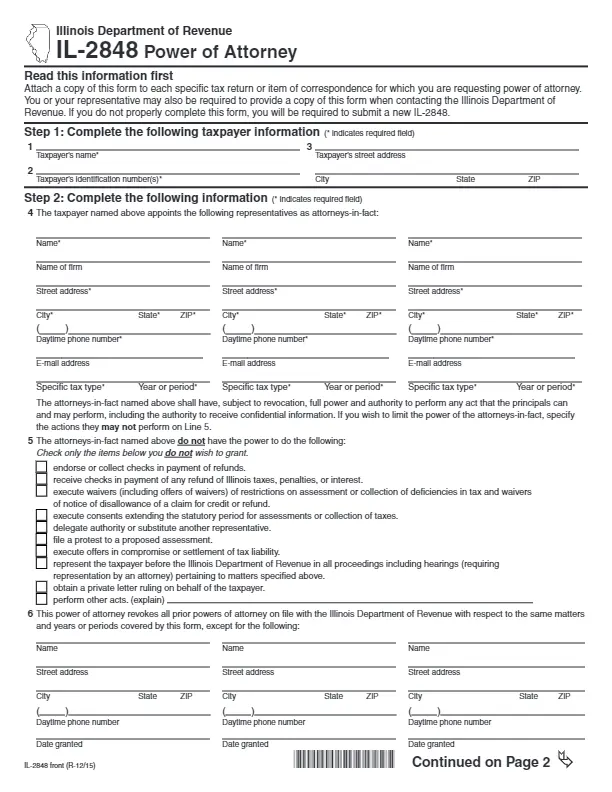

The Illinois Tax Power of Attorney form (Form IL-2848) is a document needed to use when individual wishes to select a representative to sign, verify, and file all agent’s tax returns. You will be asked to attach a copy of this record to each specific tax return or item of correspondence for which you are requesting power of attorney.

If you want to learn more about different Illinois power of attorney templates, check our dedicated state article linked in this section.

If one submits an invalid Tax POA, they will be notified to edit and resubmit it. A printable power of attorney form needs to be completed, signed, and dated before sending it again. The form will not be valid if one of the following is missing, incomplete, or incorrect:

- Taxpayer Info

- ID numbers

- Tax Types

- Tax Periods

- Taxpayer, POA, Witness, or Notary Signatures or Dates

- Any Additional Required Info

There are diverse ways to submit the form to the Illinois Department of Revenue (IDOR):

- Scan and save each Form IL-2848 as a separate PDF file and send it via email ( considered insecure)

- Send each form as separate fax (without including a cover page)

- Mail the form

The Illinois Tax Power of Attorney form will terminate ten years after gaining validity unless revoked or withdrawn. General legal rules concerning the powers of the designated Attorney-in-Fact are described in the third section of the 755 ILCS 45 law of Illinois.

Illinois Tax Power of Attorney Form Details

| Document Name | Illinois Tax Power of Attorney Form |

| State Form Name | Illinois Form IL-2848 |

| Relevant Link | Illinois Department of Revenue |

| Where to File? | Per email/fax/online or mail to: Illinois Department of Revenue Power of Attorney Forms 3-252 PO BOX 19001 SPRINGFIELD IL 62794-9001 |

| Avg. Time to Fill Out | 18 minutes |

| # of Fillable Fields | 133 |

| Available Formats | Adobe PDF |

Filling Out Illinois Tax POA

To generate an up-to-date, personalized POA document, use our form-building software.

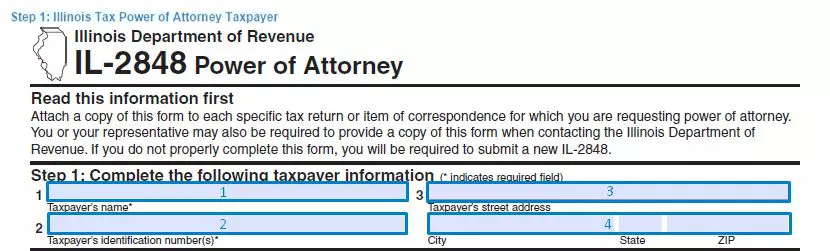

1. Input the Taxpayer’s Data

The Taxpayer has to fill out their full name, ID number, and street address (which involves city, state, and zip).

