authority to the agent, clearly naming both parties.

- The signing of the POA requires acknowledgment by a notary public (Section 633B.105 of the Iowa Code).

Importantly, under Section 633B.110 of the Iowa Code, a standard power of attorney will terminate if the principal becomes incapacitated unless the document is specifically designed to be durable.

Iowa General Power of Attorney Form Details

| Document Name | Iowa General Power of Attorney Form |

| Other Name | Iowa Financial Power of Attorney |

| Relevant Laws | Code of Iowa, Chapter 633B |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 41 |

| Available Formats | Adobe PDF |

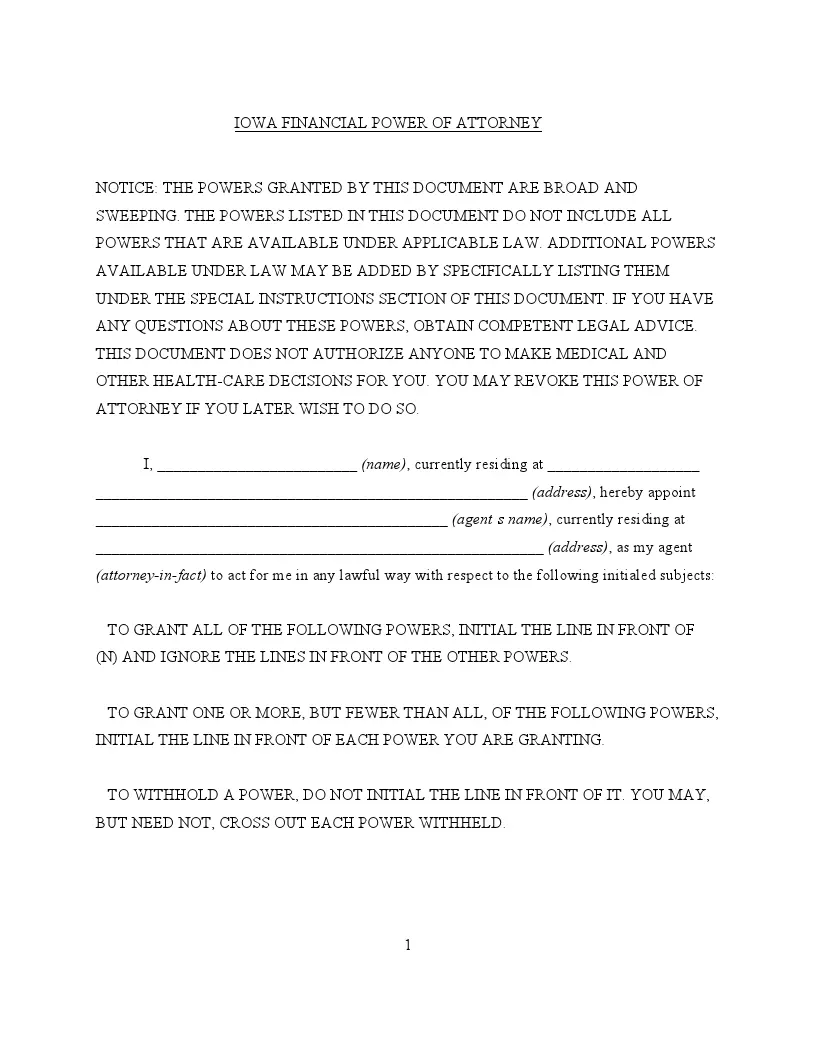

Filling Out Iowa General (Financial) POA Form

Here’s a step-by-step guide to completing a general power of attorney form in Illinois, ensuring all legal bases are covered.

1. Download the Appropriate Form

Begin by obtaining the correct general power of attorney form for Illinois. The form on FormsPal meets all state-specific requirements and statutes, so you can use it.

2. Identify the Principal and Agent

Fill in your full name and address under the section labeled “Principal.” Next, enter the name and address of the person you designate as your agent (attorney-in-fact). This person will have the authority to handle your affairs.

3. Specify Powers Granted

Review the list of powers included in the form, such as real estate transactions, financial management, and investment decisions. Initial next to each power you wish to grant to your agent. If you wish to grant all listed powers, you may simply initial the option labeled “All of the Powers Listed Above.”

4. Include Special Instructions

Use this section to detail any specific conditions or restrictions not covered by the standard powers. It could include additional powers or limitations you want to apply.

5. Set the Effective Date

Determine when a power of attorney will become effective. You can choose whether it will be effective immediately or commence on a future date. Initial the appropriate line to indicate your choice.

6. Decide on Termination

Specify how and when the power of attorney will terminate. Options typically include revocation by the principal on a specified date or upon the principal’s incapacitation. Initial next to your choice.

7. Sign and Date the Form

Sign and date the form in the presence of a notary. This step legally binds the document and verifies your identity as the principal.

8. Notarization

Have the document notarized. This step authenticates the signatures and confirms that the principal signed the document willingly and without coercion.

Give a copy of the notarized document to your agent and keep the original in a safe place. It’s advisable to inform close family members or your attorney where the document is stored. The general power of attorney should also be regularly reviewed and updated as needed. Life changes such as marriage, divorce, or the death of an agent can necessitate modifications to the document.