North Dakota Limited Power of Attorney Form

The North Dakota limited power of attorney (POA) is a legal document that authorizes an individual, known as the agent, to perform specific actions on behalf of another person, the principal. This type of POA is tailored to particular tasks or situations, like handling real estate transactions or managing financial affairs during a specified period when the principal cannot do so themselves.

A general POA grants broad authority, while a limited power of attorney confines the agent’s authority to specific, outlined activities and typically terminates when those duties are performed or on a predetermined date. This focused approach ensures that the principal maintains greater control over the extent and duration of the granted powers.

With North Dakota power of attorney forms, you can secure all your affairs and legally uphold your decisions.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

The Uniform Durable Power of Attorney Act, detailed in Title 30, Chapter 30.1-30 of the North Dakota Century Code, governs the signing requirements and legal framework for a limited POA in this state. This statute outlines the essential requirements for executing a power of attorney in a manner that ensures its legal validity and acceptance. Points to consider:

- Although not explicitly mandated by law for a limited power of attorney to be effective, notarization is highly recommended.

- Notarization confirms the signatory’s identity and strengthens the document’s legitimacy, especially in transactions involving third parties.

While North Dakota law does not require a power of attorney to be notarized, doing so can prevent complications and lend authenticity to the document. Legal experts often advise this step to avoid disputes over the validity of the principal’s signature or the agent’s authority.

North Dakota Limited Power of Attorney Form Details

| Document Name | North Dakota Limited Power of Attorney Form |

| Other Name | North Dakota Special Power of Attorney |

| Relevant Laws | North Dakota Century Code, Chapter 30.1-30 |

| Avg. Time to Fill Out | 8 minutes |

| # of Fillable Fields | 32 |

| Available Formats | Adobe PDF |

Filling Out North Dakota Limited POA

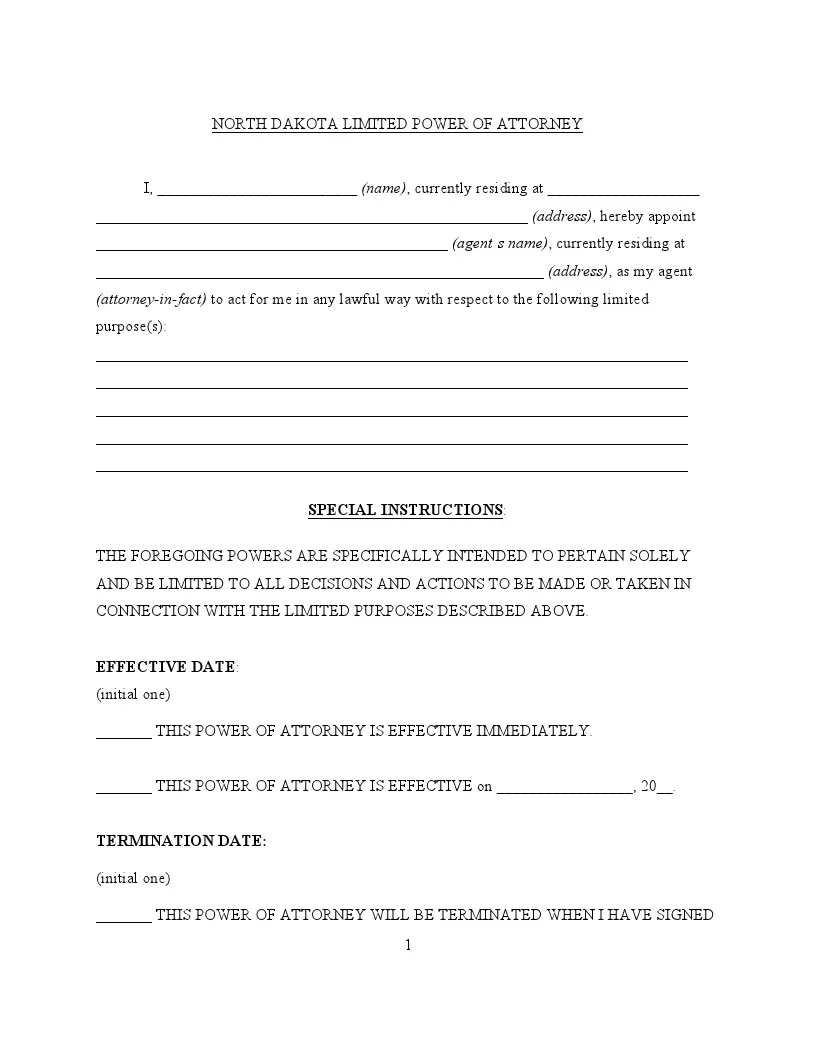

Completing a limited power of attorney in North Dakota allows you to appoint an agent to act on your behalf in specific legal or financial matters. Here is a step-by-step guide to ensure this form is filled out accurately.

1. Fill in the Principal’s Details

Start by entering your full name and current residential address in the designated spaces at the beginning of the form. This identifies you as the principal who is granting the power of attorney.

2. Appoint Your Agent

Enter the name and residential address of the person you appoint as your agent (attorney-in-fact). This person will have the authority to act on your behalf according to the limitations you set in this document.

3. Define the Powers Granted

List the specific tasks or decisions your agent is authorized to perform. Be as detailed as possible to prevent ambiguity regarding your agent’s role.

4. Set the Effective Date and Termination Conditions

You need to choose when the POA will come into effect and when it will end. You can opt for it to start immediately or on a future date. Similarly, you can decide on an automatic termination date or specify conditions such as task completion or your incapacity.

5. Designate a Successor Agent (Optional)

If you wish, appoint a successor agent who will take over if your initial agent is unable or unwilling to perform the duties. Include the successor’s full name and address.

6. Sign and Date the Form

If you wish, appoint a successor agent who will take over if your initial agent is unable or unwilling to perform the duties. Include the successor’s full name and address.

7. Notarization

Though not required by North Dakota law, having your signature notarized can add a layer of legal protection and authenticity to the document. Visit a notary and ensure they complete the acknowledgment section at the end of the form.

8. Distribute Copies

After notarization, distribute copies of the completed POA to your agent, successor agent (if applicable), and any institutions or individuals needing it, such as banks or legal entities.

9. Keep the Original Secure

Store the original signed and notarized document in a secure location, such as a safe deposit box or with a trusted attorney, to ensure it is available when needed.