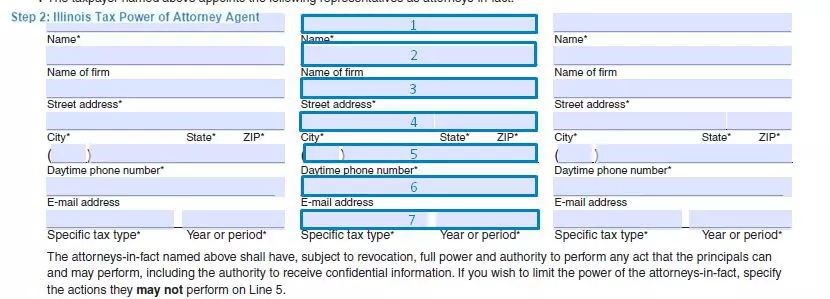

2. Designate Attorney(s)-in-Fact

You may opt for selecting more than one agent if you desire. Provide the following information about them in the second section of the document:

- Full Name

- Company Name

- Street Address (city, state, zip)

- Daytime Phone Number

- E-mail Address

- Specific Tax Type

- Year or Period

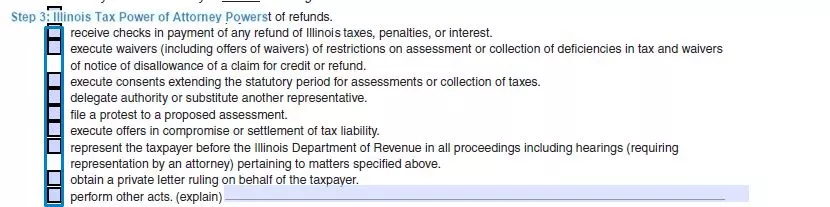

3. Indicate the Powers You Are Not Granting

The agents are supposed to be fully able on the Principal’s behalf, including the power to access confidential data. If you do not wish to grant certain powers to the agent(s), check the corresponding box in this part of the form.

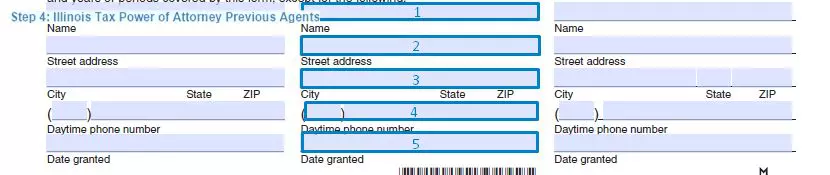

4. Provide Info about the Previous Agents

The creation of the Tax POA implies that all the other previous Attorney(s)-in-Fact will be automatically withdrawn. If you wish some of them to continue representing your interests, indicate their personal information herein.

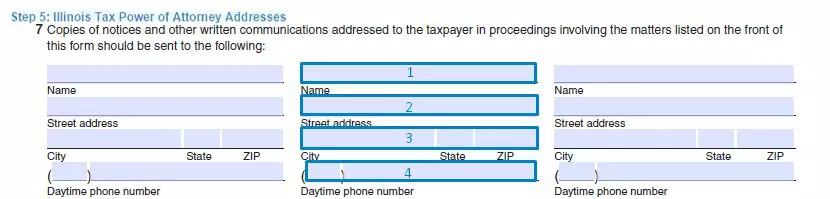

5. Submit the Addresses to Receive Your Notices

If there exist any addresses you would like your written communications to be mailed to, write down the name of the person to get your notices, their mailing address (city, state, zip), and daytime phone number if there is a need to approach the person quickly. You are allowed to provide up to three addressees herein.

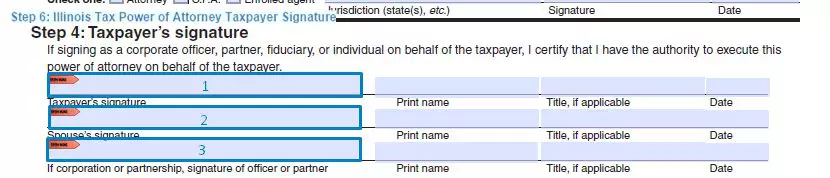

6. Put the Taxpayer’s Signature

The Principal should review the data that has been provided above and affix his or her signature. If the Taxpayer filed jointly, the spouse should also sign the paper too. In case the Taxpayer is representing an entity, the signature of the officer or partner will be required.

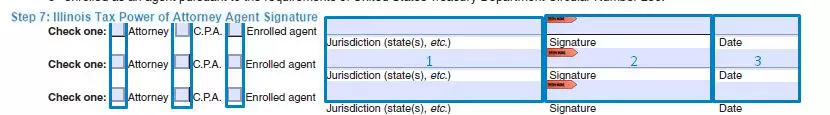

7. Put the Agent’s Signature

All of the agents appointed have to sign the document, declaring not to be under suspension or disbarment.

8. Witness or Notarize the Form (If Needed)

If the agent is not an attorney, a certified public accountant, or an enrolled agent, two adults will have to witness the paper to make it valid and enforceable. The other option is to get the form authenticated by a legal notary.