Kentucky General Financial Power of Attorney Form

The Kentucky general financial power of attorney is a formal instrument that permits an individual, the principal, to appoint another person, known as the agent (attorney-in-fact), to handle their financial matters and make decisions in their stead. This legal setup is especially beneficial when the principal cannot oversee their affairs owing to health complications or absence.

A general power of attorney grants broad powers to the agent, covering various activities such as buying or selling property, managing bank accounts, and handling business transactions. However, it does not include making healthcare decisions.

By default, a general POA in Kentucky is not durable and automatically ends if the principal becomes mentally incapacitated. Check out all Kentucky POA forms if you need a durable power of attorney for such cases.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

The laws governing general powers of attorney are structured under the Uniform Power of Attorney Act, codified in Kentucky Revised Statutes, Sections 457.010 to 457.460. Kentucky law defines a “power of attorney” as any written or recorded document authorizing an agent to represent a principal, regardless of the specific terms used. The act ensures that an agent can perform various activities as specified in the power of attorney agreement. Key provisions include:

- A power of attorney ceases to be effective when the principal becomes incapacitated unless it is specified as durable (Section 457.100).

- A notary public must acknowledge the document to be legally valid (Section 457.050).

Both parties should understand the scope of the authority granted. The agent is expected to act in the principal’s best interests, maintain accurate records, and avoid conflicts of interest.

Kentucky General Power of Attorney Form Details

| Document Name | Kentucky General Power of Attorney Form |

| Other Name | Kentucky Financial Power of Attorney |

| Relevant Laws | Kentucky Revised Statutes, Sections 457.010 to 457.460 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 41 |

| Available Formats | Adobe PDF |

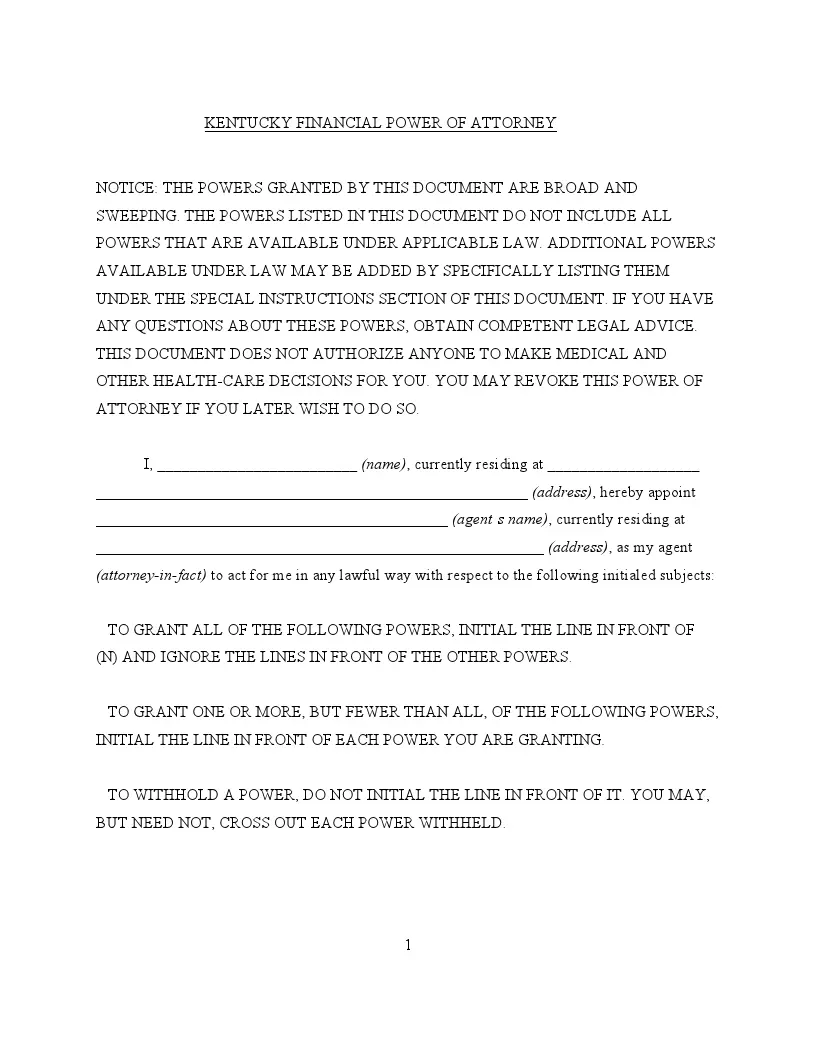

Filling Out Kentucky General (Financial) POA Form

Filling out this form is essential to make sure your affairs are managed in alignment with your wishes. Here is a detailed tutorial to help you correctly fill out the Kentucky general power of attorney document.

1. Understanding the Form

Begin by thoroughly reading the entire document to understand the scope and implications of assigning a power of attorney. It’s important to note that this form does not cover healthcare decisions and becomes invalid if you become incapacitated unless specified as durable.

2. Designating Your Agent

You will need to fill in your full name as the principal and the full name, address, and phone number of the person you are appointing as your agent. You must choose someone you trust implicitly, as they will have significant control over your financial and property matters.

3. Assigning Authority

You can grant your Agent general authority over various categories such as real estate, financial institutions, and taxes. You must initial next to each category of authority you want to grant. If you want your Agent to have comprehensive powers, you can initial “All Preceding Subjects.” Additionally, you need to initial specifically for specific powers involving significant actions like making gifts or changing beneficiary designations. These powers can significantly impact your estate, so approach with caution.

4. Adding Successor Agents

If you wish, you can appoint a successor and a second successor agent by providing their full names, addresses, and telephone numbers.

5. Providing Special Instructions

You can provide any specific guidelines or limitations you want to impose on your agent’s powers. It might include restrictions on the sale of certain assets or specific directives regarding financial strategies.

6. Signing and Notarizing

The form must be signed and dated in the presence of a notary public. Make sure your agent and any successor agents are available to sign and accept their roles, either at the same time or subsequently. The form must be acknowledged before a notary public, who will verify your identity and the authenticity of your signature.

7. Distributing Copies

Once notarized, provide copies of the form to your agent, any successor agents, and relevant financial institutions to ensure your agent’s authority is recognized and accepted. It is advisable to regularly review and update your general power of attorney as necessary, especially following major life events or changes in your financial situation.